Technology

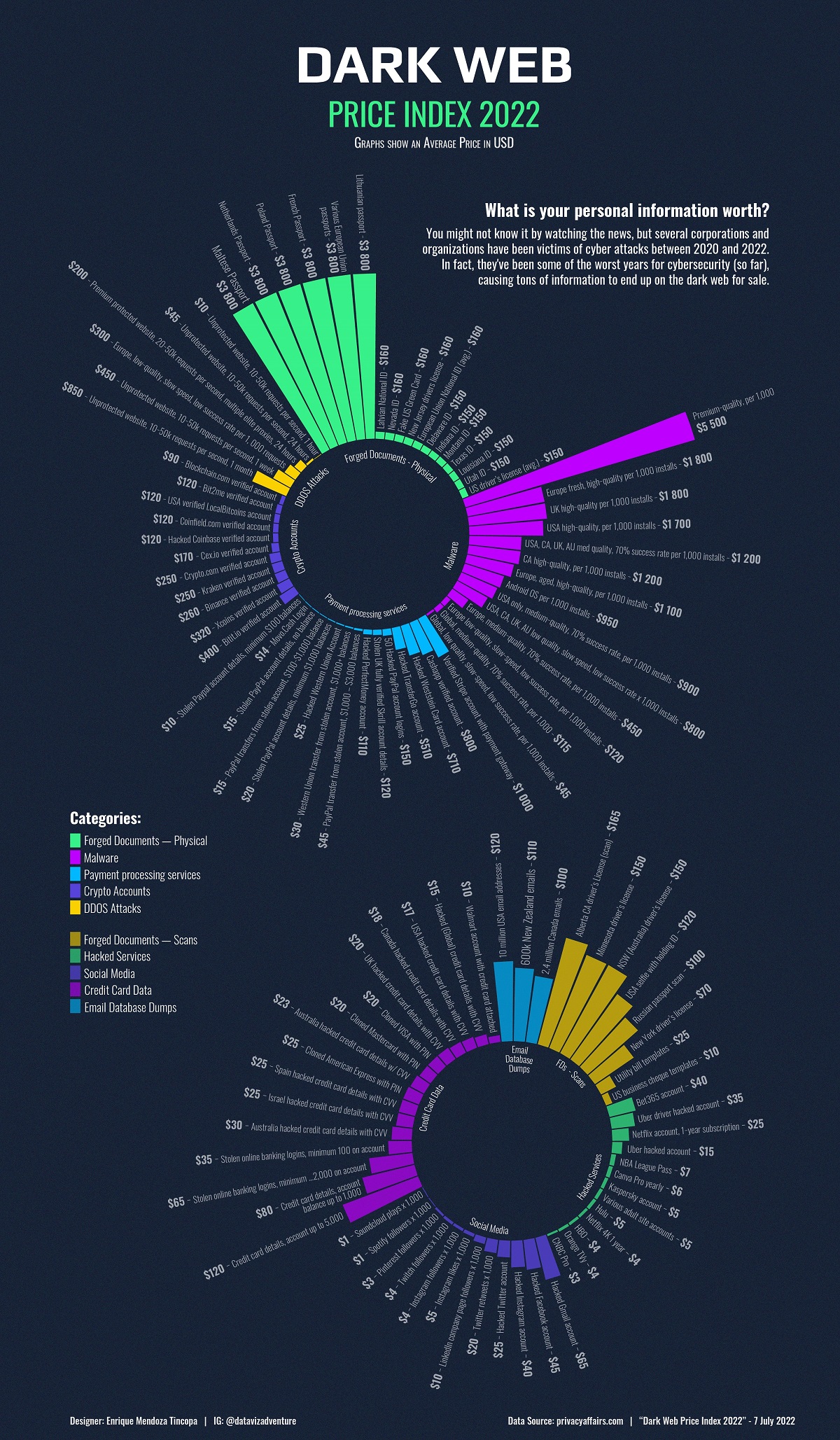

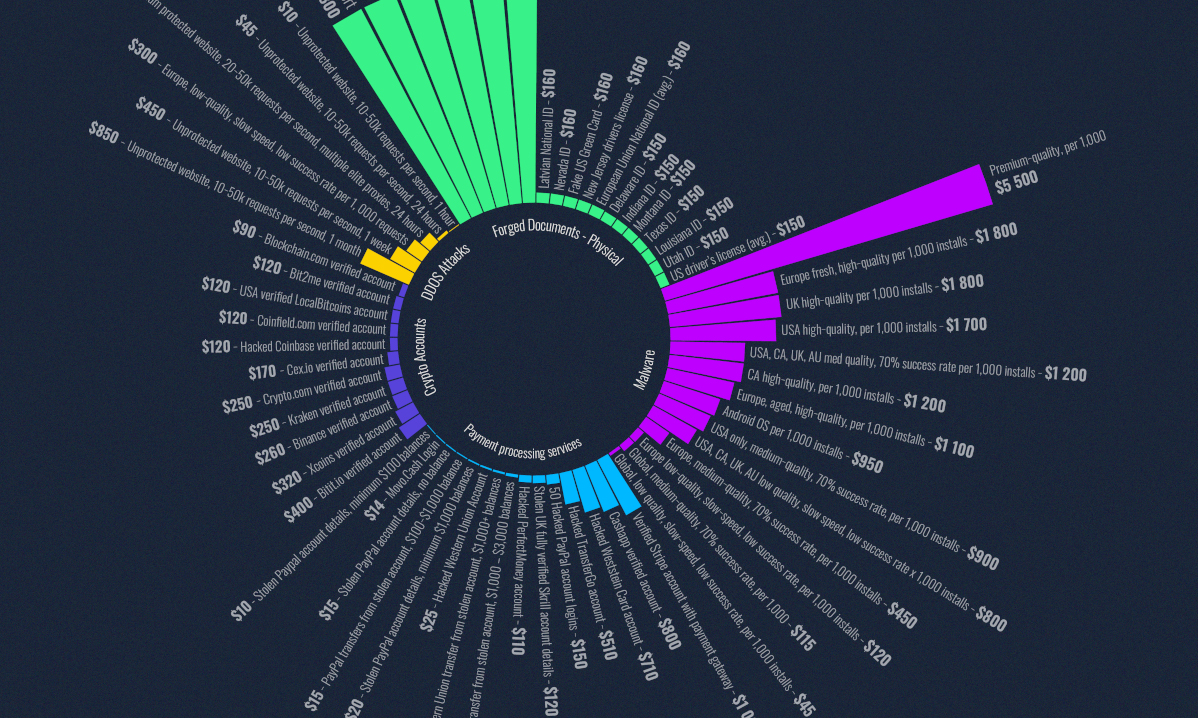

Charted: The Dark Web Price Index 2022

Click to view a larger version of the graphic.

The Dark Web Price Index 2022

Did you know that the internet you’re familiar with is only 10% of the total data that makes up the World Wide Web?

The rest of the web is hidden from plain sight, and requires special access to view. It’s known as the Deep Web, and nestled far down in the depths of it is a dark, sometimes dangerous place, known as the darknet, or Dark Web.

This graphic by Enrique Mendoza provides us a glimpse at this shrouded part of the internet, showing us some of the common items that are sold on there, and how much they typically cost.

A Brief Introduction to the Dark Web

Before diving in, it’s worth quickly explaining what the Dark Web is, and how people typically gain access to it.

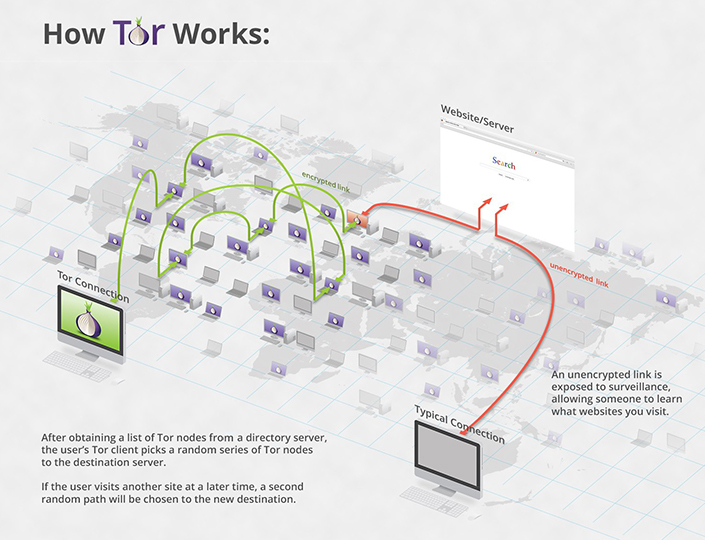

Unlike the ordinary web (which is also known as the Surface Web), the Dark Web cannot be accessed through a regular browser such as Chrome or Safari. Rather, users need to access it anonymously via a Tor browser.

Tor, which is short for “The Onion Router,” is a special portal that connects users to Dark Web websites in a complicated way that ultimately protects the user’s identity. This means users can access websites anonymously.

The Dark Web can be a breeding ground for illegal activity, where people can buy things like contract killings, drugs, malware, and other people’s personal information.

Product Price Breakdown

How much is your personal information worth on the Dark Web? This graphic uses data from the 2022 Dark Web Product Price Index to find that out and more.

This annual report by privacyaffairs.com provides insights into some of the most popular products that are for sale on the Dark Web, such as credit card data, forged documents, and hacked info, and lists the average price of each product.

While this list is far from exhaustive and not the only measure of Dark Web prices, the report gives us a glimpse into hidden online territory that’s extremely unfamiliar to many of us.

| Product | Product Category | Avg. Price USD (2022) |

|---|---|---|

| Credit card details, account balance up to 5,000 | Credit Card Data | $120 |

| Credit card details, account balance up to 1,000 | Credit Card Data | $80 |

| Stolen online banking logins, minimum 2,000 on account | Credit Card Data | $65 |

| Israel hacked credit card details with CVV | Credit Card Data | $25 |

| Hacked (Global) credit card details with CVV | Credit Card Data | $15 |

| Spain hacked credit card details with CVV | Credit Card Data | $25 |

| Cloned American Express with PIN | Credit Card Data | $25 |

| Canada hacked credit card details with CVV | Credit Card Data | $18 |

| Australia hacked credit card details w/ CVV | Credit Card Data | $23 |

| Cloned Mastercard with PIN | Credit Card Data | $20 |

| Cloned VISA with PIN | Credit Card Data | $20 |

| Stolen online banking logins, minimum 100 on account | Credit Card Data | $35 |

| Walmart account with credit card attached | Credit Card Data | $10 |

| USA hacked credit card details with CVV | Credit Card Data | $17 |

| UK hacked credit card details with CVV | Credit Card Data | $20 |

| PayPal transfer from stolen account, $1,000 – $3,000 balances | Payment Processing Services | $45 |

| Cashapp verified account | Payment Processing Services | $800 |

| Stolen PayPal account details, minimum $1,000 balances | Payment Processing Services | $20 |

| Stolen UK fully verified Skrill account details | Payment Processing Services | $120 |

| 50 Hacked PayPal account logins | Payment Processing Services | $150 |

| Hacked PerfectMoney account | Payment Processing Services | $110 |

| PayPal transfers from stolen account, $100-$1,000 balance | Payment Processing Services | $15 |

| Movo.Cash Login | Payment Processing Services | $14 |

| Hacked Western Union Account | Payment Processing Services | $25 |

| Stolen PayPal account details, minimum $100 balances | Payment Processing Services | $10 |

| Western Union transfer from stolen account, $1,000+ balances | Payment Processing Services | $30 |

| Stolen PayPal account details, no balance | Payment Processing Services | $15 |

| Verified Stripe account with payment gateway | Payment Processing Services | $1,000 |

| Hacked Weststein Card account | Payment Processing Services | $710 |

| Hacked TransferGo account | Payment Processing Services | $510 |

| 50 Hacked PayPal account logins | Payment Processing Services | $200 |

| Hacked PerfectMoney account | Payment Processing Services | $160 |

| Hacked UK Neteller account | Payment Processing Services | $70 |

| Hacked Western Union Account | Payment Processing Services | $45 |

| Movo.Cash Login | Payment Processing Services | $14 |

| Stolen PayPal account details, no balance | Payment Processing Services | $14 |

| Kraken verified account | Crypto Accounts | $250 |

| Cex.io verified account | Crypto Accounts | $170 |

| Hacked Coinbase verified account | Crypto Accounts | $120 |

| Coinfield.com verified account | Crypto Accounts | $120 |

| USA verified LocalBitcoins account | Crypto Accounts | $120 |

| Blockchain.com verified account | Crypto Accounts | $90 |

| Crypto.com verified account | Crypto Accounts | $250 |

| Xcoins verified account | Crypto Accounts | $320 |

| bitit.io verified account | Crypto Accounts | $400 |

| Bit2me verified account | Crypto Accounts | $120 |

| Netflix account, 1-year subscription | Hacked Services | $25 |

| Bet365 account | Hacked Services | $40 |

| Kaspersky account | Hacked Services | $5 |

| NBA League Pass | Hacked Services | $7 |

| Various adult site accounts | Hacked Services | $5 |

| Canva Pro yearly | Hacked Services | $6 |

| CNBC Pro | Hacked Services | $3 |

| Netflix 4K 1 year | Hacked Services | $4 |

| HBO | Hacked Services | $4 |

| Orange TV | Hacked Services | $4 |

| Hulu | Hacked Services | $5 |

| Uber hacked account | Hacked Services | $15 |

| Uber driver hacked account | Hacked Services | $35 |

| Utility bill templates | Forged Documents (Scans) | $25 |

| New York driver’s license | Forged Documents (Scans) | $70 |

| US business cheque templates | Forged Documents (Scans) | $10 |

| Russian passport scan | Forged Documents (Scans) | $100 |

| USA selfie with holding ID | Forged Documents (Scans) | $120 |

| Minnesota driver’s license | Forged Documents (Scans) | $150 |

| NSW (Australia) driver’s license | Forged Documents (Scans) | $150 |

| Alberta CA driver’s License (scan) | Forged Documents (Scans) | $165 |

| Maltese Passport | Forged Documents (Physical) | $3,800 |

| Latvian National ID | Forged Documents (Physical) | $160 |

| Netherlands Passport | Forged Documents (Physical) | $3,800 |

| Poland Passport | Forged Documents (Physical) | $3,800 |

| French Passport | Forged Documents (Physical) | $3,800 |

| Various European Union passports | Forged Documents (Physical) | $3,800 |

| Delaware ID | Forged Documents (Physical) | $150 |

| Indiana ID | Forged Documents (Physical) | $150 |

| Montana ID | Forged Documents (Physical) | $150 |

| Nevada ID | Forged Documents (Physical) | $160 |

| Texas ID | Forged Documents (Physical) | $150 |

| Fake US Green Card | Forged Documents (Physical) | $160 |

| New Jersey drivers license | Forged Documents (Physical) | $160 |

| Louisiana ID | Forged Documents (Physical) | $150 |

| Utah ID | Forged Documents (Physical) | $150 |

| European Union National ID (avg.) | Forged Documents (Physical) | $160 |

| US driver’s license | Forged Documents (Physical) | $150 |

| Lithuanian passport | Forged Documents (Physical) | $3,800 |

| 10 million USA email addresses | Email Database Dumps | $120 |

| 600k New Zealand emails | Email Database Dumps | $110 |

| 2,4 million Canada emails | Email Database Dumps | $100 |

| Europe fresh, high-quality per 1,000 installs | Malware | $1,800 |

| UK high-quality per 1,000 installs | Malware | $1,800 |

| Europe low-quality, slow-speed, low success rate, per 1,000 installs | Malware | $120 |

| USA, CA, UK, AU med quality, 70% success rate per 1,000 installs | Malware | $1,200 |

| CA high-quality, per 1,000 installs | Malware | $1,200 |

| USA high-quality, per 1,000 installs | Malware | $1,700 |

| USA, CA, UK, AU low quality, slow speed, low success rate x 1000 installs | Malware | $800 |

| Europe, aged, high-quality, per 1,000 installs | Malware | $1,100 |

| USA only, medium-quality, 70% success rate, per 1,000 installs | Malware | $900 |

| Europe, medium-quality, 70% success rate, per 1,000 installs | Malware | $450 |

| Global, low quality, slow-speed, low success rate, per 1,000 installs | Malware | $45 |

| Global, medium-quality, 70% success rate, per 1,000 | Malware | $115 |

| Android OS per 1,000 installs | Malware | $950 |

| Premium-quality, per 1,000 | Malware | $5,500 |

| Unprotected website, 10-50k requests per second, 1 month | DDOS Attacks | $850 |

| Unprotected website, 10-50k requests per second, 1 week | DDOS Attacks | $450 |

| Europe, low-quality, slow speed, low success rate per 1, 000 requests | DDOS Attacks | $300 |

| Unprotected website, 10-50k requests per second, 1 hour | DDOS Attacks | $10 |

| Unprotected website, 10-50k requests per second, 24 hours | DDOS Attacks | $45 |

| Premium protected website, 20-50k requests per second, multiple elite proxies, 24 hours | DDOS Attacks | $200 |

One of the most expensive items included in the dataset is premium malware, which costs about $5,500 per 1,000 installs. While the cost for premium malware is hefty, there are still billions of malware attacks occurring every year causing huge monetary damage.

On the other end of the spectrum are Paypal account details, Netflix logins, or stolen credit card details (complete with a CVV) all available for less than $20.

How to Protect Your Personal Information

As the line between the digital and physical realm becomes increasingly blurry, it’s more important than ever to make sure you’re protecting yourself and your personal information from identity theft.

According to Privacy Affairs, there are several proactive measures you can take to decrease your chances of getting hacked. This includes using a VPN whenever you access public Wi-Fi, using different passwords for different online accounts, and investing in anti-malware software to combat unwanted visitors.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001