Visualizing the Copper Intensity of Renewable Energy

The following content is sponsored by Trilogy Metals.

Visualizing the Copper Intensity of Renewable Energy

The world is moving away from fossil fuels, towards large-scale adoption of clean energy technologies.

Building these technologies is a mineral-intensive process. From aluminum and chromium to rare earths and cobalt, the energy transition is creating massive demand for a range of minerals.

Copper is one such mineral, which stands out due to its critical role in building both the technologies as well as the infrastructure that allows us to harness their power.

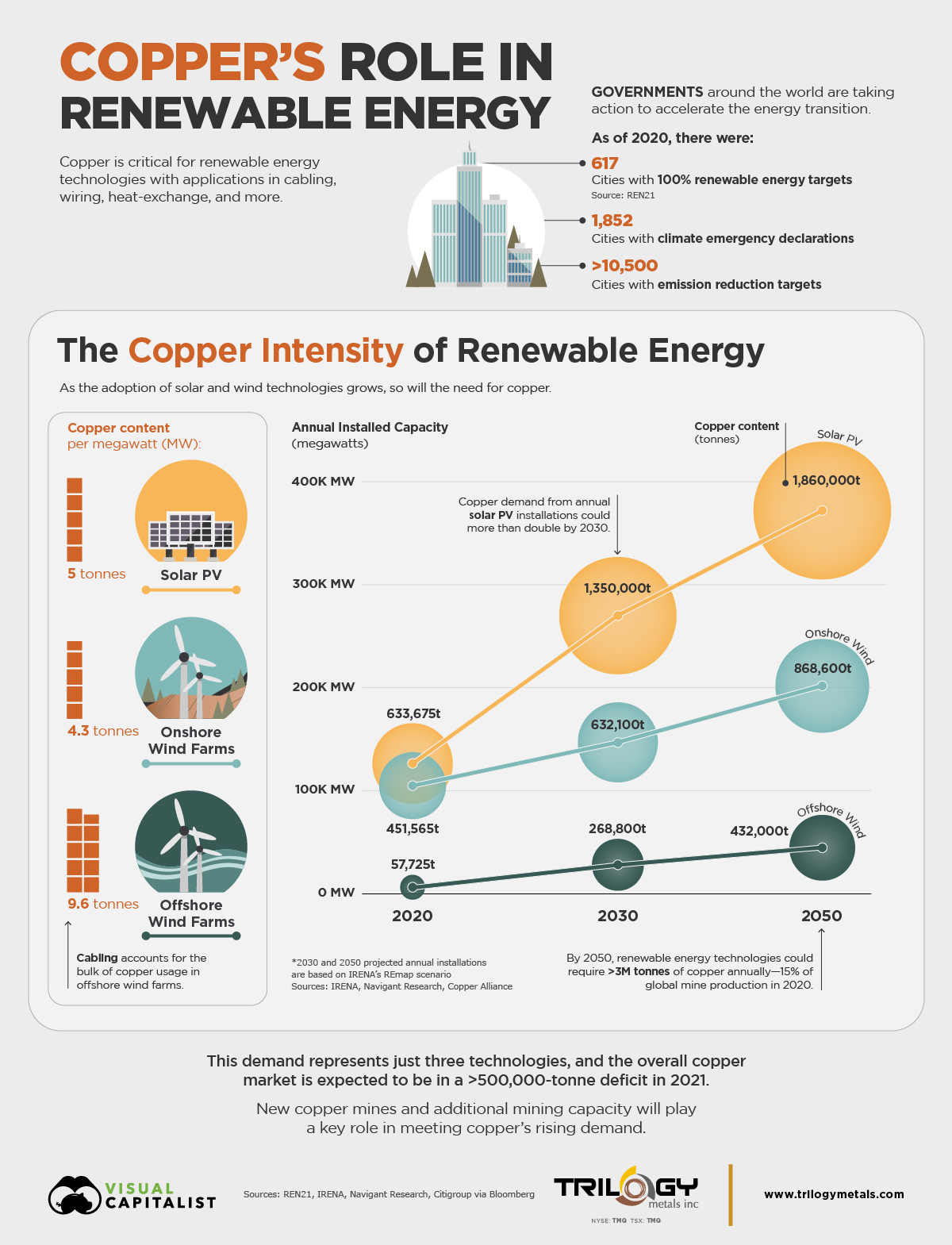

The above infographic from Trilogy Metals highlights the role of copper in renewable energy, and how the adoption of wind and solar energy will affect its demand going forward.

Copper’s Role in Renewable Energy

Copper has one of the highest thermal and electrical conductivity of all metals. As a result, it’s the most widely-used mineral among energy technologies and is essential for all electricity-related infrastructure.

According to Navigant Research, here’s how much copper wind and solar farms use per megawatt:

| Technology | Copper Usage/MW (lbs) | Copper Usage/MW (U.S. tons) | Copper Usage/MW (tonnes) |

|---|---|---|---|

| Solar PV | 11,000 | 5.5 | 4.99 |

| Onshore Wind | 9,520 | 4.76 | 4.32 |

| Offshore Wind | 21,076 | 10.54 | 9.56 |

Solar photovoltaics (PV) primarily rely on copper for cabling, wiring, and heat exchange due to its efficiency in conducting heat and electricity. Wind energy technologies make use of the red metal in their turbines, cables, and transformers. Offshore wind farms typically use larger amounts because they are connected to land via long undersea cables that are made of copper.

In addition, copper is also a key part of the grid networks that transmit electricity from power plants to our homes. With the increasing adoption of renewable energy, the demand for copper will only grow.

Copper Intensity of the Energy Transition

According to the International Renewable Energy Agency (IRENA), solar and wind energy installations need to scale up significantly under their REmap scenario, in which efforts are made to limit global temperature rise to less than 2 degrees by 2050.

Based on the copper content figures from Navigant Research and IRENA’s required capacity projections, here are the copper requirements for annual solar and wind installations in 2020 and 2050:

| Technology | 2020 Installed Capacity (megawatts) | Copper Content (2020, tonnes) | 2050p Installed Capacity (megawatts) | Copper Content (2050p, tonnes) |

|---|---|---|---|---|

| Solar PV | 126,735 MW | 633,675 | 372,000 MW | 1,860,000 |

| Onshore Wind | 105,015 MW | 451,565 | 202,000 MW | 868,600 |

| Offshore Wind | 6,013 MW | 57,725 | 45,000 MW | 432,000 |

Copper content figures were calculated by multiplying copper content per MW in tonnes with annual installed capacities in 2020 and 2050.

Relative to 2020 levels, annual copper demand from solar PV installations could more than double by 2030, and almost triple by 2050. The largest percentage increase in copper requirements comes from offshore wind farms. IRENA’s REmap scenario requires 45,000 MW of annual offshore wind installations in 2050, which translates into 432,000 tonnes of copper—a 648% increase from 2020 levels.

By 2050, annual copper demand from wind and solar technologies could exceed 3 million tonnes or around 15% of 2020 copper production. However, it isn’t clear whether we will have enough supply of copper to meet this growing demand.

Will Supply Meet Demand?

According to Citigroup, the global copper market is expected to be in a 521,000 tonne deficit in 2021—and the transition to renewables is still in its early stages.

While the demand for copper comes from a range of industries, the majority of its supply comes from a few regions, making the supply chain susceptible to disruptions. Mine shutdowns in 2020 exemplified this, as copper production fell by around 500,000 tonnes.

Additionally, average ore grades in Chile, the largest producer of copper, have fallen by 30% over the last 15 years, making it more difficult to mine copper.

Although copper is available in abundance, declining ore grades and concentrated production are a cause for concern, especially as demand rises. Therefore, new sources of copper will be valuable in meeting the growing material needs of the clean energy transition.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.