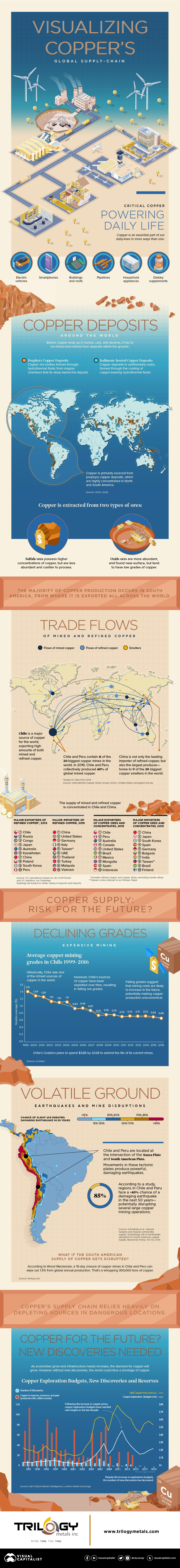

Visualizing Copper’s Global Supply Chain

Copper is all around us: in our homes, electronic devices, and transportation.

But before copper ends up in these products and technologies, the industry must mine, refine and transport this copper all over the globe.

Copper’s Supply Chain

This infographic comes to us from Trilogy Metals and it outlines copper’s supply chain from the mine to the refinery.

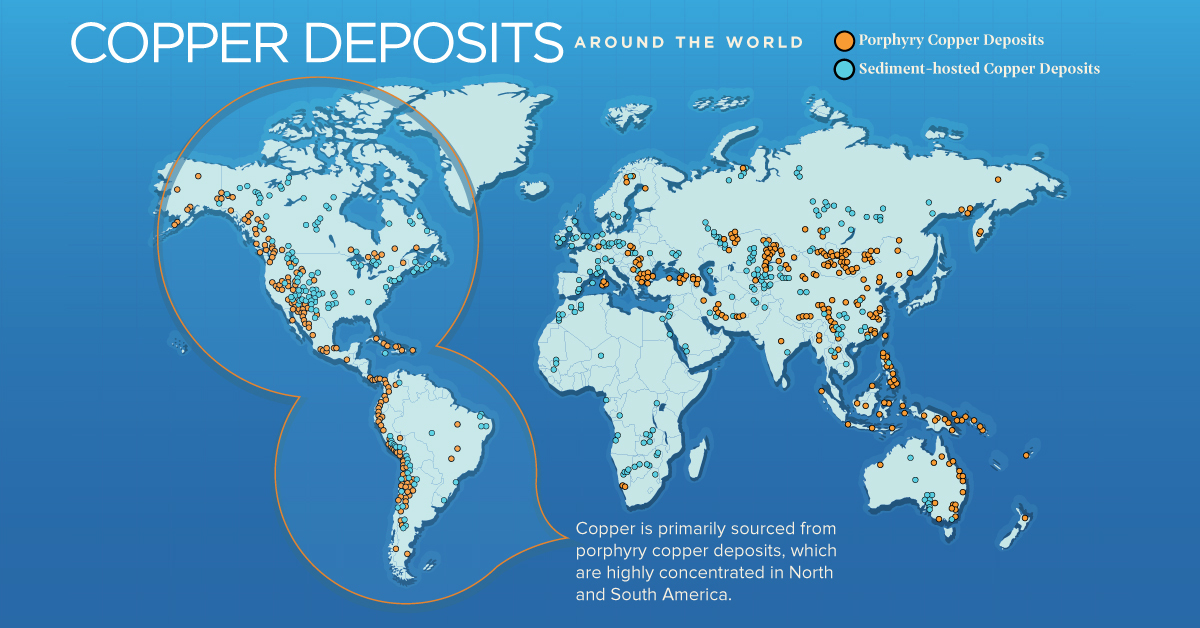

Copper Deposits Around the World

Copper is a mineral that comes from the Earth’s crust. However, natural history did not evenly distribute it around the world. There are certain geological conditions that need to happen to make an economic deposit of copper.

There are two primary types of copper deposits:

- Porphyry Copper Deposits

These copper ore deposits form from hydrothermal fluids coming from magma chambers below the copper deposit. These are currently the largest source of copper in the world.

- Sediment-hosted Copper Deposits

These are copper deposits that occur in sedimentary rocks that are bound by layers. They are formed by the cooling of copper-bearing hydrothermal fluids.

Copper-containing rock or ore only has a small percentage of copper. Most of the rock is uneconomic material, known as gangue. There are two main copper ore types in mining: copper oxide ores and copper sulfide ores.

Both ore types can be economic, however, the most common source of copper ore is the sulfide ore mineral chalcopyrite, which accounts for ~50% of copper production.

Sulfide copper ores are the most profitable ores because they have high copper content, and refiners easily separate copper from the gangue. Sulfide ores are not as abundant as the oxide ores.

Copper Trade Flows

While copper is a global business, there are clear leaders in the production and refinement of copper based on geology and demand. Chile is the major source for copper, exporting both mined and refined copper.

In a list of the 20 biggest copper mines, 11 reside in Chile and Peru accounting for 40% of mined copper. Meanwhile, China is a leading importer and exporter of refined copper, and it’s home to 9 of the 20 biggest copper smelters in the world.

However, this concentrated geography of supply creates risks for the the copper trade.

Inherent Risks

While Chile is one of the richest sources of copper in the world, the mining industry has exploited copper deposits to the point where the grade or quality of the copper ore is declining.

Codelco, the national copper miner of Chile and the world’s largest producer of copper, plans to spend $32B by 2027 to extend the life of its current mines and maintain its copper output.

In addition to declining grades, the geography of copper mining exposes the risk of supply disruption by natural forces.

The borders of Chile and Peru overlap the intersection of the Nazca and the South American Tectonic plates. Movement of these plates can produce powerful earthquakes.

According to one study, regions in Chile and Peru face a greater than 85% chance of a serious earthquake in the next 50 years, potentially disrupting copper mining operations. And according to Wood Mackenzie, a 15-day closure of copper mines in Chile and Peru could wipe out 1.5% of global annual production, or 300,000 tons of copper.

Falling grades and tectonic risk suggest that mining costs are likely to increase, making copper production more expensive and new discoveries more valuable.

Copper for the Future: New Discoveries

As economies grow and infrastructure needs increase, the demand for copper will grow. However, without new discoveries and sources of production, the world could face a shortage of the red metal.

According to data from S&P and the London Metals Exchange, the discovery of copper has not kept up with investment in copper exploration. If this trend persists, there will not be enough copper to replace current resources. On top of this, production from already producing copper mines face resource exhaustion and declining grades.

In order to maintain copper’s supply chain, the world needs new copper discoveries to ensure everyone has access to the materials and products that make modern life.