Chart: How Much Gold is in the World?

The following content is sponsored by Kalo Gold.

How Much Gold is in the World?

Gold has retained its value throughout history, partly due to the fact that it is indestructible.

That means that virtually all the gold in the world that has been mined is still around in one form or another. Some of it may have turned into jewelry, while some might be sitting inside vaults as bullion. So, just how much gold have we mined, and how much of it is left beneath the ground?

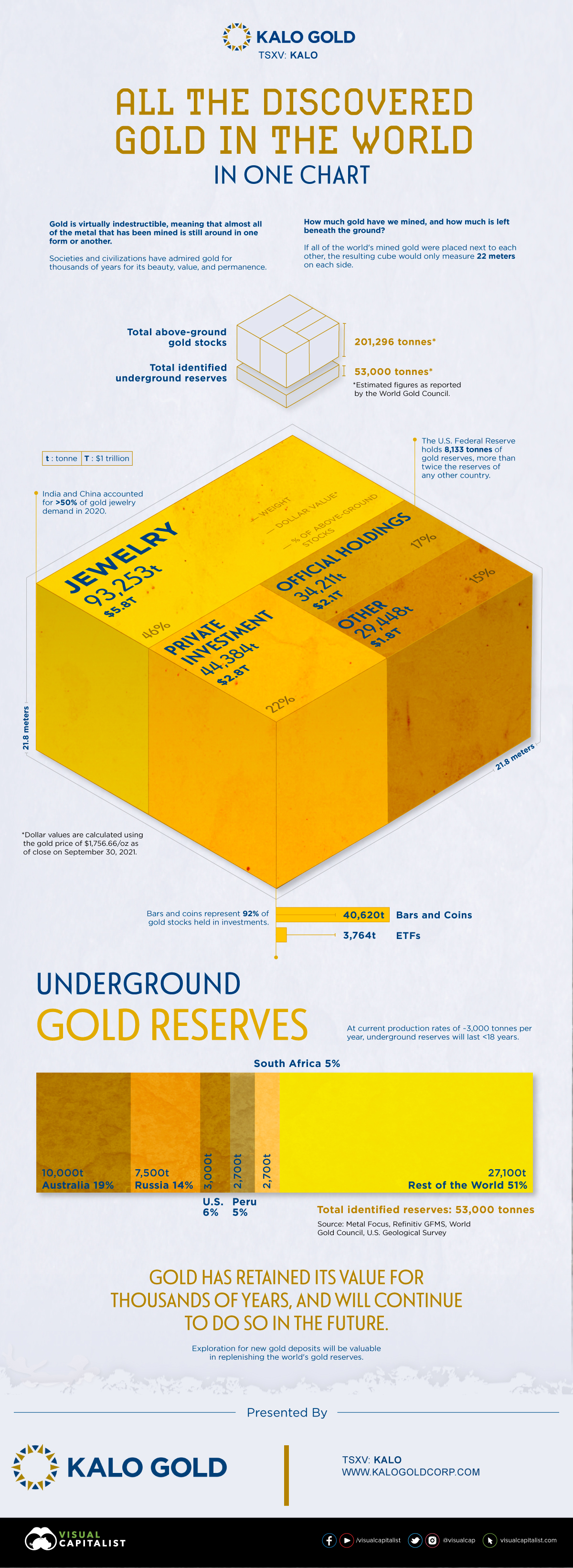

This infographic from our sponsor Kalo Gold visualizes all the gold in the world that’s above ground and the identified reserves that we have yet to mine.

Where is All the Gold?

The World Gold Council estimates that miners have historically extracted a total of 201,296 tonnes of gold, leaving another 53,000 tonnes left in identified underground reserves.

If all of the above-ground gold were stacked beside each other, the resulting cube would only measure 22 meters on each side, which is a testament to the metal’s rarity. But where exactly is all of this mined gold?

Nearly half of all the gold ever mined is held in the form of jewelry. India and China have been the largest markets for gold jewelry consumption, combining for more than 50% of global jewelry demand in 2020.

| Category | Gold stocks held (tonnes) | % of above-ground stocks | Dollar value* (US$, trillions) |

|---|---|---|---|

| Jewelry | 93,253 | 46% | $5.8T |

| Private investment | 44,384 | 22% | $2.8T |

| Official holdings/Central banks | 34,211 | 17% | $2.1T |

| Other | 29,448 | 15% | $1.8T |

| Total | 201,296 | 100% | $12.5T |

*Dollar values are based on gold’s price of $1756.66/oz as of close on Sept. 30, 2021.

Investors across the globe buy gold because of its ability to deliver value, and when inflationary pressures are high, gold often acts as a flight to safety. Consequently, investment is one of gold’s biggest end-uses, with over 44,000 tonnes of gold held as bars, coins, or bullion for gold-backed exchange-traded funds (ETFs).

Besides investors, central banks are also among the biggest holders of gold. Unlike foreign currency reserves, equities, and debt-backed securities, gold’s value largely depends on supply and demand. Therefore, central banks often use gold to diversify their assets and hedge against fiat currency depreciation. Central banks’ gold holdings account for almost one-fifth of all above-ground gold; as of 2021, official holdings exceed 35,000 tonnes.

Although gold is widely coveted as a precious metal, it also has various industrial uses, with applications in electronics, dentistry, and space. In fact, it’s estimated that a typical iPhone contains about 0.034 grams of gold, in addition to other precious metals. It is these industrial uses that account for 29,448 tonnes or roughly 15% of all above-ground gold.

Underground Gold Reserves

Before it turns into jewelry and bullion, gold goes through several stages in the supply chain, beginning with mineral exploration and mining of underground reserves. As of 2020, the world had 53,000 tonnes of gold in identified reserves. Here’s where all this gold lies:

| Country | Gold reserves (tonnes) | % of total |

|---|---|---|

| Australia 🇦🇺 | 10,000 | 19% |

| Russia 🇷🇺 | 7,500 | 14% |

| U.S. 🇺🇸 | 3,000 | 6% |

| Peru 🇵🇪 | 2,700 | 5% |

| South Africa 🇿🇦 | 2,700 | 5% |

| Rest of the World 🌎 | 27,100 | 51% |

| Total | 53,000 | 100% |

Given their availability of reserves, it’s no surprise that Australia, Russia, U.S., and Peru are among the world’s largest gold producers, with only China having produced more in 2020. These reserves not only help determine current production but can also provide an idea of where gold mining could occur in the future.

In 2020, miners produced just over 3,000 tonnes of gold, and at this rate, underground reserves will last less than 18 years without new discoveries. However, it’s important to note that reserves can change and grow as explorers find gold in different parts of the world.

A Golden Future

Gold has been around for thousands of years, and it will likely remain that way in the future.

With rising concerns over the growth in money supply and inflation, gold will continue to deliver value and protect investors in times of volatility while preserving wealth for the long term.

Kalo Gold is discovering gold on the edges of the mineral-rich Pacific Ring of Fire with its Vatu Aurum project in Fiji.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.