Retail

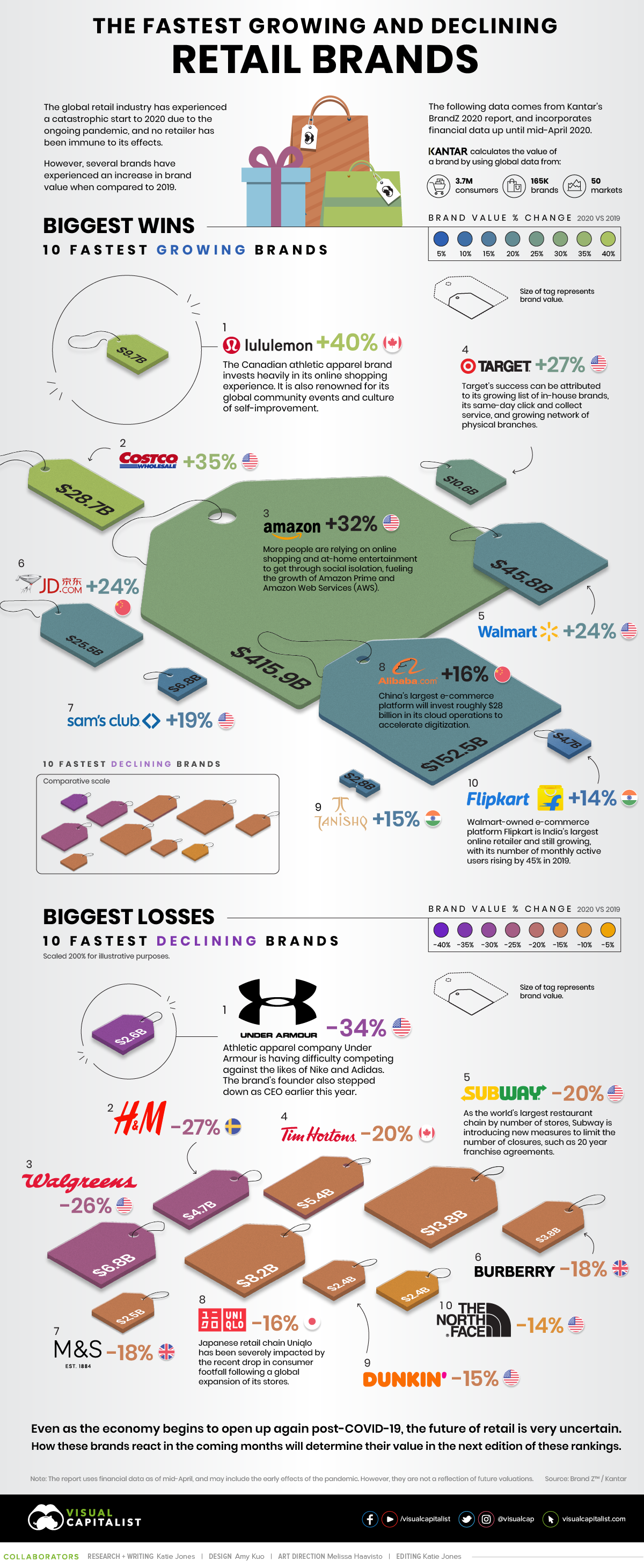

Ranked: The Fastest Growing and Declining Retail Brands, from 2019-2020

The Fastest Growing and Declining Retail Brands in 2020

The COVID-19 outbreak has led to the savage disruption of retail the world over.

Almost overnight, foot traffic in physical stores disappeared, and supply chains were left scrambled. Now at a major fork in the road, many retailers are forced to make tough decisions that were completely unforeseen.

While some global retail giants are laying down their weapons and filing for bankruptcy, others are innovating to save themselves, serving their customers in new and unexpected ways.

Today’s graphic uses data from Kantar’s Brand Z™ report to illustrate the retailers that are growing through adversity, and those that may struggle to survive.

Editor’s note: The report compares brand value of the top 75 retailers globally between 2020 and 2019, using mid-April as a cut-off date for incorporating latest financial information. Some early effects of the pandemic are incorporated in these calculations, but the pandemic’s impact on retail going forward is uncertain.

Retailers Rising to the Top

The calculation of brand value refers to the total amount that a brand contributes to the overall business value of the parent company.

In this case, it is measured by taking the financial value of a brand (latest data as of mid-April), and multiplying it by the brand’s contribution, or the ability of the brand to deliver value to the company by predisposing consumers to choose the brand over others or pay more for it, based purely on perceptions.

Based on these metrics, activewear brand lululemon is the world’s fastest growing retail brand for the second year running. Famous for its culture of accountability and global community events, the brand has struck the perfect balance between a seamless online and offline experience.

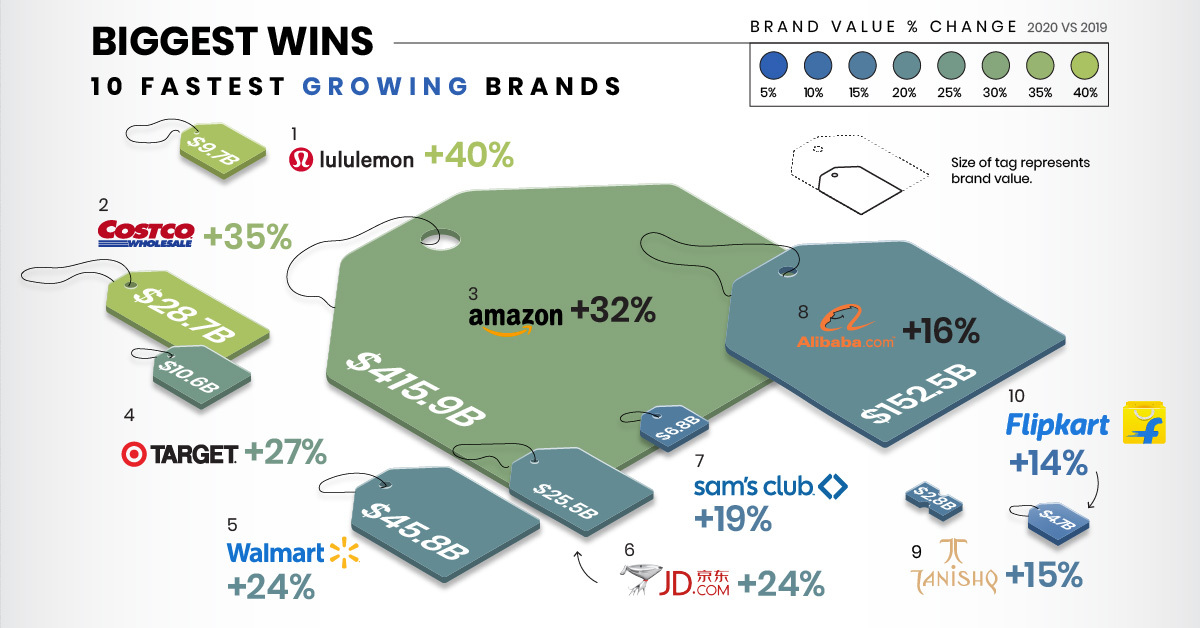

Explore the 10 fastest growing retail brands of 2020 below:

| Brand | Brand Value 2020 | Brand Value % Change 2020 Vs. 2019 | Category | Country |

|---|---|---|---|---|

| lululemon | $9.7B | 40% | Apparel | 🇨🇦 Canada |

| Costco | $28.7B | 35% | Retail | 🇺🇸 United States |

| Amazon | $415.9B | 32% | Retail | 🇺🇸 United States |

| Target | $10.6B | 32% | Retail | 🇺🇸 United States |

| Walmart | $45.8B | 24% | Retail | 🇺🇸 United States |

| JD.com | $25.5B | 24% | Retail | 🇨🇳 China |

| Sam’s Club | $6.8B | 19% | Retail | 🇺🇸 United States |

| Alibaba | $152.5B | 16% | Retail | 🇨🇳 China |

| Tanishq | $2.8B | 15% | Retail | 🇮🇳 India |

| Flipkart | $4.7B | 14% | Retail | 🇮🇳 India |

Interestingly, Walmart holds three spots in the ranking as it also owns Flipkart and Sam’s Club. Moreover, the American retail giant purchased a stake in Chinese e-commerce platform JD.com, which has grown from 5% to 12%.

The two brands entered the strategic partnership together with the goal of dominating the Chinese market and surpassing Alibaba.

The Recipe for Retail Success

While every retailer has a unique growth strategy, according to the authors of the report, there are three factors that are undeniably crucial for success.

- Value: Offering value for money through fair pricing for all products or services.

- Uniqueness: Having a clear purpose and standing for something that consumers find meaningful.

- Premium: Being perceived as being worth more than the price consumers pay.

Further, research also suggests that successful brands dominate their respective category when it comes to brand awareness and consistently provide experiences that enrich their customers’ lives, as demonstrated by lululemon.

As retailers continue to shift their focus towards digital transformation, consumers are still finding great value in having the best of both worlds when it comes to combining e-commerce and brick-and-mortar, otherwise known as “brick and click”.

Retailers Struggling to Stay Relevant

Unfortunately, there are several brands that haven’t yet mastered this winning combination, and the ruthless pandemic economy has only emphasized their struggles.

Here are the 10 fastest declining retail brands of 2020:

| Brand | Brand Value 2020 | Brand Value % Change 2020 Vs. 2019 | Category | Country |

|---|---|---|---|---|

| Under Armour | $2.6B | -34% | Apparel | 🇺🇸 United States |

| H&M | $4.7B | -27% | Apparel | 🇸🇪 Sweden |

| Walgreens | $6.8B | -26% | Retail | 🇺🇸 United States |

| Tim Hortons | $5.4B | -20% | Fast Food | 🇨🇦 Canada |

| Subway | $13.8B | -20% | Fast Food | 🇺🇸 United States |

| Burberry | $3.8B | -18% | Luxury | 🇬🇧 United Kingdom |

| M&S | $2.5B | -18% | Retail | 🇬🇧 United Kingdom |

| Uniqlo | $8.2B | -16% | Apparel | 🇯🇵 Japan |

| Dunkin' | $2.4B | -15% | Fast Food | 🇺🇸 United States |

| The North Face | $2.4B | -14% | Apparel | 🇺🇸 United States |

Under Armour’s distribution relies heavily on third party retailers and department stores, so the brand has understandably been negatively impacted by the mass store closures.

While the brand focuses on expanding its personalized and connected fitness product offerings, it faces huge pressure from powerful competitors such as Nike and Adidas who already dominate this space.

A Rising Tide Lifts All Shipments

2020 has instigated a retail renaissance of epic proportions through accelerated digitization and changing consumer values. Ultimately, some brands will be better positioned than others to benefit from these changes.

As retailers begin reopening for business, they are presented with an opportunity to recalibrate the current retail landscape by setting new standards for the industry.

Brands

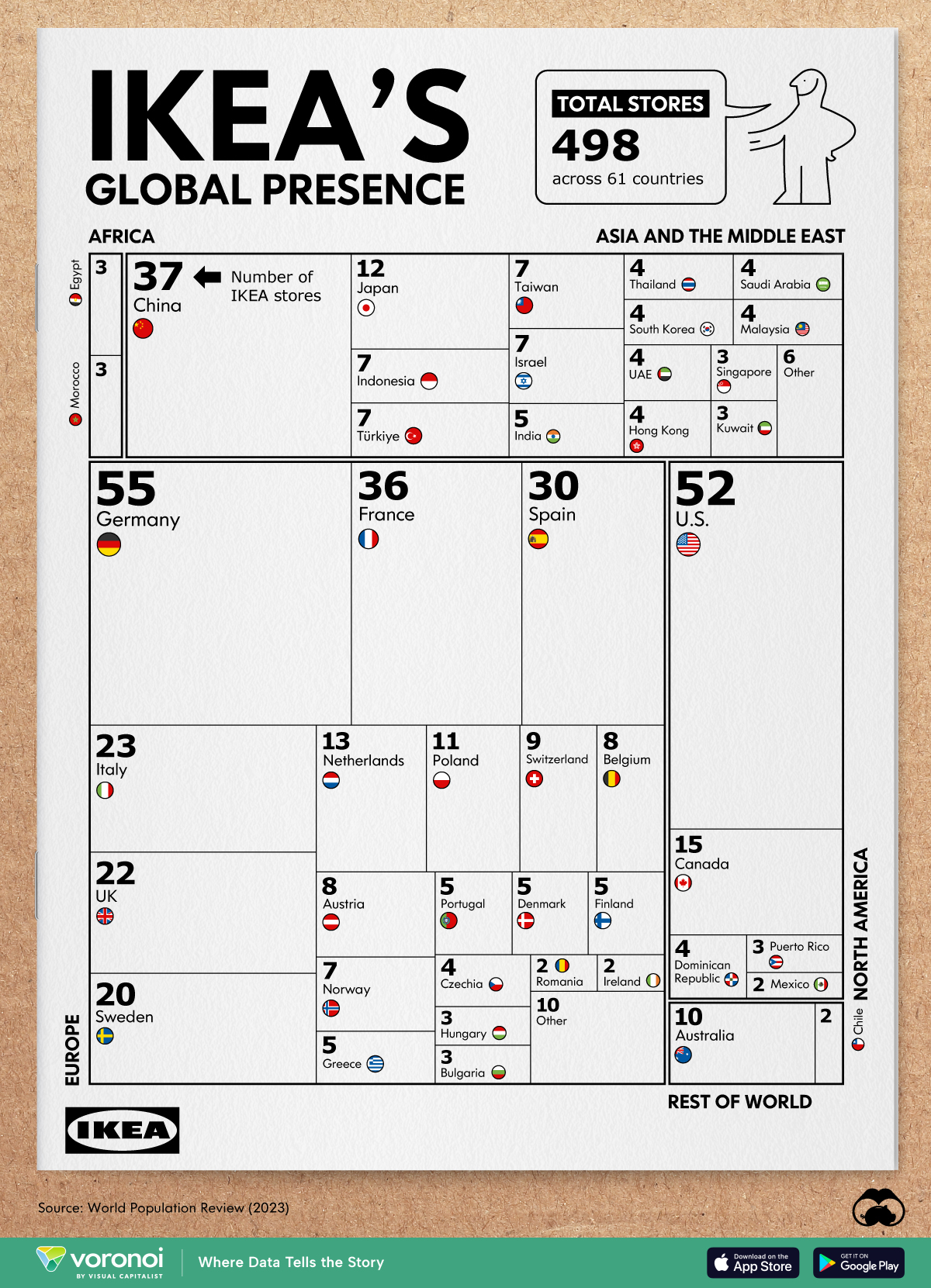

Charted: Number of IKEA Stores, by Country

Known for their size, labyrinth-like layouts, food, and of course, functional furniture, IKEA stores have become a whole shopping experience. But which country has the most of them?

Charted: Number of IKEA Stores By Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The first IKEA opened in 1958 in Älmhult, Sweden, forever changing how students and young adults on a shoestring budget decorated their homes.

Its mission to provide simple, affordable, and functional furniture to the masses revolutionized an entire industry.

But in which countries does the Scandinavian brand have the biggest presence?

We visualize the number of IKEA stores globally, by region and country, using data from World Population Review. The source warns that per-country numbers tend to fluctuate as stores can open and shut at any time. IKEA’s own store count lists them by region only, and has a lower total number, suggesting stores have closed since World Population Review’s last count.

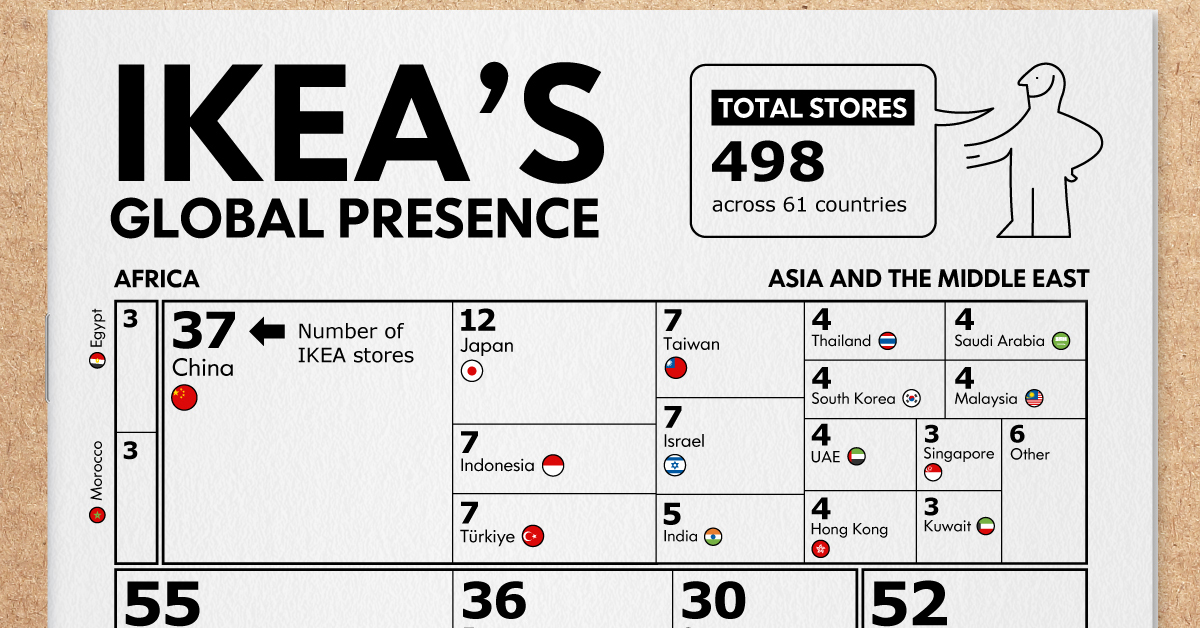

Which Countries Have the Most IKEA Stores?

IKEA’s biggest presence is in Germany, boasting of 55 stores in a country of 83 million people, or about one store per 1.5 million Germans.

| Rank | Country | Region | Ikea Stores |

|---|---|---|---|

| 1 | 🇩🇪 Germany | Europe | 55 |

| 2 | 🇺🇸 U.S. | North America | 52 |

| 3 | 🇨🇳 China | Asia | 37 |

| 4 | 🇫🇷 France | Europe | 36 |

| 5 | 🇪🇸 Spain | Europe | 30 |

| 6 | 🇮🇹 Italy | Europe | 23 |

| 7 | 🇬🇧 UK | Europe | 22 |

| 8 | 🇸🇪 Sweden | Europe | 20 |

| 9 | 🇨🇦 Canada | North America | 15 |

| 10 | 🇳🇱 Netherlands | Europe | 13 |

| 11 | 🇯🇵 Japan | Asia | 12 |

| 12 | 🇵🇱 Poland | Europe | 11 |

| 13 | 🇦🇺 Australia | Oceania | 10 |

| 14 | 🇨🇭 Switzerland | Europe | 9 |

| 15 | 🇧🇪 Belgium | Europe | 8 |

| 16 | 🇦🇹 Austria | Europe | 8 |

| 17 | 🇮🇩 Indonesia | Asia | 7 |

| 18 | 🇹🇷 Turkey | Asia | 7 |

| 19 | 🇹🇼 Taiwan | Asia | 7 |

| 20 | 🇮🇱 Israel | Asia | 7 |

| 21 | 🇳🇴 Norway | Europe | 7 |

| 22 | 🇮🇳 India | Asia | 5 |

| 23 | 🇬🇷 Greece | Europe | 5 |

| 24 | 🇵🇹 Portugal | Europe | 5 |

| 25 | 🇩🇰 Denmark | Europe | 5 |

| 26 | 🇫🇮 Finland | Europe | 5 |

| 27 | 🇹🇭 Thailand | Asia | 4 |

| 28 | 🇰🇷 South Korea | Asia | 4 |

| 29 | 🇸🇦 Saudi Arabia | Asia | 4 |

| 30 | 🇲🇾 Malaysia | Asia | 4 |

| 31 | 🇦🇪 UAE | Asia | 4 |

| 32 | 🇭🇰 Hong Kong | Asia | 4 |

| 33 | 🇨🇿 Czech Republic | Europe | 4 |

| 34 | 🇩🇴 Dominican Republic | North America | 4 |

| 35 | 🇪🇬 Egypt | Africa | 3 |

| 36 | 🇲🇦 Morocco | Africa | 3 |

| 37 | 🇸🇬 Singapore | Asia | 3 |

| 38 | 🇰🇼 Kuwait | Asia | 3 |

| 39 | 🇭🇺 Hungary | Europe | 3 |

| 40 | 🇧🇬 Bulgaria | Europe | 3 |

| 41 | 🇵🇷 Puerto Rico | North America | 3 |

| 42 | 🇷🇴 Romania | Europe | 2 |

| 43 | 🇮🇪 Ireland | Europe | 2 |

| 44 | 🇲🇽 Mexico | North America | 2 |

| 45 | 🇨🇱 Chile | South America | 2 |

| 46 | 🇵🇭 Philippines | Asia | 1 |

| 47 | 🇯🇴 Jordan | Asia | 1 |

| 48 | 🇴🇲 Oman | Asia | 1 |

| 49 | 🇶🇦 Qatar | Asia | 1 |

| 50 | 🇧🇭 Bahrain | Asia | 1 |

| 51 | 🇲🇴 Macau | Asia | 1 |

| 52 | 🇺🇦 Ukraine | Europe | 1 |

| 53 | 🇷🇸 Serbia | Europe | 1 |

| 54 | 🇸🇰 Slovakia | Europe | 1 |

| 55 | 🇭🇷 Croatia | Europe | 1 |

| 56 | 🇱🇹 Lithuania | Europe | 1 |

| 57 | 🇸🇮 Slovenia | Europe | 1 |

| 58 | 🇱🇻 Latvia | Europe | 1 |

| 59 | 🇪🇪 Estonia | Europe | 1 |

| 60 | 🇨🇾 Cyprus | Europe | 1 |

| 61 | 🇮🇸 Iceland | Europe | 1 |

| N/A | 🌐 World | N/A | 498 |

A 2022 survey found that 96% of Germans knew of the IKEA brand of which 64% actively bought furniture from them. But it’s not only a passion for minimalist home design that Germans enjoy. In 2011, a German newspaper found that IKEA ranked as the second-most popular fast food place in the country, successfully beating out McDonald’s.

Across the Atlantic, the U.S. ranks a close second with 52 IKEA stores, most of them congregating on both coasts, though a fair amount can be found in the Midwest.

Both Germany and the U.S. are well-ahead of the next closest countries, China (37), France (36), and Spain (30), which round out the top five.

Like many other brands seeking access to the 1.4-billion strong market, IKEA has focused on China as a major growth opportunity. It prioritized more modular designs to fit smaller Chinese homes, a sharp contrast to their American consumers who wanted bigger beds and closets.

Some countries in the Middle East and Eastern Europe only have a single store. However, numbers don’t tell the whole story. For example, in Croatia and Lithuania, IKEA is the most-searched brand in the country.

In the Philippines (also with a solitary IKEA), shoppers are treated to a an incredible (or tiring) experience: in Pasay City, the biggest IKEA store ever measures 700,000 square feet, or the equivalent of 150 basketball courts. Before it had even opened, Filipinos reportedly crashed the website in a rush to sign up for loyalty programs.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue