Markets

How China Became Saudi Arabia’s Largest Trading Partner

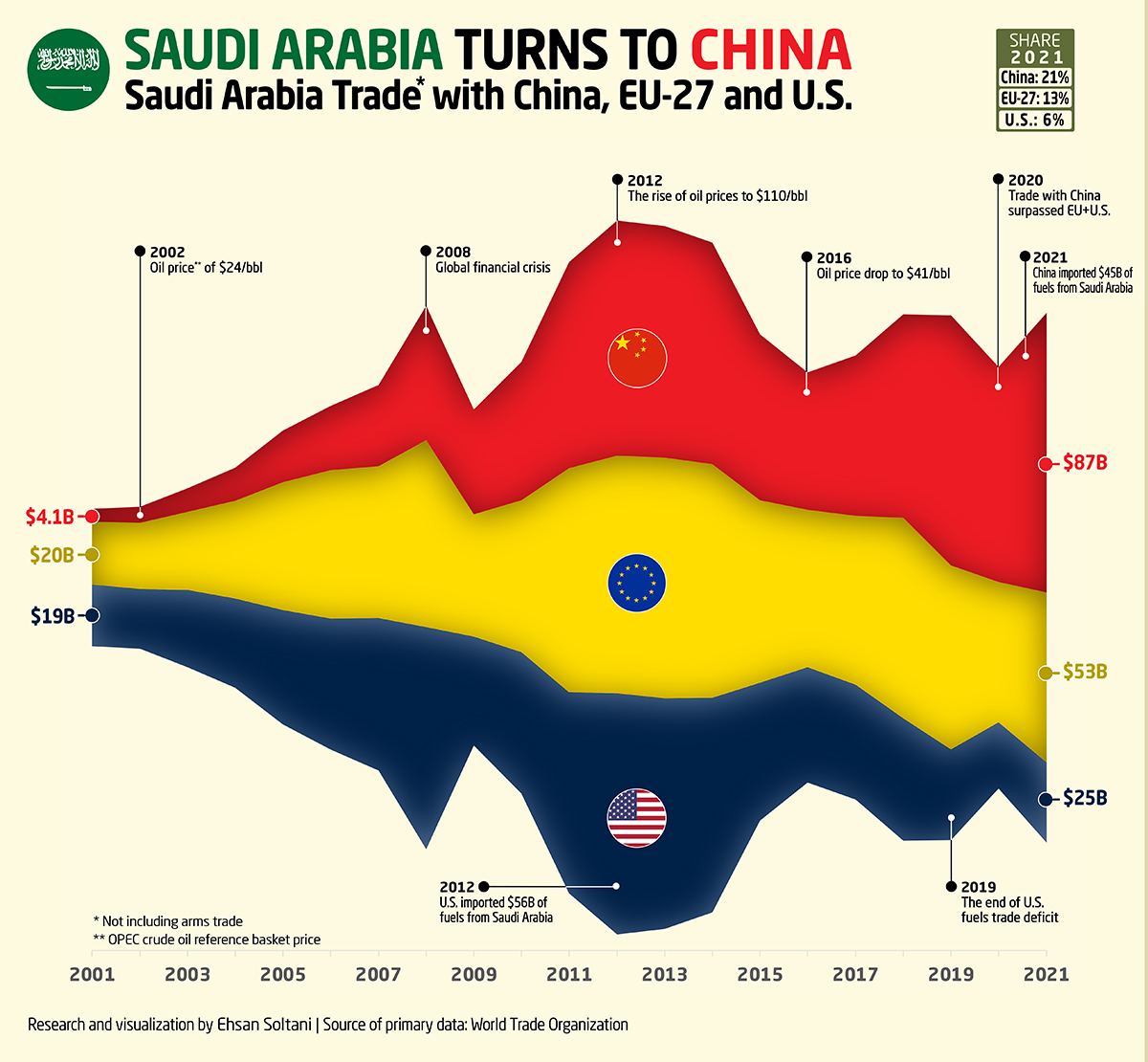

Saudi Arabia’s Trade With China Surpasses the West

Over the past two decades, the economic presence of China has been growing significantly around the world.

The country has already surpassed the U.S. as the largest trading partner of developed nations such as Japan and the European Union.

But the world’s second largest economy is making significant inroads in the Middle East as well. This graphic by Ehsan Soltani uses data from the World Trade Organization (WTO) to chart Saudi Arabia’s trading history with the EU, the U.S, and China.

Evolving Trade Relations

With China’s imports from and exports to Saudi Arabia now exceeding the major oil-producing country’s combined trade with the U.S. and the EU, China has become Saudi Arabia’s dominant trading partner.

| Saudi Arabia Net Trade by Year | With China ($B) | With U.S. ($B) | With EU-27 ($B) |

|---|---|---|---|

| 2021 | $87.3B | $25.1B | $53.1B |

| 2020 | $67.2B | $20.6B | $43.8B |

| 2019 | $78.1B | $28.3B | $57.4B |

| 2018 | $63.5B | $38.2B | $62.7B |

| 2017 | $50.1B | $36.0B | $52.6B |

| 2016 | $42.9B | $36.0B | $49.1B |

| 2015 | $51.8B | $43.2B | $56.9B |

| 2014 | $69.1B | $67.1B | $73.0B |

| 2013 | $72.2B | $72.1B | $75.2B |

| 2012 | $73.3B | $75.3B | $74.3B |

| 2011 | $64.3B | $62.7B | $70.0B |

| 2010 | $43.2B | $44.1B | $47.4B |

| 2009 | $32.6B | $34.0B | $38.2B |

| 2008 | $41.8B | $69.5B | $58.4B |

| 2007 | $25.4B | $47.6B | $47.3B |

| 2006 | $20.1B | $40.9B | $46.2B |

| 2005 | $16.1B | $35.7B | $39.9B |

| 2004 | $10.3B | $27.8B | $30.5B |

| 2003 | $7.3B | $24.1B | $24.4B |

| 2002 | $5.1B | $18.7B | $20.5B |

| 2001 | $4.1B | $19.2B | $19.6B |

Back in 2001, Saudi Arabia’s trade with China was a mere fraction—just one-tenth—of its combined trade with the EU and United States. While the total value of trade was modest at this time, it’s been increasing consistently almost every year since.

By the year 2011, China had surpassed the U.S. for the first time in bilateral trade value with Saudi Arabia. Then by 2018, trade between China and Saudi Arabia surpassed the Middle-Eastern country’s trade with the entire EU.

Fast forward to today, and China has emerged as a larger trading partner with Saudi Arabia than the rest of the West combined.

The Perfect Match?

China’s status as Saudi Arabia’s biggest trading partner makes sense considering its recent economic growth and focus.

China is the largest buyer of crude oil in the world, and it buys more from the Saudi Arabia than anywhere else. Almost half of the $87.3 billion bilateral trade between the two nations in 2021 was comprised of China’s crude oil imports. This accounted for 77% of China’s total imports from Saudi Arabia, which also included goods like plastic—a petroleum product.

Saudi Arabia, meanwhile, imported over $30 billion worth of goods including technological equipment, telephones, and light fixtures.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Markets1 week ago

Markets1 week agoRanked: The Largest U.S. Corporations by Number of Employees

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?