Base Metals

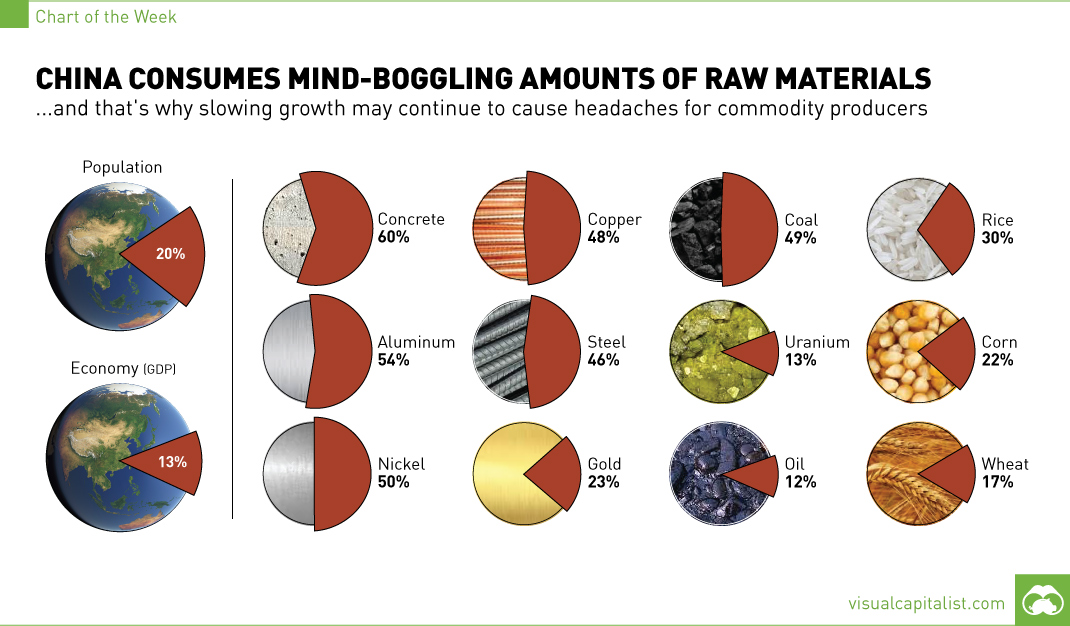

China Consumes Mind-Boggling Amounts of Raw Materials [Chart]

![China Consumes Mind-Boggling Amounts of Raw Materials [Chart]](https://www.visualcapitalist.com/wp-content/uploads/2015/09/chart-china-consumption-raw-materials11.jpg)

China Consumes Mind-Boggling Amounts of Raw Materials [Chart]

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Over the last 20 years, the world economy has relied on the Chinese economic growth engine more than it would like to admit. The 1.4 billion people living in the world’s most populous country account for 13% of global GDP, which is significant no matter how it is interpreted. However, in the commodity sector, China has another magnitude of importance. The fact is that China consumes mind-bending amounts of materials, energy, and food. That’s why the prospect of slowing Chinese growth is likely to continue as a source of nightmares for investors focused on the commodity sector.

The country consumes a big proportion of the world’s materials used in infrastructure. It consumes 54% of aluminum, 48% of copper, 50% of nickel, 45% of all steel, and 60% of concrete. In fact, the country has consumed more concrete in the last three years than the United States did in all of the 20th century.

China is also prolific in accumulating precious metals – the country buys or mines 23% of gold and 15% of the world’s silver supply.

With many mouths to feed, China also needs large amounts of food. About 30% of rice, 22% of corn, and 17% of wheat gets eaten by the Chinese.

Lastly, the country is no hack in terms of burning fuel either. Notably, China uses 49% of coal for power generation as well as metallurgical processes in making steel. It also uses 13% of the world’s uranium and 12% of all oil.

These facts really hit home to show how important China is to the global consumption of raw materials. If China is unable to navigate its tricky transition to a consumer-driven economy and has a “hard landing”, it will be unlikely to see any growth in commodity prices triggered from the demand side. That said, supply is equally as important and it tells a different story: with companies like Glencore cutting copper production by 400,000 tons to better service its massive debt, the floor for commodities could be in.

Mining

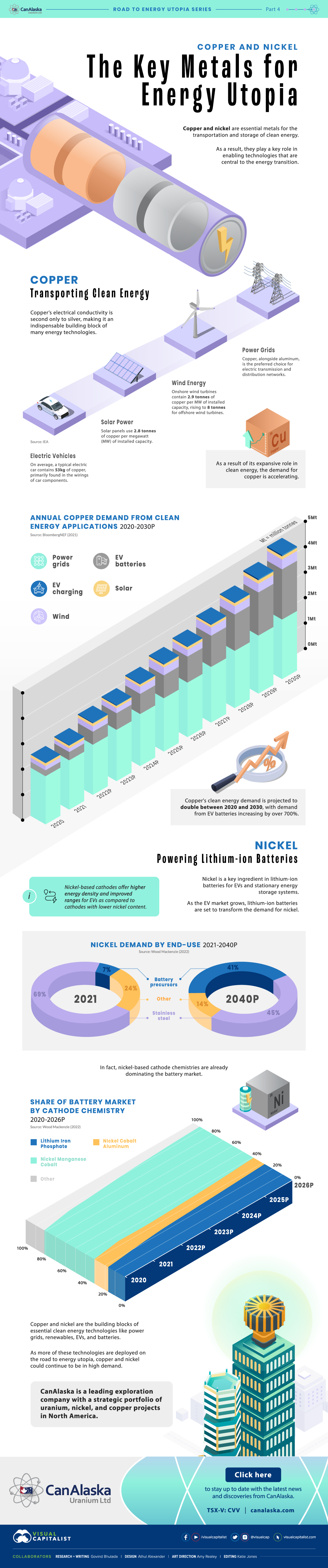

Why Copper and Nickel Are the Key Metals for Energy Utopia

With more renewables and EVs plugging into the grid, copper and nickel are essential building blocks for the energy transition.

Copper and Nickel: The Key Metals for Energy Utopia

The raw materials required to transport and store clean energy are critical for the energy transition. Copper and nickel are two such metals.

Copper is essential for the transmission and distribution of clean electricity, while nickel powers lithium-ion batteries for EVs and energy storage systems.

The above infographic sponsored by CanAlaska Uranium explores how copper and nickel are enabling green technologies and highlights why they are essential for a utopian energy future.

Copper: Transporting Clean Energy

When it comes to conducting electricity, copper is second only to silver. This property makes it an indispensable building block for multiple energy technologies, including:

- Electric vehicles: On average, a typical electric car contains 53kg of copper, primarily found in the wirings and car components.

- Solar power: Solar panels use 2.8 tonnes of copper per megawatt (MW) of installed capacity, mainly for heat exchangers, wiring, and cabling.

- Wind energy: Onshore wind turbines contain 2.9 tonnes of copper per MW of capacity. Offshore wind turbines, which typically use copper in undersea cables, use 8 tonnes per MW.

- Power grids: Copper, alongside aluminum, is the preferred choice for electric transmission and distribution networks due to its reliability and efficiency.

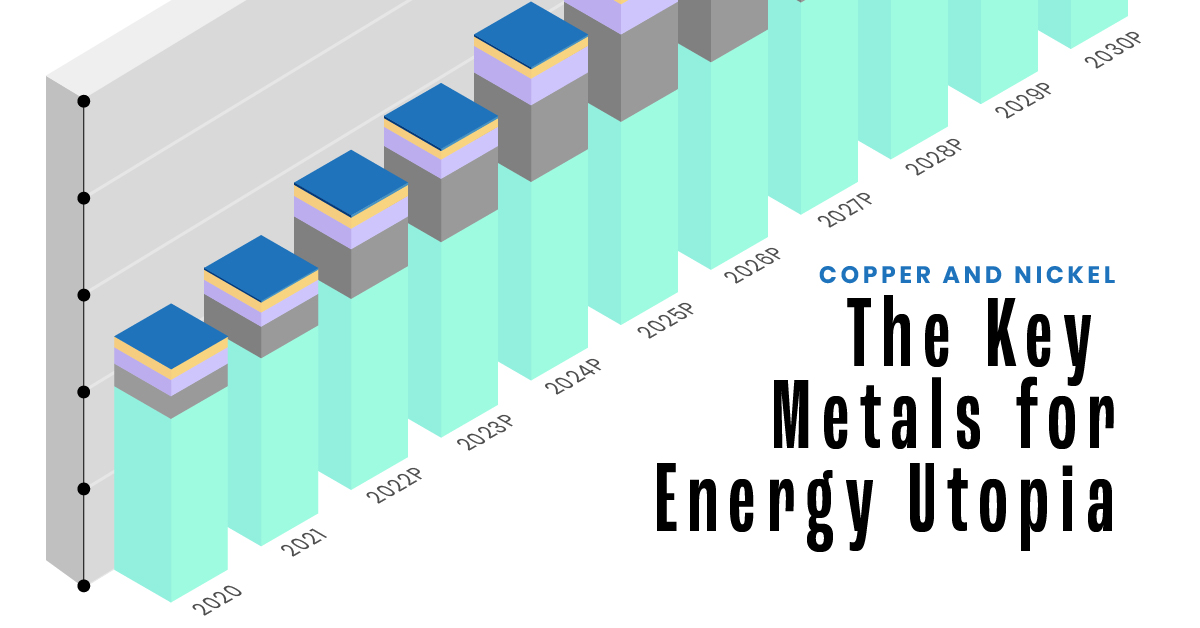

BloombergNEF projects that, due to its expansive role in clean energy, the demand for copper from clean energy applications will double by 2030 from 2020 levels. The table below compares annual copper demand from clean energy, in tonnes, in 2020 vs. 2030:

| Year | Power Grids | EV batteries | Wind | Solar | EV charging | Total (tonnes) |

|---|---|---|---|---|---|---|

| 2020 | 1,700,000 | 210,000 | 165,000 | 83,000 | 4,200 | 2,162,200 |

| 2030P | 2,000,000 | 1,800,000 | 352,000 | 104,000 | 47,100 | 4,303,100 |

Although power grids will account for the largest portion of annual copper demand through 2030, EV batteries are projected to spearhead the growth.

Nickel: Powering Lithium-ion Batteries

Nickel is a key ingredient in lithium-ion batteries for EVs and stationary energy storage systems. For EVs, nickel-based cathodes offer more energy density and longer driving ranges as compared to cathodes with lower nickel content.

According to Wood Mackenzie, batteries could account for 41% of global nickel demand by 2030, up from just 7% in 2021.

| End-use | 2021 % of Nickel Demand | 2040P % of Nickel Demand |

|---|---|---|

| Stainless steel | 69% | 45% |

| Battery precursors | 7% | 41% |

| Other | 24% | 14% |

Nickel-based cathodes for lithium-ion batteries, including NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum), are prevalent in EVs and make up more than 50% of the battery cathode chemistry market.

A Bright Future for Copper and Nickel

Both copper and nickel are essential building blocks of EVs and other key technologies for the energy transition and ultimately energy utopia.

As more such technologies are deployed, these metals are likely to be in high demand, with clean energy applications supplementing their existing industrial uses.

CanAlaska is a leading exploration company with a strategic portfolio of uranium, nickel, and copper projects in North America. Click here to learn more.

-

Mining2 days ago

Mining2 days agoGold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

While the price of gold has reached new record highs in 2024, gold mining stocks are still far from their 2011 peaks.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Markets3 months ago

Markets3 months agoThe Periodic Table of Commodity Returns (2014-2023)

Commodity returns in 2023 took a hit. This graphic shows the performance of commodities like gold, oil, nickel, and corn over the last decade.

-

Strategic Metals3 months ago

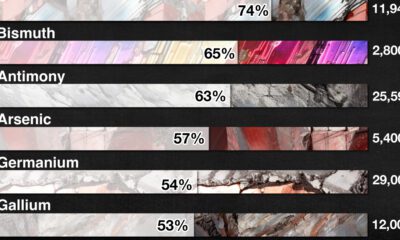

Strategic Metals3 months agoChina Dominates the Supply of U.S. Critical Minerals List

The U.S. Geological Survey estimates that in 2022, China was the world’s leading producer of 30 out of 50 entries on the U.S. critical minerals list.

-

Mining5 months ago

Mining5 months agoThe Critical Minerals to China, EU, and U.S. National Security

Ten materials, including cobalt, lithium, graphite, and rare earths, are deemed critical by all three.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?