Technology

How Facebook is Using Machine Learning to Map the World Population

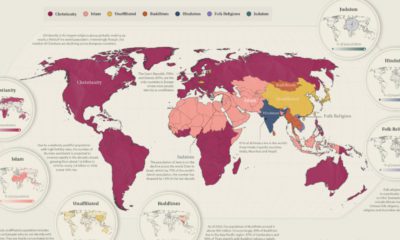

When it comes to knowing where humans around the world actually live, resources come in varying degrees of accuracy and sophistication.

Heavily urbanized and mature economies generally produce a wealth of up-to-date information on population density and granular demographic data. In rural Africa or fast-growing regions in the developing world, tracking methods cannot always keep up, or in some cases may be non-existent.

This is where new maps, produced by researchers at Facebook, come in. Building upon CIESIN’s Gridded Population of the World project, Facebook is using machine learning models on high-resolution satellite imagery to paint a definitive picture of human settlement around the world. Let’s zoom in.

Connecting the Dots

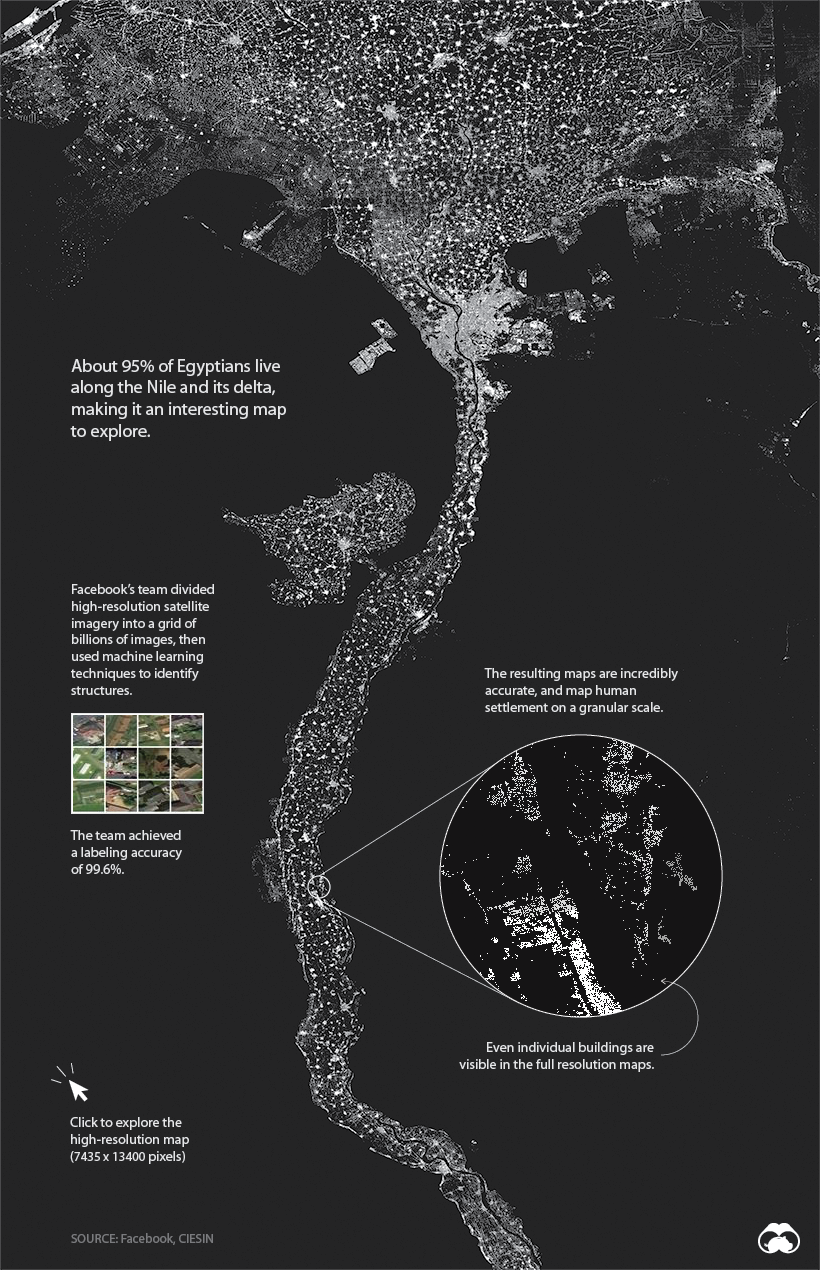

Will all other details stripped away, human settlement can form some interesting patterns. One of the most compelling examples is Egypt, where 95% of the population lives along the Nile River. Below, we can clearly see where people live, and where they don’t.

View the full-resolution version of this map.

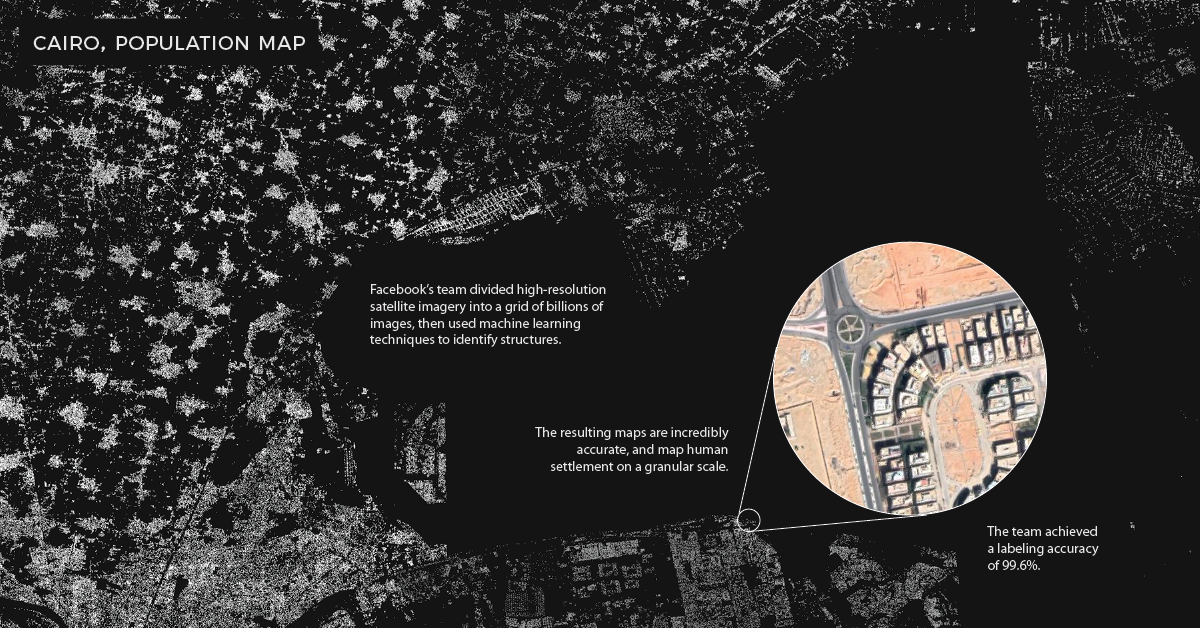

While it is possible to use a tool like Google Earth to view nearly any location on the globe, the problem is analyzing the imagery at scale. This is where machine learning comes into play.

Finding the People in the Petabytes

High-resolution imagery of the entire globe takes up about 1.5 petabytes of storage, making the task of classifying the data extremely daunting. It’s only very recently that technology was up to the task of correctly identifying buildings within all those images.

To get the results we see today, researchers used process of elimination to discard locations that couldn’t contain a building, then ranked them based on the likelihood they could contain a building.

Facebook identified structures at scale using a process called weakly supervised learning. After training the model using large batches of photos, then checking over the results, Facebook was able to reach a 99.6% labeling accuracy for positive examples.

Why it Matters

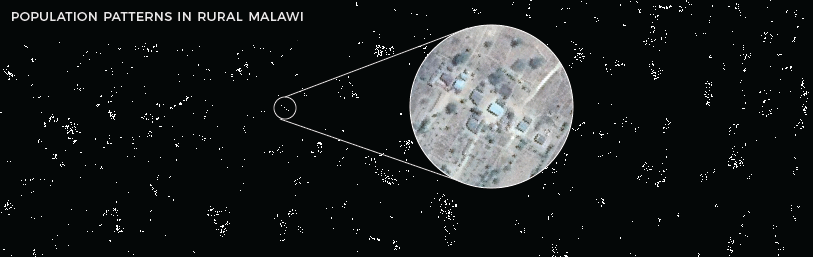

An accurate picture of where people live can be a matter of life and death.

For humanitarian agencies working in Africa, effectively distributing aid or vaccinating populations is still a challenge due to the lack of reliable maps and population density information. Researchers hope that these detailed maps will be used to save lives and improve living conditions in developing regions.

For example, Malawi is one of the world’s least urbanized countries, so finding its 19 million citizens is no easy task for people doing humanitarian work there. These maps clearly show where people live and allow organizations to create accurate population density estimates for specific areas.

Visit the project page for a full explanation and to access the full database of country maps.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel1 week ago

Travel1 week agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024