Technology

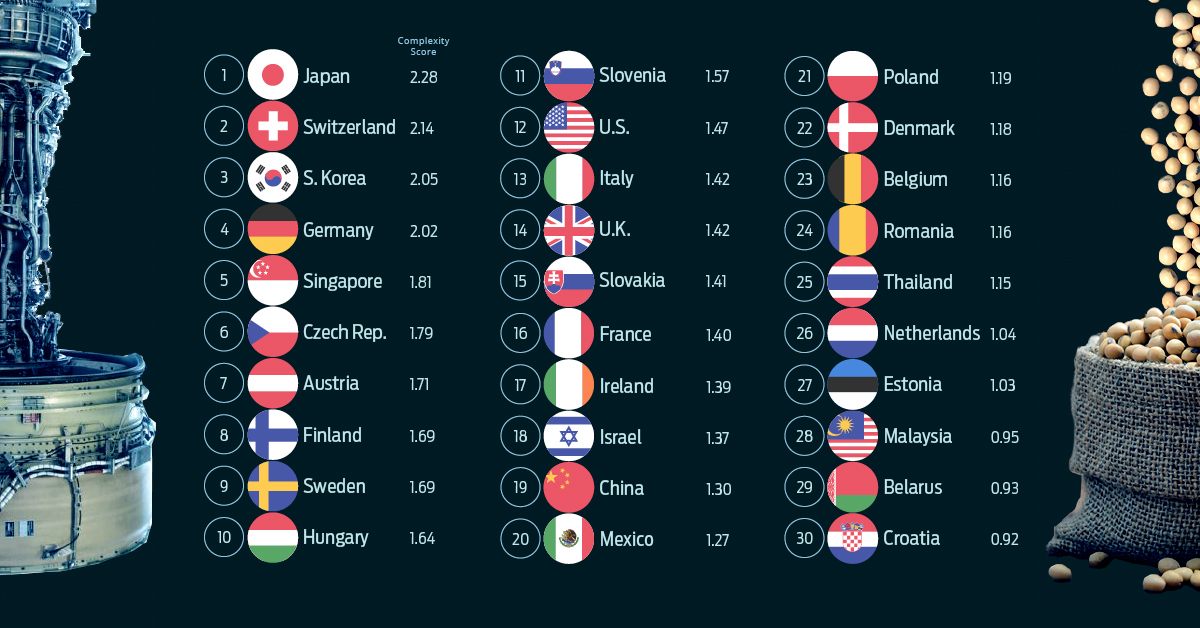

Countries Ranked by Their Economic Complexity

Countries Ranked by Their Economic Complexity

In the past, the trade between nations was a much simpler matter to grasp. Commodities and a few finished goods moved between a handful of countries in a straightforward way.

Today, around 6,000 officially classified products pass through the world’s ports, and digital products and services zip across country lines creating an extra layer of difficulty in measuring economic activity.

To try to understand this enormous level of economic complexity, the team at Harvard’s Growth Lab have created the Country Complexity Ranking. Here’s a look at the top 50 countries in the ranking:

| Rank | Country | Score | Top Export(s) |

|---|---|---|---|

| 1 | Japan | 2.28 | Cars, ICT (tech) |

| 2 | Switzerland | 2.14 | ICT, gold, packaged medicaments |

| 3 | South Korea | 2.05 | ICT, cars |

| 4 | Germany | 2.02 | Integrated circuits, ICT, cars |

| 5 | Singapore | 1.81 | ICT, cars |

| 6 | Czech Rep. | 1.79 | Cars, vehicle parts |

| 7 | Austria | 1.71 | ICT, tourism |

| 8 | Finland | 1.69 | ICT |

| 9 | Sweden | 1.67 | ICT |

| 10 | Hungary | 1.64 | ICT, cars |

| 11 | Slovenia | 1.57 | Cars, ICT |

| 12 | United States | 1.47 | ICT, tourism |

| 13 | Italy | 1.42 | ICT, tourism |

| 14 | United Kingdom | 1.42 | ICT, finance |

| 15 | Slovakia | 1.41 | Cars |

| 16 | France | 1.40 | ICT, tourism |

| 17 | Ireland | 1.39 | ICT |

| 18 | Israel | 1.37 | ICT, diamonds |

| 19 | China | 1.30 | Electronic equipment |

| 20 | Mexico | 1.27 | Cars |

| 21 | Poland | 1.19 | ICT |

| 22 | Denmark | 1.18 | Transport, ICT |

| 23 | Belgium | 1.16 | ICT |

| 24 | Romania | 1.16 | ICT, vehicle parts |

| 25 | Thailand | 1.15 | Tourism |

| 26 | Netherlands | 1.04 | ICT |

| 27 | Estonia | 1.03 | ICT, transport |

| 28 | Malaysia | 0.95 | Integrated circuits |

| 29 | Belarus | 0.93 | Refined oils, ICT |

| 30 | Croatia | 0.92 | Tourism, ICT |

| 31 | Lithuania | 0.85 | Transport, refined oils |

| 32 | Spain | 0.85 | Tourism, ICT |

| 33 | Philippines | 0.75 | Integrated circuits, ICT |

| 34 | Portugal | 0.72 | Tourism, ICT |

| 35 | Canada | 0.69 | Crude oil, cars, ICT |

| 36 | Bosnia and Herz. | 0.65 | Tourism, ICT |

| 37 | Serbia | 0.65 | ICT |

| 38 | Turkey | 0.65 | Tourism, transport |

| 39 | Latvia | 0.64 | Transport, ICT |

| 40 | Bulgaria | 0.62 | Tourism, ICT |

| 41 | Norway | 0.56 | Crude oil, petrol. gases |

| 42 | Ukraine | 0.42 | ICT, transport |

| 43 | Cyprus | 0.38 | Tourism, transport |

| 44 | Tunisia | 0.34 | Electrical wire, tourism |

| 45 | India | 0.32 | ICT |

| 46 | Costa Rica | 0.30 | ICT, tourism |

| 47 | Uruguay | 0.29 | Tourism, wood pulp |

| 48 | Brazil | 0.24 | Soya beans, iron ore |

| 49 | Russia | 0.24 | Crude oil, refined oils |

| 50 | Lebanon | 0.24 | Tourism, ICT |

Japan, Switzerland, and South Korea sit at the top of the ranking.

Czech Republic – which was recently ranked as the most attractive manufacturing destination in Europe – has a strong showing, ranking 6th in the world. The United States slipped out of the top 10 into 12th position.

The Power of Productive Knowledge

Highly ranked countries tend to have the following attributes:

-

• A high diversity of exported products

• Sophisticated and unique exported products (i.e. few other countries produce similar products)

In short, the ranking hinges on the concept of “productive knowledge” – or the tacit ability to produce a product.

Muhammed Yildirim, of Harvard University, has thought up a useful analogy for thinking about the role of productive knowledge in the complexity of an economy:

“Suppose that each type of productive knowledge is a letter and each product is a word composed of these letters. Like the game of Scrabble, each country holds a set of letters with plenty of copies of each letter and tries to make words out of these letters. For instance, with letters like A, C and T, one can construct words like CAT or ACT. Then our problem of measuring economic complexity resembles interpreting how many different letters there are in each country’s portfolio. Some letters, like A and E, go in many words, whereas other letters, like X and Q, are used in very few. Extending this analogy to the countries and products, only those with a larger diversity of letters will be able to make more and more unique products. On the other hand, words that require more letters will be made only in the countries that have all the requisite pieces.”

Not All Exports are Created Equal

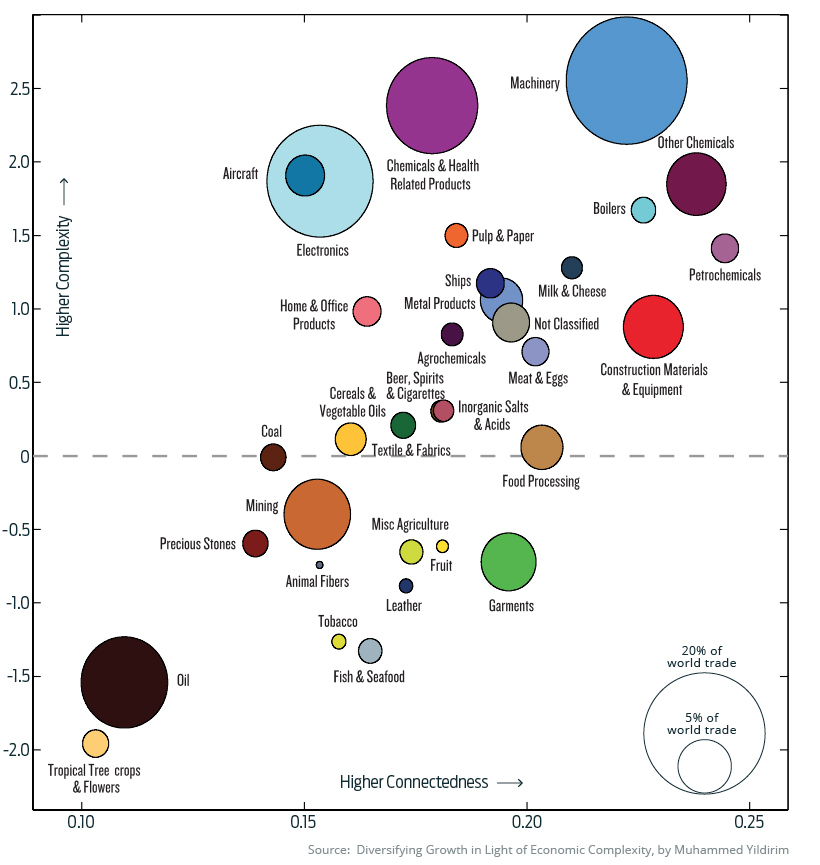

Much like the rack of letters in a Scrabble game, the elements of every export-driven economy can be broken down and quantified. The resulting categories encompass everything from rendered pig fat to integrated circuits, each contributing to the country’s overall score.

Agricultural and extractive industries tend to score lower on the complexity scale. Machinery can be highly complex to produce and is connected to many facets of the global economy.

Visualizing this overall mix of categories can provide a unique perspective beyond big picture numbers like GDP. Below are a few real world examples of export markets on both ends of the complexity spectrum.

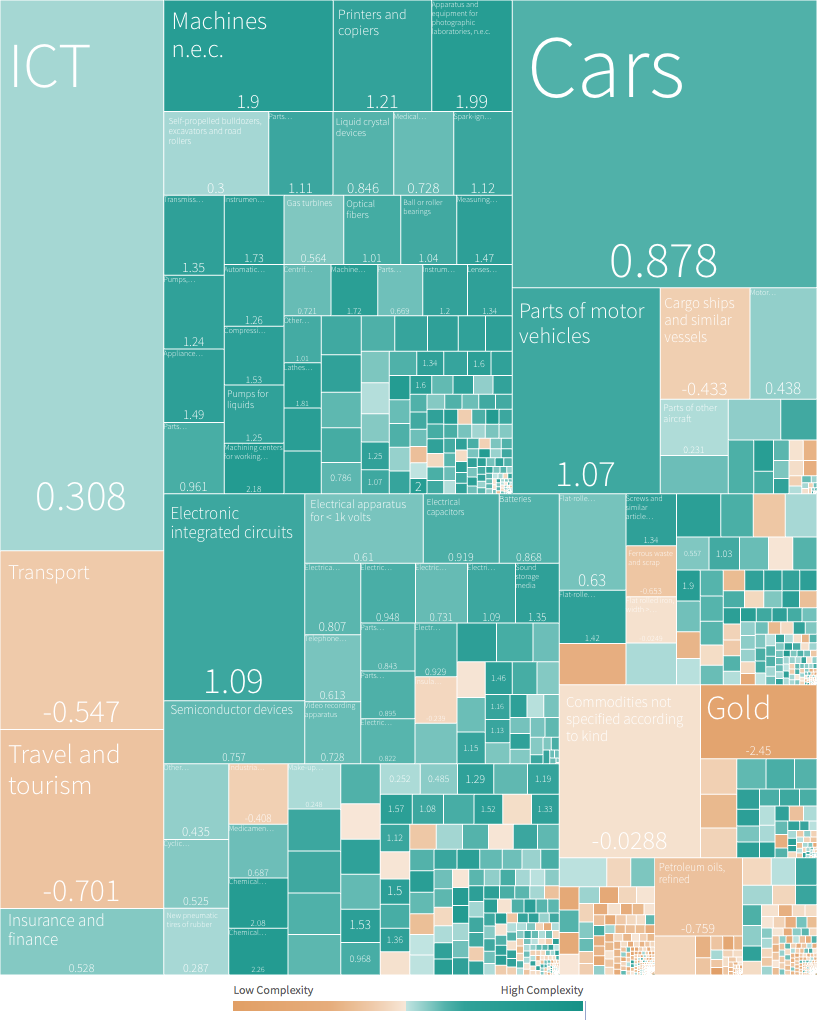

Japan

Since this ranking began in the mid-1990s, Japan has never been bumped from the top spot.

Due to a restricted land mass and some ingenuity, Japan has become the prototypical example of a low-ubiquity, high-sophistication export economy.

Cars and electronics are obvious standouts, but there numerous other high-value product categories in the mix as well. The country also has a wide variety of high value exports and trading partners, lowering the risk of a trade war or industry downturn crippling the country’s economy.

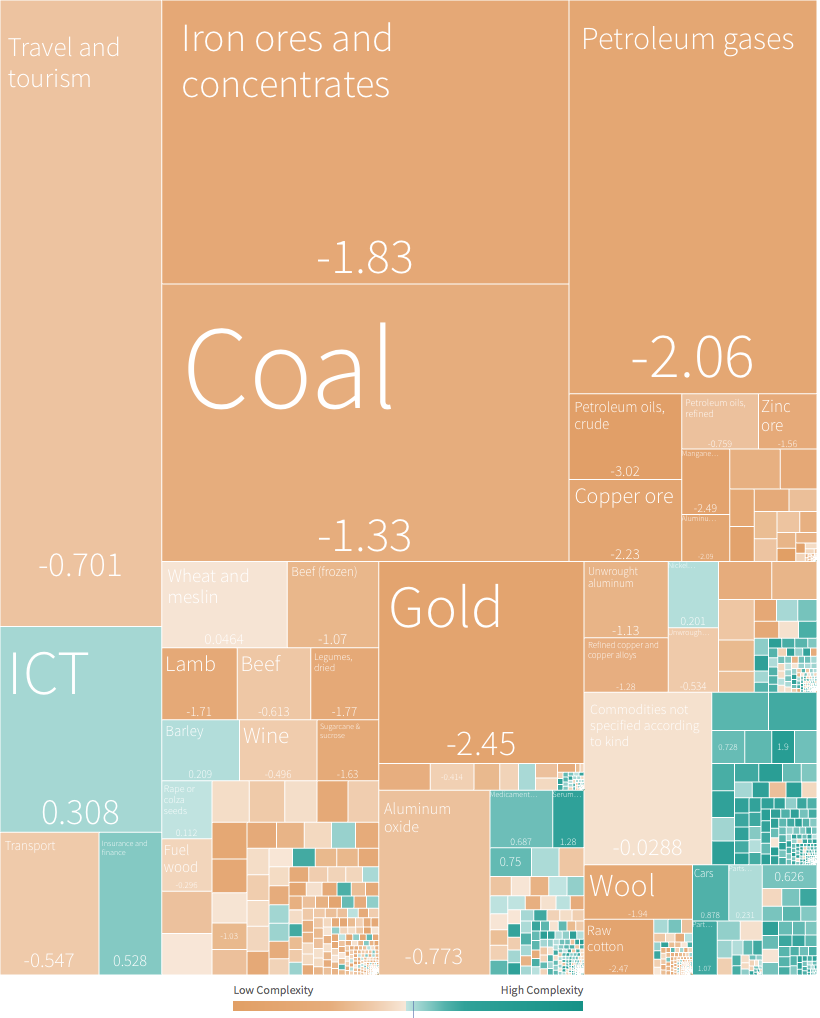

Australia

Many will be surprised to learn that Australia sits in the lower third of this complexity ranking.

Although Australia’s global ranking is high in a myriad of categories – household wealth per person, for example – its economic complexity score is -0.60, much lower than expected for its income level. Looking at the breakdown below, there are clues as to why this might be the case.

Australia’s largest exports are in low complexity categories, such as minerals and agriculture. To compound matters, the country’s economy is heavily linked to China’s. To underscore this point, a recent study found that a 5% drop in China’s GDP would result in a 2.5% dip in Australia’s.

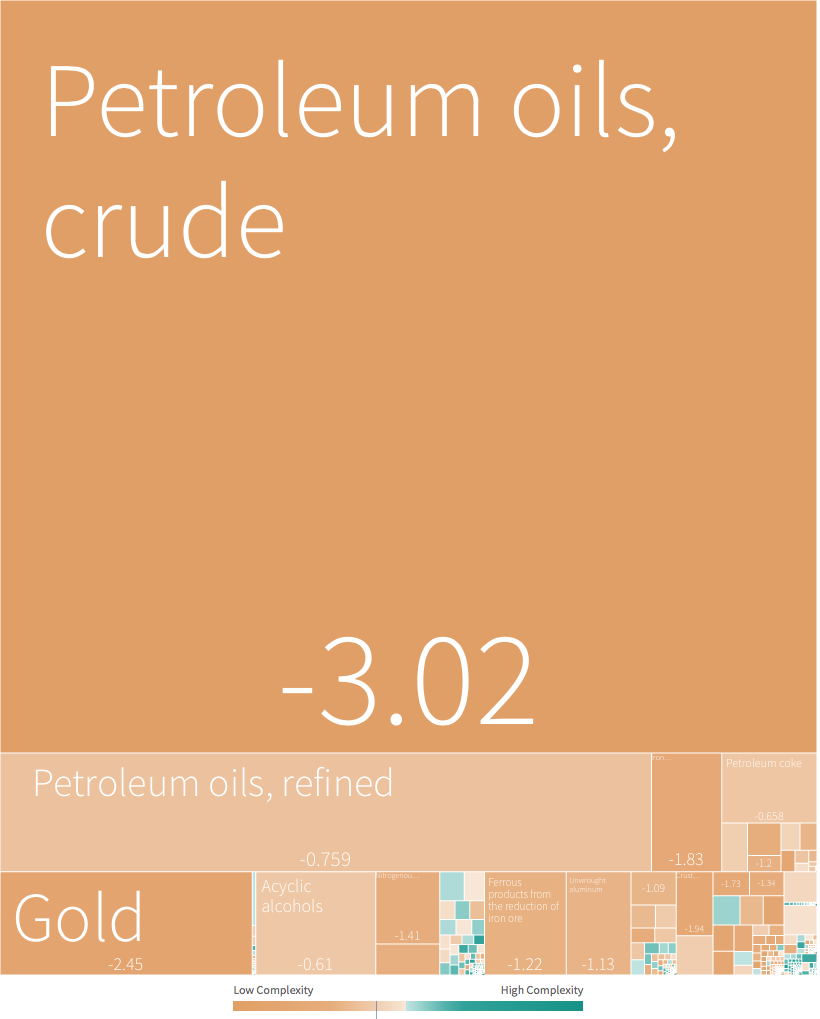

Venezuela

It’s no secret that Venezuela has seen some tough times in recent years. The chart below shows just how reliant Venezuela was on oil exports to sustain its economy.

An over-reliance on a single export can leave a country extremely vulnerable in the event of price volatility or geopolitical events. In the case of Venezuela, three quarters of their export economy was comprised of crude oil – one of the lowest scoring product categories in the ranking.

The Rush to Diversify

A low level of economic complexity isn’t necessarily a problem. Many countries with middle-to-low scores in the ranking have great standards of living and a high level of wealth. Countries like Canada, Norway, and Australia were all well down the list.

On the other hand, some countries have made diversification a priority. SoftBank’s $100 billion Vision Fund is partially the result of Saudi Arabia’s push to develop a diversified, knowledge-based economy. Other oil-rich nations, such as Kazakhstan, are also pushing to diversify in the face of the world’s evolving energy mix.

As world economies evolve and the shift from fossil fuels continues, we will likely see economic complexity increase across the board.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?