United States

Mapped: The Top U.S. Exports by State

Click to view a larger version of the graphic.

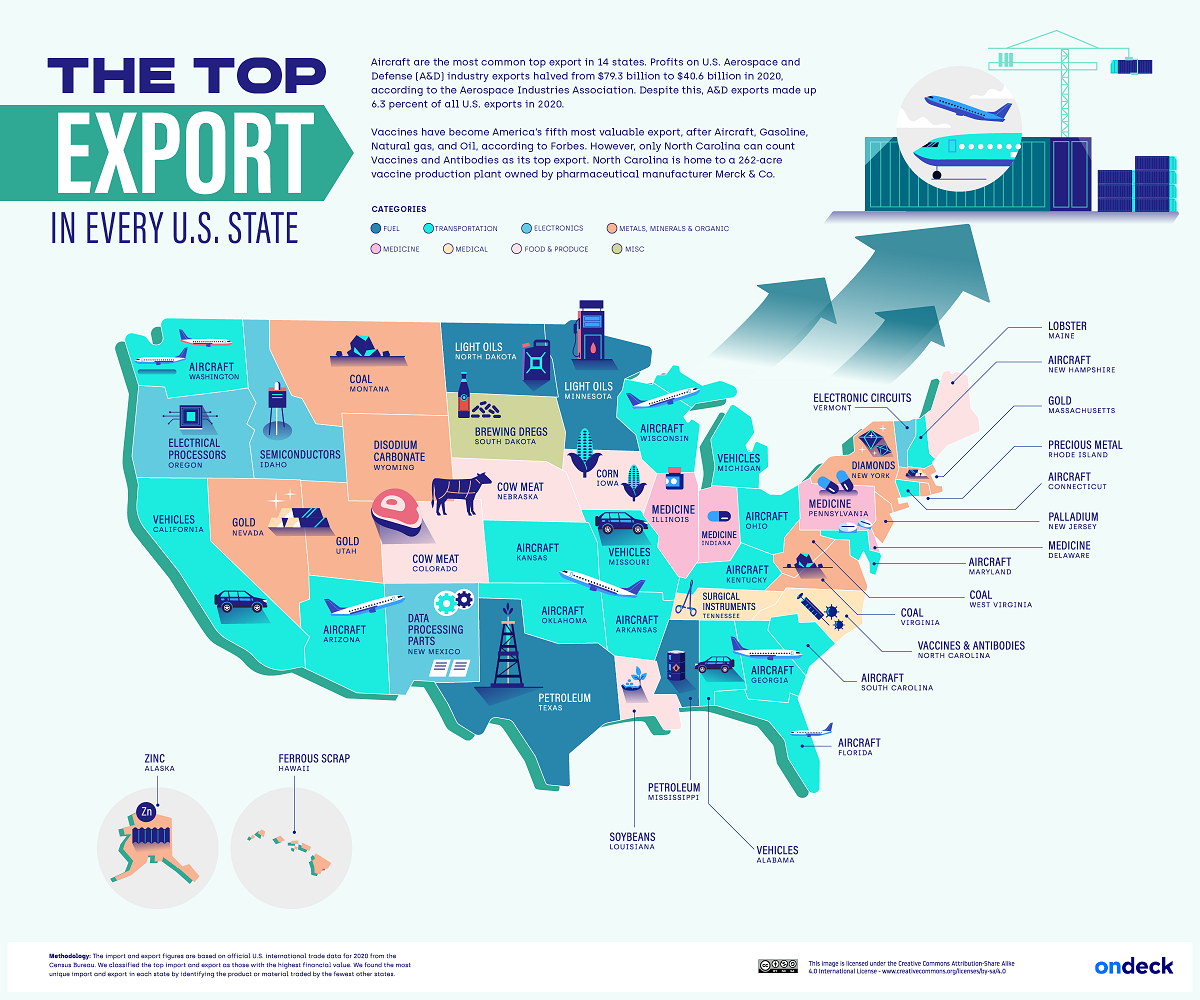

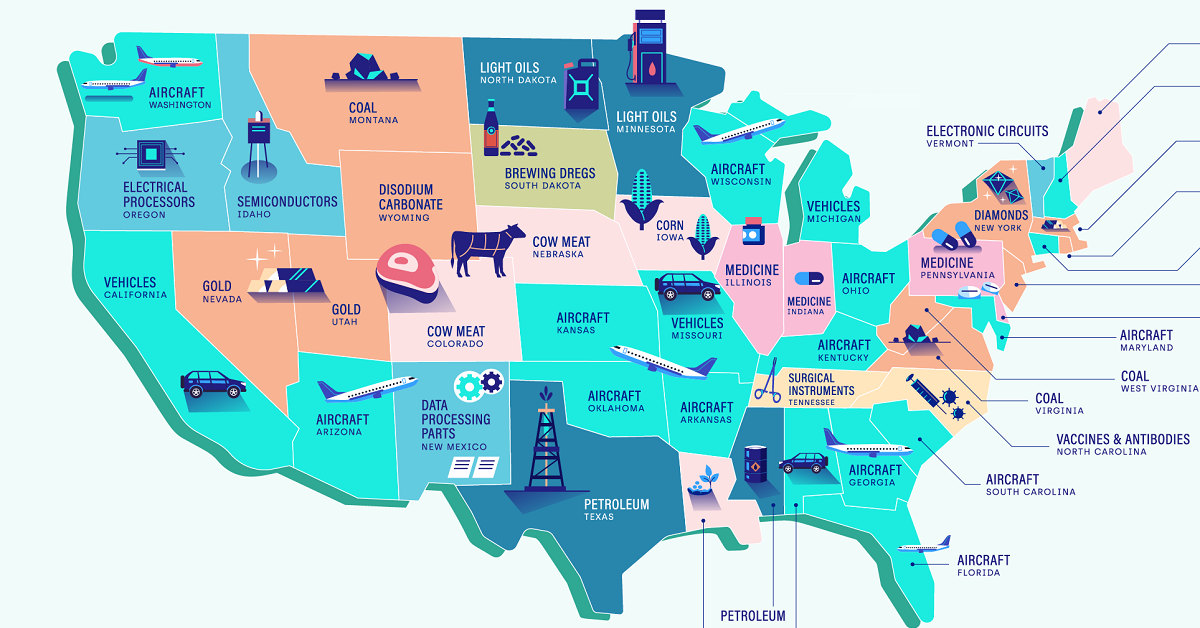

Mapped: The Top U.S. Exports by State

The U.S. exported over $1.3 trillion in goods in 2020, the second-highest amount worldwide.

While refined petroleum was the top export overall at $58.4 billion, aircraft exports were actually the highest across 14 states—more than any other form of export.

This infographic from OnDeck shows America’s top exports by state, using January 2022 data from the U.S. Census Bureau.

America’s Top Exports, by Category

As shown below, Florida, Kansas, and numerous other states all have aircraft (and related parts) as their top export.

Here is the top export category for each state, using 2020 figures.

| State | Top Export |

|---|---|

| Arizona | Aircraft |

| Arkansas | Aircraft |

| Connecticut | Aircraft |

| Florida | Aircraft |

| Georgia | Aircraft |

| Kansas | Aircraft |

| Kentucky | Aircraft |

| Maryland | Aircraft |

| New Hampshire | Aircraft |

| Ohio | Aircraft |

| Oklahoma | Aircraft |

| South Carolina | Aircraft |

| Washington | Aircraft |

| Wisconsin | Aircraft |

| South Dakota | Brewing Dregs |

| Montana | Coal |

| Virginia | Coal |

| West Virginia | Coal |

| Iowa | Corn |

| Colorado | Cow Meat |

| Nebraska | Cow Meat |

| New Mexico | Data Processing Parts |

| New York | Diamonds |

| Wyoming | Disodium Carbonate |

| Oregon | Electrical Processors |

| Vermont | Electronic Circuits |

| Hawaii | Ferrous Scrap |

| Massachusetts | Gold |

| Nevada | Gold |

| Utah | Gold |

| Minnesota | Light Oils |

| North Dakota | Light Oils |

| Maine | Lobster |

| Delaware | Medicine |

| Illinois | Medicine |

| Indiana | Medicine |

| Pennsylvania | Medicine |

| New Jersey | Palladium |

| Mississippi | Petroleum |

| Texas | Petroleum |

| Rhode Island | Precious Metal |

| Idaho | Semiconductors |

| Louisiana | Soybeans |

| Tennessee | Surgical Instruments |

| North Carolina | Vaccines and Antibodies |

| Alabama | Vehicles |

| California | Vehicles |

| Michigan | Vehicles |

| Missouri | Vehicles |

| Alaska | Zinc |

While the vast majority of the aerospace and defense industry consists of civil aerospace exports, America has also played a significant role in exports of military aircraft. Between 2000-2020, these were worth $99.6 billion, the highest in the world ahead of Russia’s $61.5 billion in military exports. This becomes less surprising when you consider that a new fighter jet can often come with a $100 million price tag.

But there were many different, and more interesting, exports. South Dakota’s top export is none other than brewing dregs, which is the sediment found in brewing beer. The largest importers of these dregs are Mexico, Vietnam, and South Korea. Often, dregs are sold to farmers for use in animal feed.

Meanwhile, the top export for Pennsylvania, Indiana, and Illinois is medicine, while North Carolina has vaccines and antibodies as a top export. In 2020, the U.S. exported over $46 billion in goods critical to combating COVID-19, the second-highest after China ($105 billion).

As the largest exporter of oil in America, Texas produces over 5 million barrels of oil each day, or 1.7 billion annually. Mississippi’s top export was also petroleum, while light oil was the top export in Minnesota and North Dakota. Overall, oil makes up roughly 10% of U.S. exports annually.

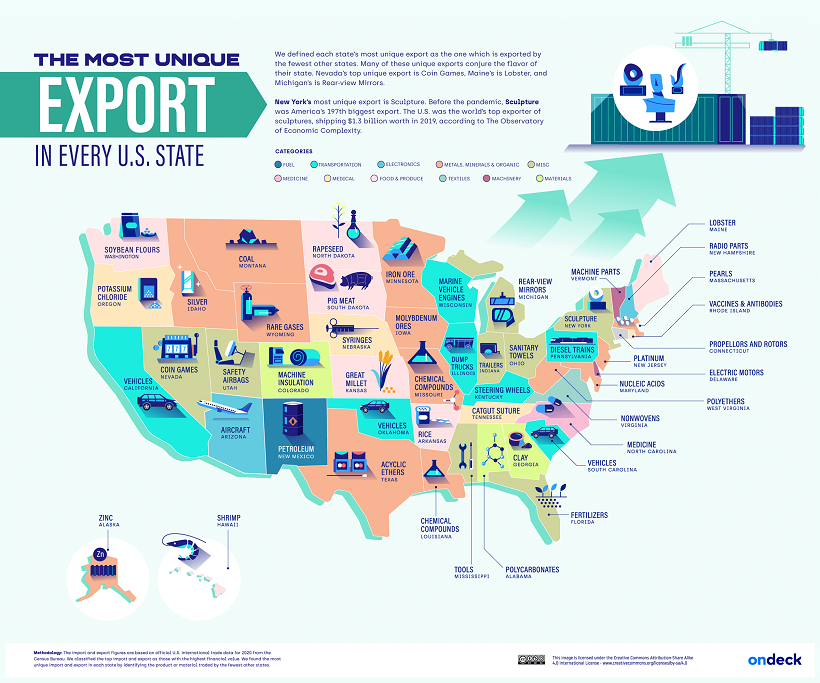

The Most Unique Exports, by State

While oil, medicine, and aircraft are the usual suspects for America’s top exports, here are the most idiosyncratic exports for each state. These are defined as those which are exported by the smallest number of other states.

Arkansas is the top exporter of rice in America, with the industry valued at $722 million. The rice industry in Arkansas began to grow substantially in the early 1900s, and expanded even more rapidly during World War I & II.

New York, on the other hand, exports more sculptures than any other state thanks to being the epicenter of the art world. The U.S. exported over $12 billion in art and antiques in 2019.

Lobster is the most unique export in Maine, known for its characteristically large claws. The north coast of Maine offers cool waters which lend themselves to more tender and sweeter lobster fare.

Finally, Massachusetts exports quahog pearls, known for their uneven texture and mosaic pattern, found across Cape Cod.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Markets

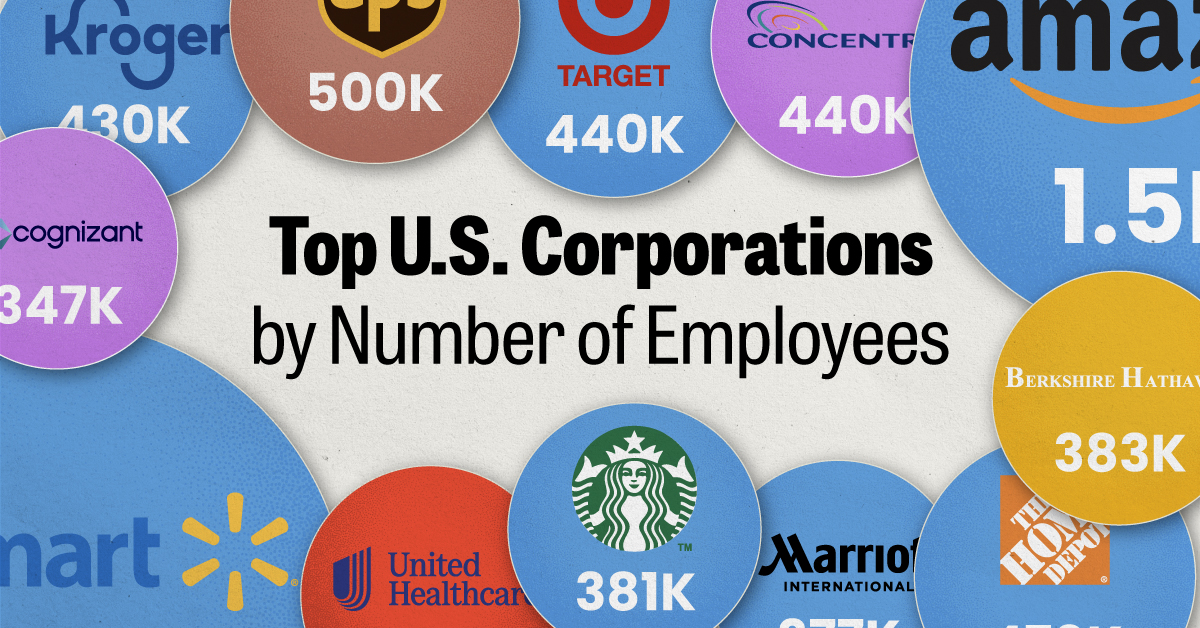

Ranked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

The Largest U.S. Corporations by Number of Employees

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

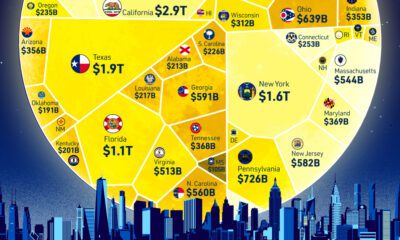

Revenue and profit are common measures for measuring the size of a business, but what about employee headcount?

To see how big companies have become from a human perspective, we’ve visualized the top U.S. companies by employees. These figures come from companiesmarketcap.com, and were accessed in March 2024. Note that this ranking includes publicly-traded companies only.

Data and Highlights

The data we used to create this list of largest U.S. corporations by number of employees can be found in the table below.

| Company | Sector | Number of Employees |

|---|---|---|

| Walmart | Consumer Staples | 2,100,000 |

| Amazon | Consumer Discretionary | 1,500,000 |

| UPS | Industrials | 500,000 |

| Home Depot | Consumer Discretionary | 470,000 |

| Concentrix | Information Technology | 440,000 |

| Target | Consumer Staples | 440,000 |

| Kroger | Consumer Staples | 430,000 |

| UnitedHealth | Health Care | 400,000 |

| Berkshire Hathaway | Financials | 383,000 |

| Starbucks | Consumer Discretionary | 381,000 |

| Marriott International | Consumer Discretionary | 377,000 |

| Cognizant | Information Technology | 346,600 |

Retail and Logistics Top the List

Companies like Walmart, Target, and Kroger have a massive headcount due to having many locations spread across the country, which require everything from cashiers to IT professionals.

Moving goods around the world is also highly labor intensive, explaining why UPS has half a million employees globally.

Below the Radar?

Two companies that rank among the largest U.S. corporations by employees which may be less familiar to the public include Concentrix and Cognizant. Both of these companies are B2B brands, meaning they primarily work with other companies rather than consumers. This contrasts with brands like Amazon or Home Depot, which are much more visible among average consumers.

A Note on Berkshire Hathaway

Warren Buffett’s company doesn’t directly employ 383,000 people. This headcount actually includes the employees of the firm’s many subsidiaries, such as GEICO (insurance), Dairy Queen (retail), and Duracell (batteries).

If you’re curious to see how Buffett’s empire has grown over the years, check out this animated graphic that visualizes the growth of Berkshire Hathaway’s portfolio from 1994 to 2022.

-

Markets1 week ago

Markets1 week agoRanked: The Largest U.S. Corporations by Number of Employees

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?