Cultured Meat 101: The Next Generation of Food

The following content is sponsored by CULT Food Science (CSE: CULT)

Cultured Meat 101: The Next Generation of Food

Investors are injecting the cellular agriculture market with billions of dollars and making big bets on the future of cultured foods—otherwise known as cell-based, or lab-grown foods.

With more countries now evaluating the regulation of these products, could this be the year consumers embrace cultured meat products with open arms?

To answer your burning questions about investing in this nascent space, here’s everything you need to know from our sponsor CULT Food Science.

What is Cultured Meat?

Cultured meat is genuine animal meat that is produced by cultivating animal cells in a controlled environment—eliminating the need to farm animals for food. Here is a step-by-step guide showing how cultured meat (also known as clean meat) is made:

Step 1:

Tissue is taken from the animal, for the purpose of extracting stem cells and creating cell lines.

Step 2:

The extracted stem cell lines are cultivated in a nutrient-rich environment, mimicking in-animal tissue growth and producing muscle fibers inside a bioreactor.

Step 3:

The muscle fibers are processed and mixed with additional fats and ingredients to assemble the finished meat product.

Because cultured meat is made of the same cell types and structure found in animal tissue, the sensory and nutritional profiles are like-for-like.

What are the Benefits?

The benefits of cultured meat are three-pronged, in that there are a wide range of benefits for the planet, for people, and for animals that include:

- Reduces land use by up to 95%.

- Reduces the impacts of global warming by up to 92% when produced with renewable energy.

- Leads to less chance of contamination.

- Requires no hormones.

- Requires no antibiotics.

- Reduces spread of zoonotic disease.

- Removes livestock almost entirely from the production process.

As cultured meat products enter the mainstream, additional benefits such as affordability can be added to this list. According to experts, buying cultured meat may one day be cheaper than buying conventional meat products.

How Big is the Market?

While consumer awareness of cultured food products is currently low, acceptance is growing across the globe. In fact, almost one-third of UK consumers are willing to try cultured meat because of its less intensive impact on the environment compared to conventional meat.

Depending on factors such as strong consumer demand, price parity, and innovation in cellular agriculture, the cultured meat market could explode within the next decade and be worth $25 billion by 2030 according to McKinsey.

Interestingly, the success of the cultured meat market will also bleed into other adjacent industries such as dairy, eggs, seafood, chocolate, and honey.

Is the Market Regulated?

While we are merely in the early chapters of the cultured meat story, many countries are already spearheading the movement.

| Region | Status |

|---|---|

| 🇸🇬 Singapore | Singapore became the first country in the world to approve the sale of a cultivated meat product in 2020. |

| 🇪🇺 Europe | When produced without genetic modification, cultured meat is regulated under the novel foods regulation in the EU, and more funding is being encouraged as a result. |

| 🇶🇦 Qatar | Qatar will likely follow in Singapore’s path and become the next nation to sell cultured meat products. |

| 🇯🇵 Japan | The government in Japan is developing a regulatory framework for cultured meat to help grow consumer acceptance. |

| 🇮🇱 Israel | With plans to become the cultured meat and alternative protein powerhouse, Israel opened the world’s first “slaughter-free” meat factory in 2021. |

| 🇺🇸 United States | The FDA and the USDA have agreed to jointly regulate cultured meat. Further clarity on next steps is expected this year. |

As cultured food products continue to edge their way into grocery stores, more regulatory approval pathways will become clear.

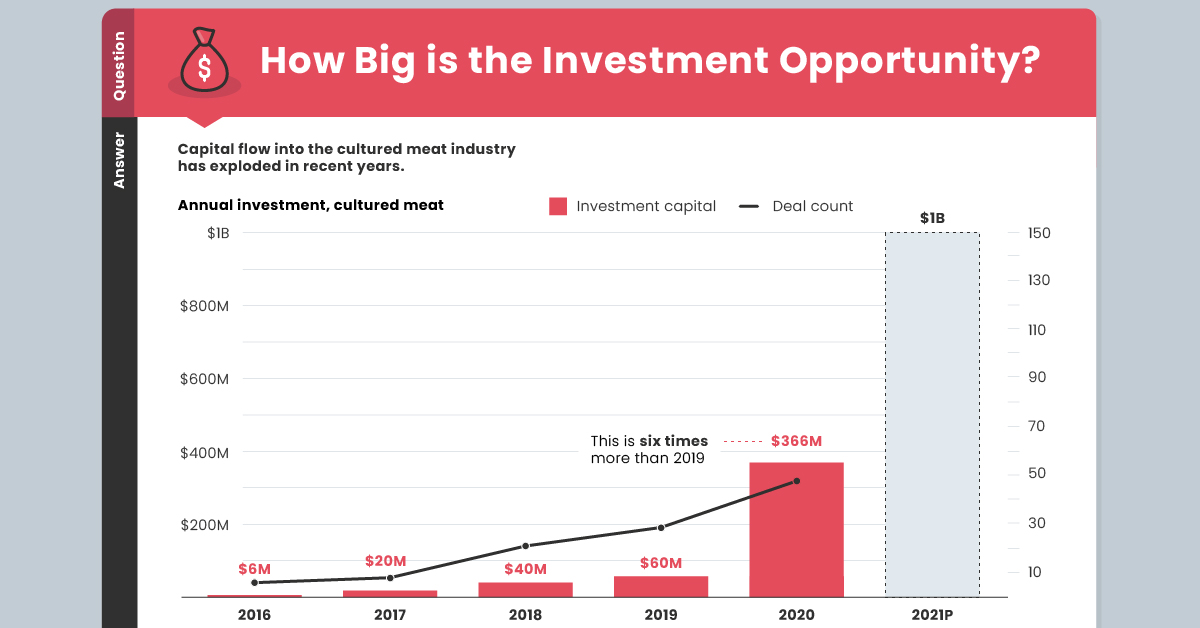

How Big is the Investment Opportunity?

Capital flow into the cultured meat industry has shot up in recent years and shows no signs of slowing down.

According to Pitchbook, $366 million worth of investment was pumped into the market in 2020. Fast forward to 2021, and that figure jumps to $1 billion according to other sources—however it must be noted that this figure is merely an estimate.

Investments are coming from major companies such as Cargill, Mitsubishi, and Tyson. While celebrities such as Bill Gates and Richard Branson are also putting their money where their mouth is and fueling the growth of the industry.

So can you expect to see cultured meat products on the shelves of your local grocery store in the years to come? All signs point to yes.

Your Path to Investing in Cultured Meat

CULT Food Science is an innovative investment platform advancing the technology behind the future of food with an exclusive focus on cultured meat, cultured dairy, and cell-based foods.

The company’s global portfolio spans four continents and includes exposure to a diverse pipeline of technologies and products, including:

- Cell lines

- End products

- Scaffolding technology

- Growth medium

- Intellectual property

Want to stay updated? Click here to subscribe to the CULT Food Science mailing list.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.