Technology

The Future of Customer Rewards: Card Linked Offers

Every customer likes receiving a discount at the till.

Not surprisingly, businesses like customer rewards programs as well – they can be a way to drive loyalty, get repeat business, and ultimately increase customer retention.

But there’s one problem: creating a quality loyalty program has been traditionally quite expensive, especially for brick-and-mortar businesses. After all, most companies do not have the clout to market a proprietary rewards app like Starbucks, so how can customer rewards be tackled more cost effectively in the digital era?

Introducing Card Linked Offers

Today’s infographic comes from Mobi724 and it explains the concept of card linked offers (CLOs), as well as the benefits they confer to consumers, retailers, and even payment processors.

As brick-and-mortar businesses look to the potential of the smartphone economy to help retain customers and increase store traffic, card linked offers (CLOs) present an interesting opportunity.

Card linked offers are relevant, personalized, and easy to redeem. Further, they ultimately create a flawless and convenient experience that can help increase brand loyalty and customer satisfaction.

How Card Linked Offers Work

Card-linked offers (CLOs) are a card-linking technology enabling operators to link a special offer or coupon to a consumer’s debit or credit card.

- Retailers and/or banks target a consumer with relevant ads

- The closer the recommendations are to the consumer’s preferences and geolocation in real time, the higher the chances are for redemption

- Offers can be redeemed with usage of the linked payment card at point of sale (POS)

Combined with the effective use of proximity marketing, CLOs can help reach customers at the right place and at the right time. In return, operators see an increase card usage and spending at participating stores, while creating a unique opportunity to actively engage customers.

A Booming Market

In recent years, CLOs have become one of the most widely used online-to-offline (O2O) technologies.

Card linked offers are already a multi-billion dollar market, and a recent industry survey found that transactions are growing at a rapid pace. Impressively, 62% of CLO users that responded to the survey saw their transactions increase by 100% or more in the last year.

What else is driving growth in this expanding market?

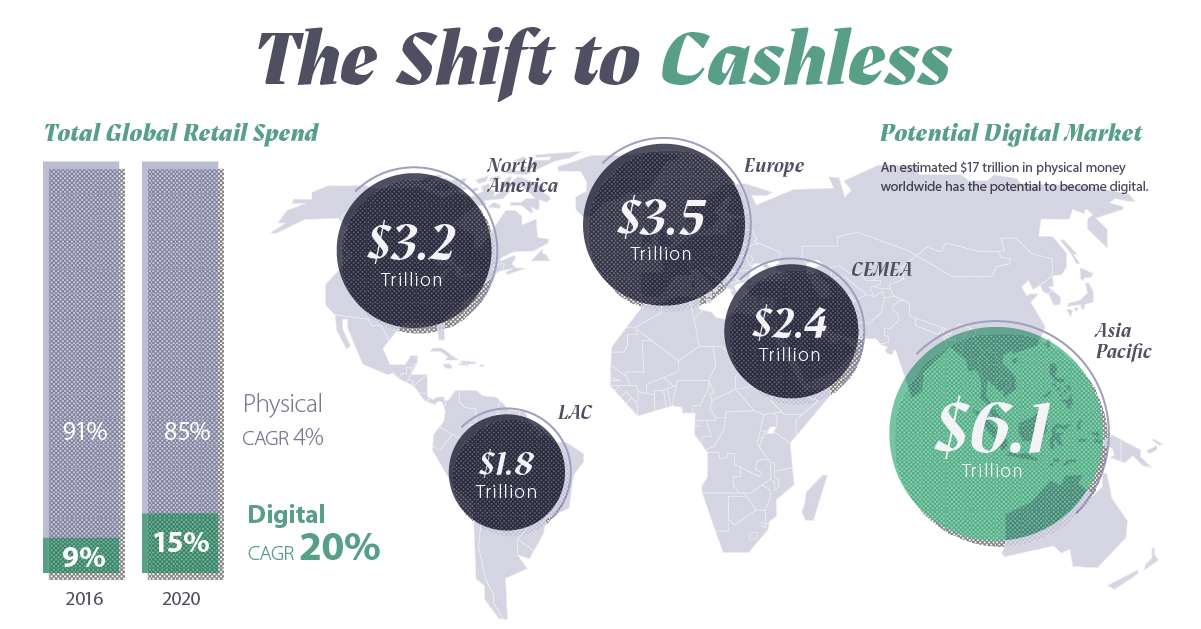

1. A Shift to Cashless

The world is embracing a cashless economy, as the popularity and convenience of using cards and mobile payment apps increases. CLOs are poised to benefit from more cashless retail transactions, which are growing at 20% per year.

2. Changing Consumer Behavior

Research shows that having an immediately gratifying rewards experience is more important to consumers than the monetary savings they get in the process. This creates a positive feedback loop with every experience.

Gauging Success

Truly successful card-linked offers must reach consumers where they are, provide personalized offers, and enable O2O – an online-to-offline redemption experience – for the customer.

If used correctly, card-linked offers can transform massive cost burdens and a lack of efficiency into new incremental revenue streams, providing a seamless user experience for all parties.

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023