Cultivating Cannabis: The Journey from Seed to Harvest

The following content is sponsored by Water Ways Technologies.

<img src="https://www.visualcapitalist.com/wp-content/uploads/2019/09/WaterWaysTech-CultivatingCannabis-Infographic-6.jpg" alt="Cannabis cultivation"

Cultivating Cannabis: The Journey from Seed to Harvest

Cannabis is emerging from the shadows of strict regulation, prompting the growth of a global market worth almost $25 billion today. This green rush has led to increased revenues throughout the entire cannabis supply chain—most notably in cannabis cultivation.

Such growth is rippling across industries such as energy and agriculture technology, with innovation allowing for greater scale.

Today’s infographic from Water Ways Technologies follows the journey of the cannabis plant, and explores cutting-edge technology that will fuel the future of cannabis cultivation.

Breaking Down the Cultivation Process

Cannabis is an annual plant, meaning it naturally goes through its entire life cycle in one year. However, this cycle is shortened to 3 months in commercial cultivation to improve productivity.

Plants can be grown from either a seed or a clone. The cloning method guarantees consistency, cost savings, and provides genetic stability from a disease-free source. All of these factors contribute to its popularity with commercial growers and the medical cannabis community.

Each stage requires different variables to ensure the highest standards are being met.

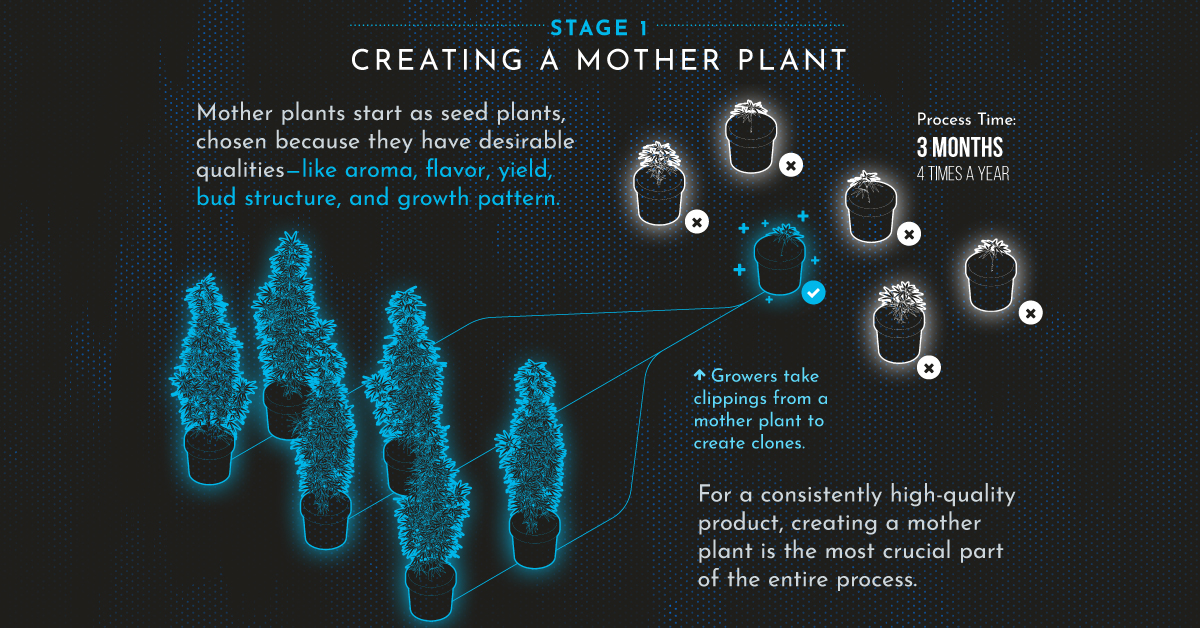

- 1: Creating a Mother Plant: 3 months, 4 times a year

Mother plants create an endless supply of clones, making this stage the most crucial. The mother plant starts as a seed, chosen for desirable qualities that the grower wants to replicate—like aroma, flavor, and yield.

- 2: Making a Clone: 7-10 days

Growers then take clippings from the chosen mother plant, and dip each one in water and fertilizer. They are then soaked in rooting fluid and placed in a plug (individual cell), before entering an incubator.

The clippings remain here until they finish rooting. The incubator maintains the plant’s moisture by facilitating leaf absorption.

- 3: Vegetation Process: 3-4 weeks

The clones are transferred to growing rooms and placed into a light substance similar to soil. They are moved on to flood benches—large tables that re-circulate excess water and fertilizer—which enable the optimal uptake of nutrients.

During this phase, the clones require 18 hours of light and 6 hours of darkness. There must be a constant analysis of the radiation levels to combat any damage from the artificial light source.

- 4: Flowering: 6-8 weeks

Following the vegetation process, the plants are separated into different flowering rooms. During this phase, buds grow and develop a solid cannabinoid and terpene profile. Terpenes are organic compounds that give cannabis varieties their distinctive aromas like citrus, berry, mint, and pine.

- 5: Post-harvest: 1-3 weeks

The cannabis plant is harvested once it reaches maturity. The flowers are de-budded, trimmed, and set on drying trays in a post-harvest room with low humidity, before they are ready for extraction.

This final stage requires a substantial amount of time and attention to detail, to ensure the best quality and most potent product possible.

Cultivating the Future of Cannabis

Efficiently producing high-quality, consistent cannabis will help meet growing consumer demand. Water Ways Technologies is an agro-tech company helping to propel this growth, by providing cultivators with data-driven insights from their precise irrigation system.

With a strong understanding of the full cannabis life cycle, Water Ways Technologies ensures that adjustments can be made at different stages throughout the growing process, resulting in the highest standards, and wider profit margins for investors.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.