Technology

Exploring the Practical Applications of Blockchain Technology

In a few short years, blockchain technology has been steadily gaining traction in traditional business applications around the world.

So much so, that blockchain-focused venture capital fundraising tripled to $3 billion between the years 2017 and 2018.

Four Practical Uses for Blockchain Tech

Today’s graphic from Noah Coin highlights four major sectors where blockchain technology is being used to innovate and enhance important business processes.

In an increasingly digital world, which industries are being transformed by blockchain?

One of the primary benefits of blockchain technology is its immutability─the unchangeable nature of the “ledger” of data posted to the network.

This critical feature can provide widespread benefits across a variety of industries around the world. Let’s dive into some key examples.

Major Practical Applications of Blockchain

1. Financial Services

Recent numbers show that the asset management industry could cut costs by $2.7 billion every year by moving to blockchain tech. Practical applications of blockchain in the financial services industry include client screening and onboarding, recordkeeping, data privacy and security, and trade processing.

Similarly, the insurance industry is fraught with errors and costly mistakes. The FBI estimates that over $40 billion a year is lost through fraud across all non-health insurance industries.

Example solution:

- RiskBlock, a proof-of-insurance product, helps insurers save time and money through automated processes, and it helps insured individuals validate their insurance claims securely and quickly.

2. Smart Contracts

Blockchain and smart contract technologies function well in instances where legal contracts are required to maintain ownership rights and data privacy laws. These customizable, self-executing smart contracts on the blockchain can be easily managed by all parties.

Issues with ownership rights and royalties are commonplace within the entertainment industry. To navigate these issues, blockchain technology offers an unchangeable, traceable, real-time distribution and reporting network for all involved.

Example solution:

- Ujomusic is one such application that is helping artists track their royalties worldwide.

3. Digital IDs

According to the World Bank, over 1.1 billion people worldwide still have no way to prove their identity. At the same time, companies and financial institutions in both traditional and digital markets are being required to follow more stringent know-your-customer (KYC) initiatives.

Despite this, many providers are still not sufficiently meeting these standards; to further complicate things, regulations vary widely from jurisdiction to jurisdiction.

Example solution:

- Companies like IBM, Microsoft, and Cisco are migrating to the blockchain to securely and privately verify users.

4. Blockchain Internet of Things (IoT)

Gartner predicts that 20.4 billion IoT-connected devices will be active by the end of 2020, with some estimates showing the IoT market will reach $3 trillion annually by 2026.

Blockchain-enabled IoT devices would operate faster and more securely for both users and businesses─enabling less centralized control over the financial industry, internet usage, and ownership rights.

Example solution:

- Helium uses a decentralized machine network to simplify connecting anything to the internet through a blockchain, wireless network, and open-source software.

A Blockchain-enabled Future

Blockchain technology promises to be the next major tidal wave of innovation. While still in its infancy, practical blockchain applications are becoming more mainstream.

As blockchain adoption spreads, it can become a driving force for promoting equitable societies, solving complex economic issues, and transforming how we live and work every day.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

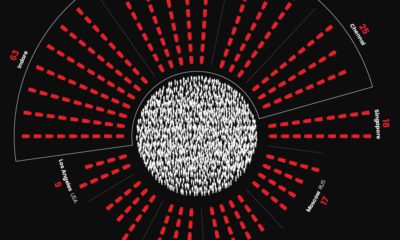

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

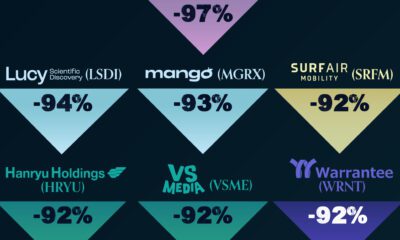

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes