Markets

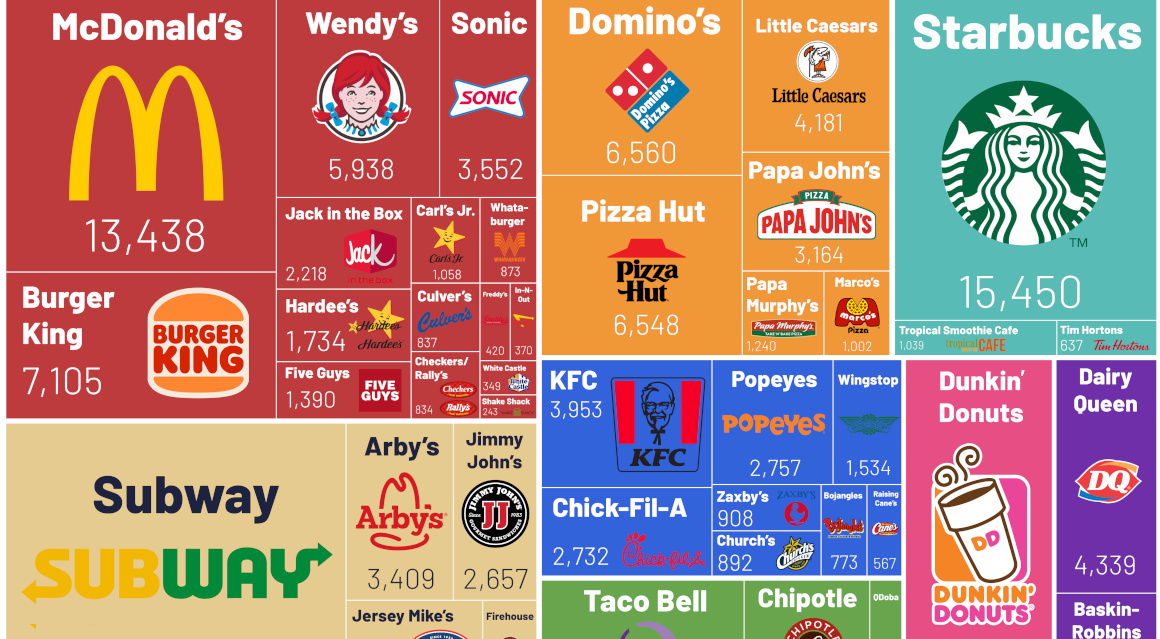

Visualizing America’s Most Popular Fast Food Chains

Visualizing America’s Most Popular Fast Food Chains

Fast food is big business in America. From national chains to regional specialties, the industry was worth $331.4 billion as of June 2022.

Which fast food brands are currently dominating this space? This graphic by Truman Du uses data from Quick Service Restaurant (QSR) Magazine to show the most popular fast food chains across America.

The Most Prevalent Fast Food Chains, by Store Count

Each year, QSR Magazine puts together a report that ranks America’s top 50 fast food chains. It uses a number of metrics to determine this, including total sales (which we’ve covered in a previous article), average-unit volume (AUVs), and growth figures.

For this graphic, Du zoomed in on a specific metric from the report—the number of stores that each fast food chain has across the country. Here are the top 50 chains, and the number of restaurants they each have across America:

| Rank | Brand | Total U.S. Stores (2021) |

|---|---|---|

| 1 | Subway | 21,147 |

| 2 | Starbucks | 15,450 |

| 3 | McDonald's | 13,438 |

| 4 | Dunkin' | 9,244 |

| 5 | Burger King | 7,105 |

| 6 | Taco Bell | 7,002 |

| 7 | Domino's | 6,560 |

| 8 | Pizza Hut | 6,548 |

| 9 | Wendy's | 5,938 |

| 10 | Dairy Queen | 4,339 |

| 11 | Little Caesars | 4,181 |

| 12 | KFC | 3,953 |

| 13 | Sonic Drive-in | 3,552 |

| 14 | Arby's | 3,409 |

| 15 | Papa Johns | 3,164 |

| 16 | Chipotle | 2,966 |

| 17 | Popeyes Louisiana Kitchen | 2,757 |

| 18 | Chick-Fil-A | 2,732 |

| 19 | Jimmy John's | 2,657 |

| 20 | Panda Express | 2,334 |

| 21 | Baskin-Robbins | 2,317 |

| 22 | Jack in the Box | 2,218 |

| 23 | Jersey Mike's | 2,100 |

| 24 | Panera Bread | 2,080 |

| 25 | Hardee's | 1,734 |

| 26 | Wingstop | 1,534 |

| 27 | Five Guys | 1,390 |

| 28 | Papa Murphy's | 1,240 |

| 29 | Firehouse Subs | 1,140 |

| 30 | Carl's Jr. | 1,058 |

| 31 | Tropical Smoothie Café | 1,039 |

| 32 | Marco's Pizza | 1,002 |

| 33 | Zaxby's | 908 |

| 34 | Church's Chicken | 892 |

| 35 | Whataburger | 873 |

| 36 | Culver's | 837 |

| 37 | Checkers / Rally's | 834 |

| 38 | Bojangles | 773 |

| 39 | Qdoba | 739 |

| 40 | Moe's | 659 |

| 41 | Tim Hortons | 637 |

| 42 | Del Taco | 600 |

| 43 | Raising Cane's | 567 |

| 44 | McAlister's Deli | 505 |

| 45 | El Pollo Loco | 481 |

| 46 | Freddy's Frozen Custard & Steakburgers | 420 |

| 47 | In-N-Out Burger | 370 |

| 48 | Krispy Kreme | 358 |

| 49 | White Castle | 349 |

| 50 | Shake Shack | 243 |

Subway takes first place with over 20,000 restaurants across the country—that’s more stores than all the other sandwich chains on the list put together.

Subway’s popularity is reflected in its sales figures, as well—in 2021, Subway generated about $9.4 billion in sales, about double its closest rival Arby’s.

Second on the list is Starbucks, with more than 15,000 stores across America. Despite a rough 2020, the coffee chain managed to turn things around in 2021, making more than $24 billion in sales that year.

The iconic burger joint McDonald’s comes in third, with more than 13,000 restaurants across the country. While the restaurant has fewer stores than Starbucks and Subway, it generated $46 billion in 2021 sales, which is more than Subway and Starbucks combined.

The “Stay in Your Lane” Curse

As the report shows, quick service restaurants are a popular dining option across America, and the successful ones have the potential to generate billions of dollars each year.

However, QSRs are not without their struggles. One difficulty facing fast food chains is the fact they’re often siloed into specific verticals—once a QSR establishes its niche, it can be difficult for that chain to branch out and successfully launch different menu items.

Take McDonald’s McPizza for example, which was launched in the mid 1980s and tested for a decade or so before being widely discontinued by 2000. Various factors contributed to its demise, but one major issue was the pizza’s relatively long cook-time of sixteen minutes.

Innovation in the Fast Food Industry

While fast food restaurants may have difficulty diversifying their menus, there’s still tons of innovation happening in the industry, especially when it comes to optimizing service and cutting wait times for customers.

For example, Starbucks’ mobile order and pay service, which allows customers to order from their phone, has grown 400% over the last five years. And in 2021, the McDonald’s app was downloaded 24 million times.

It’ll be interesting to see what changes in the next decade, as fast food companies continue to invest in their digital offers and tech support.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023