Decarbonization 101: What Carbon Emissions Are Part Of Your Footprint?

The following content is sponsored by the National Public Utility Council

What Carbon Emissions Are Part Of Your Footprint?

With many countries and companies formalizing commitments to meeting the Paris Agreement carbon emissions reduction goals, the pressure to decarbonize is on.

A common commitment from organizations is a “net-zero” pledge to both reduce and balance carbon emissions with carbon offsets. Germany, France and the UK have already signed net-zero emissions laws targeting 2050, and the U.S. and Canada recently committed to synchronize efforts towards the same net-zero goal by 2050.

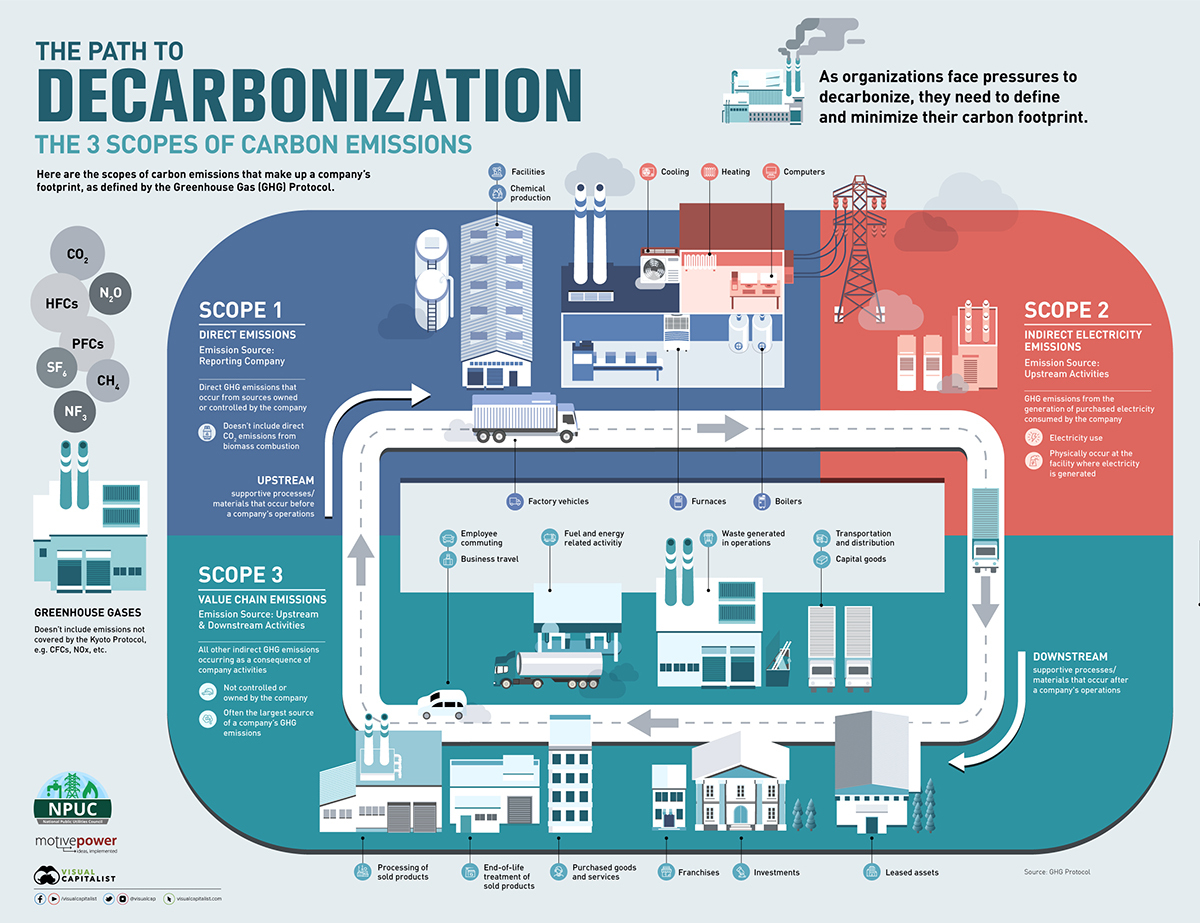

As organizations face mounting pressure from governments and consumers to decarbonize, they need to define the carbon emissions that make up their carbon footprints in order to measure and minimize them.

This infographic from the National Public Utility Council highlights the three scopes of carbon emissions that make up a company’s carbon footprint.

The 3 Scopes of Carbon Emissions To Know

The most commonly used breakdown of a company’s carbon emissions are the three scopes defined by the Greenhouse Gas Protocol, a partnership between the World Resources Institute and Business Council for Sustainable Development.

The GHG Protocol separates carbon emissions into three buckets: emissions caused directly by the company, emissions caused by the company’s consumption of electricity, and emissions caused by activities in a company’s value chain.

Scope 1: Direct emissions

These emissions are direct GHG emissions that occur from sources owned or controlled by the company, and are generally the easiest to track and change. Scope 1 emissions include:

- Factories

- Facilities

- Boilers

- Furnaces

- Company vehicles

- Chemical production (not including biomass combustion)

Scope 2: Indirect electricity emissions

These emissions are indirect GHG emissions from the generation of purchased electricity consumed by the company, which requires tracking both your company’s energy consumption and the relevant electrical output type and emissions from the supplying utility. Scope 2 emissions include:

- Electricity use (e.g. lights, computers, machinery, heating, steam, cooling)

- Emissions occur at the facility where electricity is generated (fossil fuel combustion, etc.)

Scope 3: Value chain emissions

These emissions include all other indirect GHG emissions occurring as a consequence of a company’s activities both upstream and downstream. They aren’t controlled or owned by the company, and many reporting bodies consider them optional to track, but they are often the largest source of a company’s carbon footprint and can be impacted in many different ways. Scope 3 emissions include:

- Purchased goods and services

- Transportation and distribution

- Investments

- Employee commute

- Business travel

- Use and waste of products

- Company waste disposal

The Carbon Emissions Not Measured

Most uses of the GHG Protocol by companies includes many of the most common and impactful greenhouse gases that were covered by the UN’s 1997 Kyoto Protocol. These include carbon dioxide, methane, and nitrous oxide, as well as other gases and carbon-based compounds.

But the standard doesn’t include other emissions that either act as minor greenhouse gases or are harmful to other aspects of life, such as general pollutants or ozone depletion.

These are emissions that companies aren’t required to track in the pressure to decarbonize, but are still impactful and helpful to reduce:

- Chlorofluorocarbons (CFCs) and Hydrochlorofluorocarbons (HCFCS): These are greenhouse gases used mainly in refrigeration systems and in fire suppression systems (alongside halons) that are regulated by the Montreal Protocol due to their contribution to ozone depletion.

- Nitrogen oxides (NOx): These gases include nitric oxide (NO) and nitrogen dioxide (NO2) and are caused by the combustion of fuels and act as a source of air pollution, contributing to the formation of smog and acid rain.

- Halocarbons: These carbon-halogen compounds have been used historically as solvents, pesticides, refrigerants, adhesives, and plastics, and have been deemed a direct cause of global warming for their role in the depletion of the stratospheric ozone.

There are many different types of carbon emissions for companies (and governments) to consider, measure, and reduce on the path to decarbonization. But that means there are also many places to start.

National Public Utilities Council is the go-to resource for all things decarbonization in the utilities industry. Learn more.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.