Markets

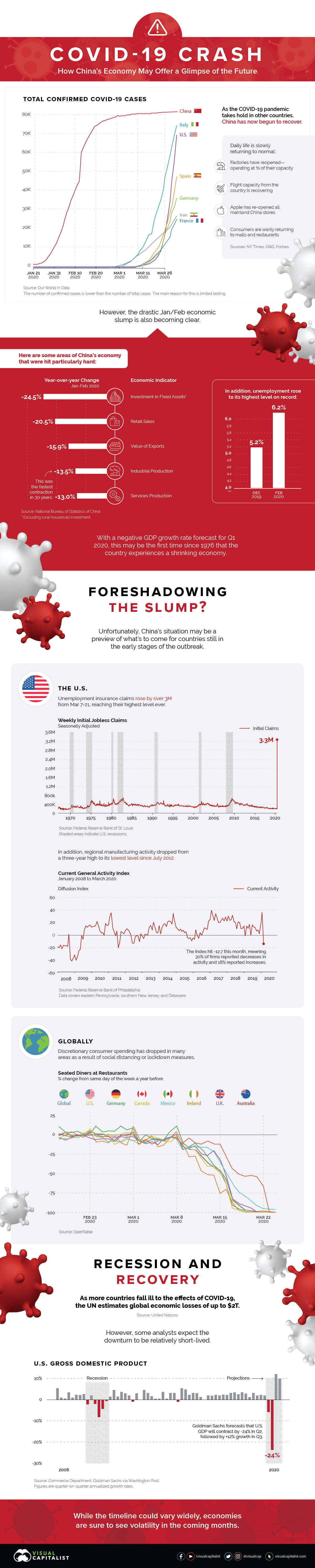

COVID-19 Crash: How China’s Economy May Offer a Glimpse of the Future

The Economic Impact of COVID-19

China, once the epicenter of the COVID-19 pandemic, appears to be turning a corner. As the number of reported local transmission cases hovers near zero, daily life is slowly returning to normal. However, economic data from the first two months of the year shows the damage done to the country’s finances.

Today’s visualization outlines the sharp losses China’s economy has experienced, and how this may foreshadow what’s to come for countries currently in the early stages of the outbreak.

A Historic Slump

The results are in: China’s business activity slowed considerably as COVID-19 spread.

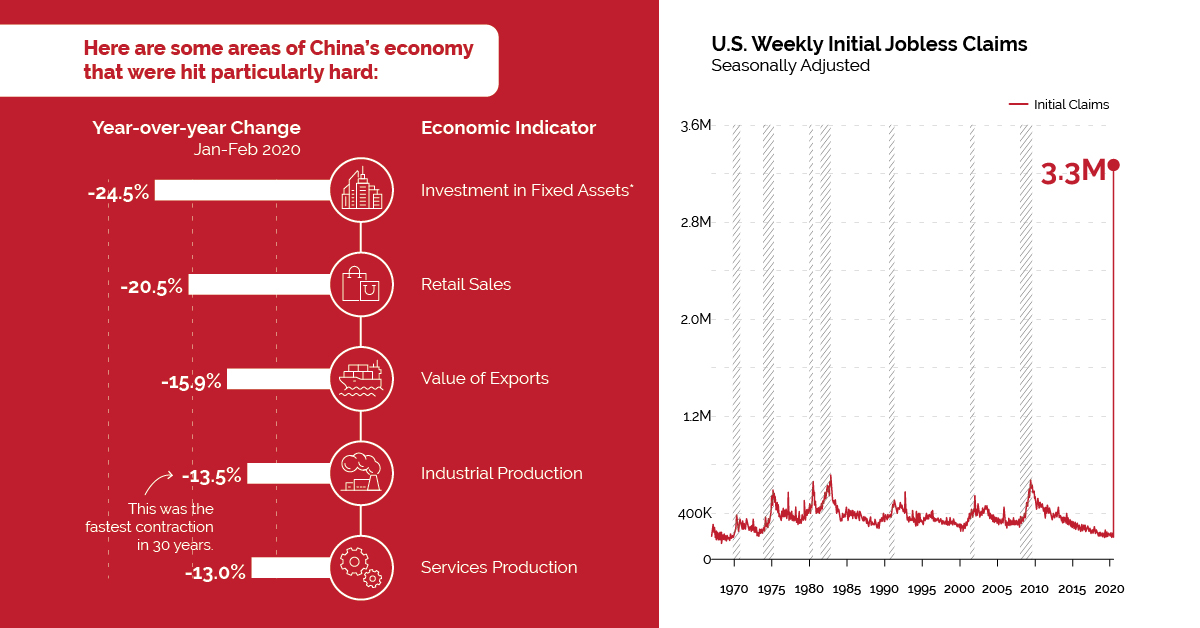

| Economic Indicator | Year-over-year Change (Jan-Feb 2020) |

|---|---|

| Investment in Fixed Assets* | -24.5% |

| Retail Sales | -20.5% |

| Value of Exports | -15.9% |

| Industrial Production | -13.5% |

| Services Production | -13.0% |

*Excluding rural household investment

As factories and shops reopen, China seems to be over the initial supply side shock caused by the lockdown. However, the country now faces a double-headed demand shock:

- Domestic demand is slow to gain traction due to psychological scars, bankruptcies, and job losses. In a survey conducted by a Beijing financial firm, almost 65% of respondents plan to “restrain” their spending habits after the virus.

- Overseas demand is suffering as more countries face outbreaks. Many stores are closing up shop and/or cancelling orders, leading to an oversupply of goods.

With a fast recovery seeming highly unlikely, many economists expect China’s GDP to shrink in the first quarter of 2020—the country’s first decline since 1976.

Danger on the Horizon

Are other countries destined to follow the same path? Based on preliminary economic data, it would appear so.

The U.S.

About half the U.S. population is on stay-at-home orders, severely restricting economic activity and forcing widespread layoffs. In the week ending March 21, total unemployment insurance claims rose to almost 3.3 million—their highest level in recorded history. For context, weekly claims reached a high of 665,000 during the global financial crisis.

“…The economy has just fallen over the cliff and is turning down into a recession.”

—Chris Rupkey, Chief Economist at MUFG in New York

In addition, manufacturing activity in eastern Pennsylvania, southern New Jersey, and Delaware dropped to its lowest level since July 2012.

Globally

Other countries are also feeling the economic impact of COVID-19. For example, global online bookings for seated diners have declined by 100% year-over-year. In Canada, nearly one million people have applied for unemployment benefits.

Hard-hit countries such as Italy and Spain, which already suffer from high unemployment, are also expecting to see economic blows. However, it’s too soon to gauge the extent of the damage.

Light at the End of the Tunnel

Given the near-shutdown of many economies, the IMF is forecasting a global recession in 2020. Separately, the UN estimates COVID-19 could cause up to a $2 trillion shortfall in global income.

On the bright side, some analysts are forecasting a recovery as early as the third quarter of 2020. A variety of factors, such as government stimulus, consumer confidence, and the number of COVID-19 cases, will play into this timeline.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries