Business

From Bean to Brew: The Coffee Supply Chain

View a more detailed version of this graphic

What Does The Coffee Supply Chain Look Like?

View a more detailed version of the above graphic by clicking here

There’s a good chance your day started with a cappuccino, or a cold brew, and you aren’t alone. In fact, coffee is one of the most consumed drinks on the planet, and it’s also one of the most traded commodities.

According to the National Coffee Association, more than 150 million people drink coffee on a daily basis in the U.S. alone. Globally, consumption is estimated at over 2.25 billion cups per day.

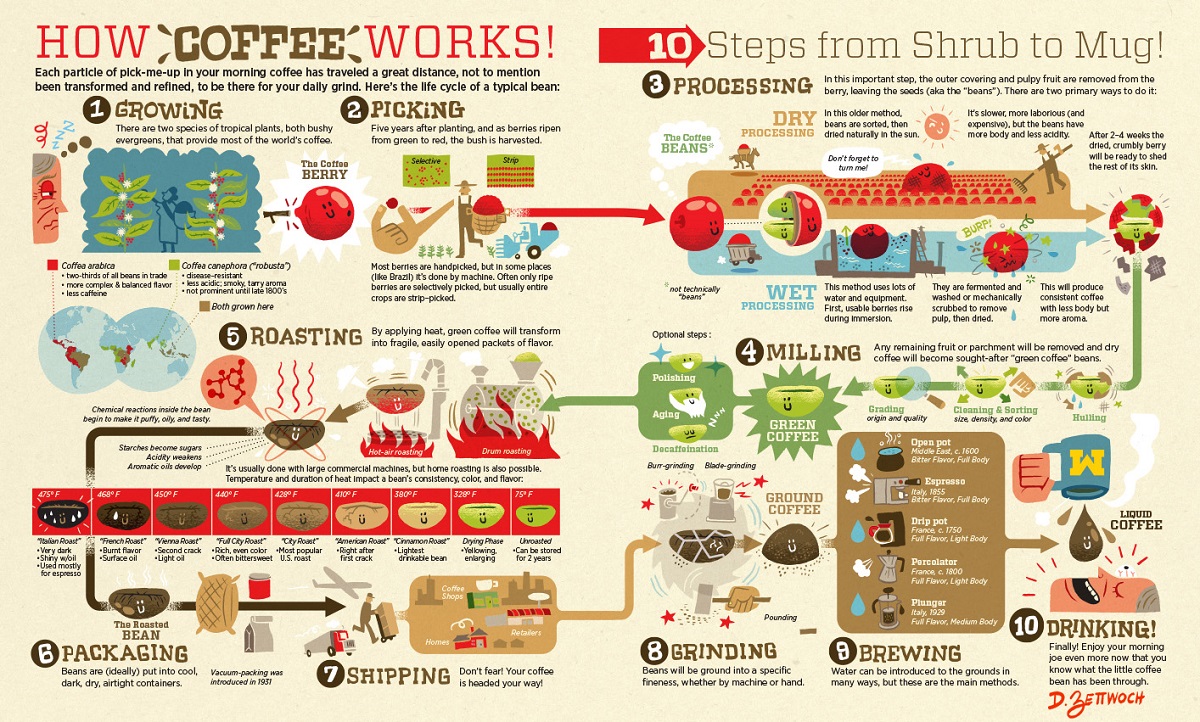

But before it gets to your morning cup, coffee beans travel through a complex global supply chain. Today’s illustration from Dan Zettwoch breaks down this journey into 10 distinct steps.

Coffee From Plant to Factory

There are two types of tropical plants that produce coffee, both preferring high altitudes and with production primarily based in South America, Asia, and Africa.

- Coffea arabica is the more plentiful bean, with a more complex flavor and less caffeine. It’s used in most specialty and “high quality” drinks as Arabica coffee.

- Coffea canephora, meanwhile, has stronger and more bitter flavors. It’s also easier to grow, and is most frequently used in espressos and instant blends as Robusta coffee.

However, both types of beans undergo the same journey:

- Growing

Plants take anywhere from 4-7 years to produce their first harvest, and grow fruit for around 25 years. - Picking

The fruit of the coffea plant is the coffee berry, containing two beans within. Ripened berries are harvested either by hand or machine. - Processing

Coffee berries are then processed either in a traditional “dry” method using the sun or “wet” method using water and machinery. This removes the outer fruit encasing the sought-after green beans. - Milling

The green coffee beans are hulled, cleaned, sorted, and (optionally) graded.

From Factory to Transport

Once the coffee berry is stripped down to green beans, it’s shipped from producing countries through a global supply network.

Green coffee beans are exported and shipped around the world. In 2018 alone, 7.2 million tonnes of green coffee beans were exported, valued at $19.2 billion.

Arriving primarily in the U.S. and Europe, the beans are now prepared for consumption:

- Roasting

Green beans are industrially roasted, becoming darker, oilier, and tasty. Different temperatures and heat duration impact the final color and flavor, with some preferring light roasts to dark roasts. - Packaging

Any imperfect or somehow ruined beans are discarded, and the remaining roasted beans are packaged together by type. - Shipping

Roasted beans are shipped both domestically and internationally. Bulk shipments go to retailers, coffee shops, and in some cases, direct to consumer.

Straight to Your Cup

Roasted coffee beans are almost ready for consumption, and by this stage the remaining steps can happen anywhere.

For example, many factories don’t ship roasted beans until they grind it themselves. Meanwhile, cafes will grind their own beans on-site before preparing drinks. The rapid growth of coffee chains made Starbucks the second-highest-earning U.S. fast food venue.

Regardless of where it happens, the final steps bring coffee straight to your cup:

- Grinding

Roasted beans are ground up in order to better extract their flavors, either by machine or by hand. The preferred fineness depends on the darkness of the roast and the brewing method. - Brewing

Water is added to the coffee grounds in a variety of methods. Some involve water being passed or pressured through the grounds (espresso, drip) while others mix the water and grounds (French press, Turkish coffee). - Drinking

Liquid coffee is ready to be enjoyed! One average cup takes 70 roasted beans to make.

The world’s choice of caffeine pick-me-up is made possible by this structured and complex supply chain. Coffee isn’t just a drink, after all, it’s a business.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue