Politics

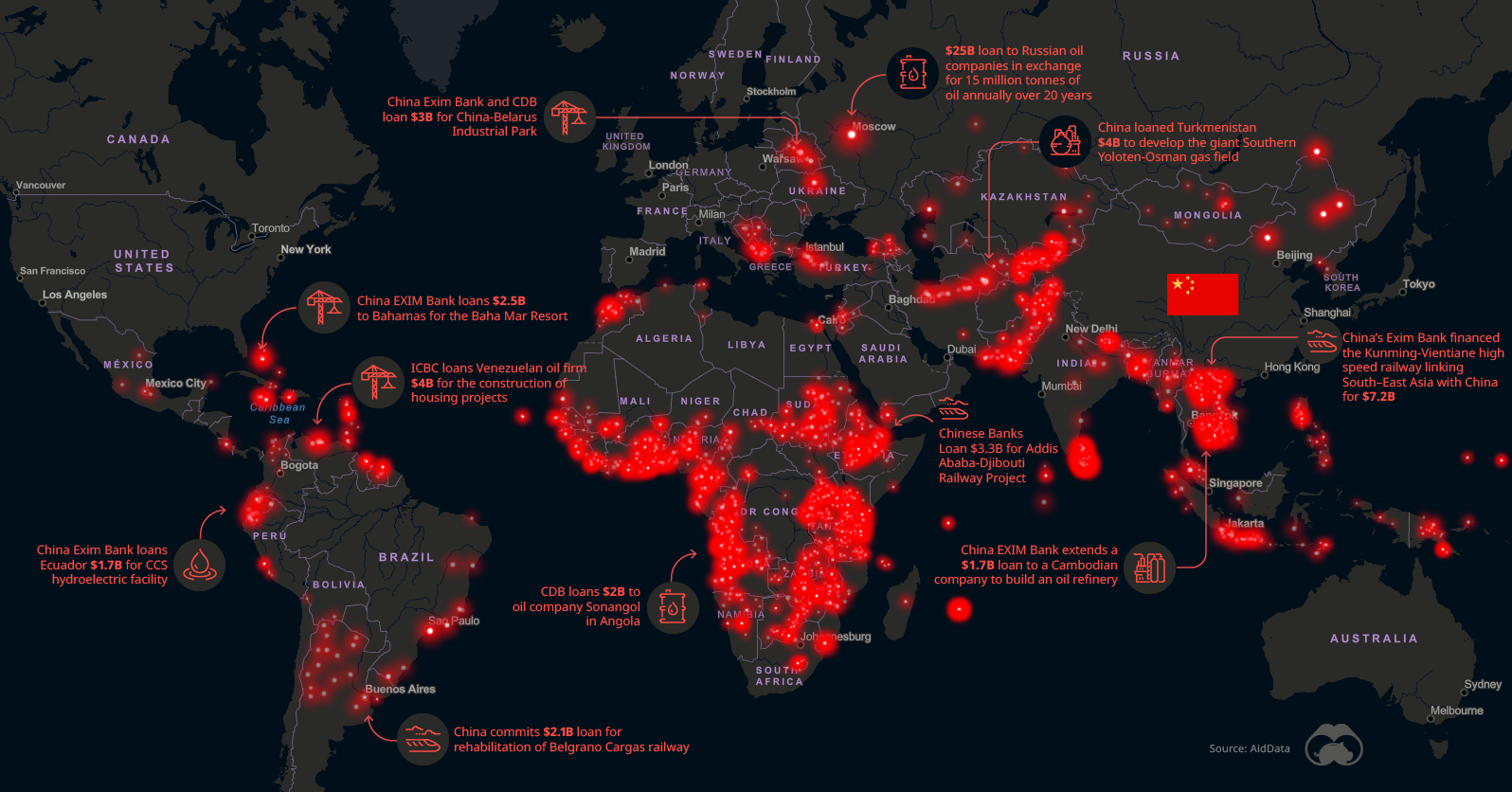

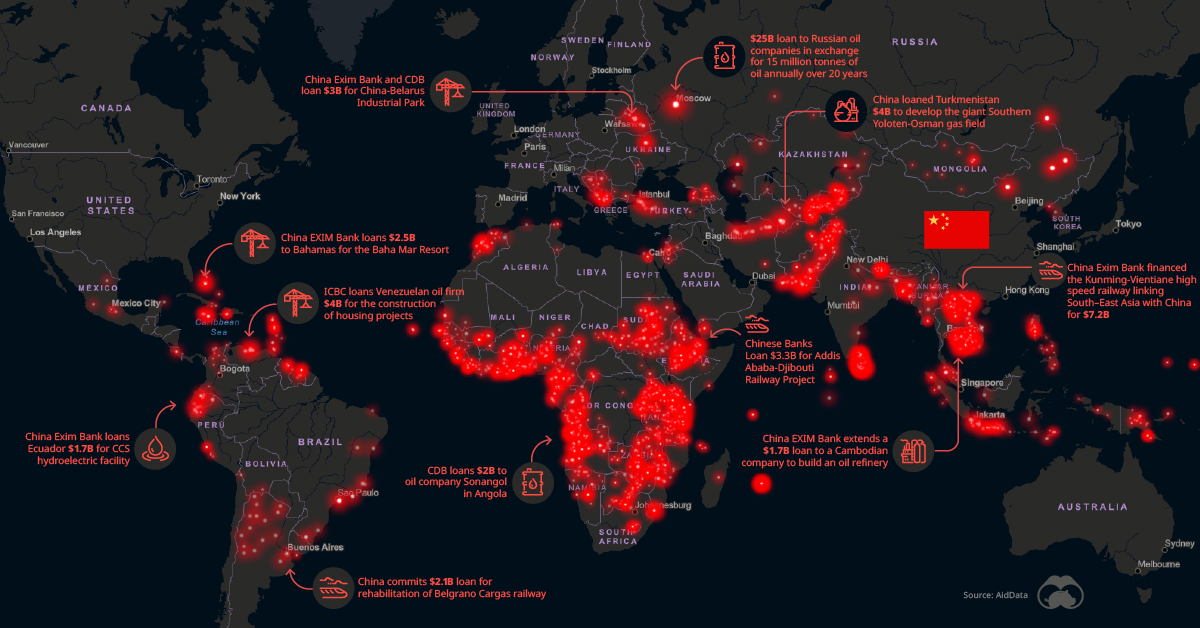

How Chinese Financing is Fueling Megaprojects Around the World

View the full-size version of this infographic.

How Chinese Financing is Fueling the World’s Megaprojects

On a mountaintop a few miles north of the bustling streets of Harare, Zimbabwe, a curving, modern complex is beginning to take shape. This building, once completed, will be the home of the African country’s parliament, and the centerpiece of a new section of the capital city.

Aside from the striking design, there’s another unique twist to this development — the entire $140 million project is a gift from Beijing. At first glance, gifting a country a new parliament building may seem extravagant, but the project is a tiny portion of China’s $270 billion in “diplomacy spending” since 2000.

AidData, a research lab at the W&M Global Research Institute, has compiled a massive database of Chinese-backed projects spanning from 2000–2017. In aggregate, it creates a comprehensive look at China’s efforts to grow its influence in countries around the world, particularly in Africa and South Asia.

Beijing has ramped up the volume and sophistication of its public diplomacy overtures, […] but infrastructure as a part of its financial diplomacy dwarfs Beijing’s other public diplomacy tools.

– Samantha Custer, Director of Policy Analysis, AidData

Below, we’ll look at three diplomacy spending hotspots around the world, and learn about key Chinese-funded megaprojects, from power plants to railway systems.

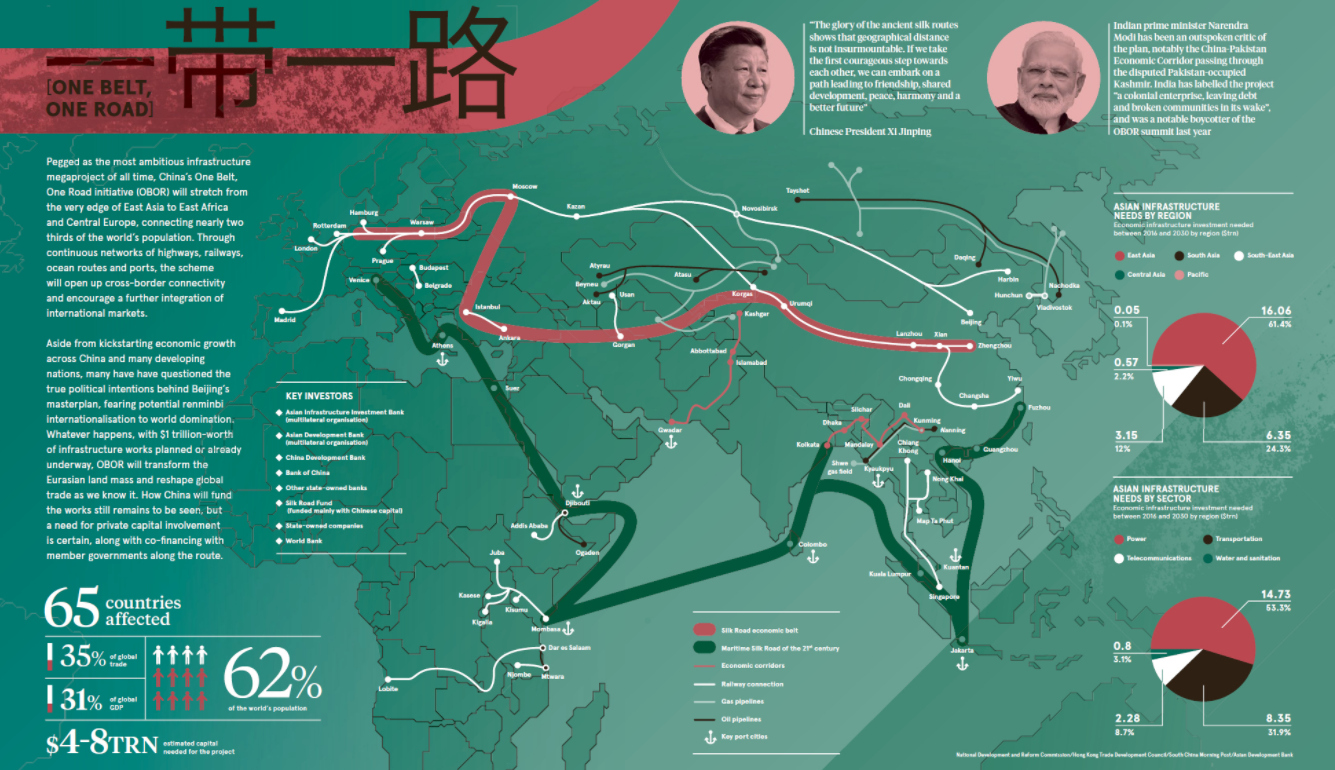

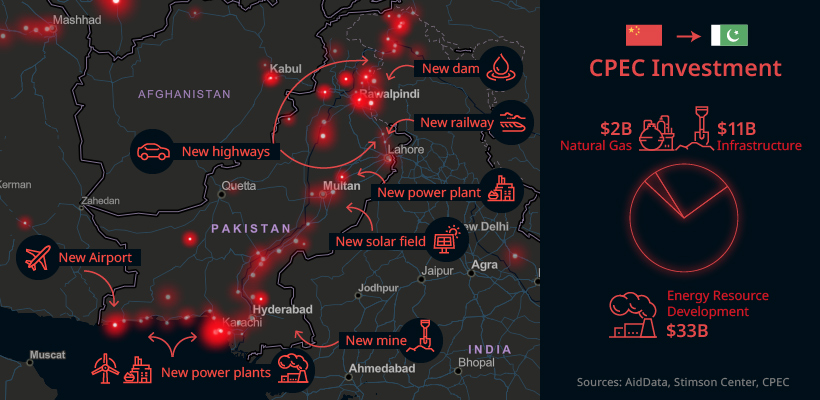

1. Pakistan

In 2015, Chinese President Xi Jingping visited Islamabad to inaugurate the China-Pakistan Economic Corridor (CPEC), kicking off a $46 billion investment that has transformed Pakistan’s transportation system and power grid. CPEC is designed to cement the strategic relationship between the two countries, and is a portion of China’s massive One Belt, One Road (OBOR) initiative.

One of the largest projects financed by China was the Karachi Nuclear Power K2/K3 project. This massive power generation project is primarily bankrolled by China’s state-owned Exim Bank which has kicked in over $6.6 billion over three phases of payments.

Billions of dollars in Chinese capital has also funded everything from highway construction to renewable energy projects across Pakistan. Pakistan’s youth unemployment rate sits as high as 40%, so jobs created by new infrastructure investments are a welcome prospect. In 2014, Pakistan had the highest public approval rating of China in the world, with nearly 80% respondents holding a favorable view of China.

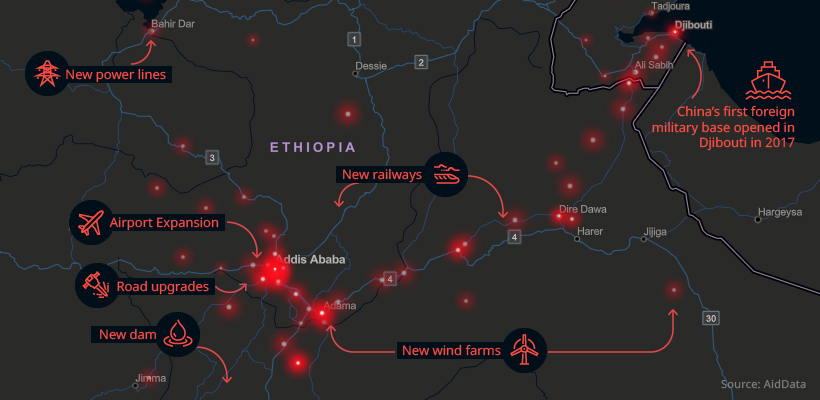

2. Ethiopia

Ethiopia has seen a number of changes within its borders thanks to Chinese financing. This is particularly evident in its capital, Addis Ababa, where a slew of transportation projects — from new ring roads to Sub-Saharan Africa’s first metro system — transformed the city.

One of the most striking symbols of Chinese influence in Addis Ababa is the futuristic African Union (AU) headquarters. The $200 million complex was gifted to the city by Beijing in 2012.

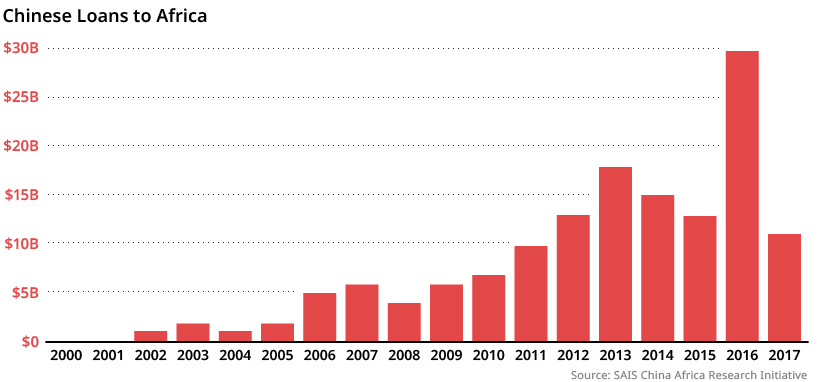

Though Ethiopia is a clear example of Chinese investment transforming a country’s infrastructure, a number of other African nations have experienced a similar influx of money from Beijing. This financing pipeline has increased dramatically in recent years.

3. Sri Lanka

In the wake of political turmoil, Sri Lanka is increasingly looking to China for loans. From 2000 to 2017, over $12 billion in loans and grants have poured into the deeply-indebted country.

Perhaps the most contentious symbol of the relationship between the two countries is a port on the south coast of the island nation, at a strategic point along one of the world’s busiest shipping lanes. The Hambantota Port project — which was completed in 2011 — followed a now familiar path. Eschewing an open bidding process, Beijing’s government financed the project and hired a state-owned firm to construct the port, primarily using Chinese workers.

By 2017, Sri Lanka’s government was burdened by debt the previous administration had taken on. After months of negotiations, the port was handed over with the land around it leased to China for 99 years. This handover was a strategic victory for China, which now has a shipping foothold within close proximity of its regional rival, India.

John Adams said infamously that a way to subjugate a country is through either the sword or debt. China has chosen the latter.

– Brahma Chellaney

Playing the Long Game

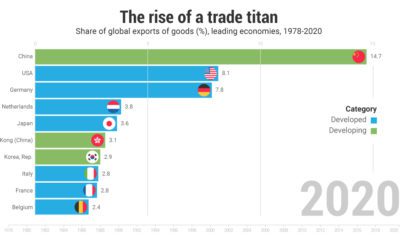

Africa’s economic rise will likely be a major contributor to global growth in coming years. Already, six of the 10 fastest growing economies in the world are located in Africa. China is also the top trading partner on the continent, with the United States sitting in third place.

OBOR spending has also earned China plenty of influence in the rest of Asia as well. If the ambitious megaproject continues along its current trajectory, China will be the central player in a more prosperous, interconnected Asia.

War

Visualized: Top 15 Global Tank Fleets

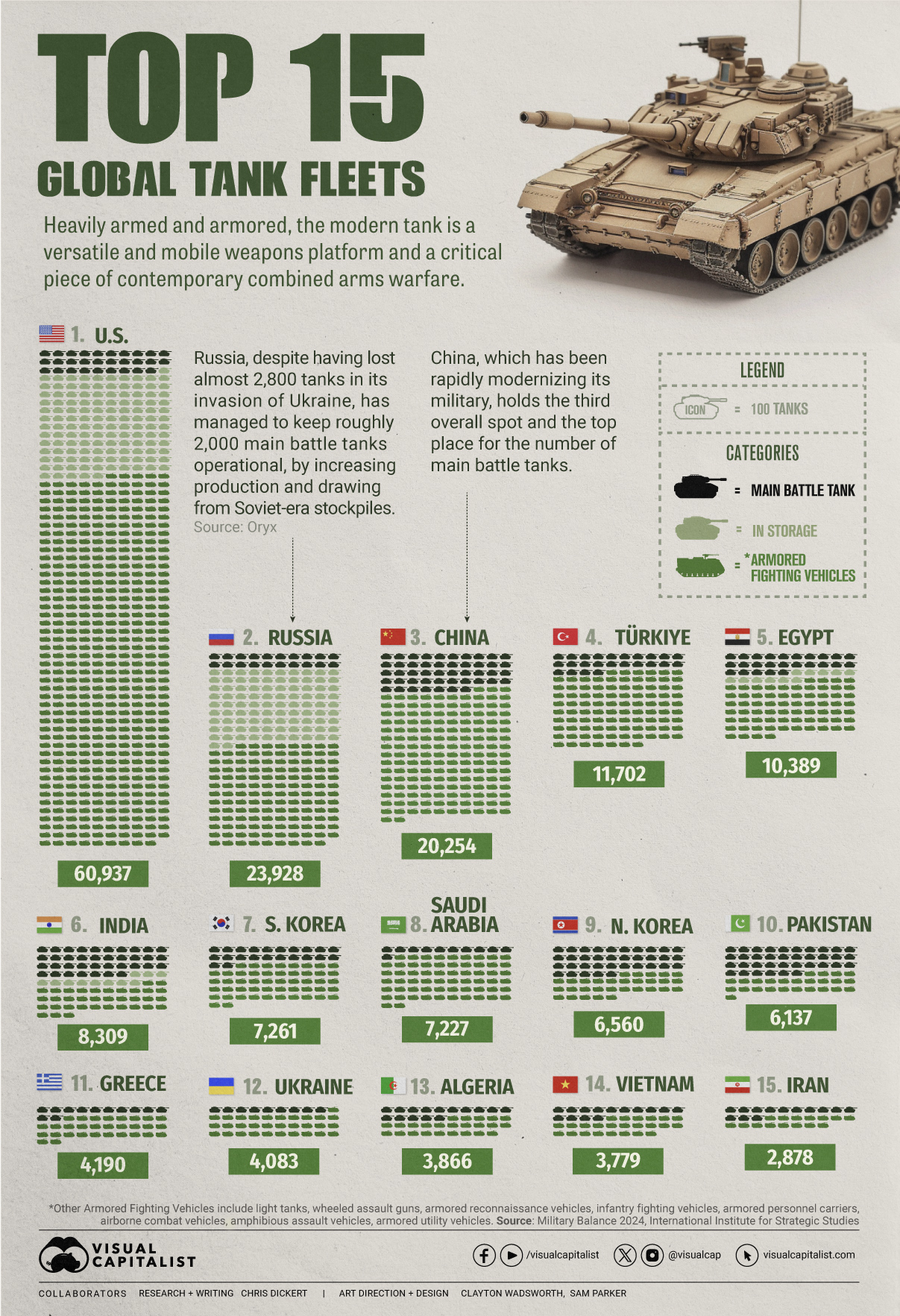

Heavily armed and armored, the modern tank is a versatile and mobile weapons platform, and a critical piece of contemporary warfare.

The Top 15 Global Tank Fleets

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Heavily armed and armored, the modern tank is a versatile and mobile weapons platform, and a critical piece of contemporary warfare.

This visualization shows the top 15 global tank fleets, using data from the 2024 Military Balance report from the International Institute for Strategic Studies (IISS).

Let’s take an in-depth look at the top three fleets:

1. United States

As the world’s pre-eminent military power, it’s perhaps no surprise that the United States also has the largest tank fleet, by a wide margin.

In total, they have just over 45,000 armored fighting vehicles in operation, along with 2,640 main battle tanks (MBTs), and 12,800 vehicles in storage, of which 2,000 are main battle tanks.

| Category | Vehicles | Global rank |

|---|---|---|

| Main battle tanks | 2,640 | 4 |

| Armored reconnaissance | 1,745 | 1 |

| Infantry fighting vehicles | 3,262 | 3 |

| Armored personnel carriers | 10,644 | 1 |

| Amphibious assault vehicles | 1,401 | 1 |

| Armored utility vehicles | 28,445 | 1 |

| Storage | 12,800 | 1 |

| Total | 60,937 | 1 |

The U.S. is internalizing the lessons from the ongoing invasion of Ukraine, where Western-supplied anti-tank weapons and massed Ukrainian artillery have been cutting Russian tanks to pieces. As a result, the U.S. recently canceled an upgrade of the M1 Abrams in favor of a more ambitious upgrade.

Meanwhile, the U.S. is nervously eyeing a more confident China and a potential clash over Taiwan, where air and naval forces will be critical. However, a recent war game showed that Taiwanese mechanized ground forces, kitted out with American-made tanks and armored fighting vehicles, were critical in keeping the island autonomous.

2. Russia

According to Oryx, a Dutch open-source intelligence defense website, at time of writing, Russia has lost almost 2,800 main battle tanks since invading Ukraine. Considering that in the 2022 edition of the Military Balance, Russia was estimated to have 2,927 MBTs in operation, those are some hefty losses.

Russia has been able to maintain about 2,000 MBTs in the field, in part, by increasing domestic production. Many defense plants have been taken over by state-owned Rostec and now operate around the clock. Russia is also now spending a full third of their budget on defense, equivalent to about 7.5% of GDP.

At the same time, they’ve also been drawing down their Soviet-era stockpiles, which are modernized before being sent to the front. Just how long they can keep this up is an open question; their stockpiles are large, but not limitless. Here is what their storage levels look like:

| Category | 2023 | 2024 | YOY change |

|---|---|---|---|

| Main battle tanks | 5,000 | 4,000 | -20.0% |

| Armored reconnaissance | 1,000 | 100 | -90.0% |

| Infantry fighting vehicles | 4,000 | 2,800 | -30.0% |

| Armored personnel carriers | 6,000 | 2,300 | -61.7% |

| Total | 16,000 | 9,200 | -42.5% |

3. China

China holds the third overall spot and top place globally for the number of main battle tanks in operation. Untypically, the People’s Liberation Army has no armored vehicles in storage, which perhaps isn’t surprising when you consider that China has been rapidly modernizing its military and that stockpiles usually contain older models.

China also has one of the world’s largest fleets of armored fighting vehicles, second only to the United States. Breaking down that headline number, we can also see that they have the largest number of light tanks, wheeled guns, and infantry fighting vehicles.

| Category | Vehicles | Global rank |

|---|---|---|

| Main battle tanks | 4,700 | 1 |

| Light tanks | 1,330 | 1 |

| Wheeled guns | 1,250 | 1 |

| Infantry fighting vehicles | 8,200 | 1 |

| Armored personnel carriers | 3,604 | 5 |

| Airborne combat vehicles | 180 | 2 |

| Amphibious assault vehicles | 990 | 2 |

| Total | 20,254 | 3 |

This is equipment that would be integral if China were to make an attempt to reunify Taiwan with the mainland by force, where lightly armored mechanized units need to move with speed to occupy the island before Western allies can enter the fray. It’s worth noting that China also has one of the world’s largest fleets of amphibious assault vehicles.

End of the Tank?

Many commentators at the outset of Russia’s invasion of Ukraine, were quick to predict the end of the tank, however, to paraphrase Mark Twain, reports of the tank’s demise are greatly exaggerated.

With the U.S. and China both developing remote and autonomous armored vehicles, tanks could be quite different in the future, but there is nothing else that matches them for firepower, mobility, and survivability on the modern battlefield today.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?