Technology

Earnings Scoreboard: A Turbulent Week in Tech [Chart]

![Earnings Scoreboard: A Turbulent Week in Tech [Chart]](https://www.visualcapitalist.com/wp-content/uploads/2016/04/tech-scoreboard-chart.png)

Earnings Scoreboard: A Turbulent Week in Tech [Chart]

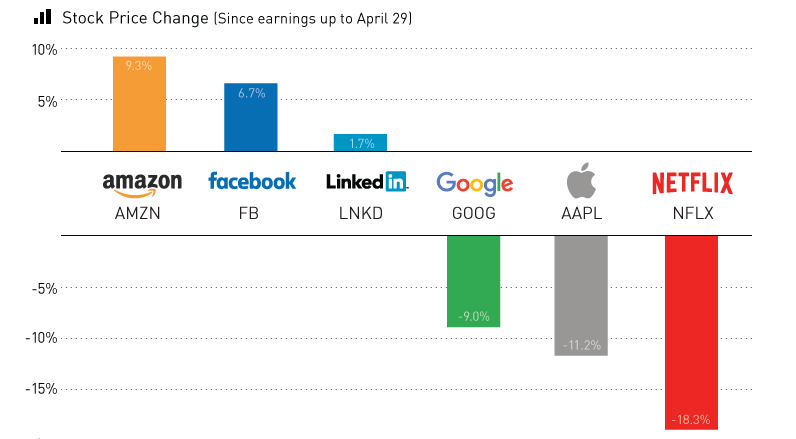

Amazon and Facebook soar, while Apple, Netflix, and Google whiff

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

For many blue chip companies, earnings season can end up being relatively dry.

For example, yesterday MasterCard reported an earnings “beat” of $0.86 earnings per share (EPS) compared to the $0.85 consensus. The stock inched up 0.7% in afternoon trading and now it’s back down today. In other words, it’s business as usual again.

However, for the world’s technology giants, earnings season can make or break a stock. The reason for this is simple: investors buy technology companies such as Amazon or Netflix for their future growth prospects, rather than their current profitability. In theory, these companies should have an incredible ability to scale, and the market prices this in to make these stocks more expensive.

If a company shows signs that it is growing slower than expected, investors punish the stock with the expectation of a ripple effect on future cash flows.

The Tech Scoreboard

The last week has been particularly eventful on the tech earnings front, and Jim Cramer’s “FANG” stocks were the center of the action. After buoying the market for much of 2015, the stocks went their separate directions.

Netflix kicked it off with a huge whiff. While revenues and EPS were on track for the quarter, its guidance on subscriber growth was the ringing of a big alarm bell. Wall Street was looking for the company to add 3.5 million international subscribers in Q2, but Netflix said it would only be adding two million. The stock has tanked spectacularly ever since, losing -18.3% in value.

Alphabet and Apple, the two most valuable public companies in the world by market capitalization, also showed signs of a struggle. Both stocks are now down close to -10% from pre-earnings, shedding a combined $100 billion in value. Apple posted its first year-over-year decline in quarterly revenue since 2003, while Google’s parent company fell short on both top and bottom lines. Co-founders Sergey Brin and Larry Page have lost a combined $3.8 billion in wealth since the report.

While this is all very dire for the tech sector, Jeff Bezos and Mark Zuckerberg came to the rescue.

Yesterday, Amazon killed it for the quarter, bringing in an extra $1.1 billion of revenue above Street estimates. The company reported its largest quarterly profit, and analysts are now ecstatic about the company’s blowout quarter. The stock is up close to 10% today.

Facebook also helped save face for Silicon Valley, and shares have now hit an all-time high as the company beat projected revenues and earnings.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?