Everything You Need to Know About In-Situ Mining

The following content is sponsored by Excelsior Mining.

Everything You Need to Know About In-Situ Mining

How do you mine without moving a rock?

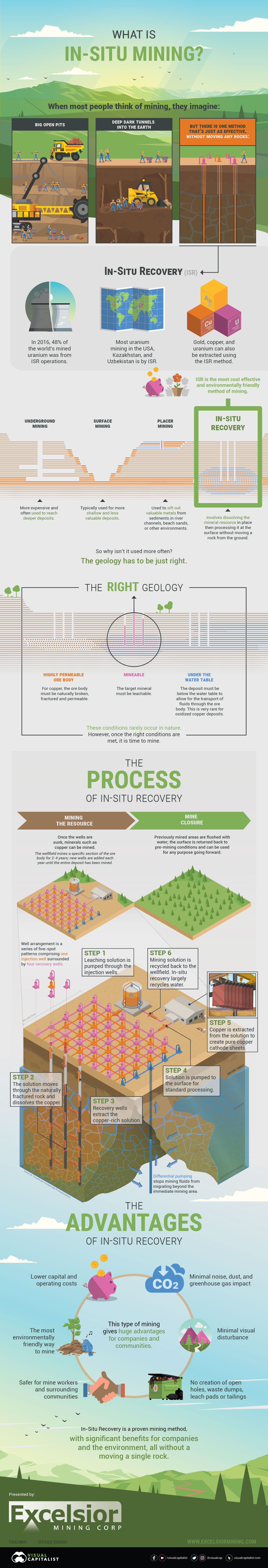

When most people think of mining they think of massive open pits or deep and winding underground tunnels. But there is one mining method that does not move a rock and leaves the landscape as is.

Today’s infographic from Excelsior Mining Corp. outlines a unique mining method, In-Situ Recovery “ISR”, also known as In-Situ Mining.

An Intro to In-Situ Mining

ISR is not a recent innovation in the mining sector. In fact, ISR has been used for the past 50 years in uranium mining, and 48% of the world’s uranium gets mined this way. Uranium is not the only mineral it can extract; there is also silver, copper, and sometimes gold.

ISR involves dissolving a mineral deposit in the ground and then processing it at surface, all without moving any rock. It is cost effective and environmentally friendly.

But if this method is so great, how come more companies do not mine this way?

The Right Geology

ISR is not widely used because the geological conditions have to be just right. There are few locations around the world that meet the following criteria:

- Highly permeable ore body. In the case of copper, the ore body must be naturally broken, fractured and permeable.

- Mineable. The target mineral must be soluble with the right fluid, typically a weak acid.

- Under the water table. The mineral deposit must be below the water table to allow for the movement of fluids throughout the ore body.

If geologists can find these conditions and it is a large enough mineral deposit, it is time to mine.

The ISR Process

Once the right conditions are met and drill holes are sunk into the ore body, mining can begin.

- Leaching solution is pumped through injection wells

- The solution moves through the naturally fractured rock and leaches the copper

- Recovery wells extract the copper-rich solution

- Solution is pumped to the surface to the plant for processing

- Copper is extracted from the solution to create pure copper sheets

- Mining solution is recycled back to the well field

Once an area is mined, the wells are flushed with water to clean out any remaining leaching solution. Meanwhile, the surface is returned back to pre-mining conditions, allowing it to be used for any purpose in the future.

Advantages of In-Situ Mining

The environmental advantages are clear, including: minimal noise, dust, or greenhouse gas emissions, along with minimal visual disturbance. In addition, it also lowers capital and operating costs while creating a safer environment for mine workers.

Too bad not all mines can operate without moving a rock.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.