Money

Visualizing Global Attitudes Towards Retirement

Global Attitudes Towards Retirement

There’s a reason retirement is often referred to as the golden years.

Many view retirement as a welcome reward following a successful career. The transition, however, is not always easy. An enjoyable retirement is often dictated by the amount of money people have set aside.

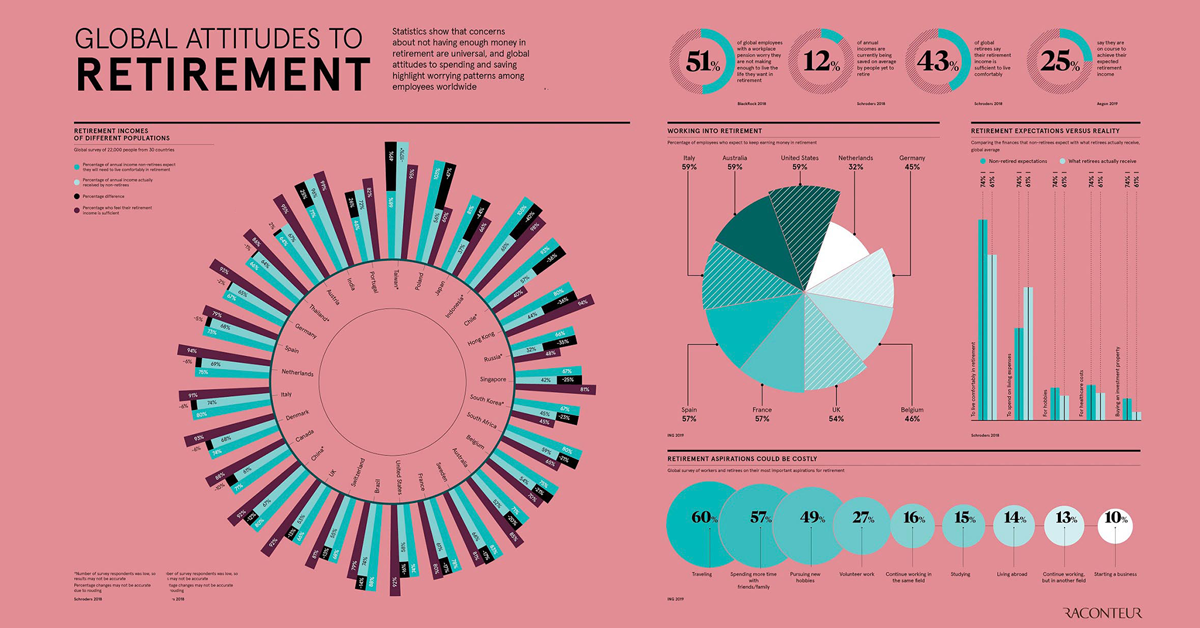

Today’s infographic from Raconteur visualizes attitudes towards retirement around the world, comparing expectations and actualities for retirement income.

Does reality meet their expectations?

Income Expectations Vary by Country

A global survey by asset manager Schroders—looking at 22,000 investors from 30 countries—highlights that retirement income often falls short of expectations.

Here’s what non-retirees (55+ in age) expect to make in retirement as a percentage of their salary, compared to the actual incomes generated by retirees:

| Country | Expectation (% of salary) | Actual (% of salary) | Difference |

|---|---|---|---|

| 🇵🇱 Poland | 103 | 56 | -47 |

| 🇯🇵 Japan | 81 | 37 | -44 |

| 🇮🇩 Indonesia | 105 | 65 | -40 |

| 🇨🇱 Chile* | 93 | 57 | -36 |

| 🇭🇰 Hong Kong | 80 | 44 | -36 |

| 🇷🇺 Russia* | 66 | 32 | -34 |

| 🇸🇬 Singapore | 67 | 42 | -25 |

| 🇰🇷 South Korea | 67 | 45 | -22 |

| 🇿🇦 South Africa | 80 | 59 | -21 |

| 🇧🇪 Belgium | 75 | 54 | -21 |

| 🇦🇺 Australia | 71 | 52 | -20 |

| 🇸🇪 Sweden | 83 | 66 | -17 |

| 🇫🇷 France | 78 | 61 | -17 |

| 🇺🇸 U.S. | 74 | 58 | -16 |

| 🇧🇷 Brazil | 88 | 74 | -14 |

| 🇨🇭 Switzerland | 68 | 55 | -13 |

| 🇬🇧 U.K. | 66 | 53 | -13 |

| 🇨🇳 China* | 80 | 67 | -13 |

| 🇨🇦 Canada | 71 | 61 | -10 |

| 🇩🇰 Denmark | 74 | 68 | -6 |

| 🇮🇹 Italy | 80 | 74 | -6 |

| 🇳🇱 Netherlands | 75 | 69 | -6 |

| 🇪🇸 Spain | 73 | 68 | -5 |

| 🇩🇪 Germany | 67 | 65 | -2 |

| 🇹🇭 Thailand* | 66 | 64 | -1 |

| 🇦🇹 Austria | 64 | 67 | 3 |

| 🇮🇳 India | 71 | 96 | 25 |

| 🇵🇹 Portugal | 46 | 72 | 26 |

| 🇹🇼 Taiwan* | 68 | 117 | 49 |

*Denotes countries with small sample sizes.

Not having enough money at retirement is a nearly universal issue, and 51% of employees with a workplace pension are worried that they won’t make enough to live their ideal retirement life.

Of course, there are always notable exceptions to every rule.

In India, for example, the reality of retirement is often better than anticipated. Non-retirees expect that 71% of their annual salary will provide what is needed to live comfortably in retirement, but in practice they get 96% of their salary in retirement—far higher than they thought.

Most Important Aspirations

The world is divided when it comes to working into retirement. The majority of people want to spend their retirement doing non-work related activities:

- Traveling: 60%

- Spending more time with friends and family: 57%

- Pursuing new hobbies: 49%

- Volunteer work: 27%

That said, 59% of employees in Italy, the U.S., and Australia expect to continue working while retired, while only 32% in the Netherlands have the same expectation. This may be partially due to the strength of the Dutch pension system, which is rated as one of the best in the world.

A Changing Retirement Landscape

The reality of retirement continues to evolve by country and by generation.

Today, only 15% of the population in developed countries is above 65 years of age—but by 2050, the proportion will more than double. People between the ages of 40 and 50 are known as the “Sandwich Generation” because they are simultaneously supporting their retired parents and their own children.

While increasing life expectancy affords people the luxury of spending more time with loved ones, will we be able to afford to live longer?

Money

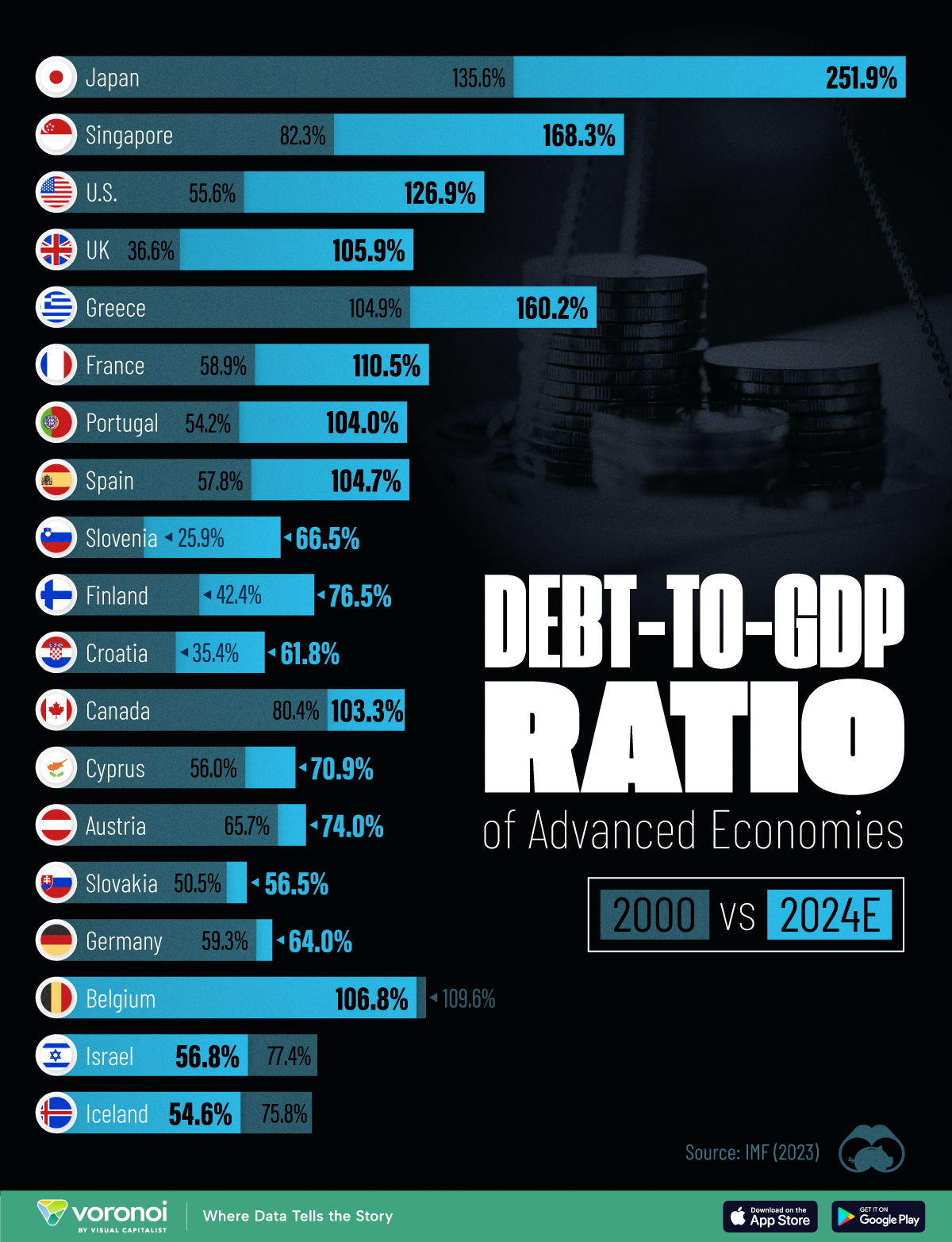

How Debt-to-GDP Ratios Have Changed Since 2000

See how much the debt-to-GDP ratios of advanced economies have grown (or shrank) since the year 2000.

How Debt-to-GDP Ratios Have Changed Since 2000

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

To gain perspective on this long-term trend, we’ve visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

| Country | 2000 (%) | 2024 (%) | Change (pp) |

|---|---|---|---|

| 🇯🇵 Japan | 135.6 | 251.9 | +116.3 |

| 🇸🇬 Singapore | 82.3 | 168.3 | +86.0 |

| 🇺🇸 United States | 55.6 | 126.9 | +71.3 |

| 🇬🇧 United Kingdom | 36.6 | 105.9 | +69.3 |

| 🇬🇷 Greece | 104.9 | 160.2 | +55.3 |

| 🇫🇷 France | 58.9 | 110.5 | +51.6 |

| 🇵🇹 Portugal | 54.2 | 104.0 | +49.8 |

| 🇪🇸 Spain | 57.8 | 104.7 | +46.9 |

| 🇸🇮 Slovenia | 25.9 | 66.5 | +40.6 |

| 🇫🇮 Finland | 42.4 | 76.5 | +34.1 |

| 🇭🇷 Croatia | 35.4 | 61.8 | +26.4 |

| 🇨🇦 Canada | 80.4 | 103.3 | +22.9 |

| 🇨🇾 Cyprus | 56.0 | 70.9 | +14.9 |

| 🇦🇹 Austria | 65.7 | 74.0 | +8.3 |

| 🇸🇰 Slovak Republic | 50.5 | 56.5 | +6.0 |

| 🇩🇪 Germany | 59.3 | 64.0 | +4.7 |

| 🇧🇪 Belgium | 109.6 | 106.8 | -2.8 |

| 🇮🇱 Israel | 77.4 | 56.8 | -20.6 |

| 🇮🇸 Iceland | 75.8 | 54.6 | -21.2 |

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

See More Debt Graphics from Visual Capitalist

Curious to see which countries have the most government debt in dollars? Check out this graphic that breaks down $97 trillion in debt as of 2023.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024