Misc

5 Megatrends Fueling the Rise of Data Storytelling

Infographic: The Rise of Data Storytelling

Humanity is creating more data than ever before, and more of that data is publicly accessible.

While “data is the new oil” has almost become a cliché, the impact that data abundance is having on the world is undeniable. All of the world’s most valuable companies are heavily reliant on data for their continued success. Even oil giant Saudi Aramco, the world’s most valuable company, runs a 6,000 m² data center, and is partnering with Google Cloud.

In a world where nearly everything is quantified, communicating insights from that data becomes a massive opportunity. This is where data storytelling comes in. In simple terms, it’s the difference between simply making a chart, and actually explaining what it means, why it’s important, and how it fits into the broader context. This style of data-driven communication is cropping up everywhere, from newsrooms to corporate communications.

Here, we examine five megatrends fueling the rise of data storytelling.

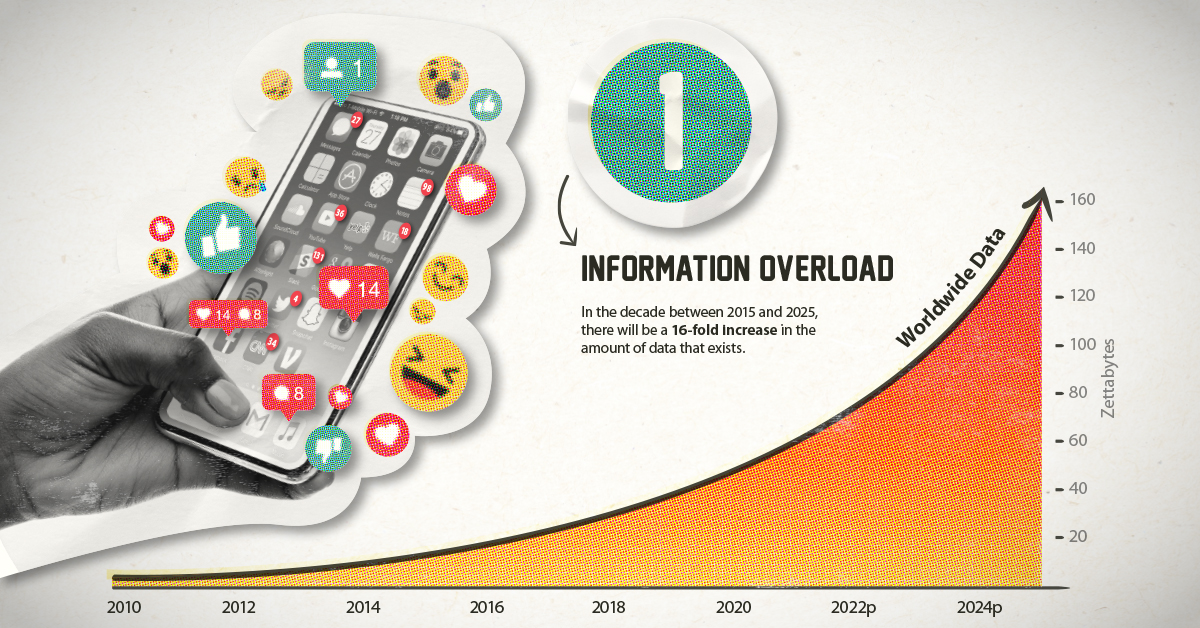

① Information Overload

It’s estimated that between 2015 and 2025, the world will see a 16-fold increase in data.

- The bad news: The rising tide of information is growing faster than our ability to harness it

- The good news: This growing universe of data holds the promise of more insight, if properly utilized

Thankfully, data storytelling is an emerging field that thrives on information abundance.

As our society and economy grow more complex, more high-quality, actionable information is critical for today’s decision makers.

② Declining Trust in Media

Trust in news media has been declining for decades, and in many countries around the world, the majority of people don’t feel that media is a trustworthy source of information.

Trust in social media is similarly shaky. Only one-third of people surveyed around the world believe that social media is a trustworthy source of information. As well, a recent poll found that 75% of U.S. adults felt that political views were likely being censored by social media platforms.

The mass media ecosystem as it currently exists is facing a crisis of confidence. When a system is no longer adequately serving the needs of its users, that system is ripe for disruption.

③ Winner-Take-All Dynamics

This information abundance should be propelling humankind forward, but more often than not, valuable insights are lost in the noise—either poorly presented or pushed to the margins by clickbait and other distractions.

Today, most of us rely on algorithms and aggregators to deliver information to us. Over time, those systems become very good at feeding us information that is generally what we’re looking for. The downside, however, is that engagement-driven algorithms reward only the most compelling narratives. The handful of stories you see are the result of fierce, darwinistic competition on platforms like Twitter or Medium.

This hyper-competitive environment is part of the reason there are so many problems with media today—clickbait and tabloidization being two prominent examples.

Data storytelling takes potentially dry, complex topics and makes them more accessible, compelling, and more likely to win the battle for people’s attention.

④ Moving Beyond Text

Many of our existing systems look the way they do in part because of past technological limitations.

Search engines, for example, are still largely driven by text-based considerations. This makes sense as the early internet was essentially a collection of pages with text and hyperlinks.

Today, search engines are much better taking other forms of information into consideration, and technological advancements are breaking new ground in analyzing video and data visualizations. Advancements in AI could soon allow users to search for visualizations in ways that don’t even involve text keywords.

In a future where searching for information in a visual format is as intuitive as a Google search today, the utility and reach of data storytelling will increase dramatically.

⑤ Democratization of Data Storytelling

Even as the number of people with professional credentials in data analytics, data science, and other similar professions is on the rise, it’s never been easier for laypersons to create and publish high quality visualizations.

Free tools which are usable on almost any device have broken down barriers of access for millions of people around the world. There is now a universe of resources for people and organizations looking to convert data into a compelling visual format.

Below is a shortlist of data storytelling resources ranging from the intuitive design tools to powerful coding language libraries:

| Resources for getting started | |||

|---|---|---|---|

| Visualization selection | Data Viz Project | From Data to Viz | Storytelling With Data |

| Color selection | Adobe Color CC | Paletton | Colors on the Web |

| Beginner friendly | Infogram | Piktochart | Venngage |

| Bringing data to life | |||

|---|---|---|---|

| Classic | Microsoft Excel | Adobe Creative Suite | Google Data Studio |

| BI-focused | PowerBI | Tableau | Domo |

| Web apps | RAW Graphs | Flourish | Datawrapper |

| Powerful, specialized resources | |||

|---|---|---|---|

| JavaScript libraries | d3.js | Chart.js | HighCharts |

| Mapping | ArcGis | MapBox | Polymaps |

| Programming languages | R | Python | Matlab |

Of course there are many more resources out there, and we’ll be covering this more comprehensively in the future.

The Last Mile

The concept of “the last mile” is typically associated with e-commerce. Fulfillment can be centralized in massive hubs and delivery can be optimized with uniform trucks and precise routes, but neighborhoods and residences refuse to conform to rigid standards. The last mile is where the orderly world of logistics fragments into randomness, making this leg of the journey the thorniest problem for companies like Amazon to solve.

This last mile analogy lends itself to communication as well. Analytics and datasets can be polished and made publicly accessible, but the real world is messy. Humans are unpredictable, each with their own style of learning and varying levels of data literacy.

Also, unlike e-commerce—which begins with a defined request—insight comes in unexpected flashes. Those moments of serendipity need the right conditions to occur, and the fact of the matter is, most sources of high quality information (databases, white papers, reports, etc.) are only accessed by the small number of people who conduct research for a living.

This is the great opportunity presented by data storytelling. High quality information is distilled into a form that is more digestible, memorable, and sharable, allowing more people to benefit from this era of information abundance.

Put simply: data storytelling bridges the gap between under-utilized knowledge and the growing number of people who are striving to separate the signal from the noise.

Misc

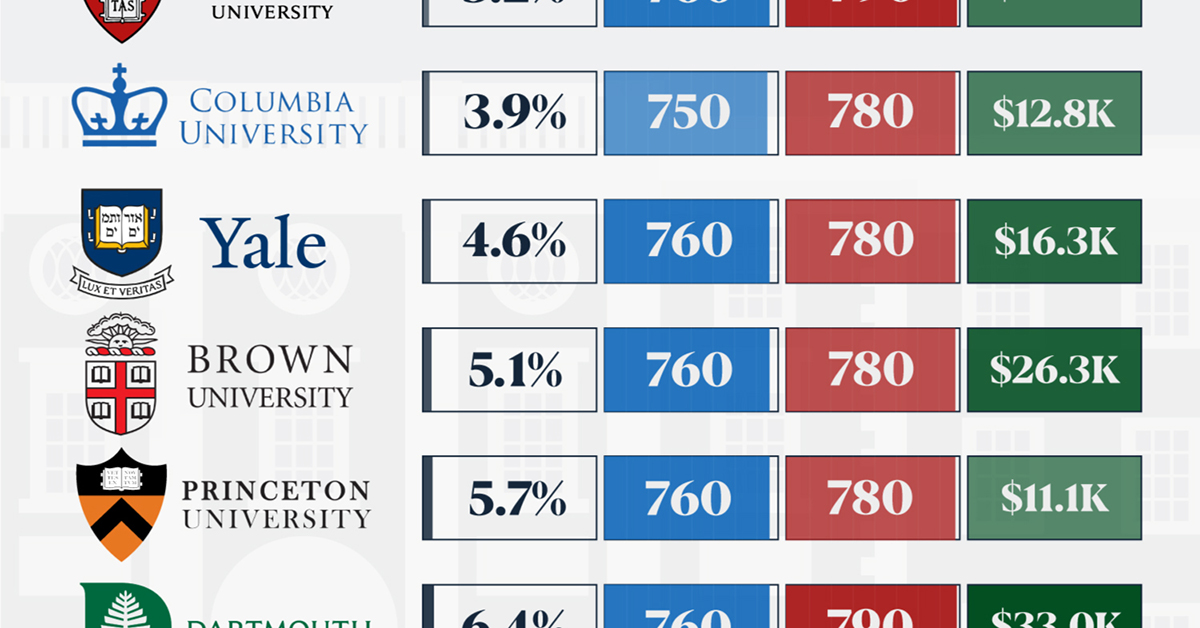

How Hard Is It to Get Into an Ivy League School?

We detail the admission rates and average annual cost for Ivy League schools, as well as the median SAT scores required to be accepted.

How Hard Is It to Get Into an Ivy League School?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Ivy League institutions are renowned worldwide for their academic excellence and long-standing traditions. But how hard is it to get into one of the top universities in the U.S.?

In this graphic, we detail the admission rates and average annual cost for Ivy League schools, as well as the median SAT scores required to be accepted. The data comes from the National Center for Education Statistics and was compiled by 24/7 Wall St.

Note that “average annual cost” represents the net price a student pays after subtracting the average value of grants and/or scholarships received.

Harvard is the Most Selective

The SAT is a standardized test commonly used for college admissions in the United States. It’s taken by high school juniors and seniors to assess their readiness for college-level academic work.

When comparing SAT scores, Harvard and Dartmouth are among the most challenging universities to gain admission to. The median SAT scores for their students are 760 for reading and writing and 790 for math. Still, Harvard has half the admission rate (3.2%) compared to Dartmouth (6.4%).

| School | Admission rate (%) | SAT Score: Reading & Writing | SAT Score: Math | Avg Annual Cost* |

|---|---|---|---|---|

| Harvard University | 3.2 | 760 | 790 | $13,259 |

| Columbia University | 3.9 | 750 | 780 | $12,836 |

| Yale University | 4.6 | 760 | 780 | $16,341 |

| Brown University | 5.1 | 760 | 780 | $26,308 |

| Princeton University | 5.7 | 760 | 780 | $11,080 |

| Dartmouth College | 6.4 | 760 | 790 | $33,023 |

| University of Pennsylvania | 6.5 | 750 | 790 | $14,851 |

| Cornell University | 7.5 | 750 | 780 | $29,011 |

*Costs after receiving federal financial aid.

Additionally, Dartmouth has the highest average annual cost at $33,000. Princeton has the lowest at $11,100.

While student debt has surged in the United States in recent years, hitting $1.73 trillion in 2023, the worth of obtaining a degree from any of the schools listed surpasses mere academics. This is evidenced by the substantial incomes earned by former students.

Harvard grads, for example, have the highest average starting salary in the country, at $91,700.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001