Finance

Companies Gone Public in 2021: Visualizing IPO Valuations

Companies Gone Public in 2021: Visualizing Valuations

Despite its many tumultuous turns, last year was a productive year for global markets, and companies going public in 2021 benefited.

From much-hyped tech initial public offerings (IPOs) to food and healthcare services, many companies with already large followings have gone public this year. Some were supposed to go public in 2020 but got delayed due to the pandemic, and others saw the opportunity to take advantage of a strong current market.

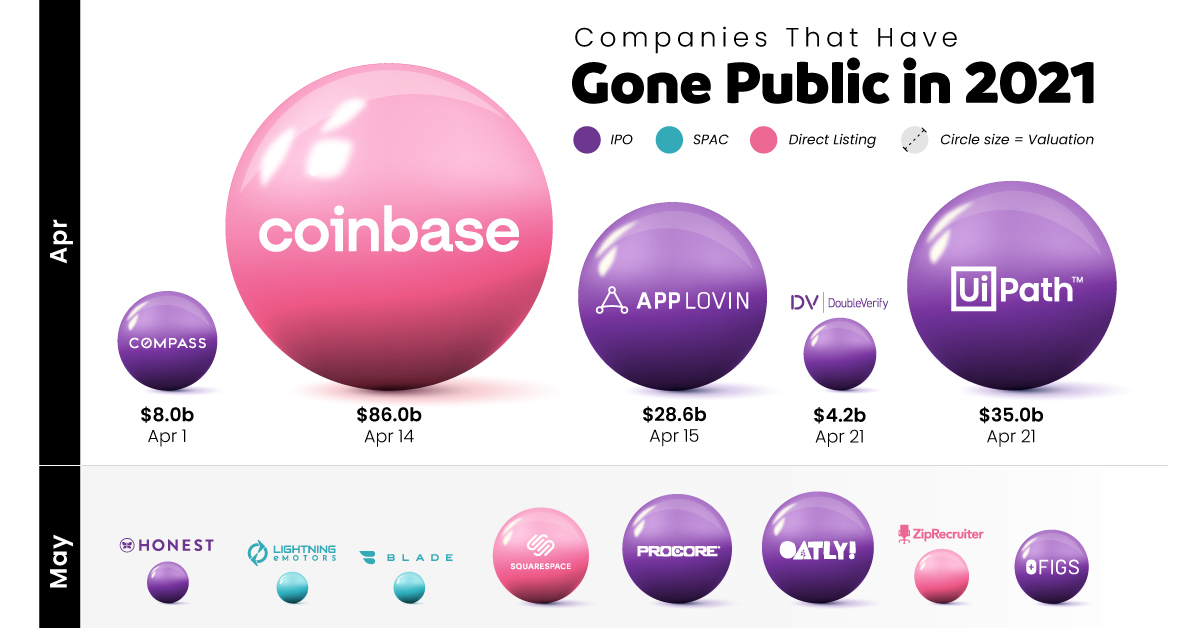

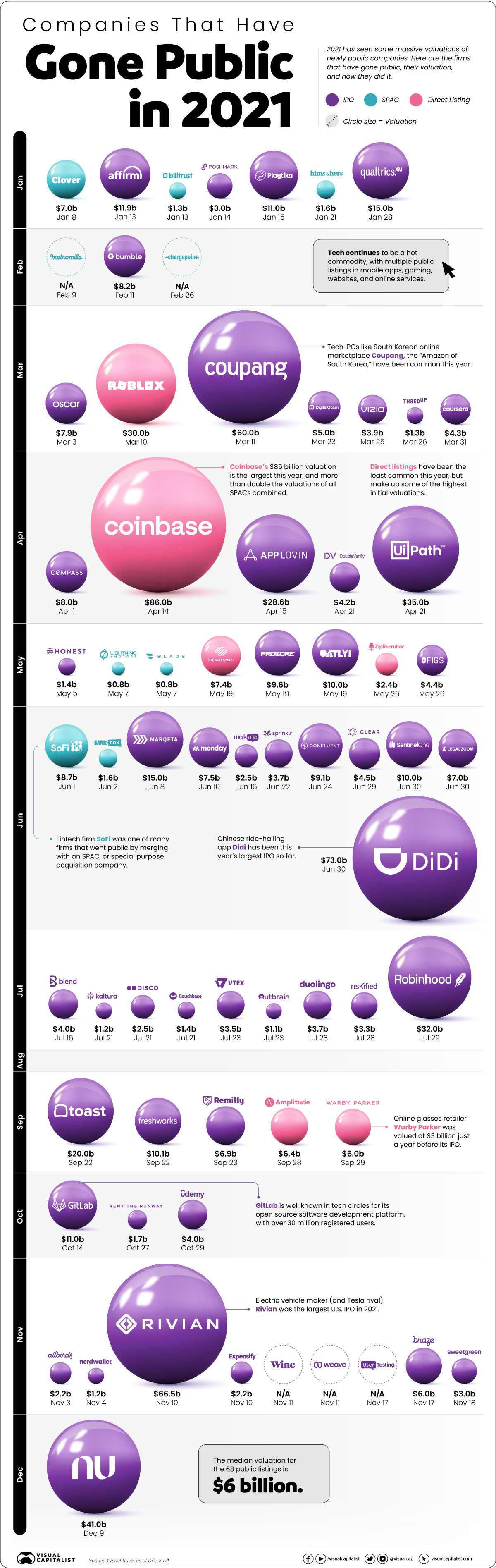

This graphic measures 68 companies that have gone public in 2021 — including IPOs, SPACs, and Direct Listings—as well as their subsequent valuations after listing.

Who’s Gone Public in 2021?

Historically, companies that wanted to go public employed one main method above others: the initial public offering (IPO).

But companies going public today readily choose from one of three different options, depending on market situations, associated costs, and shareholder preference:

- Initial Public Offering (IPO): A private company creates new shares which are underwritten by a financial organization and sold to the public.

- Special Purpose Acquisition Company (SPAC): A separate company with no operations is created strictly to raise capital to acquire the company going public. SPACs are the fastest method of going public, and have become popular in recent years.

- Direct Listing: A private company enters a market with only existing, outstanding shares being traded and no new shares created. The cost is lower than that of an IPO, since no fees need to be paid for underwriting.

The majority of companies going public in 2021 chose the IPO route, but some of the biggest valuations resulted from direct listings.

| Listing Date | Company | Valuation ($B) | Listing Type |

|---|---|---|---|

| 08-Jan-21 | Clover Health | $7.0 | SPAC |

| 13-Jan-21 | Affirm | $11.9 | IPO |

| 13-Jan-21 | Billtrust | $1.3 | SPAC |

| 14-Jan-21 | Poshmark | $3.0 | IPO |

| 15-Jan-21 | Playtika | $11.0 | IPO |

| 21-Jan-21 | Hims and Hers Health | $1.6 | SPAC |

| 28-Jan-21 | Qualtrics | $15.0 | IPO |

| 09-Feb-21 | Metromile | - | SPAC |

| 11-Feb-21 | Bumble | $8.2 | IPO |

| 26-Feb-21 | ChargePoint Holdings | - | SPAC |

| 03-Mar-21 | Oscar Health | $7.9 | IPO |

| 10-Mar-21 | Roblox | $30.0 | Direct Listing |

| 11-Mar-21 | Coupang | $60.0 | IPO |

| 23-Mar-21 | DigitalOcean | $5.0 | IPO |

| 25-Mar-21 | VIZIO | $3.9 | IPO |

| 26-Mar-21 | ThredUp | $1.3 | IPO |

| 31-Mar-21 | Coursera | $4.3 | IPO |

| 01-Apr-21 | Compass | $8.0 | IPO |

| 14-Apr-21 | Coinbase | $86.0 | Direct Listing |

| 15-Apr-21 | AppLovin | $28.6 | IPO |

| 21-Apr-21 | UiPath | $35.0 | IPO |

| 21-Apr-21 | DoubleVerify | $4.2 | IPO |

| 05-May-21 | The Honest Company | $1.4 | IPO |

| 07-May-21 | Lightning eMotors | $0.82 | SPAC |

| 07-May-21 | Blade Air Mobility | $0.83 | SPAC |

| 19-May-21 | Squarespace | $7.4 | Direct Listing |

| 19-May-21 | Procore | $9.6 | IPO |

| 19-May-21 | Oatly | $10.0 | IPO |

| 26-May-21 | ZipRecruiter | $2.4 | Direct Listing |

| 26-May-21 | FIGS | $4.4 | IPO |

| 01-Jun-21 | SoFi | $8.7 | SPAC |

| 02-Jun-21 | BarkBox | $1.6 | SPAC |

| 08-Jun-21 | Marqueta | $15.0 | IPO |

| 10-Jun-21 | Monday.com | $7.5 | IPO |

| 16-Jun-21 | WalkMe | $2.5 | IPO |

| 22-Jun-21 | Sprinklr | $3.7 | IPO |

| 24-Jun-21 | Confluent | $9.1 | IPO |

| 29-Jun-21 | Clear | $4.5 | IPO |

| 30-Jun-21 | SentinelOne | $10.0 | IPO |

| 30-Jun-21 | LegalZoom | $7.0 | IPO |

| 30-Jun-21 | Didi Chuxing | $73.0 | IPO |

| 16-Jul-21 | Blend | $4 | IPO |

| 21-Jul-21 | Kaltura | $1.24 | IPO |

| 21-Jul-21 | DISCO | $2.5 | IPO |

| 21-Jul-21 | Couchbase | $1.4 | IPO |

| 23-Jul-21 | Vtex | $3.5 | IPO |

| 23-Jul-21 | Outbrain | $1.1 | IPO |

| 28-Jul-21 | Duolingo | $3.7 | IPO |

| 28-Jul-21 | Riskified | $3.3 | IPO |

| 29-Jul-21 | Robinhood | $32.0 | IPO |

| 22-Sep-21 | Toast | $22.0 | IPO |

| 22-Sep-21 | Freshworks | $10.1 | IPO |

| 23-Sep-21 | Remitly | $6.9 | IPO |

| 28-Sep-21 | Amplitude | $6.4 | Direct Listing |

| 29-Sep-21 | Warby Parker | $6.0 | Direct Listing |

| 14-Oct-21 | GitLab | $11.0 | IPO |

| 27-Oct-21 | Rent the Runway | $1.7 | IPO |

| 29-Oct-21 | Udemy | $4.0 | IPO |

| 03-Nov-21 | Allbirds | $2.2 | IPO |

| 04-Nov-21 | NerdWallet | $1.2 | IPO |

| 10-Nov-21 | Rivian | $66.5 | IPO |

| 10-Nov-21 | Expensify | $2.2 | IPO |

| 11-Nov-21 | Winc | - | IPO |

| 11-Nov-21 | Weave | - | IPO |

| 17-Nov-21 | UserTesting | - | IPO |

| 17-Nov-21 | Braze | $6.0 | IPO |

| 18-Nov-21 | Sweetgreen | $3.0 | IPO |

| 09-Dec-21 | Nubank | $41.0 | IPO |

Though there are many well-known names in the list, one of the biggest through lines continues to be the importance of tech.

A majority of 2021’s newly public companies have been in tech, including multiple mobile apps, websites, and online services. The two biggest IPOs so far were South Korea’s Coupang, an online marketplace valued at $60 billion after going public, and China’s ride-hailing app Didi Chuxing, the year’s largest post-IPO valuation at $73 billion.

And there were many apps and services going public through other means as well. Gaming company Roblox went public through a direct listing, earning a valuation of $30 billion, and cryptocurrency platform Coinbase has earned the year’s largest valuation so far, with an $86 billion valuation following its direct listing.

Big Companies Going Public in 2022

As with every year, some of the biggest companies going public were lined up for the later half.

Tech will continue to be the talk of the markets. Payment processing firm Stripe was setting up to be the year’s biggest IPO with an estimated valuation of $95 billion, but got delayed. Likewise, online grocery delivery platform InstaCart, which saw a big upswing in traction due to the pandemic, has been looking to go public at a valuation of at least $39 billion.

Of course, it’s common that potential public listings and offerings fall through. Whether they get delayed due to weak market conditions or cancelled at the last minute, anything can happen when it comes to public markets.

This post has been updated as of January 1, 2022.

Business

Visualizing the Revenue of the Big Four Accounting Firms

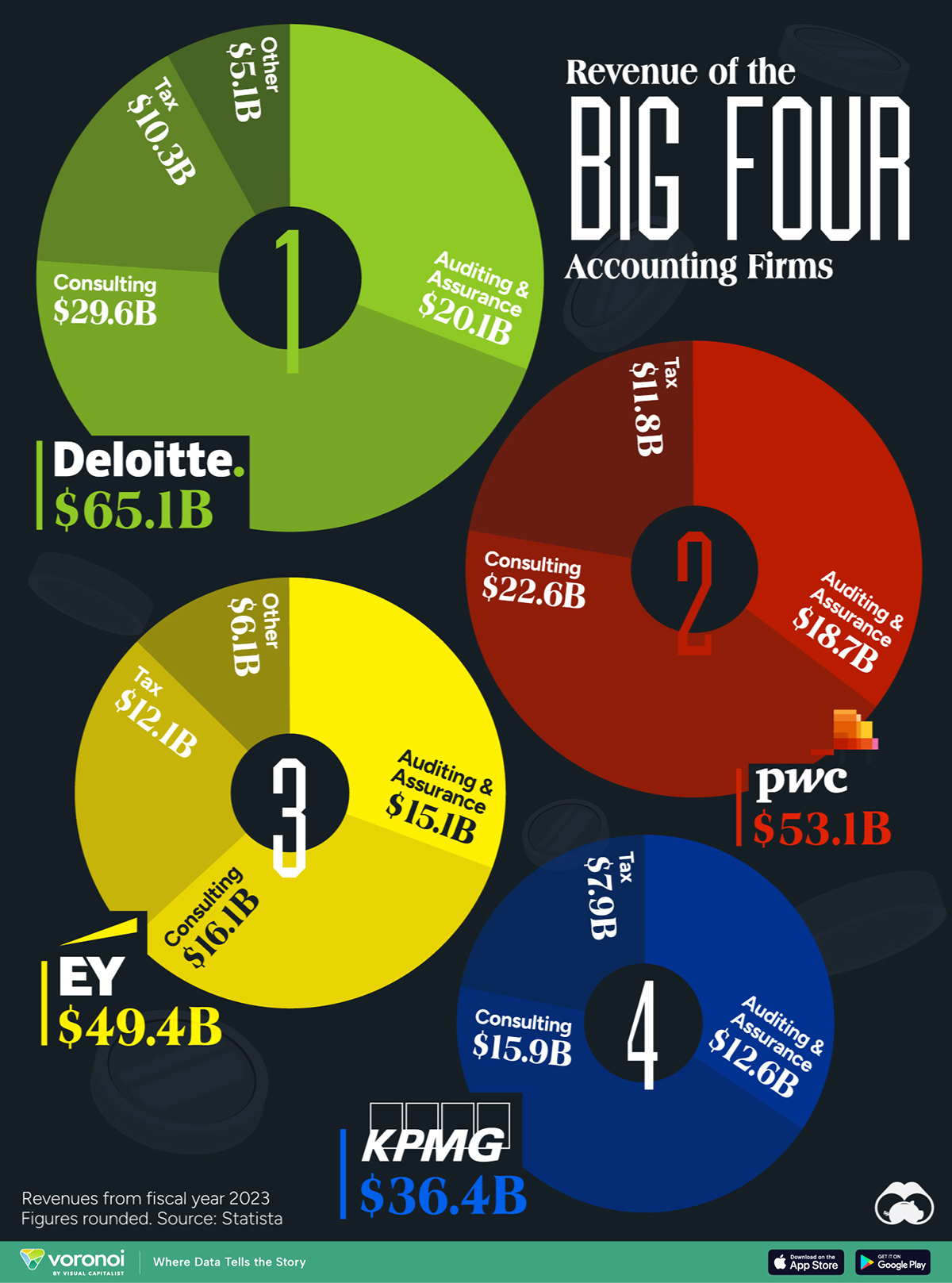

The Big Four accounting firms amassed over $200 billion in combined revenue in 2023.

Visualizing the Revenue of the Big Four Accounting Firms

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

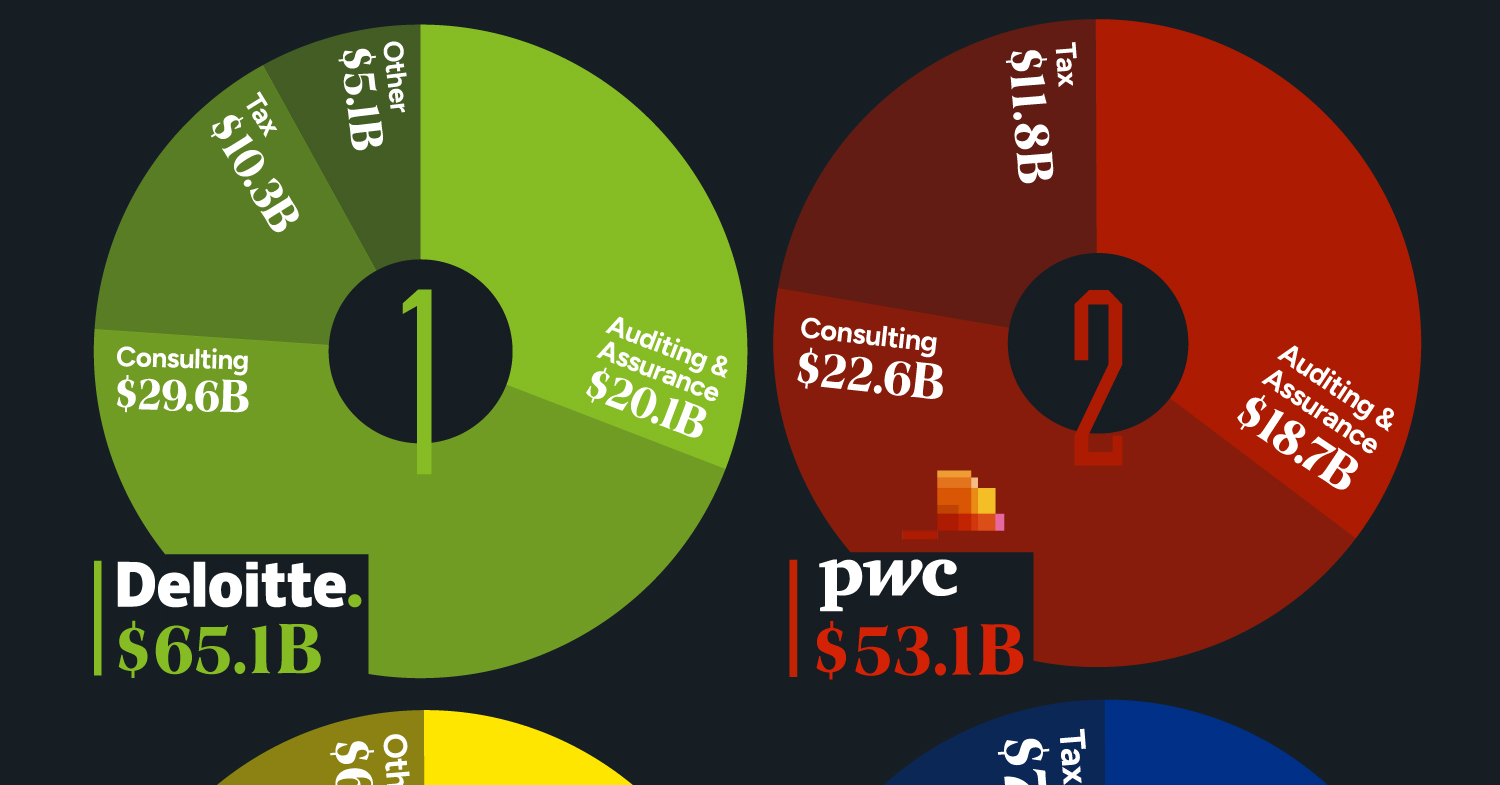

The Big Four accounting firms – Deloitte, Ernst & Young (EY), PricewaterhouseCoopers (PwC), and KPMG – have solidified their positions as global industry leaders, boasting a combined revenue exceeding $200 billion in 2023.

Together, these firms audit the majority of publicly traded companies worldwide.

This infographic details the revenues of the “Big Four” accounting firms for the fiscal year 2023, based on data from Statista.

Deloitte Leads the Big Four in 2023 Revenues

Offering diverse services, the Big Four specialize in auditing and assurance, ensuring financial transparency, and regulatory compliance for their clients. Additionally, they provide strategic consulting services. All four are legally headquartered in the UK and command a dominant global market share.

| Company | Auditing & Assurance | Consulting | Tax | Other | Total ($ billions) |

|---|---|---|---|---|---|

| Deloitte | $20.1 | $29.6 | $10.3 | $5.1 | $65.1 |

| PwC | $18.7 | $22.6 | $11.8 | $53.1 | |

| EY | $15.1 | $16.1 | $12.1 | $6.1 | $49.4 |

| KPMG | $12.6 | $15.9 | $7.9 | $36.4 |

Interestingly, the largest accounting firms were formerly known as the “Big Eight,” but mergers and closures starting in the late 1980s have reduced their number to four.

The original group consisted of Arthur Andersen, Arthur Young, Coopers & Lybrand, Deloitte Haskin & Sells, Ernst & Whinney, Peat Marwick Mitchell, Price Waterhouse, and Touche Ross, all headquartered in the U.S. or UK.

Arthur Young merged with Ernst & Whinney, and Deloitte Haskin & Sells combined with Touche Ross. Subsequently, Price Waterhouse and Coopers & Lybrand merged their practices, reducing the count to five. However, following the collapse of Arthur Andersen due to its involvement in the Enron scandal, the “Big Five” became the present-day four.

The Scale of the Big Four

Deloitte is the largest in terms of headcount, with over 456,000 employees as of FY2023, followed by Ernst & Young with more than 395,000 workers, and PwC with 364,000. Despite being the smallest among the four, KPMG still has 298,356 employees.

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes