Money

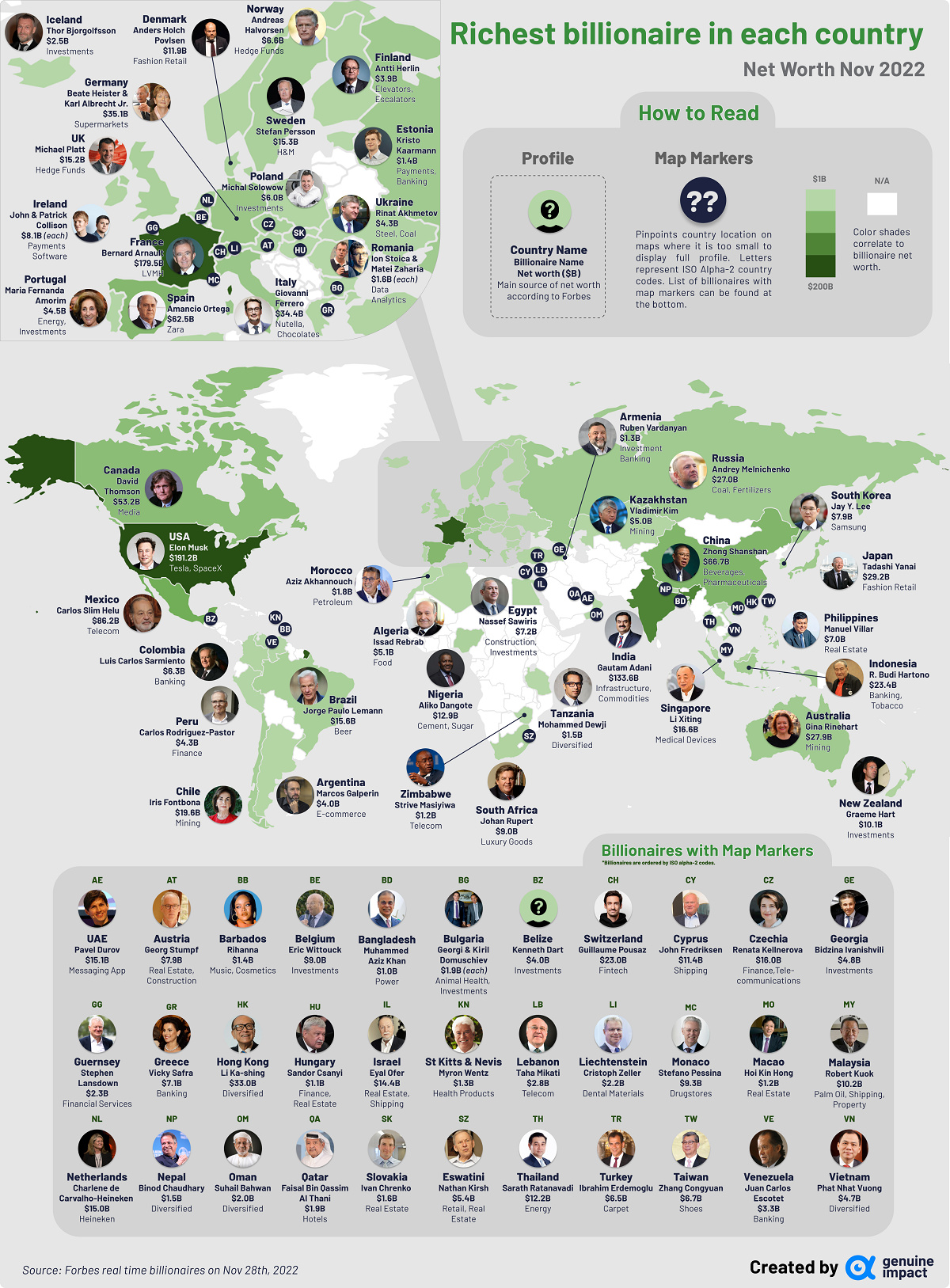

Mapping Out the Richest Billionaires in Each Country

Click to view a larger version of the graphic.

Mapping Out The Richest Billionaires in Each Country

While there are nearly 8 billion people in the world, just over 3,000 are billionaires as of November 2022. This tiny group of people is worth nearly $11.8 trillion—Equivalent to about 11.8% of global GDP.

Where do these billionaires live? This graphic by Truman Du uses data from Forbes to map out the richest billionaires around the world.

The Full List

As it turns out, billionaires are a lot more geographically concentrated than you might think.

In fact, of the 195 officially recognized countries around the world, only 76 are home to billionaires. And even within these countries, there’s vast disparities between the quantity of billionaires.

Here’s a breakdown of all the countries that have at least one billionaire. For countries with more than one, we’ve highlighted the billionaire with the highest net worth as of November 28, 2022:

| Country/territory | Name | Net worth ($B) | Main source of wealth (sector) |

|---|---|---|---|

| 🇩🇿 Algeria | Issad Rebrab | 5.1 | food |

| 🇦🇷 Argentina | Marcos Galperin | 4.0 | e-commerce |

| 🇦🇲 Armenia | Ruben Vardanyan | 1.3 | investment banking |

| 🇦🇺 Australia | Gina Rinehart | 27.9 | mining |

| 🇦🇹 Austria | Georg Stumpf | 7.9 | real estate, construction |

| 🇧🇩 Bangladesh | Muhammed Aziz Khan | 1.0 | power |

| 🇧🇧 Barbados | Rihanna | 1.4 | music, cosmetics |

| 🇧🇪 Belgium | Eric Wittouck | 9.0 | investments |

| 🇧🇿 Belize | Kenneth Dart | 4.0 | investments |

| 🇧🇷 Brazil | Jorge Paulo Lemann | 15.6 | beer |

| 🇧🇬 Bulgaria | Georgi & Kiril Domuschiev | 1.9 | animal health, investments |

| 🇨🇦 Canada | David Thomson | 53.2 | media |

| 🇨🇱 Chile | Iris Fontbona | 19.6 | mining |

| 🇨🇳 China | Zhong Shanshan | 66.7 | beverages, pharmaceuticals |

| 🇨🇴 Colombia | Luis Carlos Sarmiento | 6.3 | banking |

| 🇨🇾 Cyprus | John Fredriksen | 11.4 | shipping |

| 🇨🇿 Czechia | Renata Kellnerova | 16.0 | finance, telecommunications |

| 🇩🇰 Denmark | Anders Holch Povlsen | 11.9 | fashion retail |

| 🇪🇬 Egypt | Nassef Sawiris | 7.2 | construction, investments |

| 🇪🇪 Estonia | Kristo Kaarmann | 1.4 | payments, banking |

| 🇫🇮 Finland | Antti Herlin | 3.9 | elevators, escalators |

| 🇫🇷 France | Bernard Arnault | 179.5 | LVMH |

| 🇬🇪 Georgia | Bidzina Ivanishvili | 4.8 | investments |

| 🇩🇪 Germany | Beate Heister & Karl Albrecht Jr. | 35.1 | supermarkets |

| 🇬🇷 Greece | Vicky Safra | 7.1 | banking |

| 🇬🇬 Guernsey | Stephen Lansdown | 2.3 | financial services |

| 🇭🇰 Hong Kong | Li Ka-shing | 33.0 | diversified |

| 🇭🇺 Hungary | Sandor Csanyi | 1.1 | finance, real estate |

| 🇮🇸 Iceland | Thor Bjorgolfsson | 2.5 | investments |

| 🇮🇳 India | Gautam Adani | 133.6 | infrastructure, commodities |

| 🇮🇩 Indonesia | R. Budi Hartono | 23.4 | banking, tobacco |

| 🇮🇪 Ireland | John Collison & Patrick Collison | 8,1 | payments software |

| 🇮🇱 Israel | Eyal Ofer | 14.4 | real estate, shipping |

| 🇮🇹 Italy | Giovanni Ferrero | 34.4 | Nutella, chocolates |

| 🇯🇵 Japan | Tadashi Yanai | 29.2 | fashion retail |

| 🇰🇿 Kazakhstan | Vladimir Kim | 5.0 | mining |

| 🇱🇧 Lebanon | Taha Mikati | 2.8 | telecom |

| 🇱🇮 Liechtenstein | Christoph Zeller | 2.2 | dental materials |

| 🇲🇴 Macau | Hoi Kin Hong | 1.2 | real estate |

| 🇲🇾 Malaysia | Quek Leng Chan | 10.2 | banking, property |

| 🇲🇽 Mexico | Carlos Slim Helu | 86.2 | telecom |

| 🇲🇨 Monaco | Stefano Pessina | 9.3 | drugstores |

| 🇲🇦 Morocco | Aziz Akhannouch | 1.8 | petroleum |

| 🇳🇵 Nepal | Binod Chaudhary | 1.5 | diversified |

| 🇳🇱 Netherlands | Charlene de Carvalho-Heineken | 15.0 | Heineken |

| 🇳🇿 New Zealand | Graeme Hart | 10.1 | investments |

| 🇳🇬 Nigeria | Aliko Dangote | 12.9 | cement, sugar |

| 🇳🇴 Norway | Andreas Halvorsen | 6.6 | hedge funds |

| 🇴🇲 Oman | Suhail Bahwan | 2.0 | diversified |

| 🇵🇪 Peru | Carlos Rodriguez-Pastor | 4.3 | finance |

| 🇵🇭 Philippines | Manuel Villar | 7.0 | real estate |

| 🇵🇱 Poland | Michal Solowow | 6.0 | investments |

| 🇵🇹 Portugal | Maria Fernanda Amorim | 4.5 | energy, investments |

| 🇶🇦 Qatar | Faisal Bin Qassim Al Thani | 1.9 | hotels |

| 🇷🇴 Romania | Ion Stoica & Matei Zaharia | 1.6 | data analytics |

| 🇷🇺 Russia | Andrey Melnichenko | 27.0 | coal, fertilizers |

| 🇸🇬 Singapore | Li Xiting | 16.6 | medical devices |

| 🇸🇰 Slovakia | Ivan Chrenko | 1.6 | real estate |

| 🇿🇦 South Africa | Johann Rupert | 9.0 | luxury goods |

| 🇰🇷 South Korea | Jay Y. Lee | 7.9 | samsung |

| 🇪🇸 Spain | Amancio Ortega | 62.5 | Zara |

| 🇰🇳 St. Kitts and Nevis | Myron Wentz | 1.3 | health products |

| 🇸🇿 Swaziland (Eswatini) | Nathan Kirsh | 5.4 | retail, real estate |

| 🇸🇪 Sweden | Stefan Persson | 15.3 | H&M |

| 🇨🇭Switzerland | Guillaume Pousaz | 23.0 | fintech |

| 🇹🇼 Taiwan | Zhang Congyuan | 6.7 | shoes |

| 🇹🇿 Tanzania | Mohammed Dewji | 1.5 | diversified |

| 🇹🇭 Thailand | Sarath Ratanavadi | 12.2 | energy |

| 🇹🇷 Turkey | Ibrahim Erdemoglu | 6.5 | carpet |

| 🇺🇦 Ukraine | Rinat Akhmetov | 4.3 | steel, coal |

| 🇦🇪 United Arab Emirates | Pavel Durov | 15.1 | messaging app |

| 🇬🇧 United Kingdom | Michael Platt | 15.2 | hedge funds |

| 🇺🇸 United States | Elon Musk | 191.2 | Tesla, SpaceX |

| 🇻🇪 Venezuela | Juan Carlos Escotet | 3.2 | banking |

| 🇻🇳 Vietnam | Pham Nhat Vuong | 4.7 | diversified |

| 🇿🇼 Zimbabwe | Strive Masiyiwa | 1.2 | telecom |

The United States is well known to have one of the highest concentrations of billionaires. It’s home to over 900, with Elon Musk the wealthiest of them all with a staggering net worth of over $191 billion in November 2022. That makes him not just the richest billionaire in America, but the richest person in the world.

China has the second highest concentration of billionaires, with 400 ultra-wealthy that have a combined net worth of $1.45 trillion. China’s richest billionaire, Zhong Shanshan, is the founder of the Nongfu Spring beverage company.

Interestingly, there are no clear patterns when it comes to the type of industry or sector that these billionaires are involved in. The exception is the U.S., where a significant number of billionaires are linked to the tech industry.

And it’s important to note that some heads of states are reportedly billionaires, and in many cases might be the wealthiest people in their respective countries. But their wealth is often a state secret, well-diversified, and too difficult to accurately estimate.

Male vs. Female Billionaires

One trend that does stand out is the number of men versus women who are billionaires. Of the 76 billionaires on the list, only 7 are women.

This pattern is also evident when looking at the entire billionaire population—of the 3,311 billionaires worldwide, only 12.9% are women.

It’s worth mentioning that this population of billionaire women is rising. According to Forbes, the 2021 list included 328 women, 36% more than in 2020.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Money

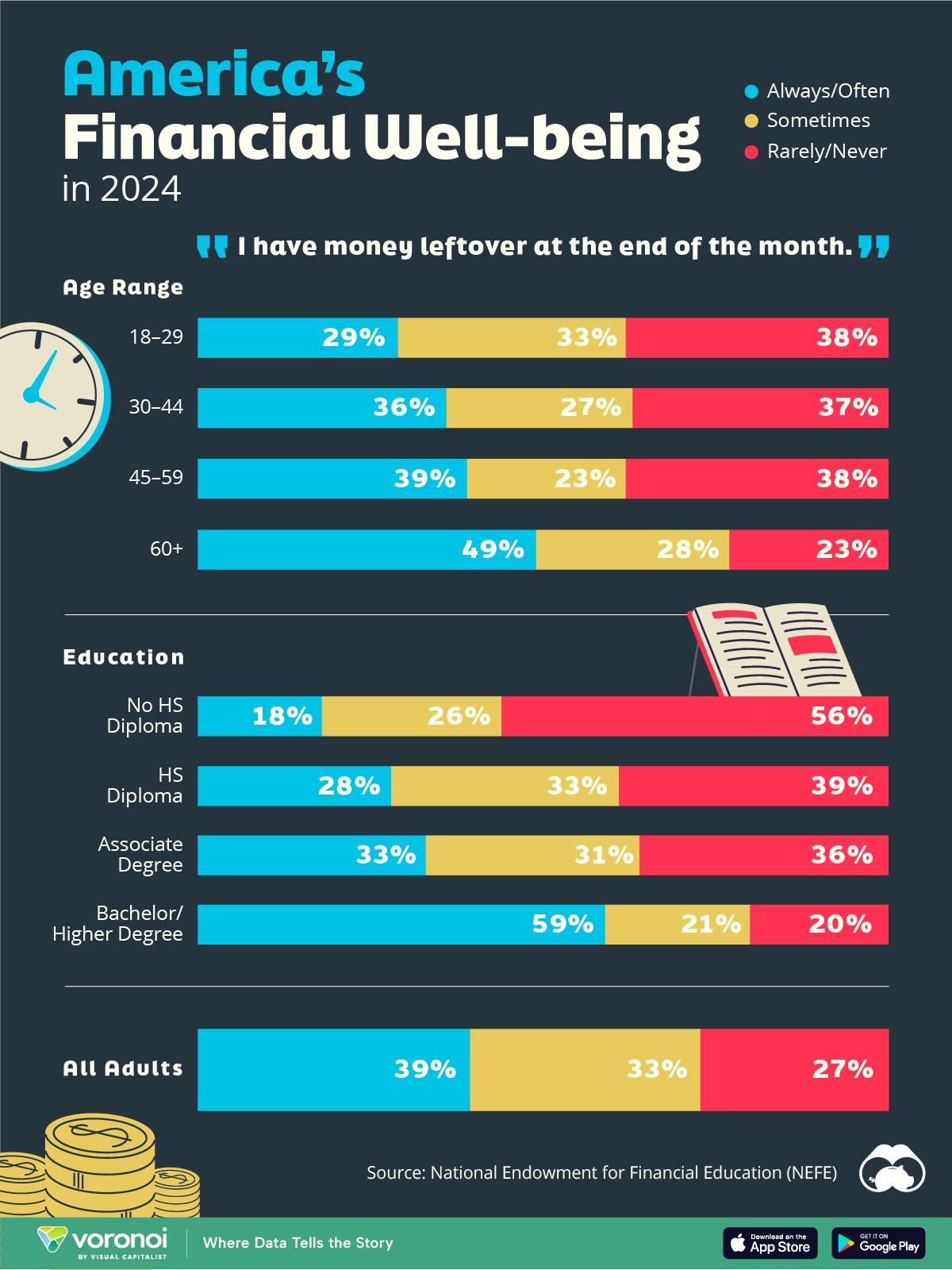

Charted: Who Has Savings in This Economy?

Older, better-educated adults are winning the savings game, reveals a January survey by the National Opinion Research Center at the University of Chicago.

Who Has Savings in This Economy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Two full years of inflation have taken their toll on American households. In 2023, the country’s collective credit card debt crossed $1 trillion for the first time. So who is managing to save money in the current economic environment?

We visualize the percentage of respondents to the statement “I have money leftover at the end of the month” categorized by age and education qualifications. Data is sourced from a National Endowment for Financial Education (NEFE) report, published last month.

The survey for NEFE was conducted from January 12-14, 2024, by the National Opinion Research Center at the University of Chicago. It involved 1,222 adults aged 18+ and aimed to be representative of the U.S. population.

Older Americans Save More Than Their Younger Counterparts

General trends from this dataset indicate that as respondents get older, a higher percentage of them are able to save.

| Age | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| 18–29 | 29% | 33% | 38% |

| 30–44 | 36% | 27% | 37% |

| 45–59 | 39% | 23% | 38% |

| Above 60 | 49% | 28% | 23% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

Perhaps not surprisingly, those aged 60+ are the age group with the highest percentage saying they have leftover money at the end of the month. This age group spent the most time making peak earnings in their careers, are more likely to have investments, and are more likely to have paid off major expenses like a mortgage or raising a family.

The Impact of Higher Education on Earnings and Savings

Based on this survey, higher education dramatically improves one’s ability to save. Shown in the table below, those with a bachelor’s degree or higher are three times more likely to have leftover money than those without a high school diploma.

| Education | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| No HS Diploma | 18% | 26% | 56% |

| HS Diploma | 28% | 33% | 39% |

| Associate Degree | 33% | 31% | 36% |

| Bachelor/Higher Degree | 59% | 21% | 20% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

As the Bureau of Labor Statistics notes, earnings improve with every level of education completed.

For example, those with a high school diploma made 25% more than those without in 2022. And as the qualifications increase, the effects keep stacking.

Meanwhile, a Federal Reserve study also found that those with more education tended to make financial decisions that contributed to building wealth, of which the first step is to save.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries