Technology

Netflix vs Disney: Who’s Winning the Streaming War?

Netflix vs Disney: Who’s Winning the Streaming War?

Netflix is well-known as one of the pioneers of mass-market video streaming. The service has become so ubiquitous that the word “Netflix” is now synonymous with watching a movie or television show.

But, while it’s one of the most recognized streaming platforms in the world, has it been able to maintain its dominant position in the industry now that more competitors have entered the fray?

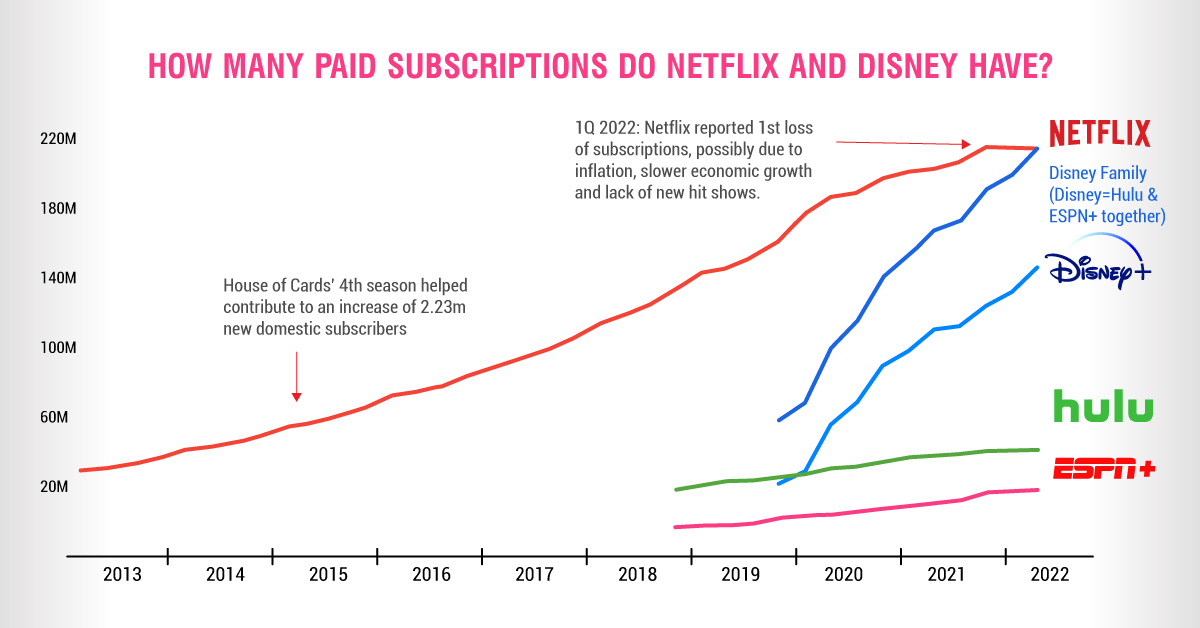

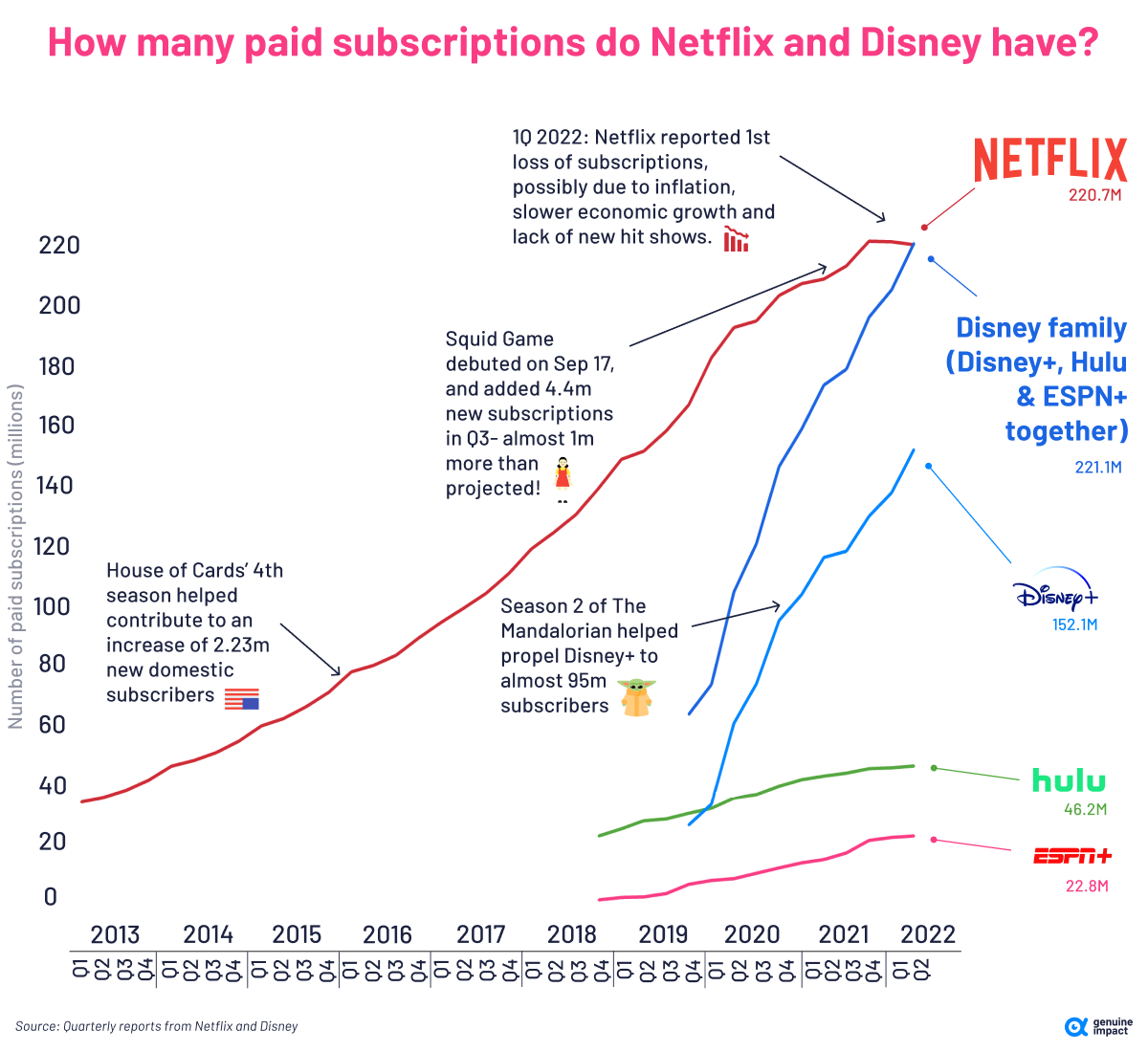

This graphic by Truman Du shows how Disney’s streaming empire (Disney+, Hulu, and ESPN+) has quickly gained subscribers and is giving Netflix a run for its money.

Netflix: The Beginning

Founded in 1997, Netflix started out as mail-order DVD rental company. One of the co-founders Reed Hastings told Fortune Magazine that he got the idea for Netflix after he was charged a $40 late fee for a VHS he’d rented out.

By 2007, Netflix had evolved from a relatively modest DVD rental company into a ground-breaking subscription-based streaming service. While there were a few other streaming platforms at the time, Netflix had a significant first mover’s advantage, operating on a subscription model and acquiring a wide pool of distribution rights from different studios.

This allowed the company to grow rapidly and establish itself as an industry leader. From 2007 to 2022, Netflix’s subscriber base grew from 7 million to 221 million, nearly 3,000%.

When Did Disney Enter the Scene?

The Walt Disney Company got involved in the streaming industry in 2009 when it first joined Hulu as a minor stakeholder, but became more directly invested in 2016 when it bought a 33% stake in BAMTECH Media, a video streaming technology company.

Disney eventually bought a majority stake in BAMTECH Media and in 2018, the company rebranded to Disney Streaming Services. In addition to launching Disney+ and ESPN+, Disney’s acquisition of 21 Century Fox gave the company a majority stake in other streaming platforms including Hulu and Star+.

While Disney arrived much later on the scene compared to Netflix, it didn’t take long for Disney’s platforms to gain traction. And as of Q2 2022, Disney’s streaming empire (Disney+, Hulu, and ESPN+) has more combined subscribers than Netflix, and are gaining at a rapid pace.

Netflix

| Platform | Subscribers (Q2 2022) | % Growth (y-o-y) |

|---|---|---|

| Netflix | 220.7 million | 5.5% |

| Netflix Total | 220.7 million | 5.5% |

Disney

| Platform | Subscribers (Q2 2022) | % Growth (y-o-y) |

|---|---|---|

| Disney+ | 152.1 million | 31.1% |

| Hulu | 46.2 million | 7.9% |

| ESPN | 22.8 million | 53.0% |

| Disney Total | 221.1 million | 27.3% |

Other streaming services like HBO Max and Amazon Prime Video also continue to pick up steam, which begs the question: has the Netflix empire started to tumble?

Recent Trouble With Netflix

In April 2022, Netflix shared its Q1 results which showed a loss of 200,000 subscribers. Though barely a fraction of its 200+ million subscribers, it was Netflix’s first drop in subscribers in over 10 years.

This sent the company’s share price plummeting below $200, the lowest since 2017. As October 10, 2022, its share price still sits at $230, over 30% down from before the Q1 announcement in April 2022.

But change for the company is on the horizon. Netflix has announced that it plans to launch a cheaper, ad-supported service in November—something that other streaming platforms like Peacock and Paramount+ have already been offering customers for a few years.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries