Energy

Cobalt: A Precarious Supply Chain

Cobalt: A Precarious Supply Chain

How does your mobile phone last for 12 hours on just one charge?

It’s the power of cobalt, along with several other energy metals, that keeps your lithium-ion battery running.

The only problem? Getting the metal from the source to your electronics is not an easy feat, and this makes for an extremely precarious supply chain for manufacturers.

Our infographic today comes to us from LiCo Energy Metals, and it focuses on where this important ingredient of green technology originates from, and the supply risks associated with its main sources.

What is Cobalt?

Cobalt is a transition metal found between iron and nickel on the periodic table. It has a high melting point (1493°C) and retains its strength to a high temperature.

Similar to iron or nickel, cobalt is ferromagnetic. It can retain its magnetic properties to 1100°C, a higher temperature than any other material. Ferromagnetism is the strongest type of magneticism: it’s the only one that typically creates forces strong enough to be felt, and is responsible for the magnets encountered in everyday life.

These unique properties make the metal perfect for two specialized high-tech purposes: superalloys and battery cathodes.

Superalloys

High-performance alloys drive 18% of cobalt demand. The metal’s ability to withstand intense temperatures and conditions makes it perfect for use in:

- Turbine blades

- Jet engines

- Gas turbines

- Prosthetics

- Permanent magnets

Lithium-ion Batteries:

Batteries drives 49% of demand – and most of this comes from cobalt’s usage in lithium-ion battery cathodes:

| Type of lithium-ion cathode | Cobalt in cathode | Spec. energy (Wh/kg) |

|---|---|---|

| LFP | 0% | 120 |

| LMO | 0% | 140 |

| NMC | 15% | 200 |

| LCO | 55% | 200 |

| NCA | 10% | 245 |

The three most powerful cathode formulations for li-ion batteries all need cobalt. As a result, the metal is indispensable in many of today’s battery-powered devices.

- Mobile phones (LCO)

- Tesla Model S (NCA)

- Tesla Powerwall (NMC)

- Chevy Volt (NMC/LMO)

The Tesla Powerwall 2 uses approximately 7kg, and a Tesla Model S (90 kWh) uses approximately 22.5kg of the energy metal.

The Cobalt Supply Chain

Cobalt production has gone almost straight up to meet demand, and production has more than doubled since the early 2000s.

But while the metal is desired, getting it is the hard part:

1. No native cobalt has ever been found in nature.

There are four widely-distributed ores that exist, but almost no cobalt is mined from them as a primary source.

2. Most cobalt production is mined as a by-product.

| Mine source | % cobalt production |

|---|---|

| Nickel (by-product) | 60% |

| Copper (by-product) | 38% |

| Cobalt (primary) | 2% |

This means it is hard to expand production when more is needed.

3. Most production occurs in the DRC, a country with elevated supply risks:

| Country | Tonnes | % |

|---|---|---|

| United States | 524 | 0.4% |

| China | 1,417 | 1.2% |

| DRC | 67,975 | 55.4% |

| Rest of World | 52,785 | 43.0% |

| Total | 122,701 | 100.0% |

(Source: CRU, estimated production for 2017, tonnes)

The Future of Cobalt Supply

Companies like Tesla and Panasonic need reliable sources of the metal, and right now there aren’t many failsafes.

The U.S. hasn’t mined cobalt in significant volumes since 1971, and the USGS reports that the United States only has 301 tonnes of the metal stored in stockpiles.

The reality is that the DRC produces about half of all cobalt, and it also holds approximately 47% of all global reserves.

Why is this a concern for end-users?

1. The DRC is one of the poorest, corrupt, and most coercive countries in the planet.

It ranks:

- 151st out of 159 countries in the Human Freedom Index

- 176th out of 188 countries on the Human Development Index

- 178th out of 184 countries in terms of GDP per capita ($455)

- 148th out of 169 countries in the Corruption Perceptions Index

2. The DRC has had more deaths from war since WWII than any other country on the planet.

Recent wars in the DRC:

- First Congo War (1996-1997) – A foreign invasion by Rwanda that overthrew the Mobutu regime.

- Second Congo War (1998-2003) – The bloodiest conflict in world history since WW2 with 5.4 million deaths.

3. Human Rights in Mining

The DRC government estimates that 20% of all cobalt production in the country comes from artisanal miners – independent workers who dig holes and mine ore without sophisticated mines or machinery.

There are at least 100,000 artisanal cobalt miners in the DRC, and UNICEF estimates that up to 40,000 children could be in the trade. Children can be as young as seven years old, and they can work up to 12 hrs with physically demanding work, earning $2 per day.

Meanwhile, Amnesty International alleges that Apple, Samsung, and Sony fail to do basic checks in making sure the metal in their supply chains did not come from child labor.

Most major companies have vowed that any such practices will not be tolerated in their supply chains.

Other Sources

Where will tomorrow’s supply come from, and will the role of the DRC eventually diminish? Will Tesla achieve its goal of a North American supply chain for its key metal inputs?

Mining exploration companies are already looking to regions like Ontario, Idaho, British Columbia, and the Northwest Territories to find tomorrow’s deposits:

Ontario: Ontario is one of the only places in the world where cobalt-primary mines that have existed. This camp is nearby the aptly named town of Cobalt, Ontario, which is located halfway between Sudbury – the world’s “Nickel Capital”, and Val-d’Or, one of the most famous gold camps in the world.

Idaho: Idaho is known as the “Gem State” while also being known for its silver camps in Couer D’Alene – but it has also been a cobalt producer in the past.

BC: The mountains of British Columbia are known for their rich gold, silver, copper, zinc, and met coal deposits. But cobalt often occurs with copper, and some mines in BC have produced cobalt in the past.

Northwest Territories: Cobalt can also be found up north, as the NWT becomes a more interesting mineral destination for companies. 160km from Yellowknife is a gold-cobalt-bismuth-copper deposit being developed.

Energy

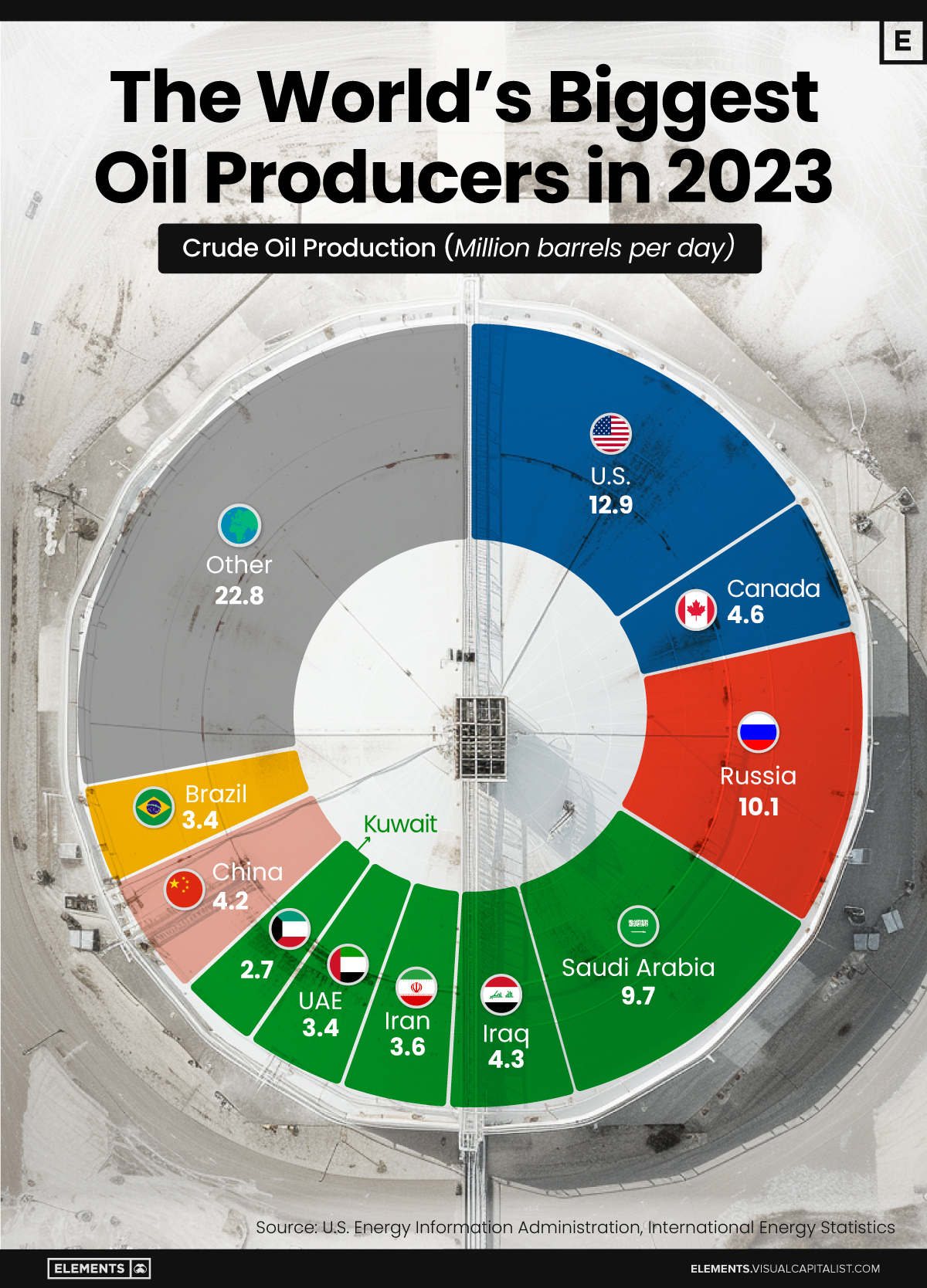

The World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

The World’s Biggest Oil Producers in 2023

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email.

Despite efforts to decarbonize the global economy, oil still remains one of the world’s most important resources. It’s also produced by a fairly limited group of countries, which can be a source of economic and political leverage.

This graphic illustrates global crude oil production in 2023, measured in million barrels per day, sourced from the U.S. Energy Information Administration (EIA).

Three Countries Account for 40% of Global Oil Production

In 2023, the United States, Russia, and Saudi Arabia collectively contributed 32.7 million barrels per day to global oil production.

| Oil Production 2023 | Million barrels per day |

|---|---|

| 🇺🇸 U.S. | 12.9 |

| 🇷🇺 Russia | 10.1 |

| 🇸🇦 Saudi Arabia | 9.7 |

| 🇨🇦 Canada | 4.6 |

| 🇮🇶 Iraq | 4.3 |

| 🇨🇳 China | 4.2 |

| 🇮🇷 Iran | 3.6 |

| 🇧🇷 Brazil | 3.4 |

| 🇦🇪 UAE | 3.4 |

| 🇰🇼 Kuwait | 2.7 |

| 🌍 Other | 22.8 |

These three nations have consistently dominated oil production since 1971. The leading position, however, has alternated among them over the past five decades.

In contrast, the combined production of the next three largest producers—Canada, Iraq, and China—reached 13.1 million barrels per day in 2023, just surpassing the production of the United States alone.

In the near term, no country is likely to surpass the record production achieved by the U.S. in 2023, as no other producer has ever reached a daily capacity of 13.0 million barrels. Recently, Saudi Arabia’s state-owned Saudi Aramco scrapped plans to increase production capacity to 13.0 million barrels per day by 2027.

In 2024, analysts forecast that the U.S. will maintain its position as the top oil producer. In fact, according to Macquarie Group, U.S. oil production is expected to achieve a record pace of about 14 million barrels per day by the end of the year.

-

Misc2 weeks ago

Misc2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners