Misc

Walmart Owns Most of the Supermarkets in Mexico

Walmart Owns Most of the Supermarkets in Mexico

The U.S. and Mexico have influenced each other in many ways over the course of their history, through both the exchange of culture and the cross-border trade of goods and services. One lesser-known area of overlap between the two nations? Supermarket ownership.

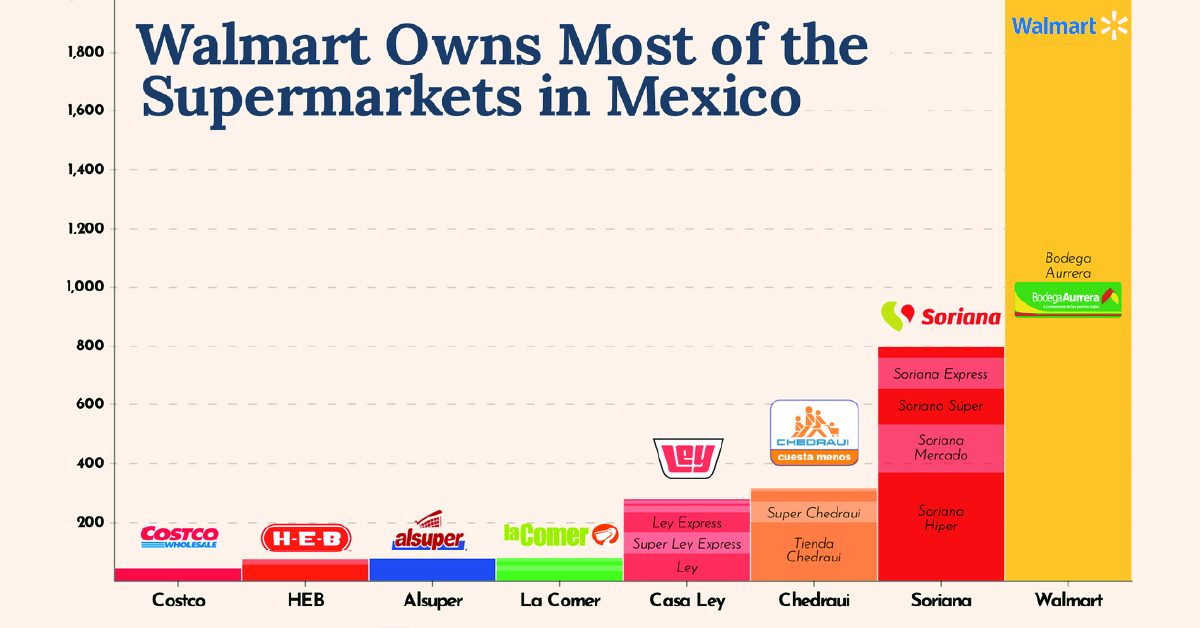

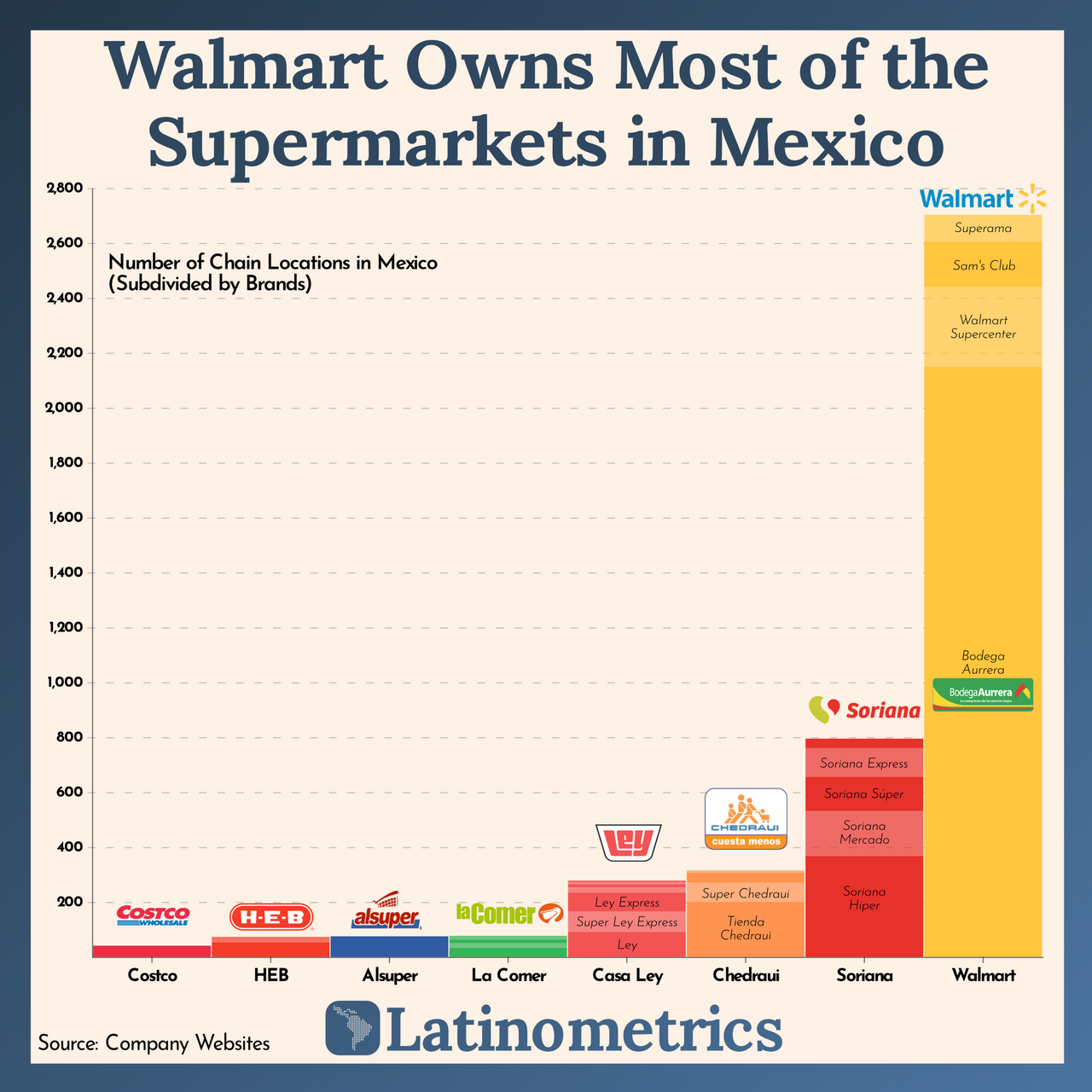

This graphic from Latinometrics ranks supermarket popularity in Mexico by tallying the number of locations per chain, and showing who owns those brands.

Mexico’s Relationship with Walmart

When it comes to supermarkets in Mexico, no single company comes close to matching the reach of Walmart. Also the world’s largest company by revenue, Walmart has over 2,700 stores in the country, including chains it owns such as Sam’s Club and Bodega Aurrera. The latter is both the largest supermarket within the Walmart category, and also the most popular in Mexico.

Bodega Aurrera was first established in the 1970s, two decades before Walmart entered Mexico’s market directly in 1991. The discount store now has some 2,000 locations across the country.

In fact, it’s almost safe to say that Mexico is Walmart’s second home. After the U.S., which has just over 5,000 stores, the greatest number of Walmart stores reside in Mexico. But on a per capita basis, there are more Walmart-owned stores in Mexico. Specifically, there is about one Walmart-owned store per 47,000 Mexicans, compared to 62,000 for Americans.

| Country | Number of Walmart Stores |

|---|---|

| USA | 5,342 |

| Mexico | 2,755 |

| Central America | 864 |

| UK* | 632 |

| China | 397 |

| Africa | 414 |

| Canada | 408 |

| Chile | 384 |

| Japan* | 328 |

| India | 29 |

Source: Walmart.com, Statista (International figures, January 2022), *Japan/UK figures from January 2021

The company’s presence in Mexico is so strong that Walmart’s Mexico division trades separately on the Bolsa Mexicana de Valores (BMV) under the name Walmex. In March of 2022, Walmex had a market cap above 1.3 trillion pesos, or $64 billion.

Supermarkets in Mexico by Revenue Market Share

Overall, with the thousands of stores that they operate, Walmart’s revenue in Mexico gives it a 68% market share within the country’s supermarket industry.

Other American grocery retailers to make the list include H-E-B, a San Antonio-based chain with stores in northeast Mexico, and Costco, which opened its first Mexican location in 1992 as Price Club (before the companies merged).

Sorianna, the next biggest supermarket operator, holds about 15% of the industry’s market share. It is joined by Chedraui, Casa Ley, La Comer, and Alsuper as Mexico’s biggest domestic grocery chains, with some of them also extending their reach into the Southwest United States.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

VC+

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our upcoming VC+ Special Dispatch will be available exclusively to VC+ members on Thursday, April 25th.

If you’re not already subscribed to VC+, make sure you sign up now to receive the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members can expect to receive.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members will receive the full Special Dispatch on Thursday, April 25th.

Make sure you join VC+ now to receive exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023