Markets

Charted: The Global Decline in Consumer Confidence

Charting the Global Decline in Consumer Confidence

Our plans to buy new things, travel, invest, and save money, all rely on one crucial factor—our ability to pay for it.

This ability in turn is dependent on not just our current savings, but our expected income and confidence in the economy, i.e. consumer confidence.

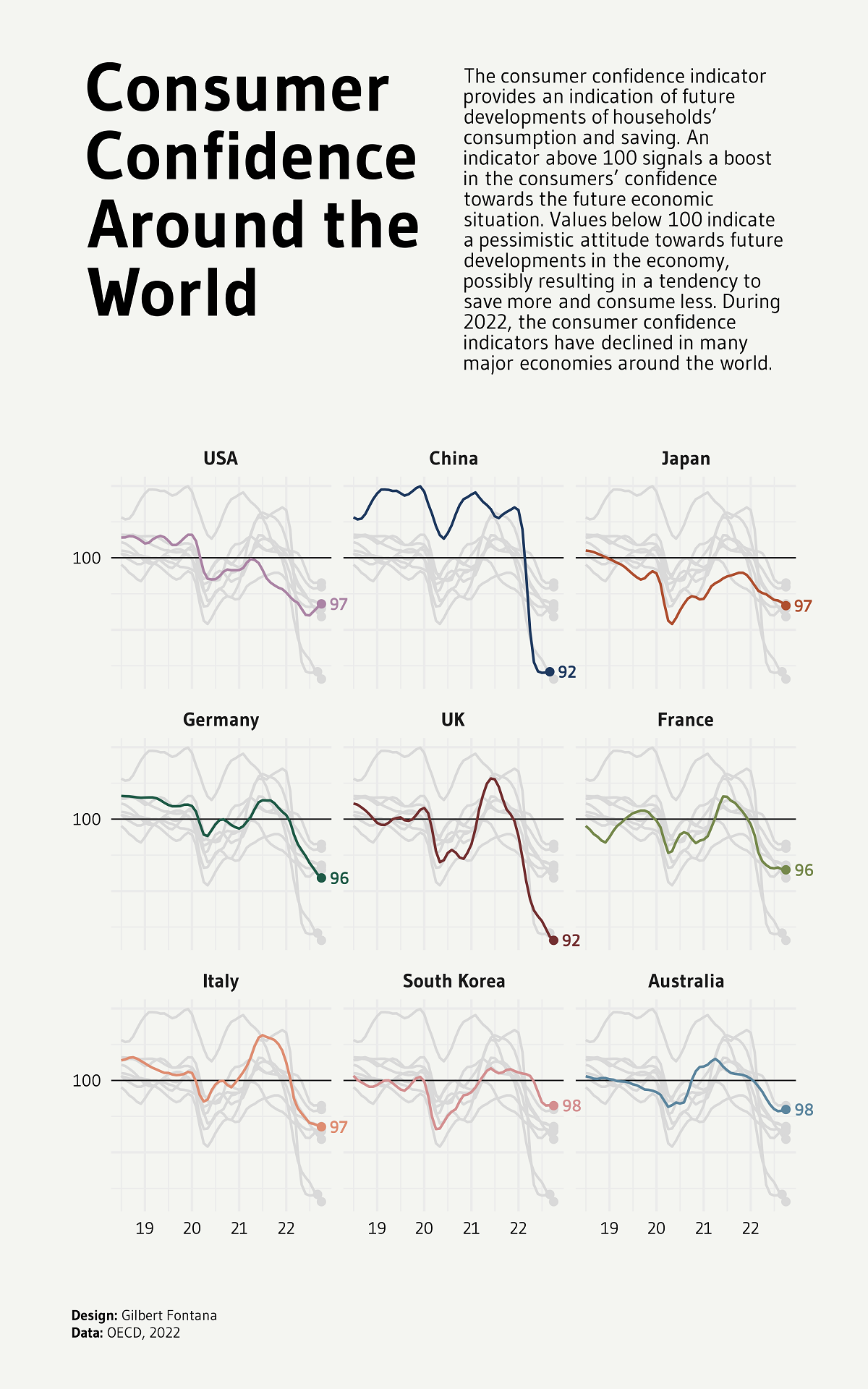

This graphic by Gilbert Fontana uses OECD data from 2019‒2022 to chart the rise and fall of consumer confidence in nine major economies.

What is Consumer Confidence?

Measured at a base value of 100, the Consumer Confidence Index takes consumers’ expectations and sentiments about their financial futures into account to indicate household consumption and saving patterns in the future.

An indicator above 100 means that there is a boost in people’s confidence towards economic prospects. This means that they are less likely to save and more inclined to spend money in the near future.

On the other hand, a value below 100 indicates that consumers are pessimistic about their economic standing in the future. This can result in them saving more and spending less.

Inflation, job losses, and expectations of a not-so-bright financial future can shake this confidence, making consumers think twice about their consumption.

Global Consumers are Becoming Pessimistic

After falling down and quickly recovering during the COVID-19 pandemic in 2020, consumer confidence seems to be trending downwards across the globe.

| Country | Consumer Confidence (Oct 2021) | Consumer Confidence (Oct 2022) |

|---|---|---|

| 🇫🇷 France | 100.8 | 96.5 |

| 🇩🇪 Germany | 101.1 | 95.9 |

| 🇮🇹 Italy | 102.8 | 96.8 |

| 🇯🇵 Japan | 99.0 | 96.7 |

| 🇬🇧 UK | 100.7 | 91.6 |

| 🇺🇸 U.S. | 98.1 | 96.8 |

| 🇨🇳 China | 103.2 | 92.1* (Sept 2022) |

| 🇦🇺 Australia | 100.4 | 98.0 |

| 🇰🇷 South Korea | 100.7 | 98.3 |

The UK was hit the worst as its Consumer Confidence Index (CCI) dropped down to 92 in 2022, from 100.6 in 2021. Just behind is China, which also fell to 92 in 2022 despite sitting at 103 two years prior.

The remaining countries had CCIs between 96‒98, including France, Germany, and the U.S.

Even with the most optimistic populations and a CCI of 98, South Korea and Australia, were below the ideal 100 mark and indicated pessimism.

The main culprits of this declining confidence in global economic markets including expectations of rising inflation—especially for food and gas—as well as high interest rates, the threats of a looming recession, and layoffs in major sectors.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023