Datastream

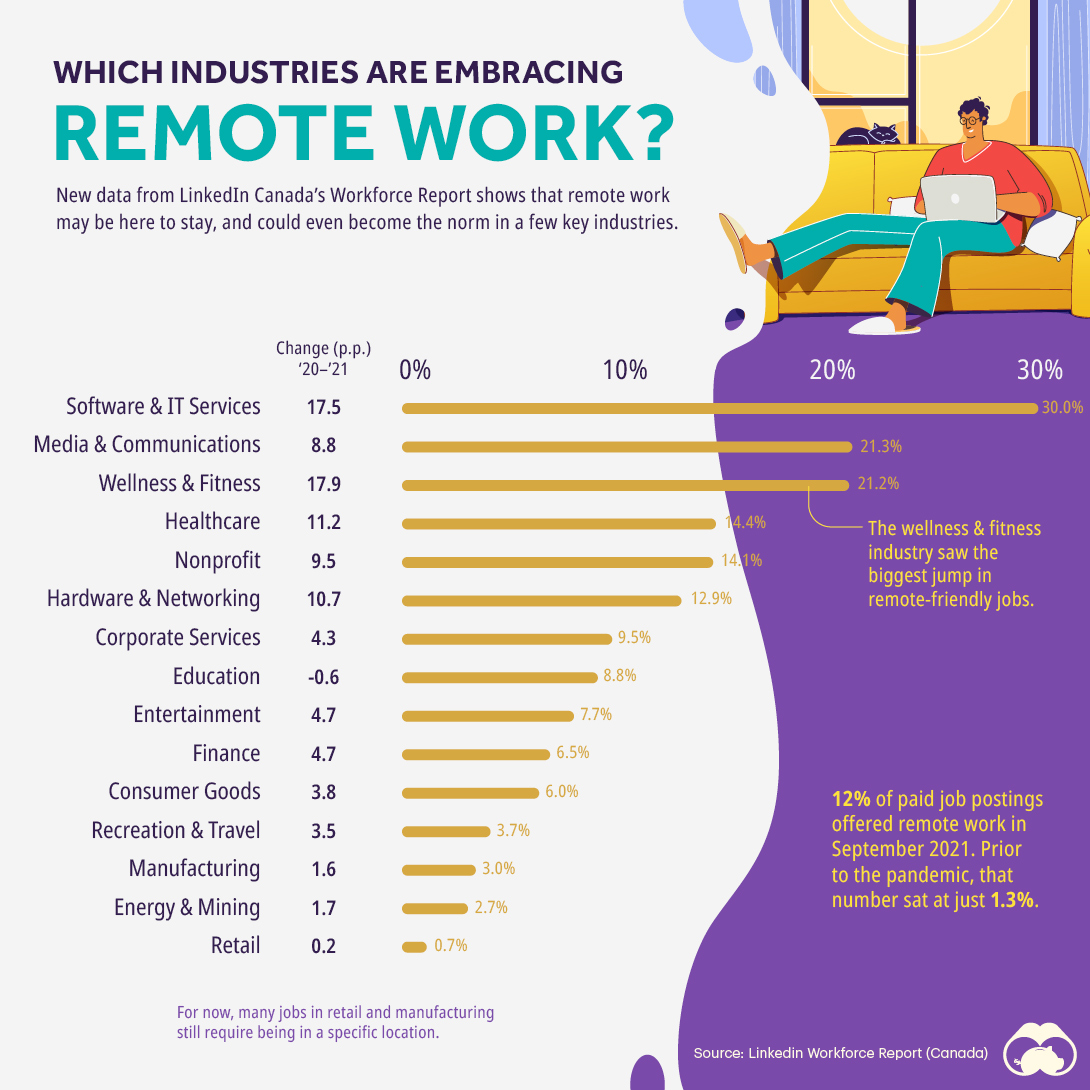

Charting the Continued Rise of Remote Jobs

The Briefing

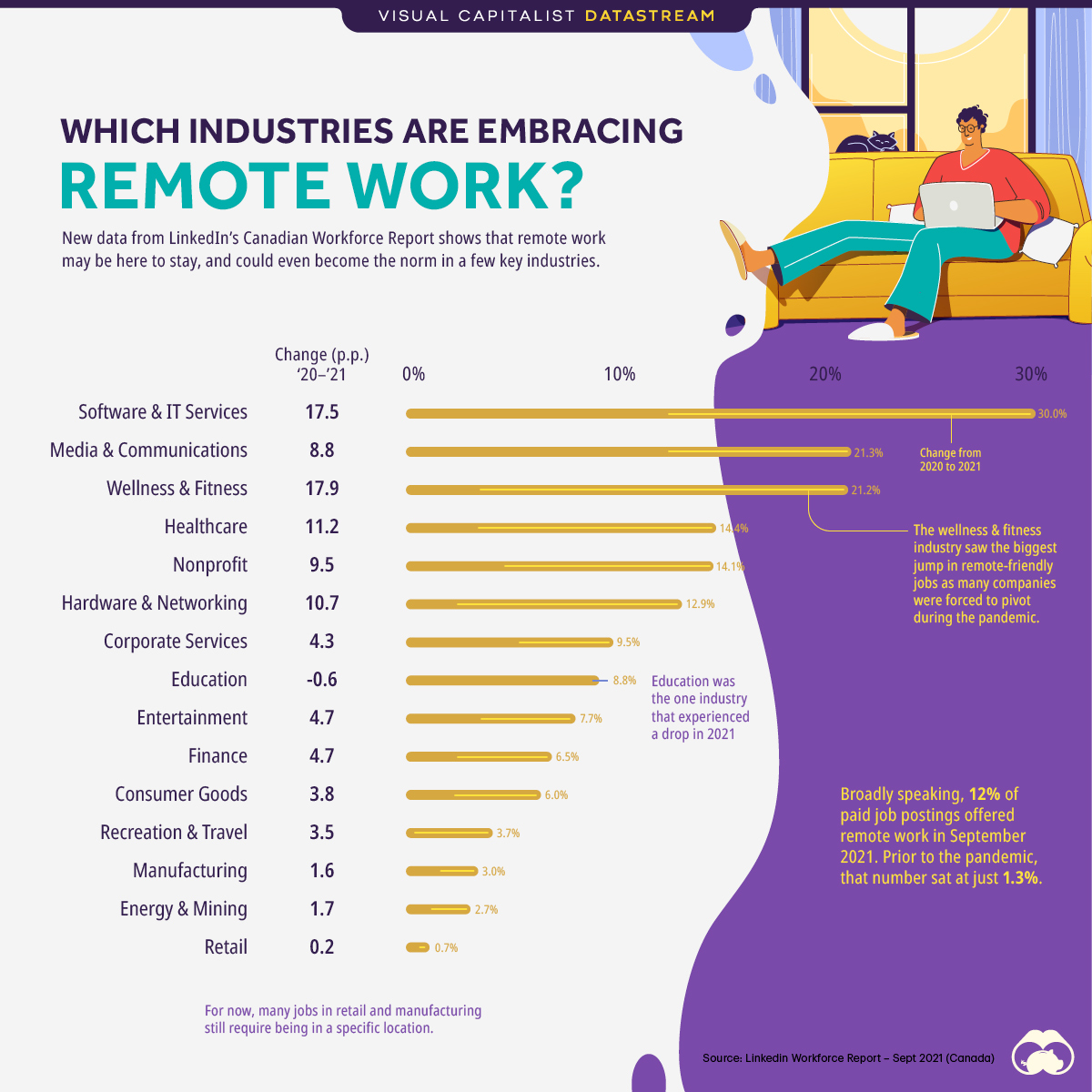

- Four industries saw massive growth in the proportion of remote-friendly job postings

- Nearly one-third of new software and IT service jobs are listed as remote / work-from-home

Charting the Continued Rise of Remote Jobs

When the pandemic first took hold in 2020, and many workplaces around the world closed their doors, a grand experiment in work-from-home began.

Today, well over a year after the first lockdown measures were put in place, there are still lingering questions about whether remote work would now become a commonplace option, or whether things would generally return to the status quo in offices around the world.

New data from LinkedIn’s Workforce Report shows that remote work may be here to stay, and could even become the norm in a few key industries.

Broadly speaking, 12% of all Canadian paid job postings on LinkedIn offered remote work in September 2021. Prior to the pandemic, that number sat at just 1.3%.

While this data was specific to Canada, the country’s similarity to the U.S. means that these trends are likely being seen across the border as well.

Which Industries are Embracing Remote Work?

The nature of work can vary broadly by job type—for example, mining is tough to do from one’s living room sofa—so remote jobs were not distributed equally across industries.

Here are the numbers on job postings that were geared towards remote work:

| Industry | % Remote (Sept 2020) | % Remote (Sept 2021) | Change (p.p.) |

|---|---|---|---|

| Software & IT Services | 12.5% | 30.0% | 17.5 |

| Media & Communications | 12.5% | 21.3% | 8.8 |

| Wellness & Fitness | 3.3% | 21.2% | 17.9 |

| Healthcare | 3.2% | 14.4% | 11.2 |

| Nonprofit | 4.6% | 14.1% | 9.5 |

| Hardware & Networking | 2.2% | 12.9% | 10.7 |

| Corporate Services | 5.2% | 9.5% | 4.3 |

| Education | 9.4% | 8.8% | -0.6 |

| Entertainment | 3.0% | 7.7% | 4.7 |

| Finance | 1.8% | 6.5% | 4.7 |

| Consumer Goods | 2.2% | 6.0% | 3.8 |

| Recreation & Travel | 0.2% | 3.7% | 3.5 |

| Manufacturing | 1.4% | 3.0% | 1.6 |

| Energy & Mining | 1.0% | 2.7% | 1.7 |

| Retail | 0.5% | 0.7% | 0.2 |

Tech and healthcare industries are showing big shifts towards remote work, with the latter being influenced by a number of tech-driven changes, including telemedicine.

Physical distancing measures forced some industries to pivot quickly. Whether virtual fitness and wellness options (e.g. Peloton and Headspace) would remain popular beyond the pandemic was a big question mark, but this jobs data seems to indicate continued digital growth in these industries.

What the Future Holds

Since COVID-19 outbreaks are still underway, the true test for this trend will be whether these numbers hold up a year or two from now. When offices and gyms are reliably open again, will companies dial back the work-from-home options?

Today, hybrid solutions are proving popular amidst worries that fully distributed teams suffer from lower levels of collaboration and communication between colleagues, and that innovation could be stifled by lack of in-person collaboration.

Of course, employees themselves are reporting being more productive and happy at home, with 98% of people wanting the option to work remotely for the rest of their careers.

It’s clear that the culture of work is undergoing an evolution today, and companies and employees will continue to seek the perfect balance of productivity and happiness.

Where does this data come from?

Source: LinkedIn’s Workforce Report for September 2021 (Canada)

Data Note: LinkedIn analyzed hundreds of thousands of paid remote job postings in Canada posted on LinkedIn between February 2020 and September 21, 2021. A “remote job” is defined as one where either the job poster explicitly labeled it as “remote” or if the job contained keywords like “work from home” in the listing.

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001