Technology

Mapped: The State of Facial Recognition Around the World

View the full-size version of this infographic.

Mapping The State of Facial Recognition Around the World

View the high resolution version of this infographic by clicking here.

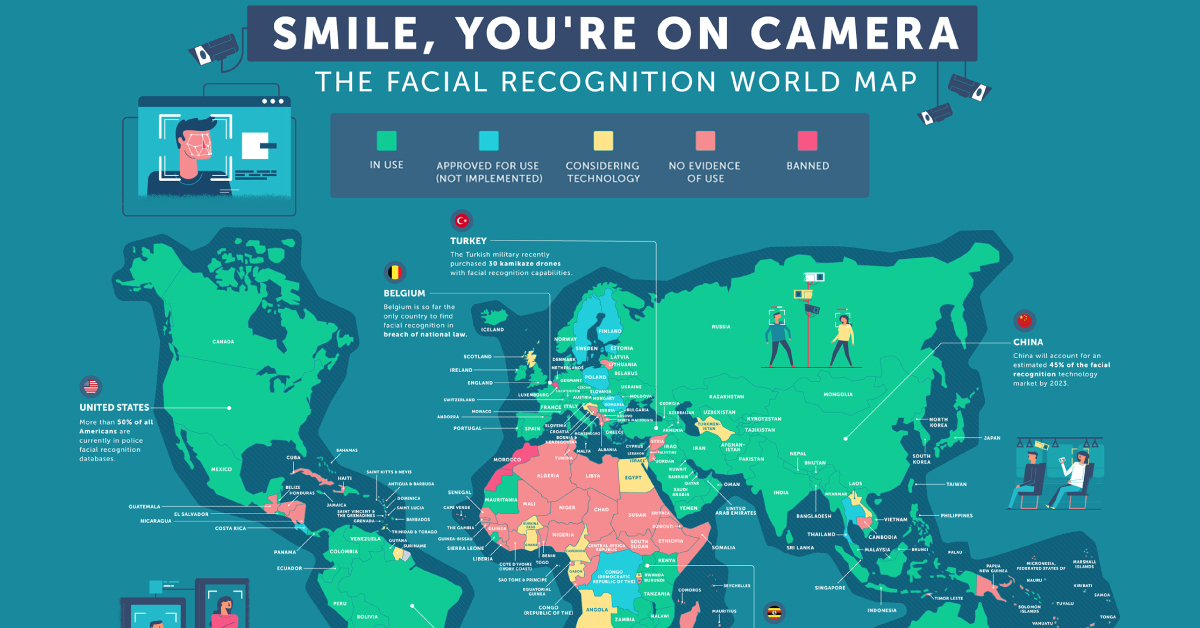

From public CCTV cameras to biometric identification systems in airports, facial recognition technology is now common in a growing number of places around the world.

In its most benign form, facial recognition technology is a convenient way to unlock your smartphone. At the state level though, facial recognition is a key component of mass surveillance, and it already touches half the global population on a regular basis.

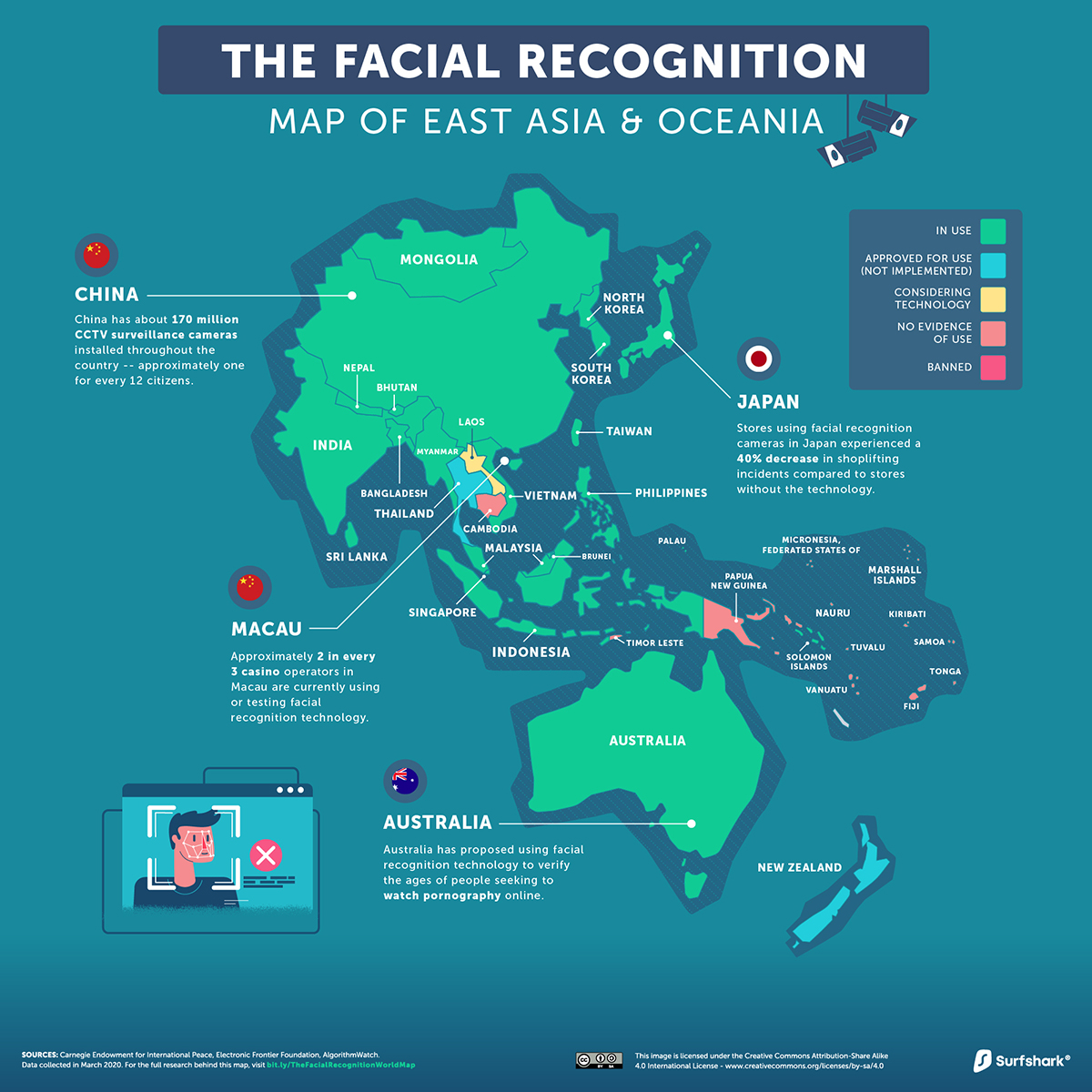

Today’s visualizations from SurfShark classify 194 countries and regions based on the extent of surveillance.

| Facial Recognition Status | Total Countries |

|---|---|

| In Use | 98 |

| Approved, but not implemented | 12 |

| Considering technology | 13 |

| No evidence of use | 68 |

| Banned | 3 |

Click here to explore the full research methodology.

Let’s dive into the ways facial recognition technology is used across every region.

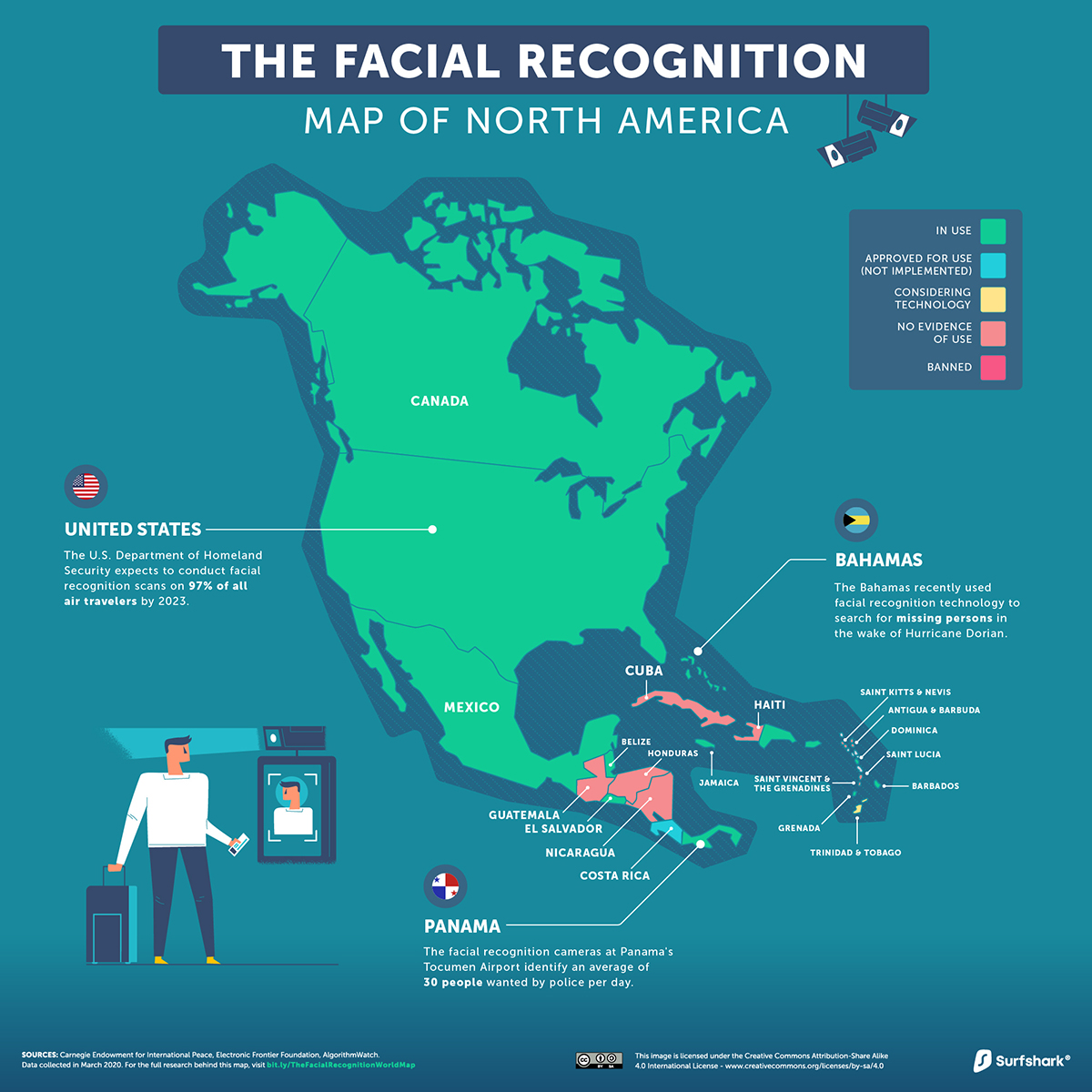

North America, Central America, and Caribbean

In the U.S., a 2016 study showed that already half of American adults were captured in some kind of facial recognition network. More recently, the Department of Homeland Security unveiled its “Biometric Exit” plan, which aims to use facial recognition technology on nearly all air travel passengers by 2023, to identify compliance with visa status.

Perhaps surprisingly, 59% of Americans are actually in favor of implementing facial recognition technology, considering it acceptable for use in law enforcement according to a Pew Research survey. Yet, some cities such as San Francisco have pushed to ban surveillance, citing a stand against its potential abuse by the government.

Facial recognition technology can potentially come in handy after a natural disaster. After Hurricane Dorian hit in late summer of 2019, the Bahamas launched a blockchain-based missing persons database “FindMeBahamas” to identify thousands of displaced people.

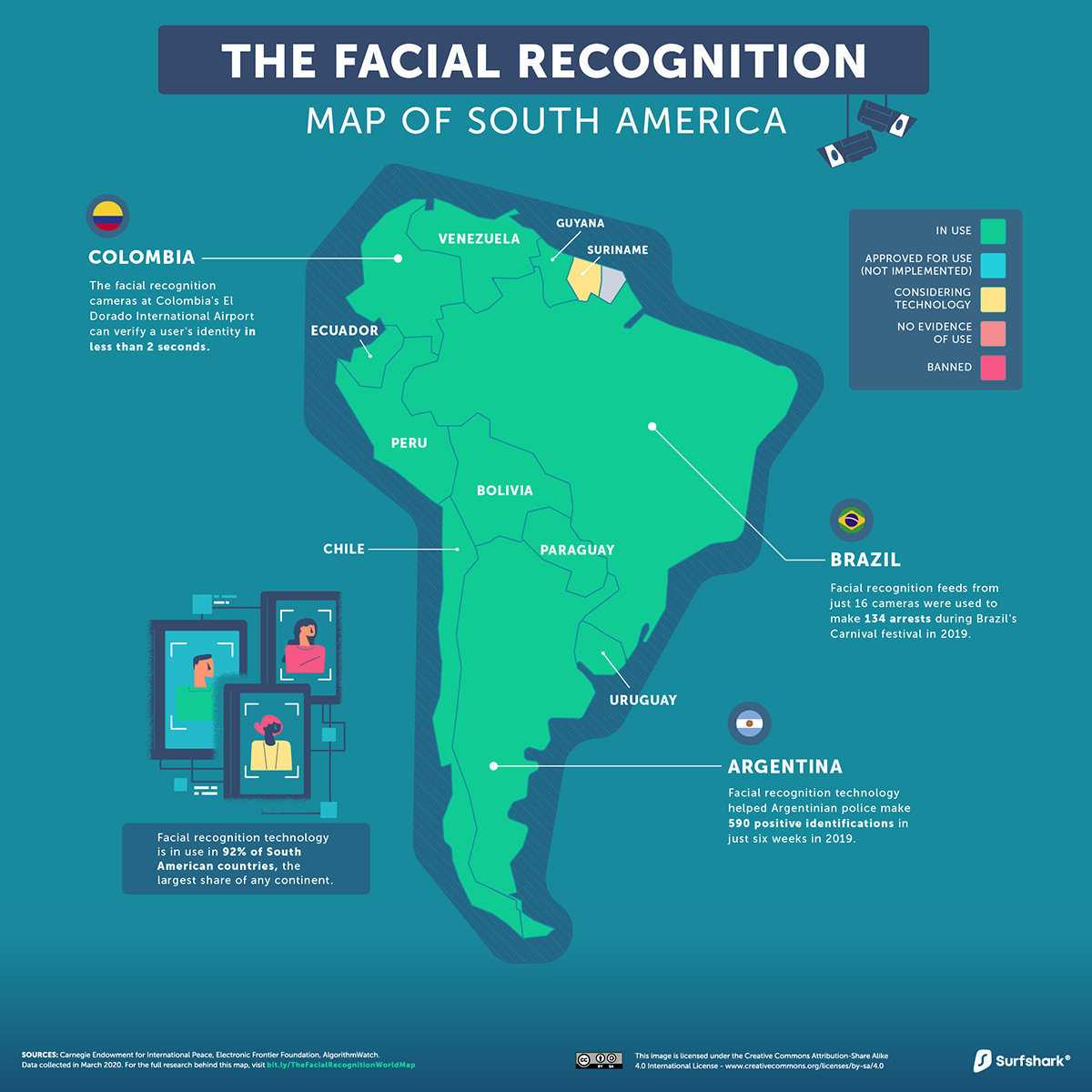

South America

The majority of facial recognition technology in South America is aimed at cracking down on crime. In fact, it worked in Brazil to capture Interpol’s second-most wanted criminal.

Home to over 209 million, Brazil soon plans to create a biometric database of its citizens. However, some are nervous that this could also serve as a means to prevent dissent against the current political order.

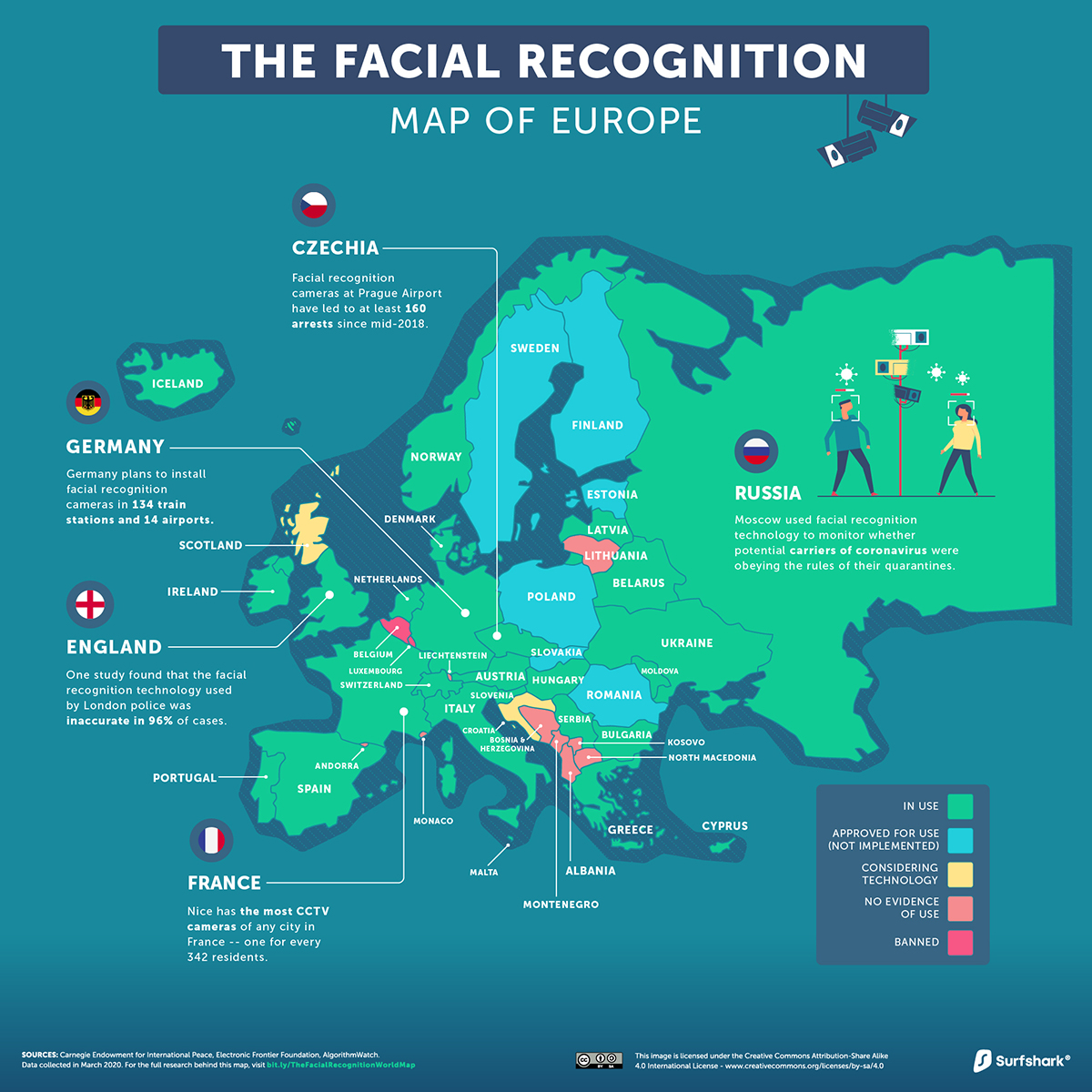

Europe

Belgium and Luxembourg are two of only three governments in the world to officially oppose the use of facial recognition technology.

Further, 80% of Europeans are not keen on sharing facial data with authorities. Despite such negative sentiment, it’s still in use across 26 European countries to date.

The EU has been a haven for unlawful biometric experimentation and surveillance.

—European Digital Rights (EDRi)

In Russia, authorities have relied on facial recognition technology to check for breaches of quarantine rules by potential COVID-19 carriers. In Moscow alone, there are reportedly over 100,000 facial recognition enabled cameras in operation.

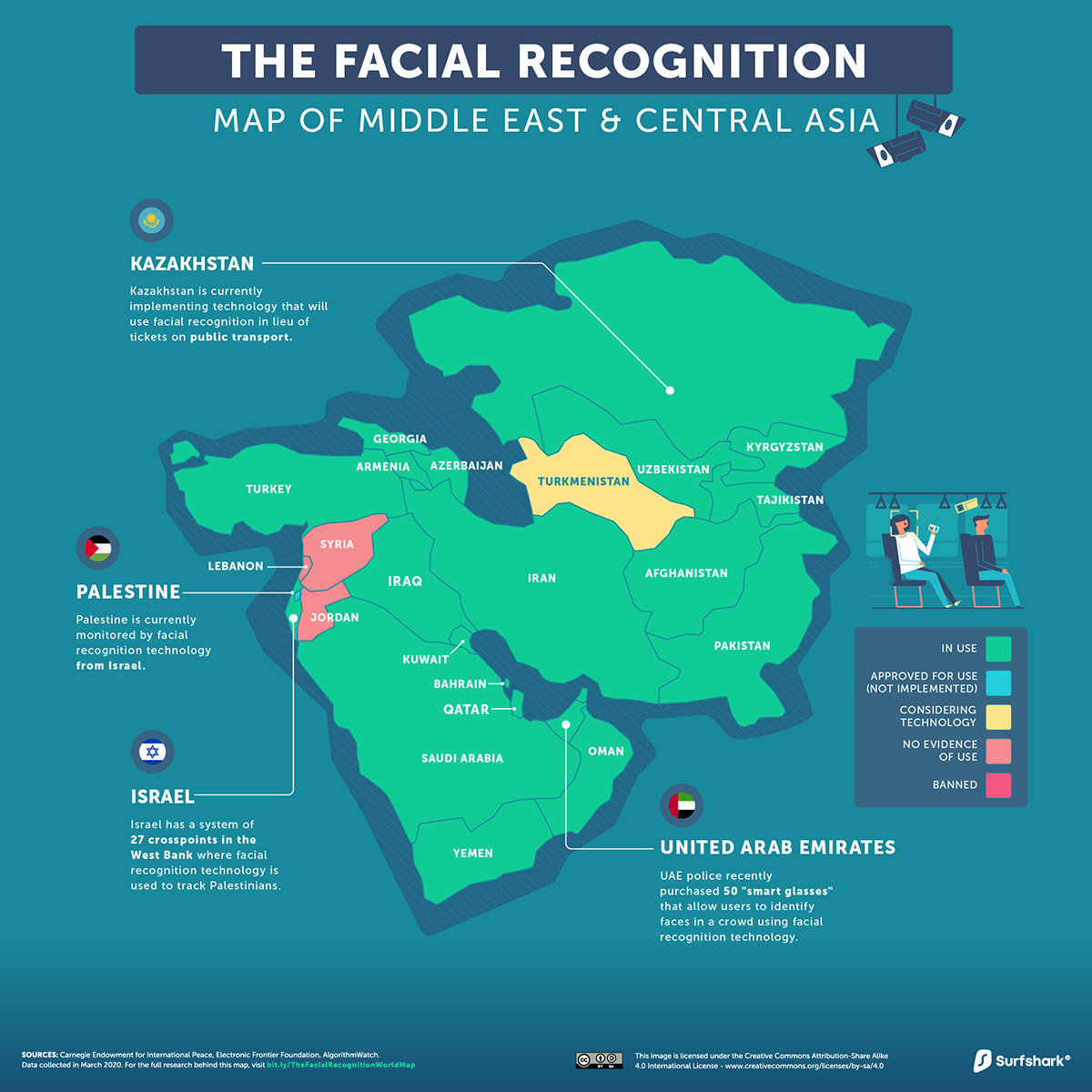

Middle East and Central Asia

Facial recognition technology is widespread in this region, notably for military purposes.

In Turkey, 30 domestically-developed kamikaze drones will use AI and facial recognition for border security. Similarly, Israel has a close eye on Palestinian citizens across 27 West Bank checkpoints.

In other parts of the region, police in the UAE have purchased discreet smart glasses that can be used to scan crowds, where positive matches show up on an embedded lens display. Over in Kazakhstan, facial recognition technology could replace public transportation passes entirely.

East Asia and Oceania

In the COVID-19 battle, contact tracing through biometric identification became a common tool to slow the infection rates in countries such as China, South Korea, Taiwan, and Singapore. In some instances, this included the use of facial recognition technology to monitor temperatures as well as spot those without a mask.

That said, questions remain about whether the pandemic panopticon will stop there.

China is often cited as a notorious use case of mass surveillance, and the country has the highest ratio of CCTV cameras to citizens in the world—one for every 12 people. By 2023, China will be the single biggest player in the global facial recognition market. And it’s not just implementing the technology at home–it’s exporting too.

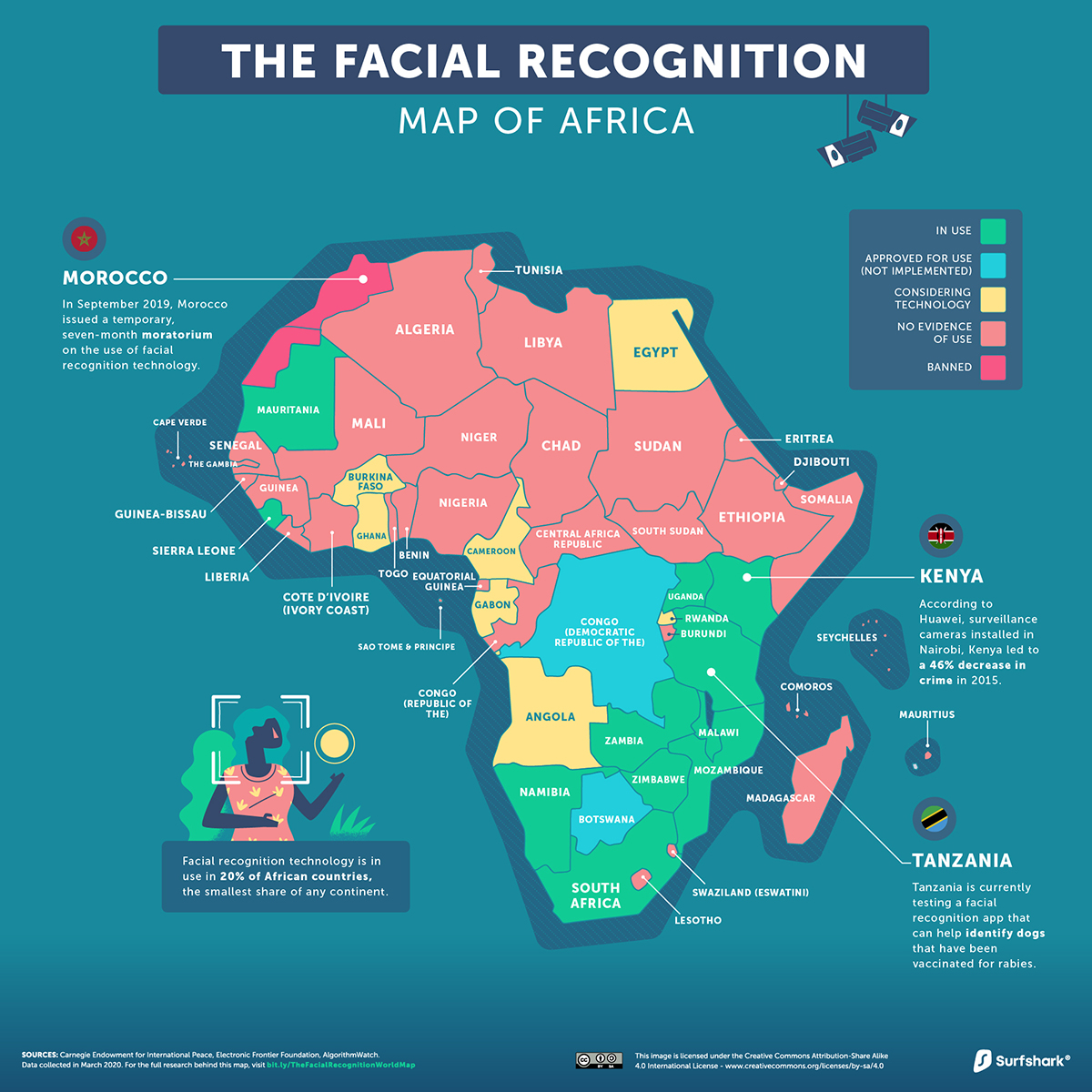

Africa

While the African continent currently has the lowest concentration of facial recognition technology in use, this deficit may not last for long.

Several African countries, such as Kenya and Uganda, have received telecommunications and surveillance financing and infrastructure from Chinese companies—Huawei in particular. While the company claims this has enabled regional crime rates to plummet, some activists are wary of the partnership.

Whether you approach facial recognition technology from public and national security lens or from an individual liberty perspective, it’s clear that this kind of surveillance is here to stay.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Business2 weeks ago

Business2 weeks agoAmerica’s Top Companies by Revenue (1994 vs. 2023)

-

Environment1 week ago

Environment1 week agoRanked: Top Countries by Total Forest Loss Since 2001

-

Markets1 week ago

Markets1 week agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population

-

Misc2 weeks ago

Misc2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.