Demographics

How Different Generations Approach Work

View the full-size version of the infographic

How Different Generations Approach Work

View the full-size version of the infographic by clicking here

The first representatives of Generation Z have started to trickle into the workplace – and like generations before them, they are bringing a different perspective to things.

Did you know that there are now up to five generations now working under any given roof, ranging all the way from the Silent Generation (born Pre-WWII) to the aforementioned Gen Z?

Let’s see how these generational groups differ in their approaches to communication, career priorities, and company loyalty.

Generational Differences at Work

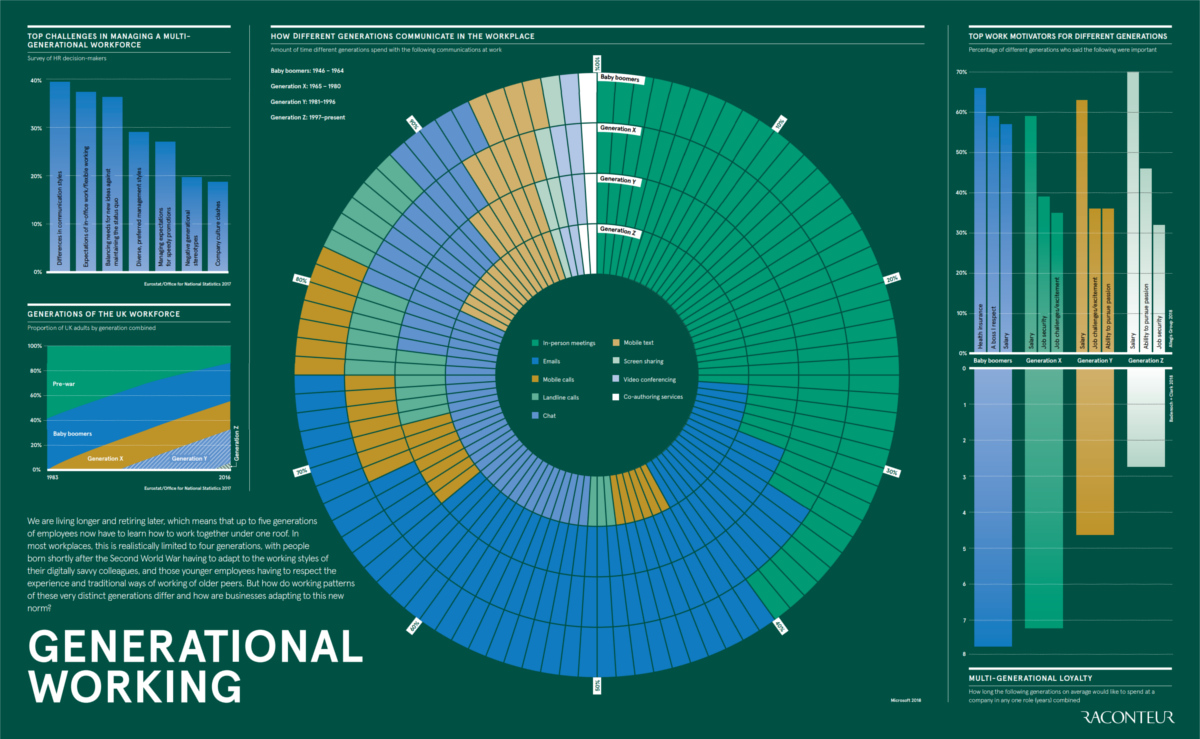

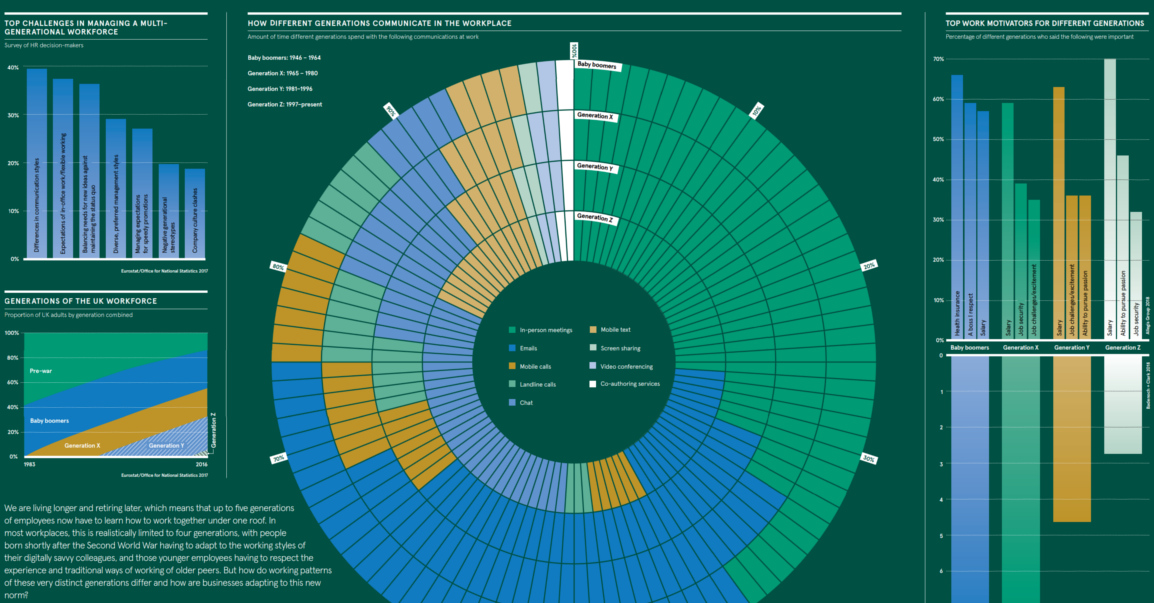

Today’s infographic comes to us from Raconteur, and it breaks down some key differences in how generational groups are thinking about the workplace.

Let’s dive deeper into the data for each category.

Communication

How people prefer to communicate is one major and obvious difference that manifests itself between generations.

While many in older generations have dabbled in new technologies and trends around communications, it’s less likely that they will internalize those methods as habits. Meanwhile, for younger folks, these newer methods (chat, texting, etc.) are what they grew up with.

Top three communication methods by generation:

- Baby Boomers:

40% of communication is in person, 35% by email, and 13% by phone - Gen X:

34% of communication is in person, 34% by email, and 13% by phone - Millennials:

33% of communication is by email, 31% is in person, and 12% by chat - Gen Z:

31% of communication is by chat, 26% is in person, and 16% by emails

Motivators

Meanwhile, the generations are divided on what motivates them in the workplace. Boomers place health insurance as an important decision factor, while younger groups view salary and pursuing a passion as being key elements to a successful career.

Three most important work motivators by generation (in order):

- Baby Boomers:

Health insurance, a boss worthy of respect, and salary - Gen X:

Salary, job security, and job challenges/excitement - Millennials:

Salary, job challenges/excitement, and ability to pursue passion - Gen Z:

Salary, ability to pursue passion, and job security

Loyalty

Finally, generational groups have varying perspectives on how long they would be willing to stay in any one role.

- Baby Boomers: 8 years

- Gen X: 7 years

- Millennials: 5 years

- Gen Z: 3 years

Given the above differences, employers will have to think clearly about how to attract and retain talent across a wide scope of generations. Further, employers will have to learn what motivates each group, as well as what makes them each feel the most comfortable in the workplace.

Demographics

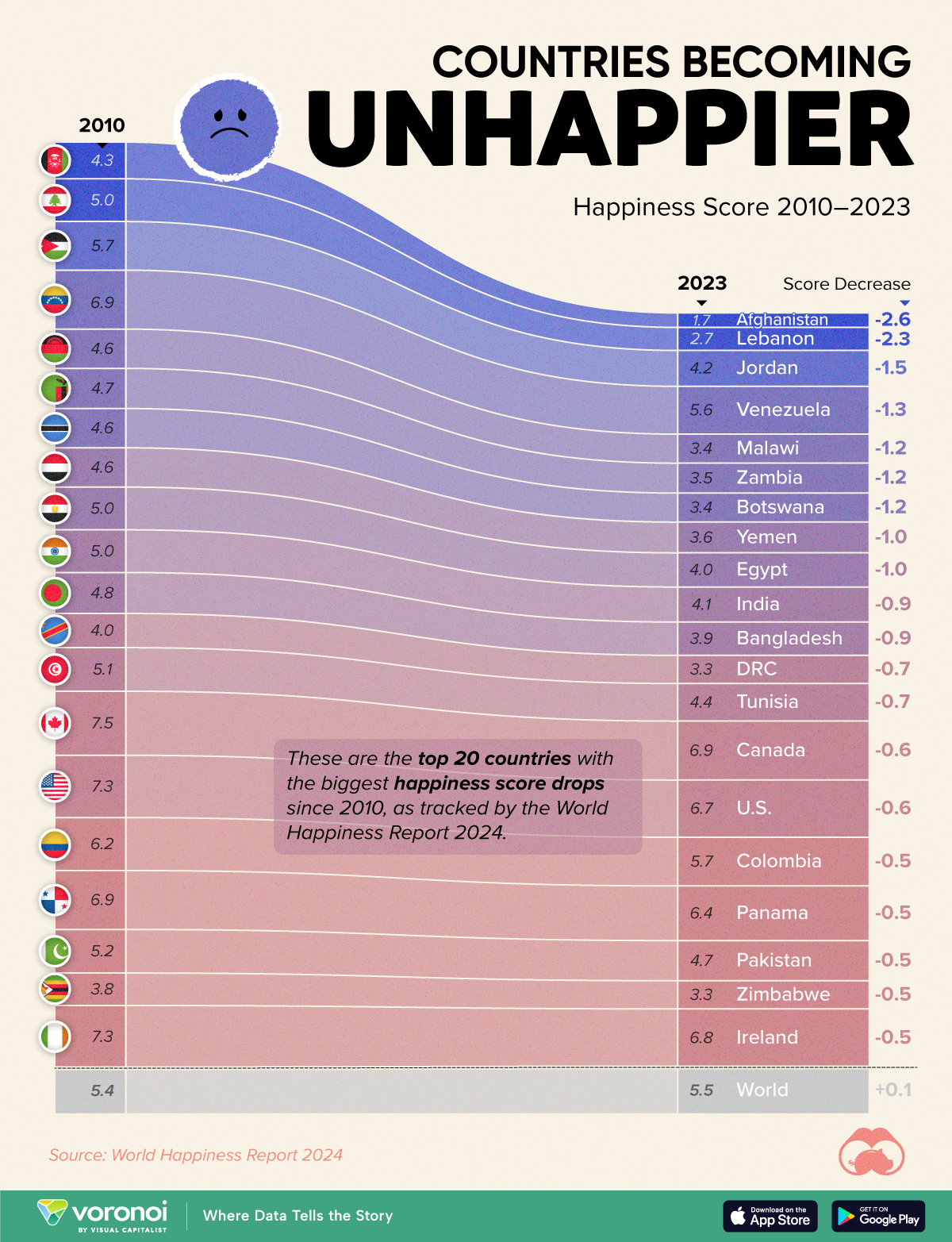

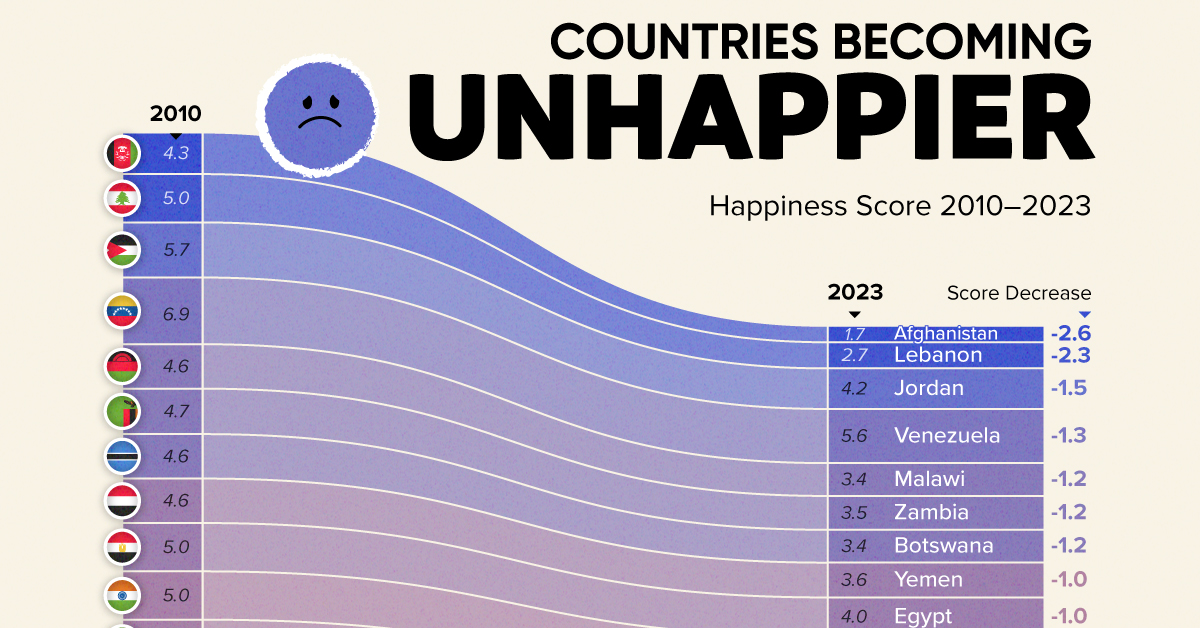

The Countries That Have Become Sadder Since 2010

Tracking Gallup survey data for more than a decade reveals some countries are witnessing big happiness declines, reflecting their shifting socio-economic conditions.

The Countries That Have Become Sadder Since 2010

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Can happiness be quantified?

Some approaches that try to answer this question make a distinction between two differing components of happiness: a daily experience part, and a more general life evaluation (which includes how people think about their life as a whole).

The World Happiness Report—first launched in 2012—has been making a serious go at quantifying happiness, by examining Gallup poll data that asks respondents in nearly every country to evaluate their life on a 0–10 scale. From this they extrapolate a single “happiness score” out of 10 to compare how happy (or unhappy) countries are.

More than a decade later, the 2024 World Happiness Report continues the mission. Its latest findings also include how some countries have become sadder in the intervening years.

Which Countries Have Become Unhappier Since 2010?

Afghanistan is the unhappiest country in the world right now, and is also 60% unhappier than over a decade ago, indicating how much life has worsened since 2010.

In 2021, the Taliban officially returned to power in Afghanistan, after nearly two decades of American occupation in the country. The Islamic fundamentalist group has made life harder, especially for women, who are restricted from pursuing higher education, travel, and work.

On a broader scale, the Afghan economy has suffered post-Taliban takeover, with various consequent effects: mass unemployment, a drop in income, malnutrition, and a crumbling healthcare system.

| Rank | Country | Happiness Score Loss (2010–24) | 2024 Happiness Score (out of 10) |

|---|---|---|---|

| 1 | 🇦🇫 Afghanistan | -2.6 | 1.7 |

| 2 | 🇱🇧 Lebanon | -2.3 | 2.7 |

| 3 | 🇯🇴 Jordan | -1.5 | 4.2 |

| 4 | 🇻🇪 Venezuela | -1.3 | 5.6 |

| 5 | 🇲🇼 Malawi | -1.2 | 3.4 |

| 6 | 🇿🇲 Zambia | -1.2 | 3.5 |

| 7 | 🇧🇼 Botswana | -1.2 | 3.4 |

| 8 | 🇾🇪 Yemen | -1.0 | 3.6 |

| 9 | 🇪🇬 Egypt | -1.0 | 4.0 |

| 10 | 🇮🇳 India | -0.9 | 4.1 |

| 11 | 🇧🇩 Bangladesh | -0.9 | 3.9 |

| 12 | 🇨🇩 DRC | -0.7 | 3.3 |

| 13 | 🇹🇳 Tunisia | -0.7 | 4.4 |

| 14 | 🇨🇦 Canada | -0.6 | 6.9 |

| 15 | 🇺🇸 U.S. | -0.6 | 6.7 |

| 16 | 🇨🇴 Colombia | -0.5 | 5.7 |

| 17 | 🇵🇦 Panama | -0.5 | 6.4 |

| 18 | 🇵🇰 Pakistan | -0.5 | 4.7 |

| 19 | 🇿🇼 Zimbabwe | -0.5 | 3.3 |

| 20 | 🇮🇪 Ireland | -0.5 | 6.8 |

| N/A | 🌍 World | +0.1 | 5.5 |

Nine countries in total saw their happiness score drop by a full point or more, on the 0–10 scale.

Noticeably, many of them have seen years of social and economic upheaval. Lebanon, for example, has been grappling with decades of corruption, and a severe liquidity crisis since 2019 that has resulted in a banking system collapse, sending poverty levels skyrocketing.

In Jordan, unprecedented population growth—from refugees leaving Iraq and Syria—has aggravated unemployment rates. A somewhat abrupt change in the line of succession has also raised concerns about political stability in the country.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries