Technology

Animation: The Rise and Fall of Popular Web Browsers Since 1994

Animation: The Rise and Fall of Popular Web Browsers Since 1994

In its early stages, the internet was a highly technical interface that most people had difficulty navigating. But that all changed when the Mosaic web browser entered the scene in 1993.

Mosaic was one of the first “user-friendly” internet portals—although by today’s standards, the browser was actually quite difficult to access. Comparatively, modern browsers in high use today have changed exponentially.

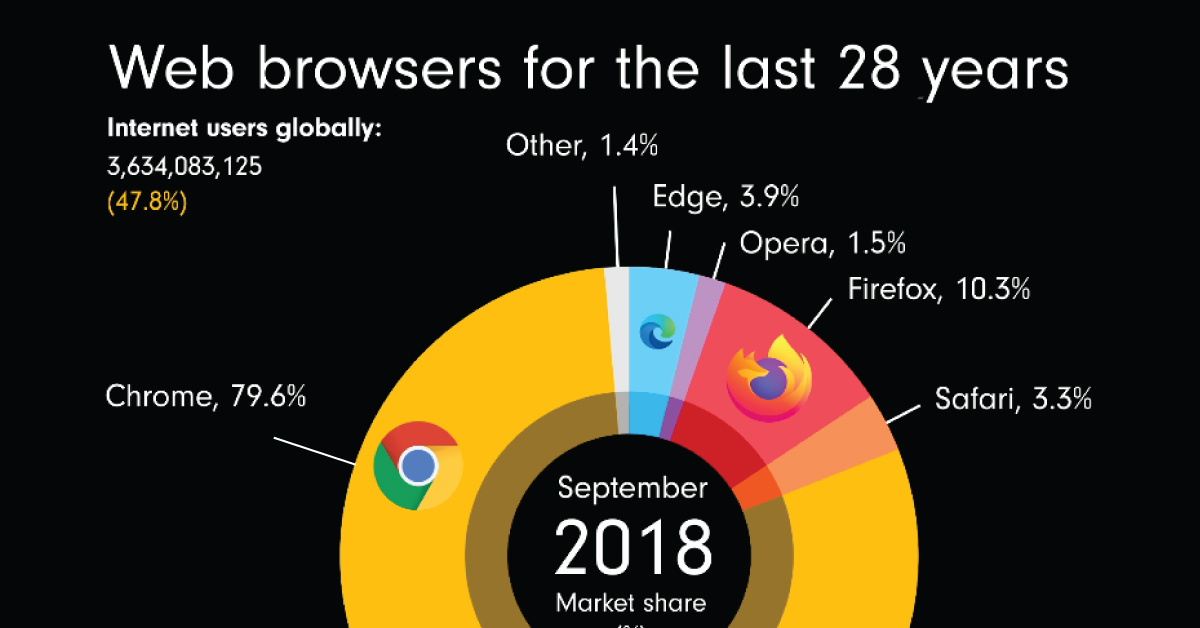

This animated graphic by James Eagle chronicles the evolution of the web browser market, showing the rise and fall of various internet portals from January 1994 to March 2022.

The 1990s: From Mosaic to Netscape

In the early 90s, Mosaic was by far the most dominant web browser. At the time, about 97% of all internet searches were done through this popular web portal.

| Web browser | % Share (January 1994) |

|---|---|

| Mosaic | 97.0% |

| Other | 3.0% |

Mosaic was the first web browser to display images directly on a page in line with text. Earlier browsers loaded pictures as separate files, which meant users have to click, download, and open a new file in order to view them.

The pioneering portal was created by a team of university undergrads at the University of Illinois, led by 21-year-old Marc Andreessen. When Andreessen graduated, he went on to be the co-founder of Mosaic Communications Corporation, which evolved into Netscape Communications Corporation, the company that created Netscape Navigator.

Netscape was essentially a new and improved version of Mosaic, but since the University of Illinois owned the rights to Mosaic, Andreessen’s new company couldn’t actually use any of the original code.

Netscape became a nearly instant success, and as a result, Mosaic’s market share began to fall. By the late 90s, Netscape had captured 89% of the web browser market.

| Web browser | % Share (April 1996) |

|---|---|

| Netscape | 88.9% |

| Mosaic | 7.2% |

| Internet Explorer | 3.9% |

Netscape dominated the market for a few more years. However, in the new millennium, a new tech giant started to take over—Internet Explorer.

The 2000s: Internet Explorer Enters the Chat, Followed by Firefox

In 1995, Microsoft launched Internet Explorer as part of an add-on package for its operating system, Microsoft Windows 95.

Given the popularity of the Windows franchise at the time, Internet Explorer was quickly adopted. By the early 2000s, it had captured over 90% of the market, reflecting Microsoft’s hold on the personal computing market.

| Web browser | % Share (January 2000) |

|---|---|

| Internet Explorer | 76.6% |

| Netscape | 18.4% |

| Opera | 0.7% |

| Other | 4.3% |

Netscape was mostly phased out of the market by then, which meant Internet Explorer didn’t have much competition until Mozilla entered the arena.

Founded by members of Netscape, Mozilla began in 1998 as a project for fostering innovation in the web browser market. They shared Netscape’s source code with the public, and over time built a community of programmers around the world that helped make the product even better.

By 2004, Mozilla launched Firefox, and by 2006, the free, open-source browser had captured nearly 30% of the market. Firefox and Internet Explorer battled it out for a few more years, but by the mid-2010s, both browsers started to get leapfrogged by Google Chrome.

Present Day: Google Chrome is King of the Web Browsers

When Google’s co-founders Larry Page and Sergey Brin pitched the idea of starting a Google web browser to CEO Larry Schmidt in 2003, he was worried that they couldn’t keep up with the fierce competition. Eventually, the co-founders convinced Schmidt, and in 2008, Google Chrome was released to the public.

One of Chrome’s distinguishing features was (and still is) the fact that each tab operated separately. This meant that if one tab froze, it wouldn’t stall or crash the others, at the cost of higher memory and CPU usage.

By 2013, Chrome had swallowed up half the market. And with Android emerging as the most popular mobile OS on the global market, there were even more Chrome installations (and of course, searches on Google) as a result.

Notes on Data and Methodology

It’s important to note that the dataset in this animation uses visitor log files from web development site and resource W3Schools from 1999 onwards. Despite getting more than 60 million monthly visits, its userbase is likely slanted towards PC over mobile users.

Further, though Google’s Android platform has a sizable lead over Apple’s iOS in the global mobile sector, this likely slant also impacts the representation of iOS and therefore Safari browsers in the animation and dataset.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Maps1 week ago

Maps1 week agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share