Finance

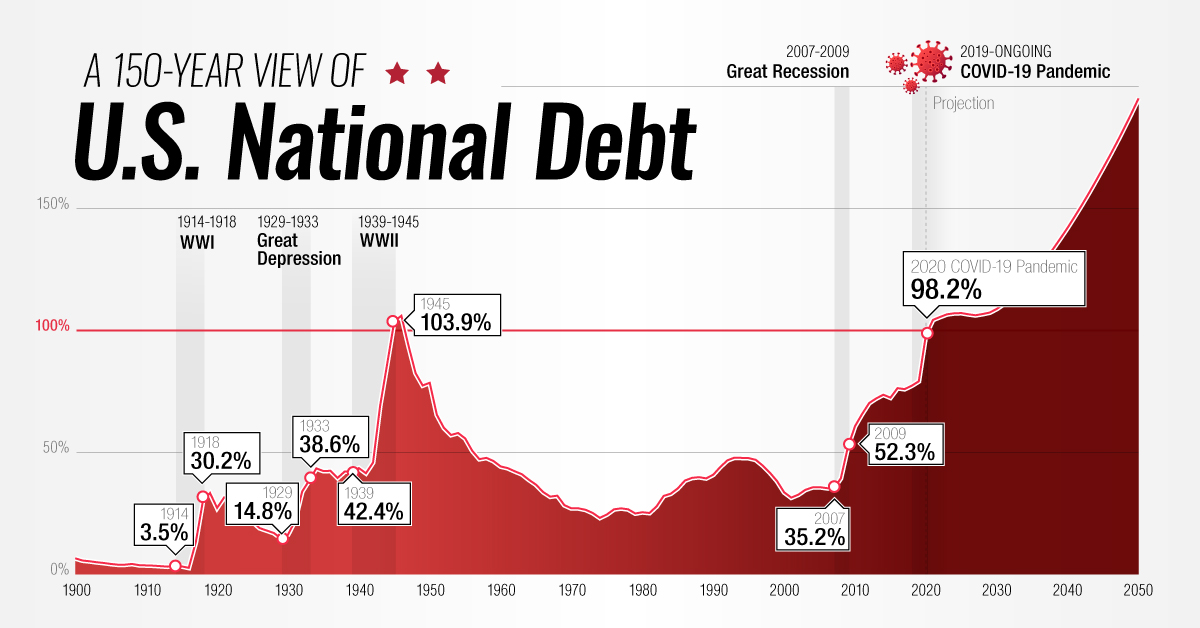

Timeline: 150 Years of U.S. National Debt

This interactive visualization uses debt held by the public for its calculations, which excludes intragovernmental holdings.

var divElement = document.getElementById(‘viz1641521546794’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’1200px’;vizElement.style.height=’2647px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

Looking Back at 150 Years of U.S. Debt

The total U.S. national debt reached an all-time high of $28 trillion* in March 2021, the largest amount ever recorded.

Recent increases to the debt have been fueled by massive fiscal stimulus bills like the CARES Act ($2.2 trillion in March 2020), the Consolidated Appropriations Act ($2.3 trillion in December 2020), and most recently, the American Rescue Plan ($1.9 trillion in March 2021).

To see how America’s debt has gotten to its current point, we’ve created an interactive timeline using data from the Congressional Budget Office (CBO). It’s crucial to note that the data set uses U.S. national debt held by the public, which excludes intergovernmental holdings.

*Editor’s note: This top level figure includes intragovernmental holdings, or the roughly $6 trillion of debt owed within the government to itself.

What Influences U.S. Debt?

It’s worth pointing out that the national debt hasn’t always been this large.

Looking back 150 years, we can see that its size relative to GDP has fluctuated greatly, hitting multiple peaks and troughs. These movements generally correspond with events such as wars and recessions.

| Decade | Gross debt at start of decade (USD billions) | Avg. Debt Held By Public Throughout Decade (% of GDP) | Major Events |

|---|---|---|---|

| 1900 | - | 4.8% | - |

| 1910 | - | 10.0% | World War I |

| 1920 | - | 22.9% | The Great Depression |

| 1930 | $16 | 36.4% | President Roosevelt's New Deal |

| 1940 | $40 | 75.1% | World War II |

| 1950 | $257 | 56.8% | Korean War |

| 1960 | $286 | 37.3% | Vietnam War |

| 1970 | $371 | 26.1% | Stagflation (inflation + high unemployment) |

| 1980 | $908 | 33.7% | President Reagan's tax cuts |

| 1990 | $3,233 | 44.7% | Gulf War |

| 2000 | $5,674 | 36.6% | 9/11 attacks & Global Financial Crisis |

| 2010 | $13,562 | 72.4% | Debt ceiling is raised by Congress |

| 2020 | $27,748 | 105.6% | COVID-19 pandemic |

| 2030P | - | 121.8% | - |

| 2040P | - | 164.7% | - |

| 2050P | - | 195.2% | - |

Source: CBO, The Balance

To gain further insight into the history of the U.S. national debt, let’s review some key economic events in America’s history.

The Great Depression

After its WWI victory, the U.S. enjoyed a period of post-war prosperity commonly referred to as the Roaring Twenties.

This led to the creation of a stock market bubble which would eventually burst in 1929, causing massive damage to the U.S. economy. The country’s GDP was cut in half (partially due to deflation), while the unemployment rate rose to 25%.

Government revenues dipped as a result, pushing debt held by the public as a % of GDP from its low of 15% in 1929, to a high of 44% in 1934.

World War II

WWII quickly brought the U.S. back to full employment, but it was an incredibly expensive endeavor. The total cost of the war is estimated to be over $4 trillion in today’s dollars.

To finance its efforts, the U.S. relied heavily on war bonds, a type of bond that is marketed to citizens during armed conflicts. These bonds were sold in various denominations ranging from $25-$10,000 and had a 2.9% interest rate compounded semiannually.

Over 85 million Americans purchased these bonds, helping the U.S. government to raise $186 billion (not adjusted for inflation). This pushed debt above 100% of GDP for the first time ever, but was also enough to cover 63% of the war’s total cost.

The Postwar Period

Following World War II, the U.S. experienced robust economic growth.

Despite involvement in the Korea and Vietnam wars, debt-to-GDP declined to a low of 23% in 1974—largely because these wars were financed by raising taxes rather than borrowing.

The economy eventually slowed in the early 1980s, prompting President Reagan to slash taxes on corporations and high earning individuals. Income taxes on the top bracket, for example, fell from 70% to 50%.

2008 Global Financial Crisis

The Global Financial Crisis served as a precursor for today’s debt landscape.

Interest rates were reduced to near-zero levels to speed up the economic recovery, enabling the government to borrow with relative ease. Rates remained at these suppressed levels from 2008 to 2015, and debt-to-GDP grew from 39% to 73%.

It’s important to note that even before 2008, the U.S. government had been consistently running annual budget deficits. This means that the government spends more than it earns each year through taxes.

The National Debt Today

The COVID-19 pandemic damaged many areas of the global economy, forcing governments to drastically increase their spending. At the same time, many central banks once again reduced interest rates to zero.

This has resulted in a growing snowball of government debt that shows little signs of shrinking, even though the worst of the pandemic is already behind us.

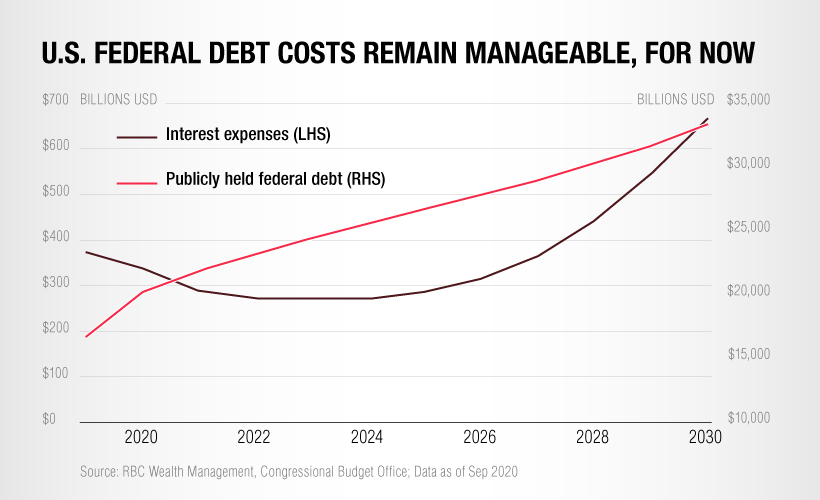

In the U.S., federal debt has reached or surpassed WWII levels. When excluding intragovernmental holdings, it now sits at 104% of GDP—and including those holdings, it sits at 128% of GDP. But while the debt is expected to grow even further, the cost of servicing this debt has actually decreased in recent years.

This is because existing government bonds, which were originally issued at higher rates, are now maturing and being refinanced to take advantage of today’s lower borrowing costs.

The key takeaway from this is that the U.S. national debt will remain manageable for the foreseeable future. Longer term, however, interest expenses are expected to grow significantly—especially if interest rates begin to rise again.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Business

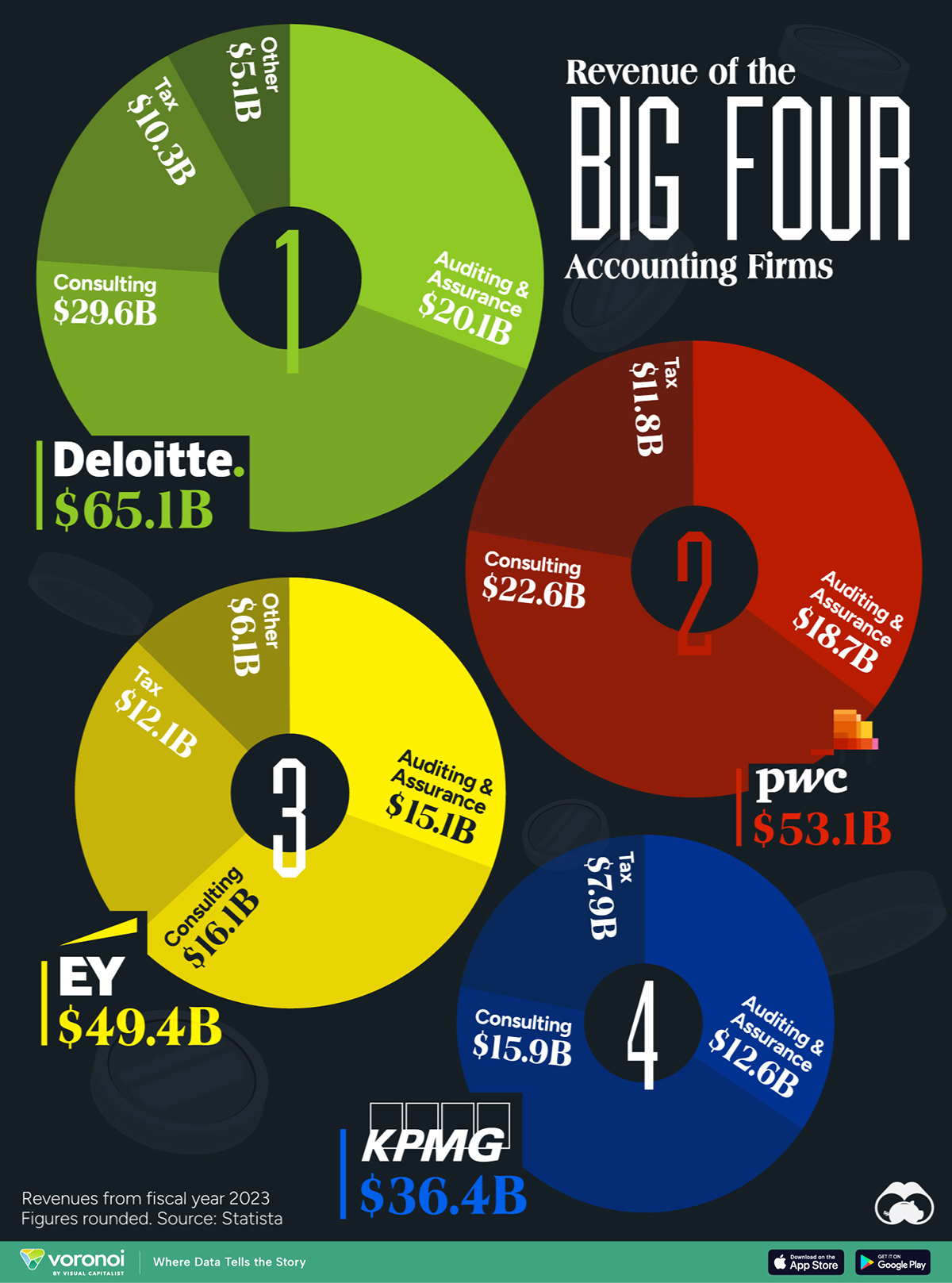

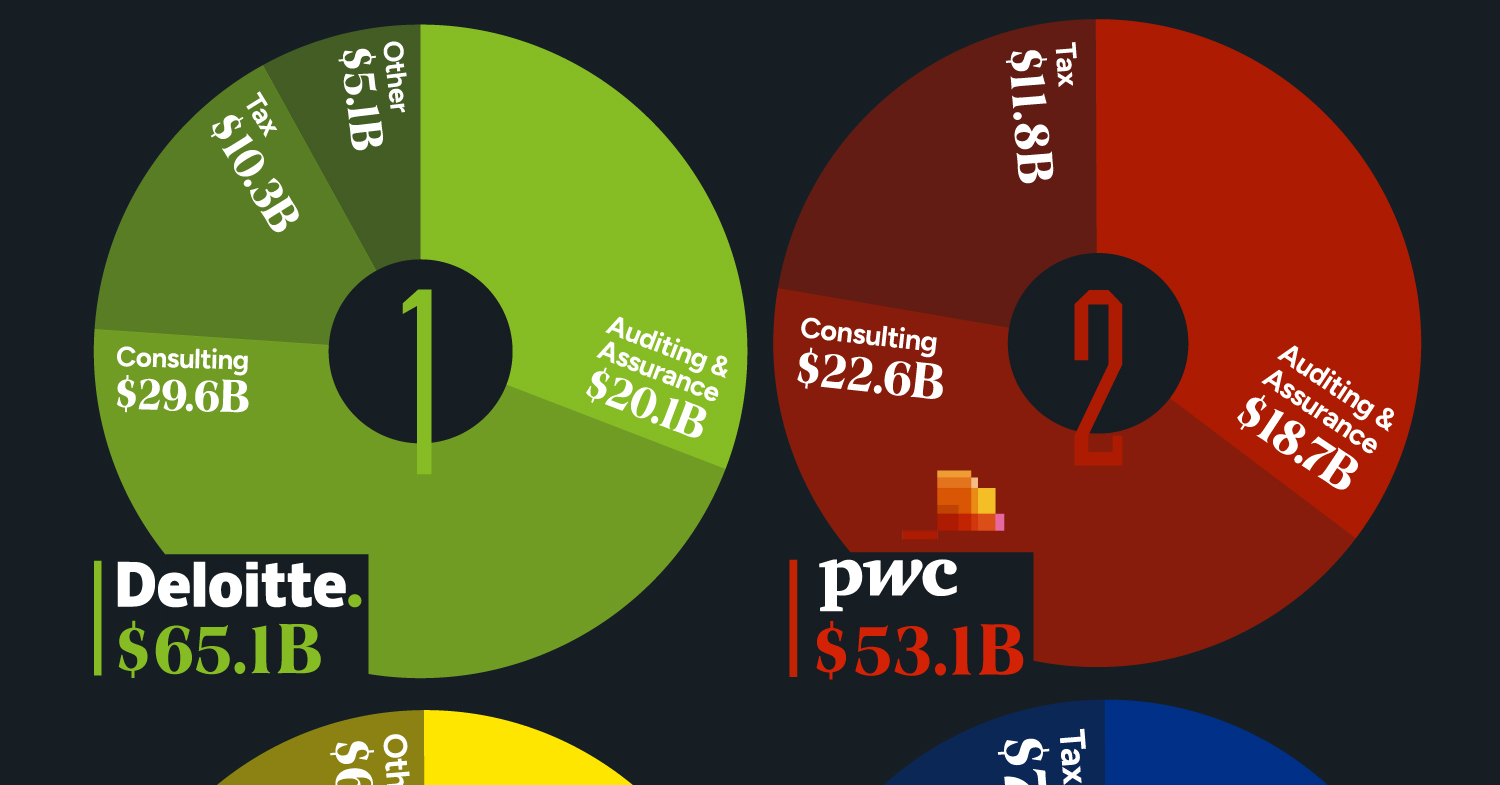

Visualizing the Revenue of the Big Four Accounting Firms

The Big Four accounting firms amassed over $200 billion in combined revenue in 2023.

Visualizing the Revenue of the Big Four Accounting Firms

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The Big Four accounting firms – Deloitte, Ernst & Young (EY), PricewaterhouseCoopers (PwC), and KPMG – have solidified their positions as global industry leaders, boasting a combined revenue exceeding $200 billion in 2023.

Together, these firms audit the majority of publicly traded companies worldwide.

This infographic details the revenues of the “Big Four” accounting firms for the fiscal year 2023, based on data from Statista.

Deloitte Leads the Big Four in 2023 Revenues

Offering diverse services, the Big Four specialize in auditing and assurance, ensuring financial transparency, and regulatory compliance for their clients. Additionally, they provide strategic consulting services. All four are legally headquartered in the UK and command a dominant global market share.

| Company | Auditing & Assurance | Consulting | Tax | Other | Total ($ billions) |

|---|---|---|---|---|---|

| Deloitte | $20.1 | $29.6 | $10.3 | $5.1 | $65.1 |

| PwC | $18.7 | $22.6 | $11.8 | $53.1 | |

| EY | $15.1 | $16.1 | $12.1 | $6.1 | $49.4 |

| KPMG | $12.6 | $15.9 | $7.9 | $36.4 |

Interestingly, the largest accounting firms were formerly known as the “Big Eight,” but mergers and closures starting in the late 1980s have reduced their number to four.

The original group consisted of Arthur Andersen, Arthur Young, Coopers & Lybrand, Deloitte Haskin & Sells, Ernst & Whinney, Peat Marwick Mitchell, Price Waterhouse, and Touche Ross, all headquartered in the U.S. or UK.

Arthur Young merged with Ernst & Whinney, and Deloitte Haskin & Sells combined with Touche Ross. Subsequently, Price Waterhouse and Coopers & Lybrand merged their practices, reducing the count to five. However, following the collapse of Arthur Andersen due to its involvement in the Enron scandal, the “Big Five” became the present-day four.

The Scale of the Big Four

Deloitte is the largest in terms of headcount, with over 456,000 employees as of FY2023, followed by Ernst & Young with more than 395,000 workers, and PwC with 364,000. Despite being the smallest among the four, KPMG still has 298,356 employees.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries