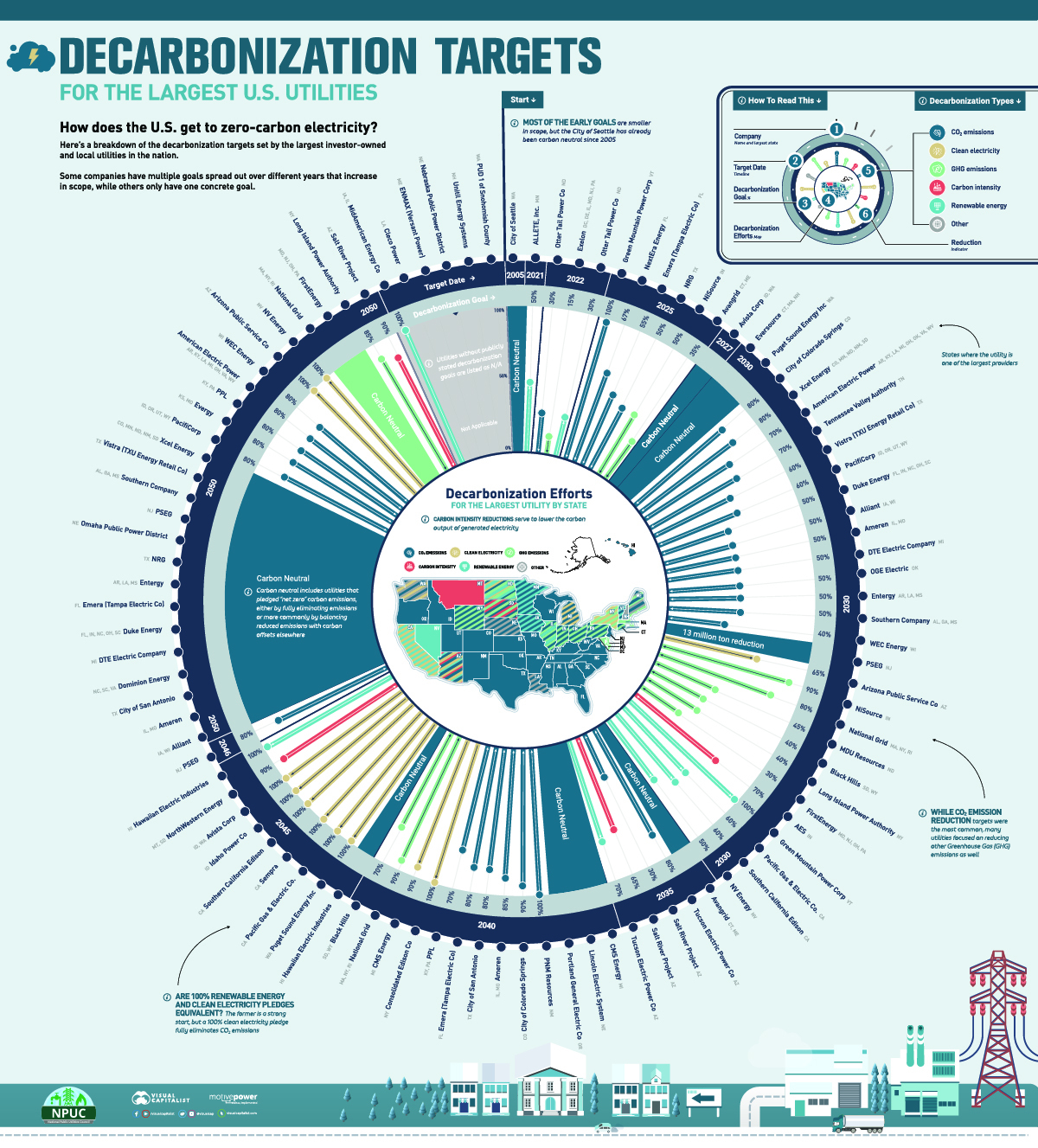

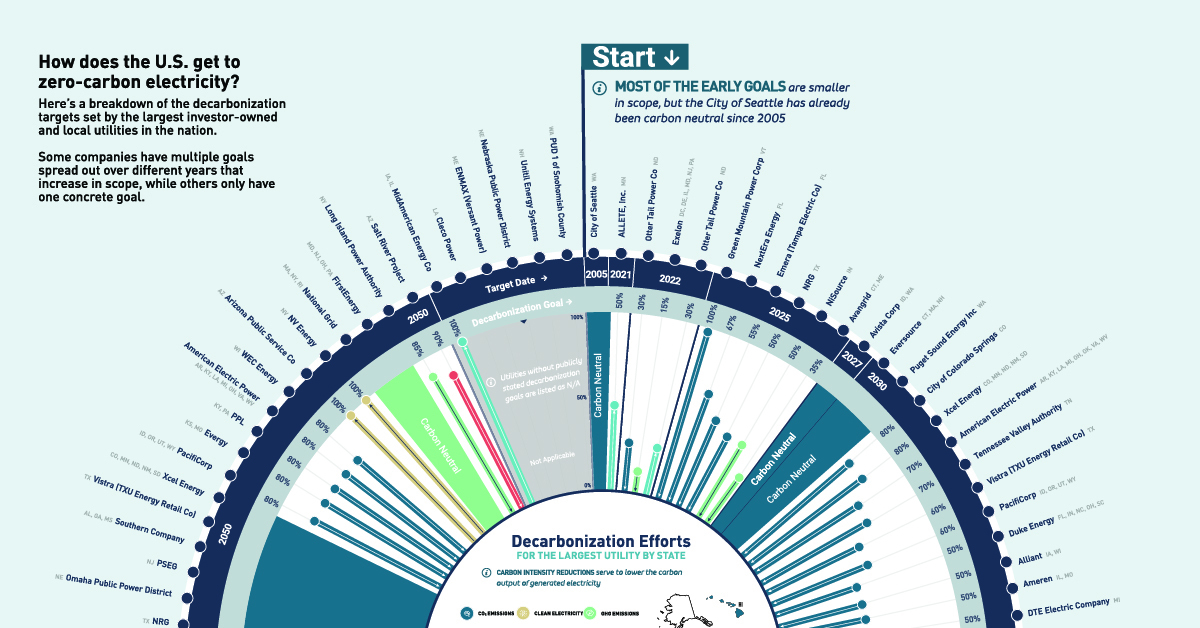

Decarbonization Targets for the Largest U.S. Utilities

The following content is sponsored by the National Public Utility Council

Decarbonization Targets for the Largest U.S. Utilities

The U.S. recently rejoined the Paris Climate Agreement and decarbonization is back on the minds of government officials and companies alike.

Though every sector plays a major role on the path to net zero carbon emissions, none are as impactful as the energy sector. In 2016, almost three-quarters of global GHG emissions came from energy consumption. With organizations looking to either curb energy consumption or transition to cleaner forms of energy, the pressure is on utilities to decarbonize and offer green alternatives.

How are U.S. utilities responding?

This infographic from the National Public Utility Council highlights the decarbonization targets of the largest investor-owned and public U.S. utilities.

U.S. Utility Decarbonization Targets Through 2035

The American energy sector has many players, but the largest utilities account for the bulk of production.

For each state, we looked at the largest investor-owned and public electric utilities by retail sales as tracked by the U.S. Energy Information Administration. Decarbonization targets were taken from each utility’s stated goals or sustainability report.

After narrowing down from 3,328 different entities and subsidiaries, the final list of 60 utilities accounted for 60% of U.S. energy sales in 2019 at just under 1.93 trillion MWh (megawatt hours).

Many companies on the list have multiple goals spread across different timeframes, but they can be grouped into a few distinct categories:

- Reducing carbon dioxide (CO2) or greenhouse gas (GHG) emissions: These measures are either percentage-based or flat reductions, and also include becoming carbon neutral or “net zero” by balancing reduced emissions with carbon offsets.

- Reducing carbon intensity: These measures work on reducing the impact of electricity generated by fossil fuels, rather than reducing the amount directly.

- Increasing renewable energy production: These measures focus on adding renewable energy with a lower carbon footprint to the production mix and can be either percentage-based or flat additions.

- Increasing clean electricity production: These measures are centered around ensuring that electricity produced is 100% carbon free.

Utilities with decarbonization targets set for 2035 and earlier vary wildly in scope, from completely carbon neutral to minimal reductions.

| Entity | State (Largest Provider) | Decarbonization Goal | Target Year |

|---|---|---|---|

| City of Seattle | WA | Carbon neutral | 2005 (since) |

| ALLETE | MN | △50% Renewable energy | 2021 |

| Exelon | DC, DE, IL, MD, NJ, PA | ▽15% GHG emissions | 2022 |

| Otter Tail Power | ND | ▽30% CO2 emissions, △30% Renewable energy | 2022 |

| Avangrid | CT, ME | ▽35% GHG emissions | 2025 |

| Emera (Tampa Electric) | FL | ▽55% CO2 emissions | 2025 |

| Green Mountain Power | VT | ▽100% CO2 emissions | 2025 |

| NextEra Energy | FL | ▽67% CO2 emissions | 2025 |

| NiSource | IN | ▽50% GHG emissions | 2025 |

| NRG | TX | ▽50% CO2 emissions | 2025 |

| Avista Corp | ID, WA | Carbon neutral | 2027 |

| AES | IN | ▽70% Carbon intensity | 2030 |

| Alliant | IA, WI | ▽50% CO2 emissions | 2030 |

| Ameren | IL, MO | ▽50% CO2 emissions | 2030 |

| American Electric Power | AR, KY, LA, MI, OK, OH, VA, WV | ▽70% CO2 emissions | 2030 |

| Arizona Public Service | AZ | △65% Clean electricity | 2030 |

| Black Hills | SD, WY | ▽40% GHG emissions | 2030 |

| City of Colorado Springs | CO | ▽80% CO2 emissions | 2030 |

| DTE Electric Company | MI | ▽50% CO2 emissions | 2030 |

| Duke Energy | FL, IN, NC, OH, SC | ▽50% CO2 emissions | 2030 |

| Entergy | AR, LA, MS | ▽50% CO2 emissions | 2030 |

| Eversource | CT, MA, NH | Carbon neutral | 2030 |

| FirstEnergy | MD, NJ, OH, PA | ▽30% GHG emissions | 2030 |

| Green Mountain Power | VT | △100% Renewable energy | 2030 |

| Long Island Power Authority | NY | ▽40% GHG emissions | 2030 |

| MDU Resources | ND | ▽45% GHG emissions | 2030 |

| National Grid | MA, NY, RI | ▽80% GHG emissions | 2030 |

| NiSource | IN | ▽90% GHG emissions | 2030 |

| NV Energy | NV | △50% Renewable energy | 2030 |

| OGE Electric | OK | ▽50% CO2 emissions | 2030 |

| Pacific Gas & Electric | CA | △60% Renewable energy | 2030 |

| PacifiCorp | ID, OR, UT, WY | ▽60% CO2 emissions | 2030 |

| PSEG | NJ | ▽13 million tons CO2 emissions | 2030 |

| Puget Sound Energy | WA | Carbon neutral | 2030 |

| Southern California Edison | CA | △60% Renewable energy | 2030 |

| Southern Company | AL, GA, MS | ▽50% CO2 emissions | 2030 |

| Tennessee Valley Authority | TN | ▽70% CO2 emissions | 2030 |

| Vistra (TXU Energy Retail) | TX | ▽60% CO2 emissions | 2030 |

| WEC Energy | WI | ▽40% CO2 emissions | 2030 |

| Xcel Energy | CO, MN, ND, NM, SD | ▽80% CO2 emissions | 2030 |

| Avangrid | CT, ME | Carbon neutral | 2035 |

| Salt River Project | AZ | ▽65% Carbon intensity, ▽30% CO2 emissions | 2035 |

| Tucson Electric Power | AZ | ▽80% CO2 emissions, △70% Renewable energy | 2035 |

It’s also important to note that carbon emission reductions are not equal across the board.

Reduction is traditionally based on a base-year measurement (usually 2000 or 2005) that changes for each utility, and a small reduction at a major energy producer can be more impactful than 100% clean energy at a small local utility.

U.S. Utility Decarbonization Targets 2040 and Beyond

From 2040 and beyond, the decarbonization efforts become more ambitious.

In line with many states and the federal government making sweeping clean energy commitments, most of the utility companies with decarbonization targets from 2040 to 2050 are aimed at either carbon neutrality or significant reductions.

For some companies these are their first and only targets, while others are building on smaller goals from earlier years. In the case of the few utility companies marked *N/A, a decarbonization target goal couldn’t be found.

| Entity | State (Largest Provider) | Decarbonization Goal | Target Year |

|---|---|---|---|

| Ameren | IL, MO | ▽85% CO2 emissions | 2040 |

| Black Hills | SD, WY | ▽70% GHG emissions | 2040 |

| City of Colorado Springs | CO | ▽90% CO2 emissions | 2040 |

| City of San Antonio | TX | ▽80% CO2 emissions | 2040 |

| CMS Energy | MI | Carbon neutral, △90% Clean electricity | 2040 |

| Consolidated Edison | NY | △100% Clean electricity | 2040 |

| Emera (Tampa Electric) | FL | ▽80% CO2 emissions | 2040 |

| Lincoln Electric System | NE | Carbon neutral | 2040 |

| National Grid | MA, NY, RI | ▽90% GHG emissions | 2040 |

| PNM Resources | NM | ▽100% CO2 emissions | 2040 |

| Portland General Electric | OR | Carbon neutral | 2040 |

| PPL | KY, PA | ▽70% CO2 emissions | 2040 |

| Avista Corp | ID, WA | △100% Clean electricity | 2045 |

| Hawaiian Electric Industries | HI | Carbon neutral, △100% Renewable energy | 2045 |

| Idaho Power | ID | △100% Clean electricity | 2045 |

| NorthWestern Energy | MT, SD | ▽90% Carbon intensity | 2045 |

| Pacific Gas & Electric | CA | △100% Clean electricity | 2045 |

| Puget Sound Energy | WA | △100% Clean electricity | 2045 |

| Sempra | CA | △100% Clean electricity | 2045 |

| Southern California Edison | CA | △100% Clean electricity | 2045 |

| PSEG | NJ | ▽80% CO2 emissions | 2046 |

| Alliant | IA, WI | Carbon neutral | 2050 |

| Ameren | IL, MO | Carbon neutral | 2050 |

| American Electric Power | AR, KY, LA, MI, OK, OH, VA, WV | ▽80% CO2 emissions | 2050 |

| Arizona Public Service | AZ | △100% Clean electricity | 2050 |

| City of San Antonio | TX | Carbon neutral | 2050 |

| Dominion Energy | NC, SC, VA | Carbon neutral | 2050 |

| DTE Electric Company | MI | Carbon neutral | 2050 |

| Duke Energy | FL, IN, NC, OH, SC | Carbon neutral | 2050 |

| Emera (Tampa Electric) | FL | Carbon neutral | 2050 |

| Entergy | AR, LA, MS | Carbon neutral | 2050 |

| Evergy | KS, MO | ▽80% CO2 emissions | 2050 |

| FirstEnergy | MD, NJ, OH, PA | Carbon neutral | 2050 |

| Long Island Power Authority | NY | ▽85% GHG emissions | 2050 |

| National Grid | MA, NY, RI | Carbon neutral | 2050 |

| NRG | TX | Carbon neutral | 2050 |

| NV Energy | NV | △100% Clean electricity | 2050 |

| Omaha Public Power District | NE | Carbon neutral | 2050 |

| PacifiCorp | ID, OR, UT, WY | ▽80% CO2 emissions | 2050 |

| PPL | KY, PA | ▽80% CO2 emissions | 2050 |

| PSEG | NJ | Carbon neutral | 2050 |

| Salt River Project | AZ | ▽90% Carbon intensity | 2050 |

| Southern Company | AL, GA, MS | Carbon neutral | 2050 |

| Vistra (TXU Energy Retail) | TX | Carbon neutral | 2050 |

| WEC Energy | WI | ▽80% CO2 emissions | 2050 |

| Xcel Energy | CO, MN, ND, NM, SD | Carbon neutral | 2050 |

| MidAmerican Energy | IA, IL | △100% Renewable energy | N/A |

| Cleco Power | LA | N/A | N/A |

| ENMAX (Versant Power) | ME | N/A | N/A |

| Nebraska Public Power District | NE | N/A | N/A |

| PUD 1 of Snohomish County | WA | N/A | N/A |

| Unitil Energy Systems | NH | N/A | N/A |

While the targets set above are significant, they are also a long time away from being met. With pressure to decarbonize increasing across the board, utility companies may need to reassess the impact or timeliness of their decarbonization targets.

The National Public Utilities Council is the go-to resource for all things decarbonization in the utilities industry. Learn more.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.