Money

Here’s How Reserve Currencies Have Evolved Over 120 Years

Here’s How Reserve Currencies Have Evolved Over 120 Years

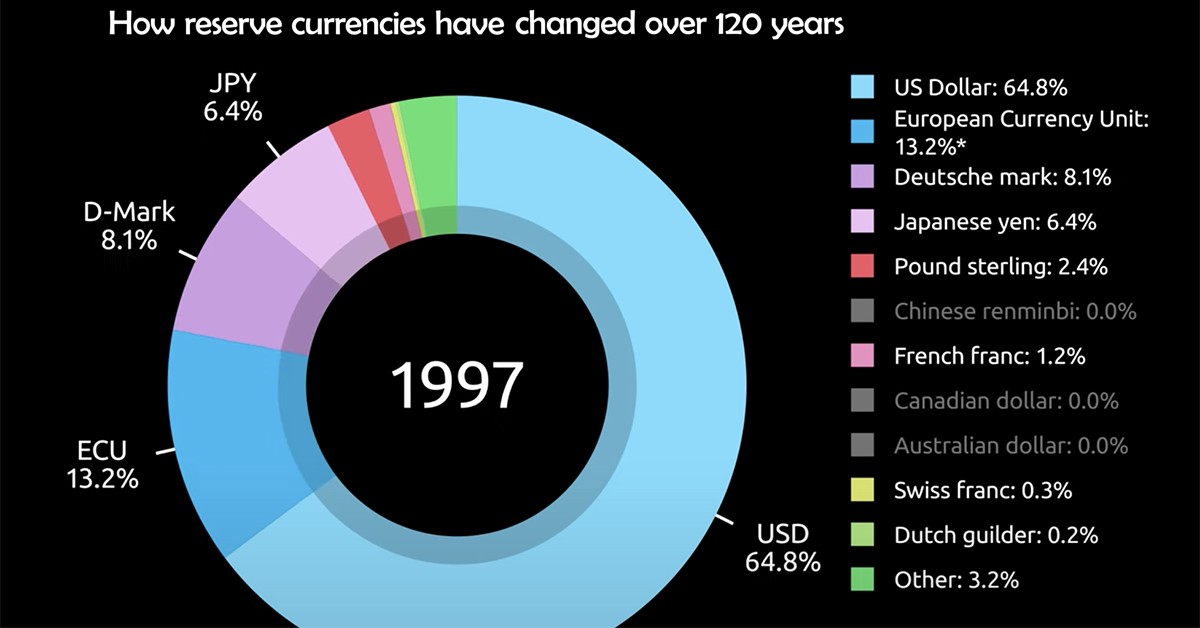

Over the last 120 years, the popularity of different reserve currencies have ebbed and flowed, reflecting the shifting fortunes of leading global economies.

For example, in the year 1900, the U.S. dollar and pound sterling made up 0% and 62% of global reserves respectively. But fast forward to 2020, and the pound now represents just 4.7% of global currency reserves, while the U.S. dollar stands at nearly 60%.

Today’s motion graphic from James Eagle looks at the year-over-year change in currency reserves as a portion of total reserves, spread across 120 years.

| Currency | 1900 | 1920 | 1940 | 1960 | 1980 | 2000 | 2020 |

|---|---|---|---|---|---|---|---|

| U.S. Dollar | 0.0% | 28.4% | 27.9% | 61.7% | 57.9% | 71.2% | 59.0% |

| Euro | 0.0% | 0.0% | 0.0% | 0.0% | 17.5% | 18.5% | 21.2% |

| Deutsche mark | 14.7% | 4.2% | 0.0% | 0.0% | 12.9% | 0.0% | 0.0% |

| Japanese yen | 0.0% | 0.0% | 0.0% | 0.0% | 3.9% | 5.8% | 6.0% |

| Pound sterling | 62.0% | 57.3% | 68.9% | 35.1% | 2.4% | 2.7% | 4.7% |

| Chinese renminbi | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.3% |

| French franc | 17.5% | 6.2% | 2.1% | 1.3% | 1.0% | 0.0% | 0.0% |

| Canadian dollar | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.1% |

| Australian dollar | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 1.8% |

| Swiss franc | 0.0% | 0.0% | 0.8% | 0.3% | 2.2% | 0.3% | 0.2% |

| Dutch guilder | 0.0% | 3.9% | 0.3% | 0.1% | 0.9% | 0.0% | 0.0% |

| Other | 5.7% | 0.0% | 0.0% | 1.6% | 1.3% | 1.5% | 2.7% |

What is a Reserve Currency?

A reserve currency is a large quantity of currency held in “reserve” by monetary authorities like central banks.

Currencies are often held in reserve in preparation for investments and transactions, among other things. Our vast global trade system, which is approaching $20 trillion in value, means plenty of currencies are always needed in reserve. In fact, an estimated $5 trillion in currency swaps hands every single day.

Here are some reasons that currency reserves are held:

- Exchange rate stability for the domestic currency

- To ensures liquidity in times of crisis

- To diversify central bank portfolios, which can reduce risk and improve credit ratings

- More than 65 countries peg their currencies to the U.S. dollar

- Five U.S. territories and a number of sovereign countries, such as Ecuador and Panama, use it as an official currency of exchange

- Around 90% of all Forex trading involves the U.S. dollar

All things equal, countries benefit economically from greater demand for their respective currencies.

The Rise and Fall of Reserve Currencies

Some economists argue that the demand for currencies in the long run revolves around the economic relevance of a country. In general, the larger and more powerful a nation’s economy is, the greater the network effect, and the more interlinked they are to the global economy. Thus, the greater demand there is to hold their currency in reserve.

The last 120 years of currency reserve data shows some support for this claim. For example, Japan’s economy hit a peak in terms of its relative share of global GDP in the early 1990s, just before the effects of the Lost Decade were felt. Subsequently, their peak as a reserve currency was around the same horizon, at 9.4% in 1990.

America’s Era of Dominance

Due to the economic strength of the United States in the post-WWII era, the dollar is what economists call a vehicle currency.

This means many non-dollar economies still choose to engage in international transactions using the dollar. These smaller and less accepted currencies are often converted to U.S. dollars before proceeding with any business or trade dealings. This is why, although Asian economies tend to have neighboring states as their top trade partners, they still engage in a massive portion of these transactions with the U.S. greenback as the currency of choice.

Here are some facts that further exemplify the strength and power of the U.S. dollar:

Additionally, the dollar is often seen as a haven in times of extreme uncertainty and tumult. Given its status as the world’s reserve currency, it can be perceived as less risky and can withstand economic shock to a greater degree relative to other currencies.

New Challengers to the Dollar

In the not too distant past, the U.S. displaced the UK economically and as the world’s reserve currency. Today, the U.S. economy is showing signs of slowing down, based on GDP growth.

China is on the rise, having already displaced the U.S. as the EU’s top trade partner. With projections for China to overtake the U.S. as the world’s largest economy before 2030 in nominal terms, could a new global reserve currency emerge?

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Demographics

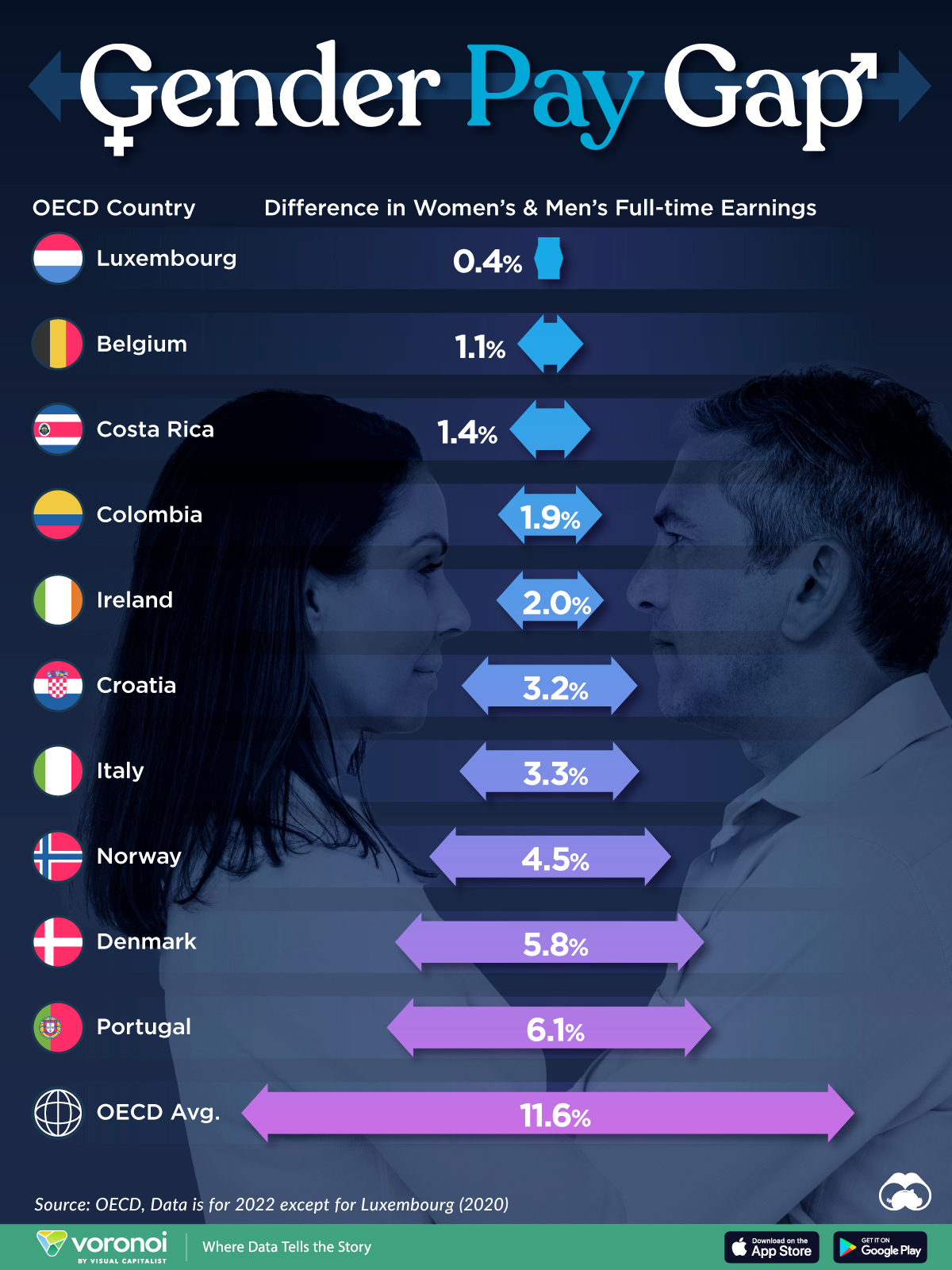

The Smallest Gender Wage Gaps in OECD Countries

Which OECD countries have the smallest gender wage gaps? We look at the 10 countries with gaps lower than the average.

The Smallest Gender Pay Gaps in OECD Countries

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Among the 38 member countries in the Organization for Economic Cooperation and Development (OECD), several have made significant strides in addressing income inequality between men and women.

In this graphic we’ve ranked the OECD countries with the 10 smallest gender pay gaps, using the latest data from the OECD for 2022.

The gender pay gap is calculated as the difference between median full-time earnings for men and women divided by the median full-time earnings of men.

Which Countries Have the Smallest Gender Pay Gaps?

Luxembourg’s gender pay gap is the lowest among OECD members at only 0.4%—well below the OECD average of 11.6%.

| Rank | Country | Percentage Difference in Men's & Women's Full-time Earnings |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | 0.4% |

| 2 | 🇧🇪 Belgium | 1.1% |

| 3 | 🇨🇷 Costa Rica | 1.4% |

| 4 | 🇨🇴 Colombia | 1.9% |

| 5 | 🇮🇪 Ireland | 2.0% |

| 6 | 🇭🇷 Croatia | 3.2% |

| 7 | 🇮🇹 Italy | 3.3% |

| 8 | 🇳🇴 Norway | 4.5% |

| 9 | 🇩🇰 Denmark | 5.8% |

| 10 | 🇵🇹 Portugal | 6.1% |

| OECD Average | 11.6% |

Notably, eight of the top 10 countries with the smallest gender pay gaps are located in Europe, as labor equality laws designed to target gender differences have begun to pay off.

The two other countries that made the list were Costa Rica (1.4%) and Colombia (1.9%), which came in third and fourth place, respectively.

How Did Luxembourg (Nearly) Eliminate its Gender Wage Gap?

Luxembourg’s virtually-non-existent gender wage gap in 2020 can be traced back to its diligent efforts to prioritize equal pay. Since 2016, firms that have not complied with the Labor Code’s equal pay laws have been subjected to penalizing fines ranging from €251 to €25,000.

Higher female education rates also contribute to the diminishing pay gap, with Luxembourg tied for first in the educational attainment rankings of the World Economic Forum’s Global Gender Gap Index Report for 2023.

See More Graphics about Demographics and Money

While these 10 countries are well below the OECD’s average gender pay gap of 11.6%, many OECD member countries including the U.S. are significantly above the average. To see the full list of the top 10 OECD countries with the largest gender pay gaps, check out this visualization.

-

Business2 weeks ago

Business2 weeks agoAmerica’s Top Companies by Revenue (1994 vs. 2023)

-

Environment1 week ago

Environment1 week agoRanked: Top Countries by Total Forest Loss Since 2001

-

Markets1 week ago

Markets1 week agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population

-

Misc2 weeks ago

Misc2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.