Money

Which Countries Have the Most Wealth Per Capita?

Which Countries Have the Most Wealth Per Capita?

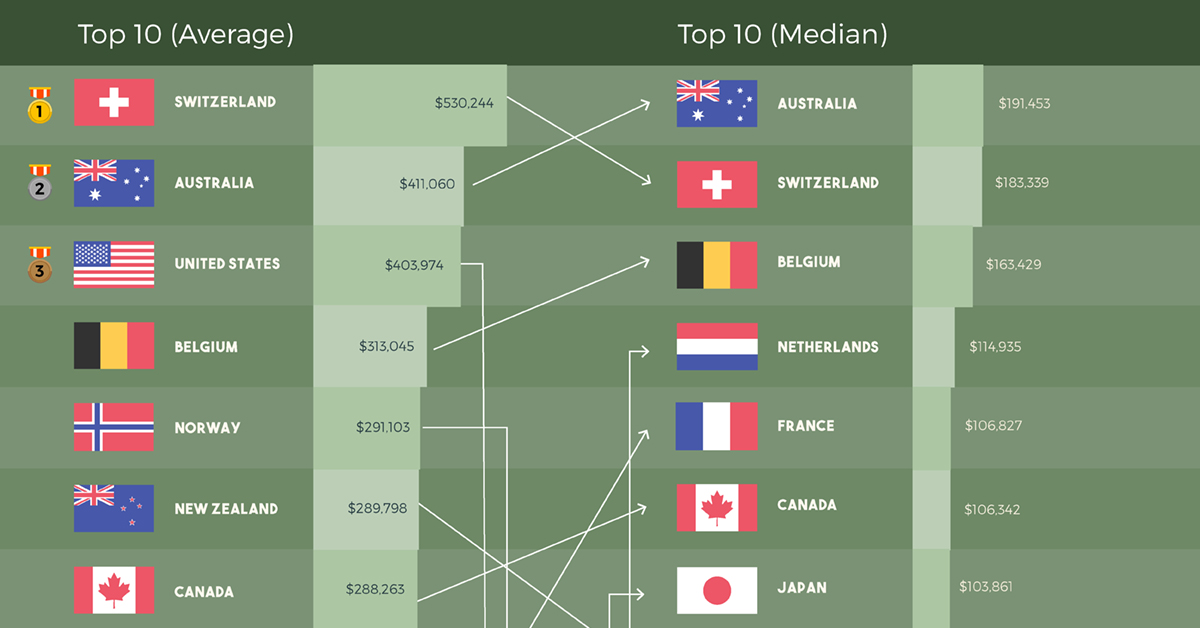

Our animated chart this week uses data from the ninth Credit Suisse Global Wealth report, which ranks countries by average wealth, calculated as gross assets per adult citizen.

While using such a metric certainly gives a quick snapshot of wealth per capita, it doesn’t necessarily show the complete picture.

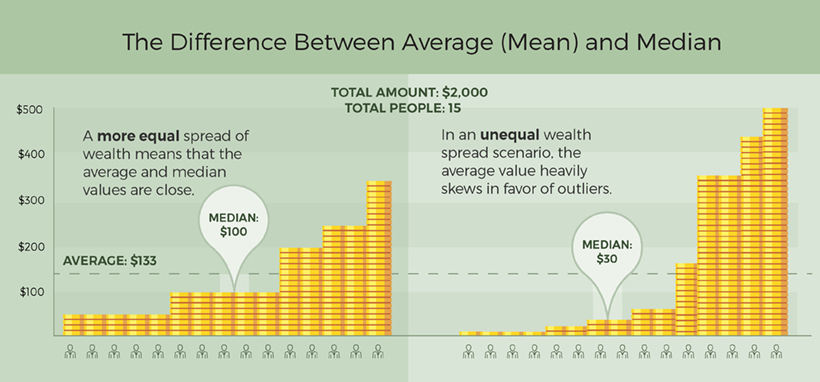

Some argue, for example, that calculating the mean doesn’t factor in the gap between the richest and poorest in a population—also known as wealth inequality. For this reason, we’ve compared this number to median wealth for each country, providing a separate angle on which countries really have the most wealth per capita.

Mean or Median: Which Makes More Sense?

Below, we’ve visualized a hypothetical example of two groups of people, each earning various sums of money, to show how average (mean) and median calculations make a difference.

What can we observe in both datasets?

- Total wealth: $2,000

- Total people: 15 people

- Average wealth: $2,000 ÷ 15 = $133

However, that’s where the similarities end. In the first group, wealth is distributed more evenly, with the disparity between the lowest-paid and highest-paid being $300. The median wealth for this group reaches $100, which is close to the average value. In the second group, this gap climbs to $495, and the median wealth drops sharply to only $30.

Scaling up this example to the true wealth of nations, we can see how the median wealth provides a more accurate picture of the typical adult, especially in societies that are less equal.

Let’s see how this shakes out when ranking the world’s most affluent countries.

Ranking Top Contenders on Wealth per Capita

When it comes to wealth per capita, it’s clear that Australia and Switzerland lead the pack. In fact, the data shows that both nations top the lists for both mean and median wealth.

However, both nations also have the highest absolute household debt-to-GDP ratios in the world: in 2018, Switzerland’s levels reached nearly 129%, while Australia followed behind at 120%.

Here is a full ranking of the top 20 countries by mean and median wealth:

| Rank | Country | Mean wealth per adult | Country | Median wealth per adult |

|---|---|---|---|---|

| #1 | 🇨🇭 Switzerland | $530,244 | 🇦🇺 Australia | $191,453 |

| #2 | 🇦🇺 Australia | $411,060 | 🇨🇭 Switzerland | $183,339 |

| #3 | 🇺🇸 United States | $403,974 | 🇧🇪 Belgium | $163,429 |

| #4 | 🇧🇪 Belgium | $313,045 | 🇳🇱 Netherlands | $114,935 |

| #5 | 🇳🇴 Norway | $291,103 | 🇫🇷 France | $106,827 |

| #6 | 🇳🇿 New Zealand | $289,798 | 🇨🇦 Canada | $106,342 |

| #7 | 🇨🇦 Canada | $288,263 | 🇯🇵 Japan | $103,861 |

| #8 | 🇩🇰 Denmark | $286,712 | 🇳🇿 New Zealand | $98,613 |

| #9 | 🇸🇬 Singapore | $283,118 | 🇬🇧 United Kingdom | $97,169 |

| #10 | 🇫🇷 France | $280,580 | 🇸🇬 Singapore | $91,656 |

| #11 | 🇬🇧 United Kingdom | $279,048 | 🇪🇸 Spain | $87,188 |

| #12 | 🇳🇱 Netherlands | $253,205 | 🇳🇴 Norway | $80,054 |

| #13 | 🇸🇪 Sweden | $249,765 | 🇮🇹 Italy | $79,239 |

| #14 | 🇭🇰 Hong Kong | $244,672 | 🇹🇼 Taiwan | $78,177 |

| #15 | 🇮🇪 Ireland | $232,952 | 🇮🇪 Ireland | $72,473 |

| #16 | 🇦🇹 Austria | $231,368 | 🇦🇹 Austria | $70,074 |

| #17 | 🇯🇵 Japan | $227,235 | 🇰🇷 South Korea | $65,463 |

| #18 | 🇮🇹 Italy | $217,727 | 🇺🇸 United States | $61,667 |

| #19 | 🇩🇪 Germany | $214,893 | 🇩🇰 Denmark | $60,999 |

| #20 | 🇹🇼 Taiwan | $212,375 | 🇭🇰 Hong Kong | $58,905 |

The United States boasts 41% of the world’s millionaires, but it’s clear that the fruits of labor are enjoyed by only a select group—average wealth ($403,974) is almost seven times higher than median wealth ($61,667). This growing inequality gap knocks the country down to 18th place for median wealth.

The Nordic countries of Norway and Denmark can be found in the top ten for average wealth, but they drop to 12th place ($80,054) and 19th place ($60,999) respectively for median wealth. Despite this difference, these countries also provide a strong safety net—including access to healthcare and education—to more vulnerable citizens.

Finally, wealth in Japan is fairly evenly distributed among its large middle class, which lands it in seventh place on the median wealth list at $103,861. One possible reason is that the pay gap ratio between Japanese CEOs and the average worker is much lower than other developed nations.

With reducing income inequality as a priority for many countries around the world, how might this list change in coming years?

Footnote: All data estimates are using mid-2018 values, and reflected in US$.

Money

Charted: Who Has Savings in This Economy?

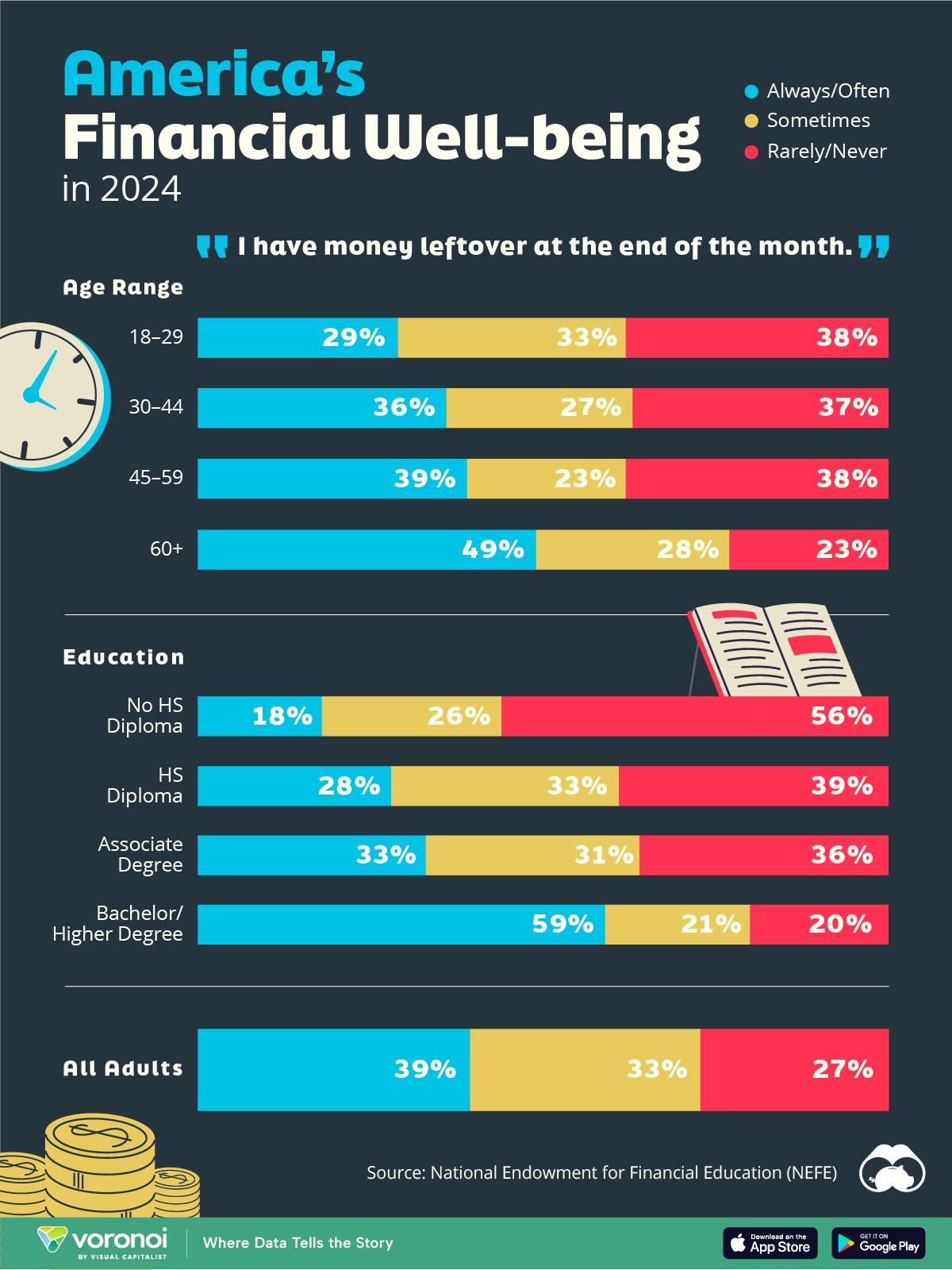

Older, better-educated adults are winning the savings game, reveals a January survey by the National Opinion Research Center at the University of Chicago.

Who Has Savings in This Economy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Two full years of inflation have taken their toll on American households. In 2023, the country’s collective credit card debt crossed $1 trillion for the first time. So who is managing to save money in the current economic environment?

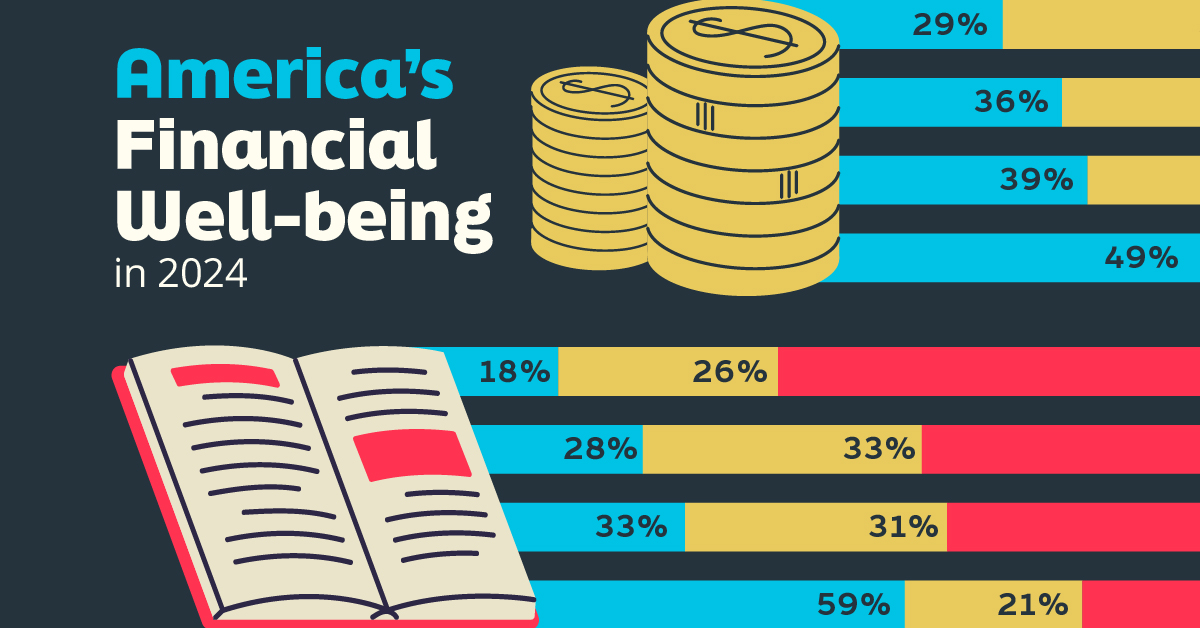

We visualize the percentage of respondents to the statement “I have money leftover at the end of the month” categorized by age and education qualifications. Data is sourced from a National Endowment for Financial Education (NEFE) report, published last month.

The survey for NEFE was conducted from January 12-14, 2024, by the National Opinion Research Center at the University of Chicago. It involved 1,222 adults aged 18+ and aimed to be representative of the U.S. population.

Older Americans Save More Than Their Younger Counterparts

General trends from this dataset indicate that as respondents get older, a higher percentage of them are able to save.

| Age | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| 18–29 | 29% | 33% | 38% |

| 30–44 | 36% | 27% | 37% |

| 45–59 | 39% | 23% | 38% |

| Above 60 | 49% | 28% | 23% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

Perhaps not surprisingly, those aged 60+ are the age group with the highest percentage saying they have leftover money at the end of the month. This age group spent the most time making peak earnings in their careers, are more likely to have investments, and are more likely to have paid off major expenses like a mortgage or raising a family.

The Impact of Higher Education on Earnings and Savings

Based on this survey, higher education dramatically improves one’s ability to save. Shown in the table below, those with a bachelor’s degree or higher are three times more likely to have leftover money than those without a high school diploma.

| Education | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| No HS Diploma | 18% | 26% | 56% |

| HS Diploma | 28% | 33% | 39% |

| Associate Degree | 33% | 31% | 36% |

| Bachelor/Higher Degree | 59% | 21% | 20% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

As the Bureau of Labor Statistics notes, earnings improve with every level of education completed.

For example, those with a high school diploma made 25% more than those without in 2022. And as the qualifications increase, the effects keep stacking.

Meanwhile, a Federal Reserve study also found that those with more education tended to make financial decisions that contributed to building wealth, of which the first step is to save.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries