Technology

The Emergence of Commercial Drones

Unmanned aerial vehicles (UAVs), commonly known as drones, have actually been around for about a century.

Even in 1918, the U.S. military had its first UAV, which acted as a “cruise missile” in combat. Nicknamed the Kettering Bug, it was essentially a flying bomb with 12-foot wings made of cardboard and paper mâché, running off a 40-horsepower Ford engine.

As you might imagine, the military has been a catalyst over the years for the development of UAV technology, which has allowed commercial drones to become cheaper, lighter, and more sophisticated. Today, drones aren’t just for delivering military payloads in foreign lands – UAVs will also be delivering your packages, taking photos, providing wireless internet services, and monitoring conservation efforts in remote locations.

The Commercial Drones Market

The following infographic comes to us from IFLY, a Drone Economy Strategy ETF focusing on the “development, research, and utilization of drones”.

It shows the history of military drone applications, and how that has led to today’s emerging market for commercial drones.

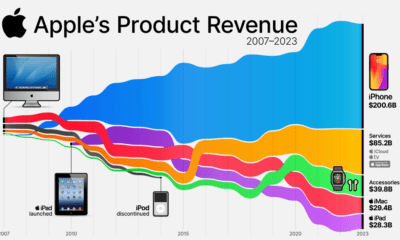

According to BI Intelligence, the total drone market today is close to $10 billion.

And despite the military market remaining the largest for now, it is worth noting that the commercial drone sector will grow at a compound annual growth rate (CAGR) of 19% between 2015 and 2020. Eventually, it will pass the military market in size, as that is only growing at a 5% clip.

The Emerging Opportunity for Commercial Drones

The growing market on the civilian side will impact a variety of industries, including private security, law enforcement, real estate, media, film, construction, mining, agriculture, and utilities.

Hardware for commercial drones is important, especially in the early stages. However, as we see in other sectors, it will likely be the software that makes the difference in many applications. As it becomes cheaper to customize commercial drones, the door will be opened to allow new functionality in a wide array of niche spaces. Sophisticated drones could soon be doing everyday tasks like fertilizing crop fields on an automated basis, monitoring traffic incidents, surveying hard-to-reach places, or even delivering pizzas.

At the end of the day, the impact of commercial drones could be $82 billion and a 100,000 job boost to the U.S. economy by 2025.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue