Technology

Visualizing Financials of the World’s Biggest Companies: From IPO to Today

In today’s fast-paced world, companies need to adapt if they want to stay relevant. Even the Big Tech giants can’t get too comfortable—to remain competitive, large corporations like Google and Amazon are constantly innovating and evolving.

This series of graphics by Truman Du illustrates the income statements of five of the world’s biggest companies—Amazon, Apple, Microsoft, Tesla, and Alphabet—and shows how their financials have evolved since the date of their very first public disclosures.

Editor’s note: Click on any graphic to see a full-width version that is higher resolution. Also, because these companies are in some cases 10,000x the size they were at IPO date, the two visual financial statements are not meant to be directly comparable in sizing.

Visual Income Statements: From IPO to Today

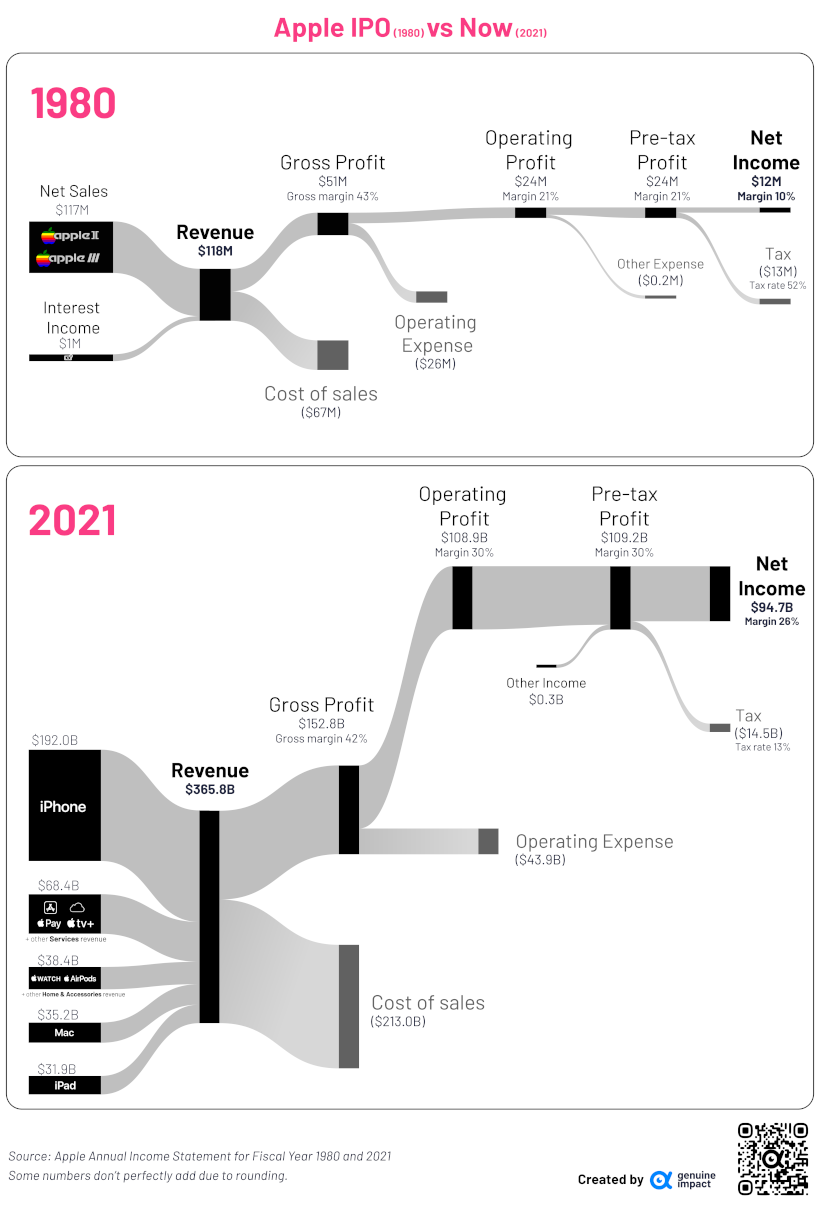

Let’s start with Apple, the first company to go public, and the biggest in the mix:

1. Apple

View the full-size infographic

Back in 1998, Apple went by the name “Apple Computer,” because at the time, the company only sold computers and computer hardware kits. However, over the next decade, the company expanded its product offerings and started to sell various consumer tech products like phones, portable music players, and even tablets.

Apple’s consumer tech was so successful, that by 2007 the company decided to drop “Computer” from its name. Fast forward to today, and the company also generates revenue through services like Apple TV and Apple Pay.

While computers are still a core part of its business, the iPhone has become the biggest revenue driver for the company.

In 2021, Apple generated $94.7 billion in profit at a 26% margin. Today, the company is one of the only Big Tech companies that has been able to withstand the industrywide drop in valuations. Sitting strong with a market capitalization over $2 trillion, the company is worth roughly the same as Amazon, Alphabet, and Meta combined.

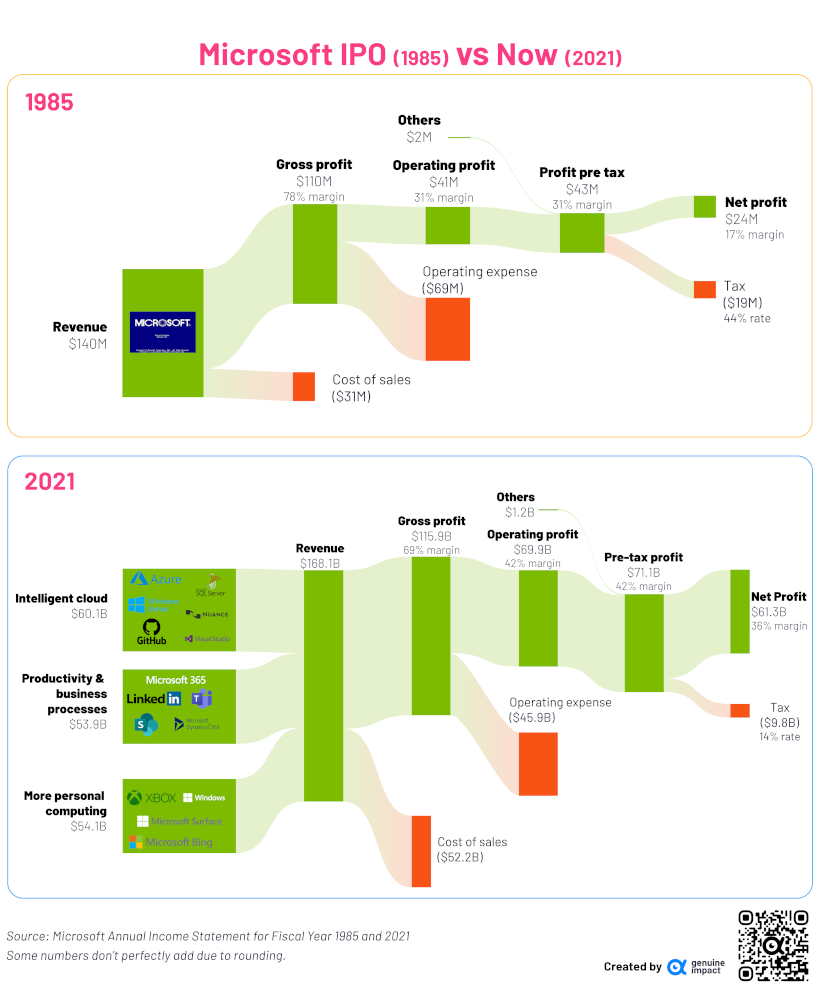

2. Microsoft

View the full-size infographic

Microsoft, one of the oldest companies on this list, went public in 1985. Back then, the company only sold microprocessors and software—hence the name Micro-Soft.

And while Microsoft’s flagship operating system (Windows) is still one of its major revenue drivers, the company’s product offerings have become much more diverse.

Now, its revenue streams are split fairly evenly between its cloud service (Azure), productivity tools (Office), and personal computing (Xbox and Windows OS).

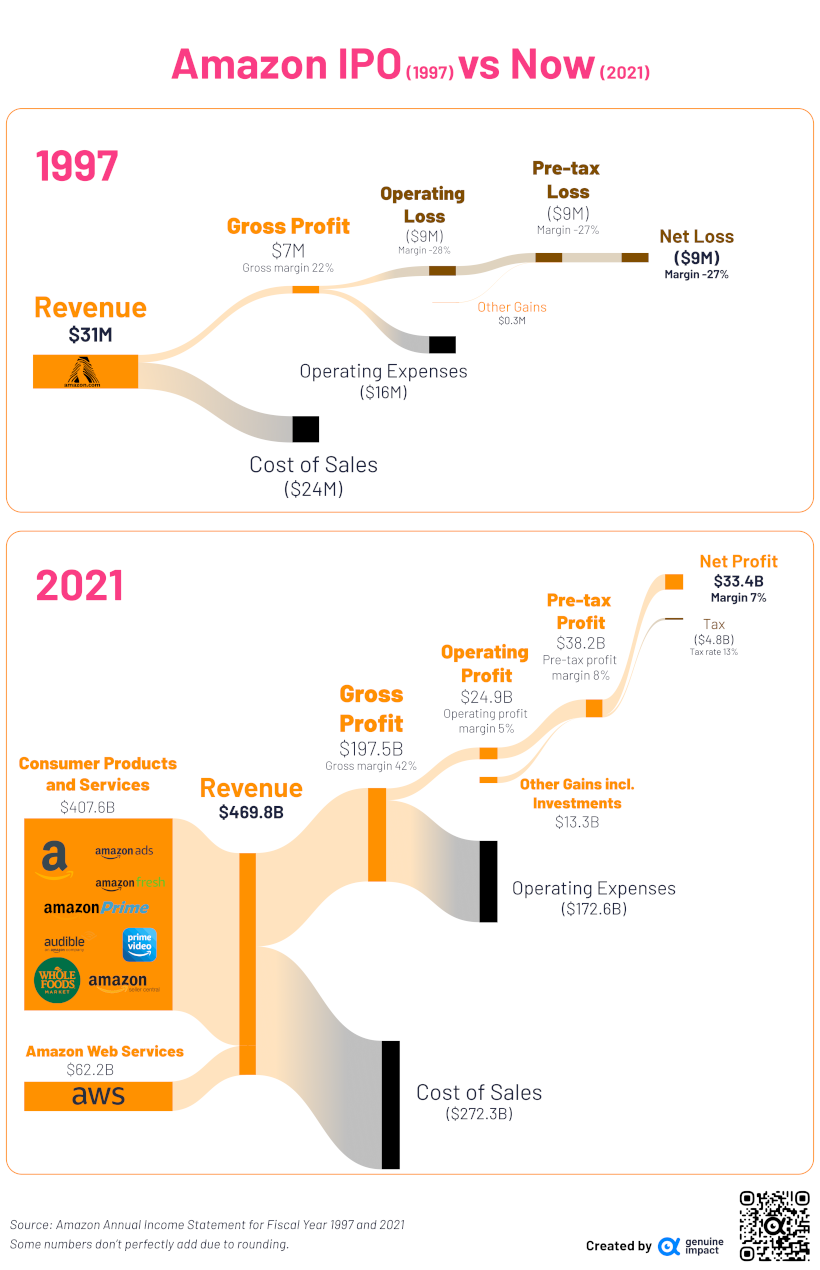

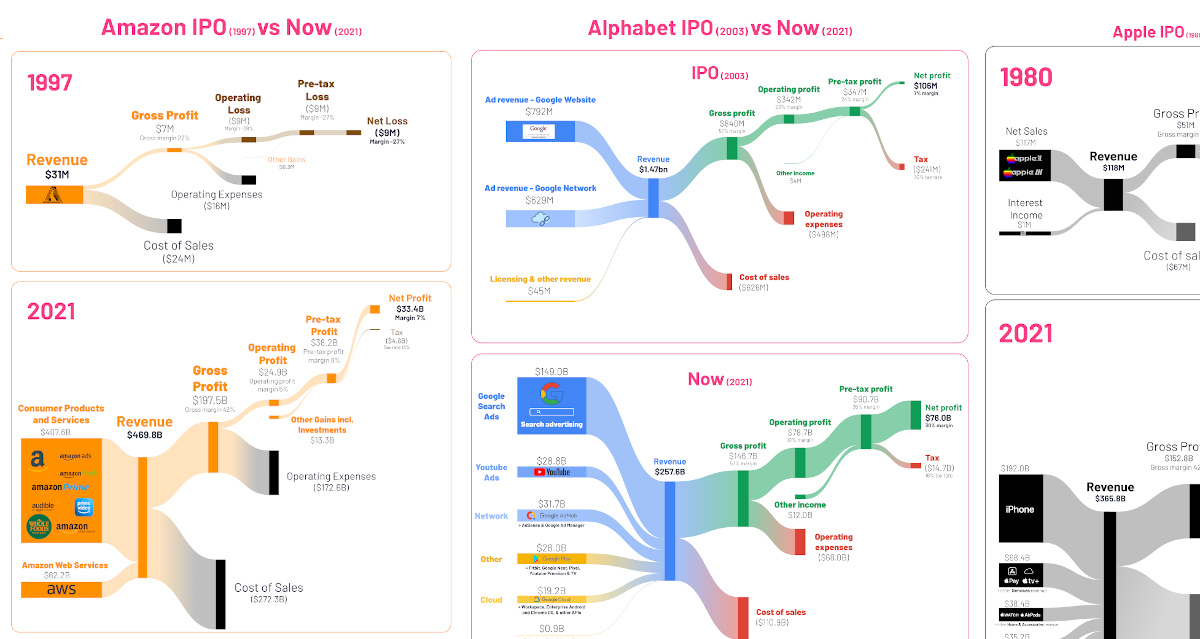

3. Amazon

View the full-size infographic

When Amazon went public in 1997, the online retailer was only selling books.

But by 1998, Amazon started rapidly expanding its product offering. Soon it was selling everything from CDs and toys to electronics, and even tools.

Fast forward to now, and the ecommerce segment of Amazon has become just a portion of the company’s overall business.

Amazon is also a cloud-service provider (AWS), supermarket chain (with its grocery brands Amazon Fresh and its acquisition of Whole Foods) and even a video streaming service (Prime Video). In particular, AWS stands out as an important part of Amazon’s overall business, driving a whopping 74% of operating profits.

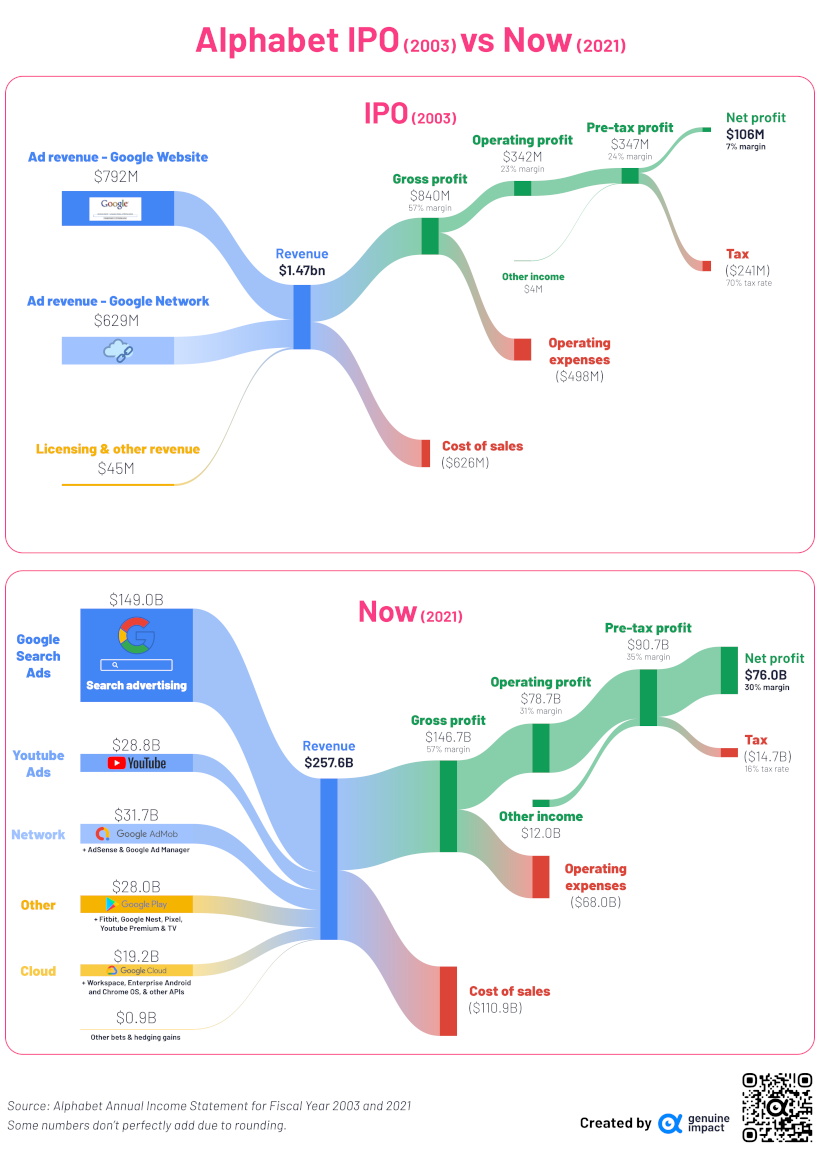

4. Alphabet

View the full-size infographic

When Google went public in 2003, it was a simple search engine that generated about $1.4 billion in ad revenue from its website and cloud network.

Today, the company (now renamed Alphabet) has become synonymous with the internet, and accounts for an overwhelming majority of the internet’s search traffic. Because of this, it generates hundreds of billions in ad revenue each year.

The company also owns YouTube, and has branched out into different verticals as well like consumer tech (Fitbit), and premium streaming (YouTube Premium &TV).

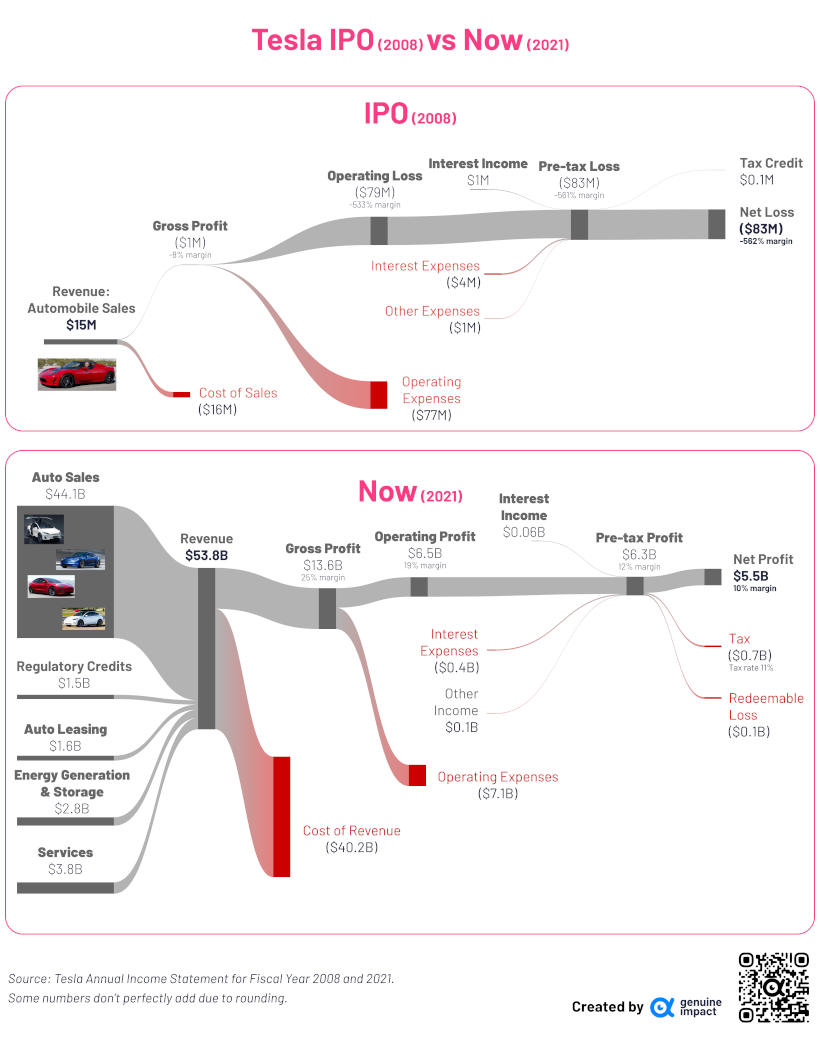

5. Tesla

View the full-size infographic

Tesla’s IPO was in 2008, making it the youngest company on the list. And as the newest kid on the block, Tesla’s revenue streams haven’t changed as drastically as the others have.

However, while electric vehicles are still the company’s main revenue driver, Tesla has managed to dip its toes into other verticals over the last 10 years. For instance, in 2021, about $2.8 billion of its $53.8 billion in revenue came from energy generation and storage.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue