Technology

Which Countries are Granted the Most New Patents?

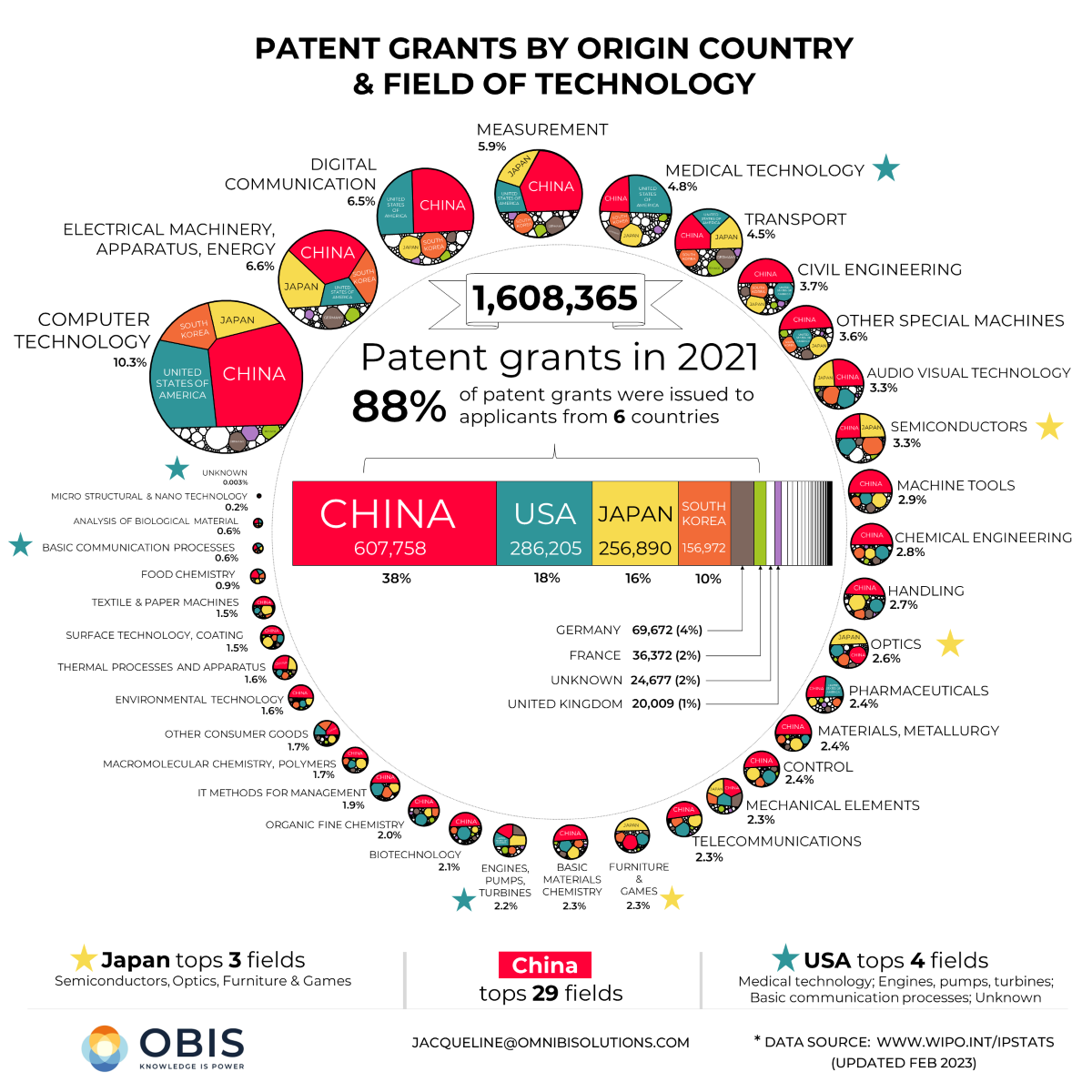

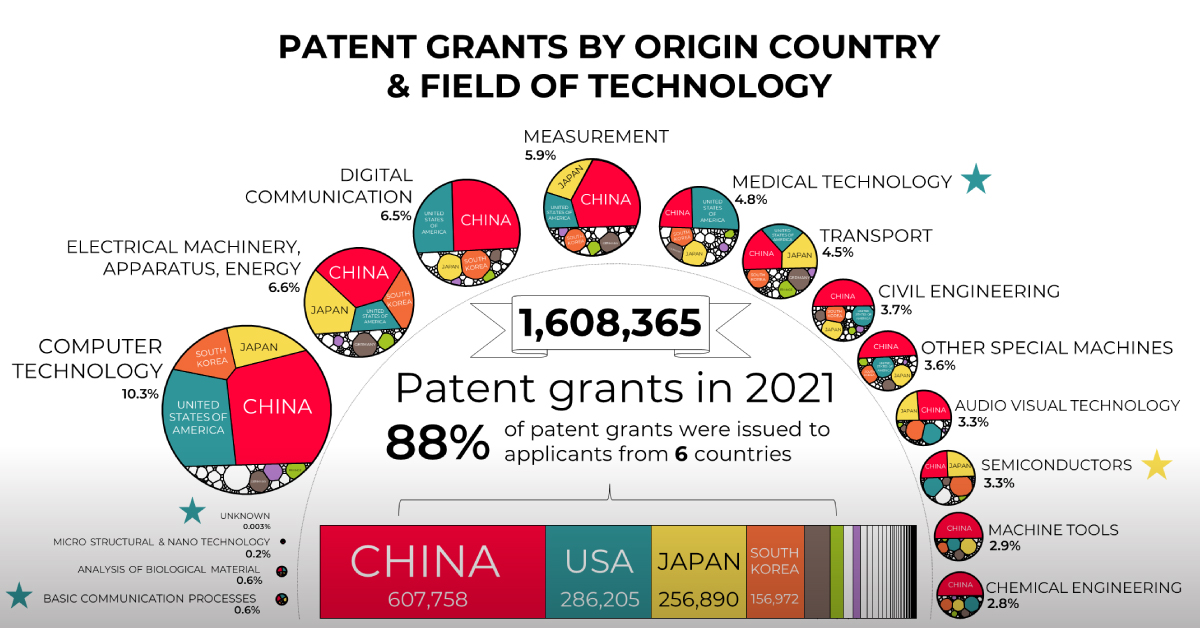

Click to view this graphic in a higher-resolution.

Which Countries are Granted the Most New Patents?

Every year, the UN’s World Intellectual Property Organization (WIPO) tracks hundreds of thousands of patents across industries.

These patents grant their inventors exclusive intellectual property rights over their creations. They encourage new ideas, spur scientific development, and lead to new technologies and entire sectors being born.

However, the number of patents granted varies greatly across nations. When viewing the origin of each patent’s applicant, we see a handful of countries dominating certain industries.

In this graphic, Jacqueline Ann DeStefano-Tangorra uses 2021 WIPO data to showcase which countries were granted the most new patents, along with their sector categorizations.

Countries with the Most New Patents

In 2021, out of 1,608,375 patents across multiple fields, 87% were granted to innovators from just six countries.

| Applicants by Country | Granted Patents (2021) | % of Total |

|---|---|---|

| 🇨🇳 China | 607,758 | 37.8% |

| 🇺🇸 United States | 286,205 | 17.8% |

| 🇯🇵 Japan | 256,890 | 16.0% |

| 🇰🇷 South Korea | 156,972 | 9.8% |

| 🇩🇪 Germany | 69,672 | 4.3% |

| 🇬🇧 United Kingdom | 20,009 | 1.2% |

| ❓ Unknown | 24,677 | 1.5% |

| 🌎 Other Countries | 186,192 | 11.6% |

| World Total | 1,608,375 | 100.0% |

After rapidly increasing its patent output in recent years, China topped the chart in 29 out of 36 total fields including computer technology, electrical machinery, and digital communication. The Chinese government’s focus on innovation led to the nation’s applicants receiving 38% of the 1.6 million patents granted in 2021.

The United States—home to the world’s largest tech companies—came in second with 286,205 granted patents by origin. The U.S. also topped four fields of its own: medical technology, engines and turbines, basic communication processes, and unknown (for inventions that can’t be assigned to a specific field).

Not far behind is Japan with 256,890 granted patents. It dominated the other nations in the fields of semiconductors, optics, and furniture and games, cementing its well-earned reputation of technological innovation.

“Unknown” origin applicants, for which the nationality or country of residence couldn’t be determined for the inventor(s), accounted for 24,677 of granted patents.

The Origin of New Patents by Field

When assessing which technological fields inventors are pursuing in 2021, it’s not unexpected that digital and electrical technologies are in the lead:

| Rank | Main Field of Technology | % of Granted Patents |

|---|---|---|

| 1 | Computer technology | 10.3% |

| 2 | Electrical machinery, apparatus, energy | 6.6% |

| 3 | Digital communication | 6.5% |

| 4 | Measurement | 5.9% |

| 5 | Medical technology | 4.8% |

| 6 | Transport | 4.5% |

| 7 | Civil engineering | 3.7% |

| 8 | Other special machines | 3.6% |

| 9 | Audio visual technology | 3.3% |

| 10 | Semiconductors | 3.3% |

| 11 | Machine tools | 2.9% |

| 12 | Chemical engineering | 2.8% |

| 13 | Handling | 2.7% |

| 14 | Optics | 2.6% |

| 15 | Pharmaceuticals | 2.4% |

| 16 | Materials, metallurgy | 2.4% |

| 17 | Control | 2.4% |

| 18 | Mechanical elements | 2.3% |

| 19 | Telecommunications | 2.3% |

| 20 | Furniture & games | 2.3% |

| 21 | Basic materials chemistry | 2.3% |

| 22 | Engines, pumps, turbines | 2.2% |

| 23 | Biotechnology | 2.1% |

| 24 | Organic fine chemistry | 2.0% |

| 25 | IT methods for management | 1.9% |

| 26 | Macromolecular chemistry, polymers | 1.7% |

| 27 | Other consumer goods | 1.7% |

| 28 | Environmental technology | 1.6% |

| 29 | Thermal Processes and apparatus | 1.6% |

| 30 | Surface technology, coating | 1.5% |

| 31 | Textile & paper machines | 1.5% |

| 32 | Food chemistry | 0.9% |

| 33 | Basic communication processes | 0.6% |

| 34 | Analysis of biological material | 0.6% |

| 35 | Micro structural & nano technology | 0.2% |

| 36 | Unknown | 0.003% |

There are also many patents granted mainly in infrastructure-related fields, which have become all the more important following the COVID-19 pandemic and an increasing focus on trade.

These include medical technology, transport, civil engineering, and semiconductors.

A Tech-Savvy Future

The number of patents granted in 2021 is a testament to the growing importance of innovation around the world.

While a select few nations have dominated the patent landscape so far, there are many others making significant contributions to innovation and intellectual property.

As technology continues to advance and the global economy becomes more interconnected, the importance of intellectual property rights will only continue to grow.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Misc2 weeks ago

Misc2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners