Markets

What is the Difference Between the NYSE and Nasdaq?

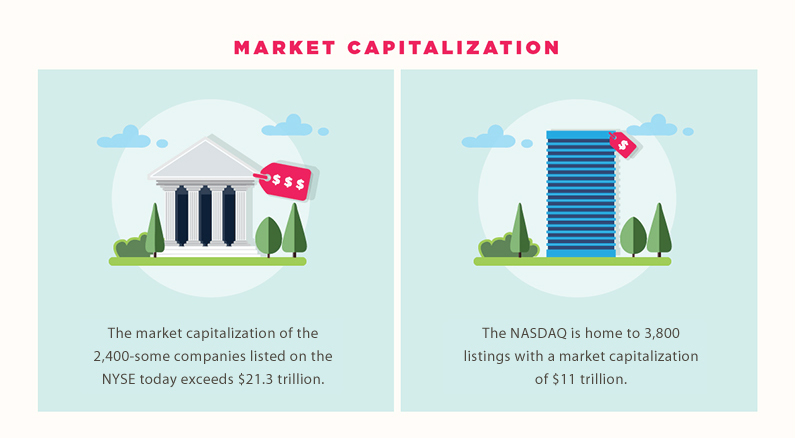

The NYSE and Nasdaq exchanges are worth more than $35 trillion in market capitalization, making up a sizable portion of the global equities market.

However, while they are both large American stock exchanges containing listings that are household names, they are also very different in how they work.

Comparing the NYSE and Nasdaq Exchanges

Today’s infographic from StocksToTrade.com explains the major differences between these two exchanges.

The NYSE and Nasdaq have significant differences, including the size and number of listings, how trades are made, and also how they are perceived by investors.

Size and Number of Listings

By the value of listed companies, the NYSE and Nasdaq are the two largest exchanges in the world.

The NYSE has over 2,400 companies that combine for $26 trillion in market capitalization. It’s also home to many of the big “blue chip” companies that have existed for decades, like Walmart, Exxon Mobil, or General Electric. This is partly because the exchange has existed since 1792.

Meanwhile, the Nasdaq has more companies than the NYSE, but has a wider spectrum in terms of the size of companies. Of course, the exchange is known for having the large tech-focused companies like Facebook, Google, and Amazon, but there are many smaller listings on the Nasdaq as well. In fact, there are around 1,200 smaller securities listed on the 46-year-old exchange with market caps of $200 million or less.

In total, there are over 3,800 companies listed on the Nasdaq, worth a total of $11 trillion in market capitalization.

Operational Differences

Aside from the obvious differences in the size and types of listings, the NYSE and Nasdaq also have significant operational differences.

The largest difference in the past was that the NYSE market was an auction market, while the Nasdaq was considered a dealer market. In the former, the highest bid for a stock is matched with the lowest asking price. In the latter, buying and selling happens in split seconds electronically through dealers. This difference has since changed as a result of trading technology, and both markets effectively connect buyers and sellers instantaneously in similar ways at the best price.

The Nasdaq has multiple market makers per stock – and some, like Apple even have 54 such registered makers. Meanwhile, the NYSE usually has one Designated Market Maker (DMM) per stock that ensures a fair and orderly market in that security. The NYSE also uses Supplementary Liquidity Providers (SLPs) as well.

Different Perspectives

For various reasons, both stocks are seen a little differently by investors, as well.

The NYSE is seen as the stock market for “tried and true” securities that have been, and will continue to be, the mainstays of the financial world for decades.

The Nasdaq, on the other hand, is seen as a place for growth-oriented tech stocks. It was where the action was in the Dotcom boom and bust, and it’s the place where the world’s largest tech stocks are listed today.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries