Markets

Fertility Rates Keep Dropping, and it’s Going to Hit the Economy Hard

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

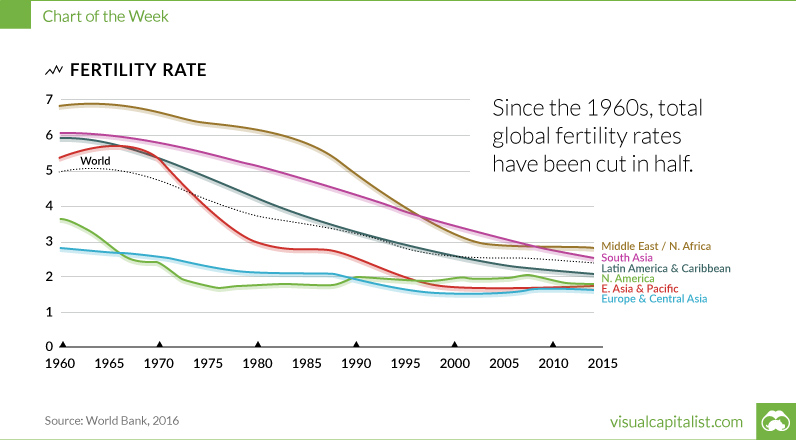

Total fertility rates, which can be defined as the average number of children born to a woman who survives her reproductive years (aged 15-49), have decreased globally by about half since 1960.

This has drastically shaped today’s global economy, but a continued decline could have much more severe long-term consequences. If the world has too many elderly dependents and not enough workers, the burden on economic growth will be difficult to overcome.

Fertility Rates Start to Decline

First, it’s important to address some of the reasons for these falling fertility rates.

In developed nations the introduction of commercially available birth control has played a large role, but this also coincided with several major societal shifts. Changing religious values, the emancipation of women and their increasing participation in the workforce, and higher costs of childcare and education have all factored into declining fertility rates.

Birthrates Wane, Economy Gains

Initially, reduced child dependency rates were actually beneficial to economic growth.

By delaying childbirth, men and women could gain an education before starting a family. This was important in a shifting labor market where smaller, family-run businesses were in decline and a more skilled and specialized labor force was in demand.

Men and women could also choose to start their careers before having families, while paying more in income taxes and enjoying the benefits of a higher disposable income. Increased spending power creates demand, which stimulates job growth – and the economy benefits in the short-term.

A Global Phenomenon

Worldwide fertility rates began to fall substantially in the mid-1960s. While each country has its own underlying causes for this, it is interesting that in developed and developing nations, the downward trend is similar.

Part of this is due to developing countries’ own efforts to rein in their rapidly expanding populations. In China, the One Child Policy was introduced in 1979, however fertility rates had already dropped significantly prior to this. India’s government was also active on this front, sterilizing an estimated 8.3 million people (mostly men) between 1975 and 1977 as a method of population control.

The Age Imbalance

So here we are now, with a global fertility rate of just 2.5 – roughly half of what it was 50 years ago.

Today, 46% of the world’s population lives in countries that are below the average global replacement rate of 2.1 children per woman.

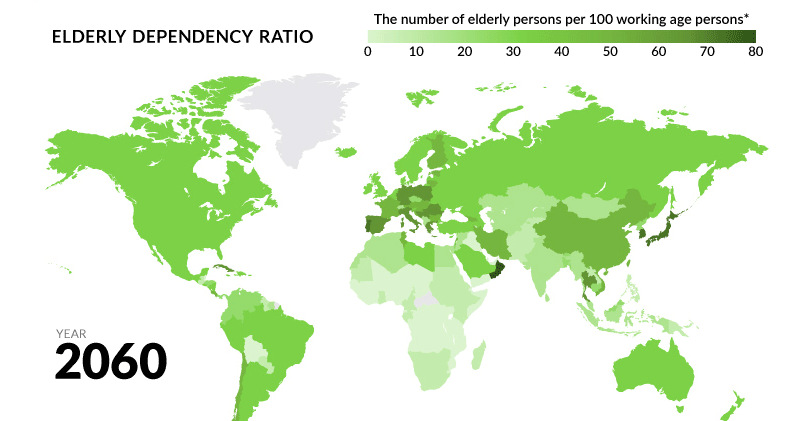

Because these countries (59 to be exact, including BRIC nations Brazil, Russia, and China) are not repopulating quickly enough to sustain their current populations, we are beginning to see a substantial imbalance in the ratio of elderly dependents to working-age people, which will only intensify over the coming decades.

By 2100, the U.N. predicts that nearly 30% of the population will be made of people 60 years and older. Life expectancy also continues to increase steadily, which means those dependents will be living even longer. Between 2000 and 2015 the average global life expectancy at birth increased by around 5 years, reaching an average of 73.8 years for females and 69.1 years for males.

Economic Reversal

What does this mean for the economy?

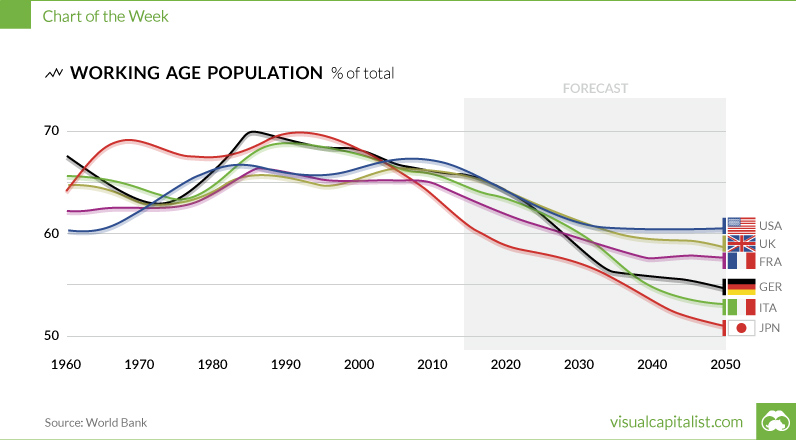

As this large aging population exits the workforce, most of the positive trends that were spurred by declining fertility rates will be reversed, and economic growth will face a significant burden.

The global increase of elderly dependent populations will have serious economic consequences. Health care costs for the elderly will strain resources, while the smaller working population will struggle to produce enough income tax revenue to support these rising costs. It’s likely this will cause spending power to decrease, consumerism to decline, job production to slow – and the economy to stagnate.

Solutions

Immigration has been a source of short-term population sustenance for many nations, including the U.S. and Britain. However, aside from obvious societal tensions associated with this strategy, immigrants are often adults themselves when they relocate, meaning they too will be elderly dependents soon.

Several nations are already experiencing the effects of a large proportion of elderly dependents. Japan, with one-quarter of its total population currently over the age of 65, has been a pioneer in developing technologies, such as robotics, as a solution to ease strained health care resources. Many countries are restructuring health care programs with long-term solutions in mind, while others are attempting to lower the cost of childcare and education.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries