Climate Investing: What it is, What’s Propelling it, and Where to Start

The following content is sponsored by iShares by BlackRock.

Climate Investing: What it is and Where to Start

Across all sustainability issues, 88% of global investors rated the environment as the number one priority. Clearly, investors are recognising the urgency of climate change and the need for related investing strategies.

In this graphic from iShares by BlackRock, we define climate investing, the forces giving it momentum, and how investors can begin to implement it in their own portfolios.

What is Climate Investing?

Climate investing involves selecting sustainable strategies where climate risks and/or opportunities are key considerations. This helps investors align their portfolios with the transition to a low carbon economy.

What’s Propelling it?

There are a number of long-term structural forces accelerating the shift to climate investing.

- Extreme weather damage: In 2020 alone, damages from natural disasters hit $210 billion—the highest amount ever recorded.

- Global climate regulations: Around the world, 134 countries have made a carbon neutral pledge.

- Clean energy innovations: Renewable energy is getting cheaper, with production costs of solar photovoltaic technology falling 89% between 2009 and 2019.

- Favourable investor sentiment: Almost two-thirds of people in 50 countries believe climate change is a global emergency.

In response to this momentum, the number of companies disclosing on climate change has almost doubled in the last five years. This transparency can enable investors to make more informed decisions.

How Can Investors Navigate This Fast-moving Transition With ETFs?

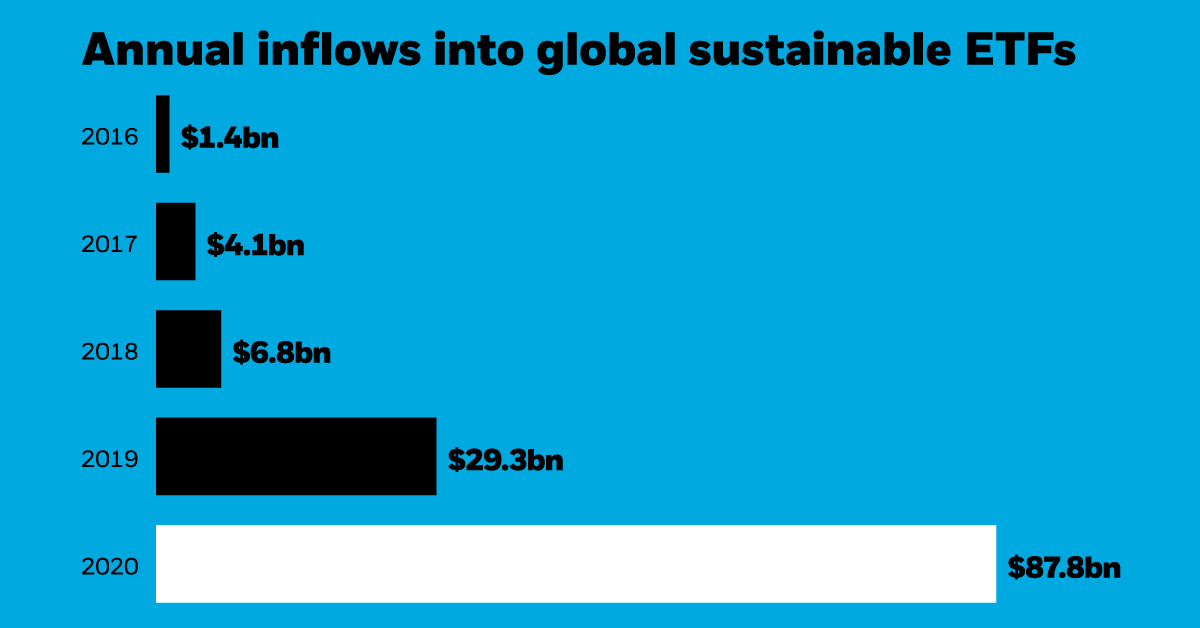

New products with climate considerations are helping investors with the transition, and one widely available vehicle is Exchange Traded Funds (ETFs). In fact, annual inflows into global sustainable ETFs have grown substantially.

| Year | Annual Inflows |

|---|---|

| 2016 | $1.4B |

| 2017 | $4.1B |

| 2018 | $6.8B |

| 2019 | $29.3B |

| 2020 | $87.8B |

In 2020, inflows into sustainable ETFs were 63 times higher than they were in 2016. ETFs are a useful tool because they offer the transparency investors need to pursue specific financial and climate goals.

The Three Climate Investing Approaches

Within sustainable ETFs, there are a range of funds that incorporate climate considerations. To bring clarity to this space, BlackRock has categorised climate investing into three key approaches:

- Reduce exposure to carbon emissions or fossil fuels. For example, this could involve minimising or eliminating companies that have high carbon emissions relative to their sector peers.

- Prioritise companies based on climate risks and opportunities. In practice, this could mean increasing the weighting of companies based on their commitments to align with Paris Agreement temperature goals.

- Target climate themes and impact outcomes. For example, an investor could invest in a specific sustainable activity or project, such as clean energy.

“We believe that the biggest potential benefits will accrue to the global investors who are quickest to ready their portfolio for the new era of climate investing.”

—Manuela Sperandeo, EMEA Head of Sustainable Indexing at BlackRock

No matter an investor’s approach, iShares believes that they can help catalyse the shift to sustainable investing.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.