Politics

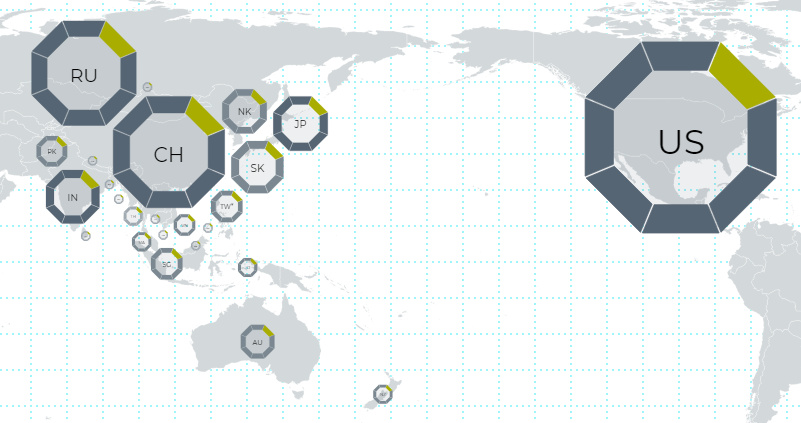

Interactive: Comparing Asian Powers to the U.S.

Interactive: Comparing Asian Powers to the U.S.

Whether it’s the planning and execution of massive infrastructure projects like One Belt, One Road, or the dramatic increase in wealth occurring in the region, it’s clear that the economic boom in the East is rapidly expanding Asia’s influence on the world stage.

More importantly, this growing economic might is also translating to geopolitical influence – and over time, it could have a paradigm-shifting impact on the balance of power in the world.

How to Compare Asian Powers

Today’s interactive infographic on the Asia Power Index comes to us from the Lowy Institute, and it introduces a methodology to compare Asian powers using macro categories such as economic resources, military capabilities, cultural influence, diplomatic influence, and defense networks.

Each category is informed by a number of indicators – and there are 114 metrics in total. They include quantifiable numbers from public sources on things like military expenditures, global exports, global investment outflows, number of supercomputers, satellites launched, etc.

Interestingly, all of the data used to score powers in Asia is also contrasted to the United States, which helps give an idea of relative significance.

The Most Powerful Nations

We recommend exploring the interactive piece to get the most out of the data – but here are some meaningful spoilers to start with:

Overall Power

Taking all 114 metrics into consideration puts the U.S. into the #1 spot with a score of 85.0. Right behind are China (75.5), Japan (42.1), India (41.5), Russia (33.3), and then Australia (32.5). The U.S. leads in five categories, but falls behind China in three: Future Trends, Diplomatic Influence, and Economic Relationships.

Economic Resources

In this category, the U.S. and China are neck-and-neck with scores of 91.7 and 91.3 respectively. The next closest Asian powers are well-behind: Japan (32.9), India (26.8), Russia (17.0) and South Korea (17.0).

Military Capability

As expected, the U.S. ranks #1 with 94.6. On the Asian side, we have China (69.9), Russia (61.4), India (48.9), and North Korea (35.8).

Future Trends

This category takes into account future projections on economic growth, military expenditures, and working age population size. Not surprisingly, China ranks #1 here at 83.0. Behind it is the United States (60.0), and India (55.6). Other Asian powers are a ways further down the list, with Indonesia (11.7) and Russia (11.4) being the only other countries with double-digit scores.

For more, we recommend checking out the full-width interactive version provided by the Lowy Institute here.

Economy

The Bloc Effect: International Trade with Geopolitical Allies on the Rise

Rising geopolitical tensions are shaping the future of international trade, but what is the effect on trading among G7 and BRICS countries?

The Bloc Effect: International Trade with Allies on the Rise

International trade has become increasingly fragmented over the last five years as countries have shifted to trading more with their geopolitical allies.

This graphic from The Hinrich Foundation, the first in a three-part series covering the future of trade, provides visual context to the growing divide in trade in G7 and pre-expansion BRICS countries, which are used as proxies for geopolitical blocs.

Trade Shifts in G7 and BRICS Countries

This analysis uses IMF data to examine differences in shares of exports within and between trading blocs from 2018 to 2023. For example, we looked at the percentage of China’s exports with other BRICS members as well as with G7 members to see how these proportions shifted in percentage points (pp) over time.

Countries traded nearly $270 billion more with allies in 2023 compared to 2018. This shift came at the expense of trade with rival blocs, which saw a decline of $314 billion.

Country Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

🇮🇳 India 0.0 3.9

🇷🇺 Russia 0.7 -3.8

🇮🇹 Italy 0.8 -0.7

🇨🇦 Canada 0.9 -0.7

🇫🇷 France 1.0 -1.1

🇪🇺 EU 1.1 -1.5

🇩🇪 Germany 1.4 -2.1

🇿🇦 South Africa 1.5 1.5

🇺🇸 U.S. 1.6 -0.4

🇯🇵 Japan 2.0 -1.7

🇨🇳 China 2.1 -5.2

🇧🇷 Brazil 3.7 -3.3

🇬🇧 UK 10.2 0.5

All shifts reported are in percentage points. For example, the EU saw its share of exports to G7 countries rise from 74.3% in 2018 to 75.4% in 2023, which equates to a 1.1 percentage point increase.

The UK saw the largest uptick in trading with other countries within the G7 (+10.2 percentage points), namely the EU, as the post-Brexit trade slump to the region recovered.

Meanwhile, the U.S.-China trade dispute caused China’s share of exports to the G7 to fall by 5.2 percentage points from 2018 to 2023, the largest decline in our sample set. In fact, partly as a result of the conflict, the U.S. has by far the highest number of harmful tariffs in place.

The Russia-Ukraine War and ensuing sanctions by the West contributed to Russia’s share of exports to the G7 falling by 3.8 percentage points over the same timeframe.

India, South Africa, and the UK bucked the trend and continued to witness advances in exports with the opposing bloc.

Average Trade Shifts of G7 and BRICS Blocs

Though results varied significantly on a country-by-country basis, the broader trend towards favoring geopolitical allies in international trade is clear.

Bloc Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

Average 2.1 -1.1

BRICS 1.6 -1.4

G7 incl. EU 2.4 -1.0

Overall, BRICS countries saw a larger shift away from exports with the other bloc, while for G7 countries the shift within their own bloc was more pronounced. This implies that though BRICS countries are trading less with the G7, they are relying more on trade partners outside their bloc to make up for the lost G7 share.

A Global Shift in International Trade and Geopolitical Proximity

The movement towards strengthening trade relations based on geopolitical proximity is a global trend.

The United Nations categorizes countries along a scale of geopolitical proximity based on UN voting records.

According to the organization’s analysis, international trade between geopolitically close countries rose from the first quarter of 2022 (when Russia first invaded Ukraine) to the third quarter of 2023 by over 6%. Conversely, trade with geopolitically distant countries declined.

The second piece in this series will explore China’s gradual move away from using the U.S. dollar in trade settlements.

Visit the Hinrich Foundation to learn more about the future of geopolitical trade

-

Markets1 week ago

Markets1 week agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

We visualized product categories that saw the highest % increase in price due to U.S. inflation as of March 2024.

-

Economy4 weeks ago

Economy4 weeks agoG20 Inflation Rates: Feb 2024 vs COVID Peak

We visualize inflation rates across G20 countries as of Feb 2024, in the context of their COVID-19 pandemic peak.

-

Economy4 weeks ago

Economy4 weeks agoMapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

-

Markets2 months ago

Markets2 months agoConfidence in the Global Economy, by Country

Will the global economy be stronger in 2024 than in 2023?

-

Maps2 months ago

Maps2 months agoMapped: Breaking Down the $3 Trillion African Economy by Country

The top three economic powerhouses of Africa contribute more than one-third to the African economy. We rank the nations of the world’s second-largest continent by 2024…

-

Green1 week ago

Green1 week agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Technology2 weeks ago

Technology2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075