Technology

Visualizing the Current Landscape of the Fintech Industry

Visualizing the Current Landscape of the Fintech Industry

Since the introduction of the first credit card with a magnetic stripe in 1966, financial technology has come a long way. Silicon Valley may not have birthed the term “fintech”, but it has certainly helped catapult its applications into the mainstream.

Leveraging everything from basic apps to the blockchain, the changing dynamics of fintech are creating new investment opportunities everyday, growing its appetite with every new megadeal.

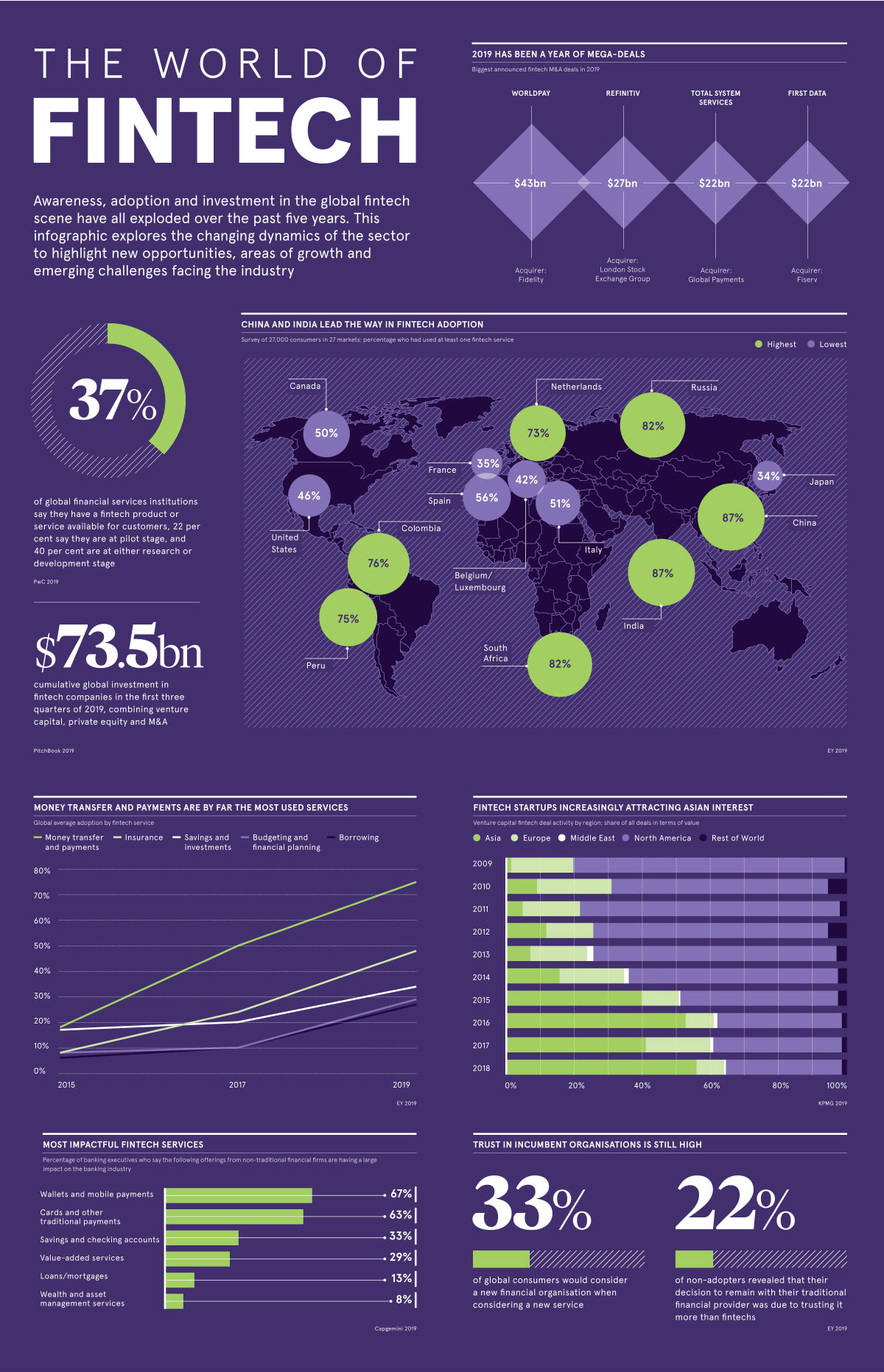

Today’s graphic from Raconteur highlights the global growth of the fintech industry, the services with the most staying power, and major M&A developments of the past year as traditional institutions scramble to deal with this digital disruption.

How Fintech Levels the Playing Field

Over the past five years, digitally-enabled financial technology services have delivered convenient and cheaper access to financial services to millions of consumers.

What draws consumers towards using fintech?

- Attractive rates and fees (27%)

- Easy access and account setup (20%)

- Variety of innovative products and services (18%)

- Better service quality and product features (12%)

This new implementation of technology is democratizing financial services for the masses, a strong contrast to accessing them through traditional brick-and-mortar institutions.

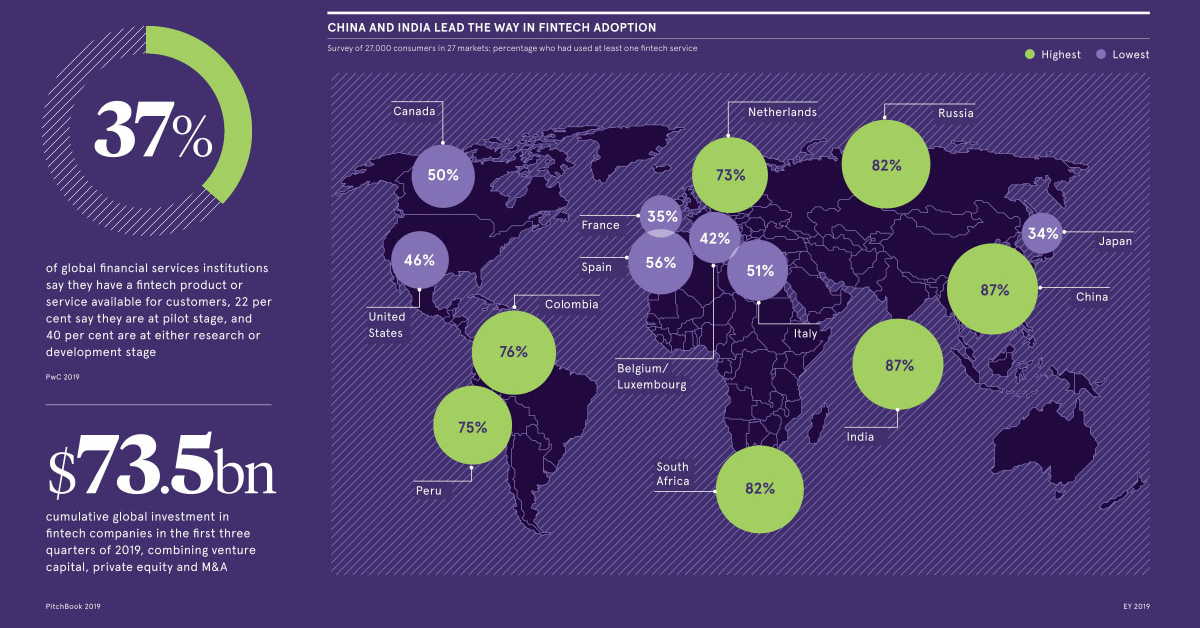

How Fintech Fares Across Borders

On average, 64% of the world’s digitally active population has used at least one fintech service. But China and India surpass this benchmark by a mile—in a survey of 27,000 consumers across 27 markets, both countries demonstrated a 87% fintech adoption rate.

Russia and South Africa are in close second, with 82% adoption respectively. On the other hand, France and Japan are tied at the low end of the spectrum with only 35% fintech adoption.

The trajectory of mobile payments and digital wallets in China can help put high Asian adoption rates in perspective. Thanks to services like Alipay and WeChat, 890 million unique mobile payment users are essentially transforming China from a cash economy to a digital one.

Which Services Have Caught Consumer Attention?

Just like “Googling” is synonymous with looking up information online, the term “Venmo-ing” has become an American verb for paying someone back via a digital wallet.

That’s why it’s no surprise that money transfer and payments are by far the most rapidly growing fintech services, shooting up from 18% to 75% global adoption in just four years. Here’s how global average adoption rates differ by fintech service, across time:

| Fintech Category | 2015 | 2017 | 2019 |

|---|---|---|---|

| 💸 Money transfer and payments | 18% | 50% | 75% |

| 💰 Savings and investments | 17% | 20% | 34% |

| 📋 Budgeting and financial planning | 8% | 10% | 29% |

| 🛡️ Insurance | 8% | 24% | 48% |

| 💳 Borrowing | 6% | 10% | 27% |

Source: EY Global Fintech Adoption Index 2019

Insurtech has steadily gained traction in the market. Digital insurance solutions provide personalized and on-demand coverage plans for clients, using bots and machine learning to assess risk levels. As a result, this sub-segment has been attracting large funding rounds due to the time—and money—it helps free up for firms.

According to CapGemini, incumbents in the financial industry see wallets and mobile payments from fintech providers as the most significant offerings impacting their companies. That may be why they’re resorting to big moves to protect their business.

Deals and More Deals

Major financial institutions made some serious plays in 2019, in the way of mergers and acquisitions of fintech companies:

- FIS bought the payments processing company Worldpay for $35 billion, valuing the company at $43 billion when debt is included. (Reuters)

- The London Stock Exchange Group plans to acquire financial markets data provider Refinitiv for $27 billion, in the hopes of rivaling Bloomberg. (Reuters)

- Global Payments bought the payments processing company Total System Services for $21.5 billion, planning to provide services to over 1,300 financial institutions. (Bloomberg)

- Fiserv acquired payments processing company First Data for $22 billion—the two companies combined are a backbone of Wall Street’s financial technology. (WSJ)

- Visa purchased the payments authentication company Plaid for $5.3 billion in January 2020, in hopes of strengthening its relations with financial institutions. (CNBC)

As billions of dollars exchange hands, it’s been noted that many of these plays were made by established incumbents to curb the threat posed by fintech startups.

At the same time, however, it’s also clear that traditional institutions want to tap into what fintech startups are doing right.

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023