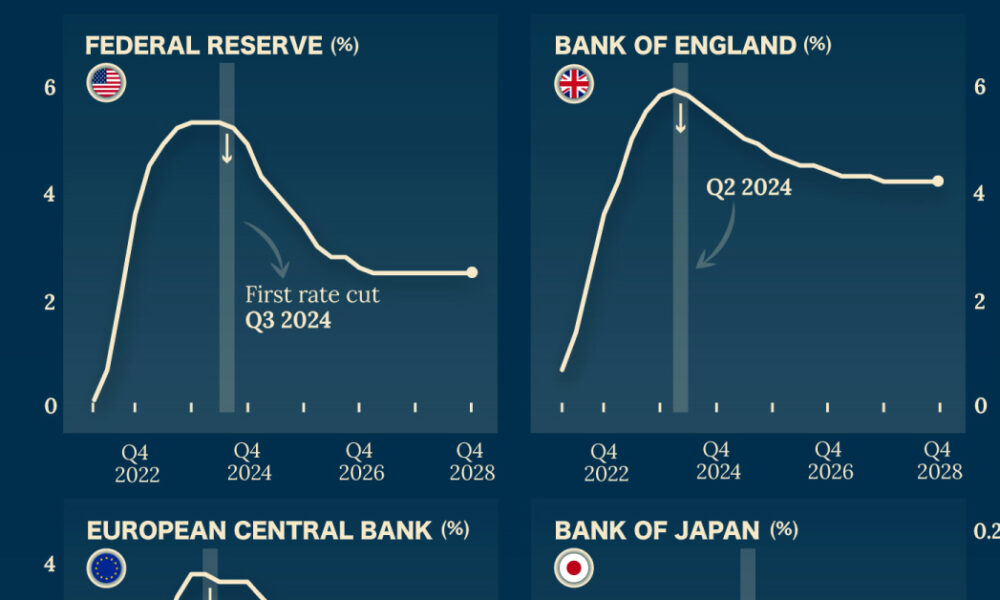

Which economies are expected to see interest rates rise, or fall? We highlight IMF forecasts for international interest rates through...

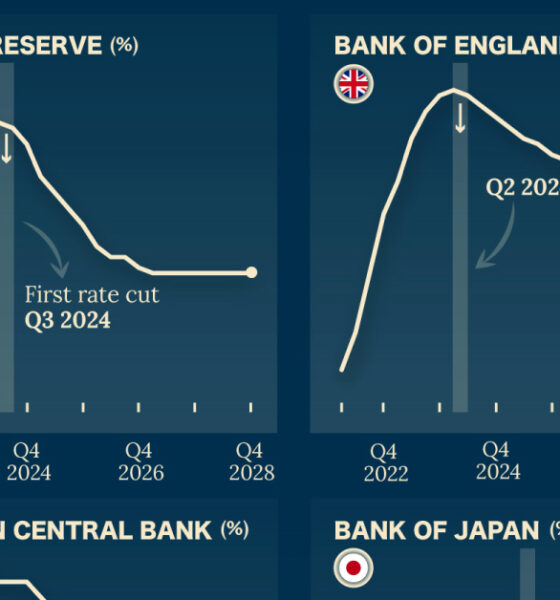

Public trust in the Federal Reserve chair has hit its lowest point in 20 years. Get the details in this infographic.

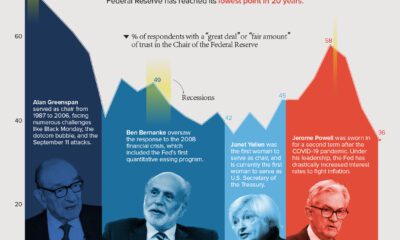

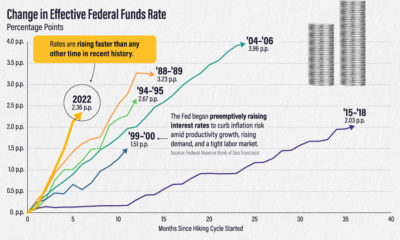

The effective federal funds rate has risen nearly five percentage points in 14 months, the fastest interest rate hikes in modern history.

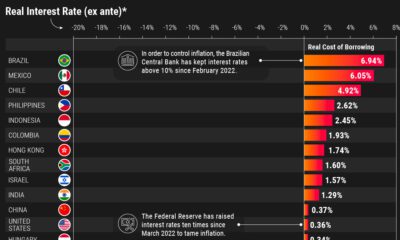

What countries have the highest real interest rates? We look at 40 economies to analyze nominal and real rates after projected inflation.

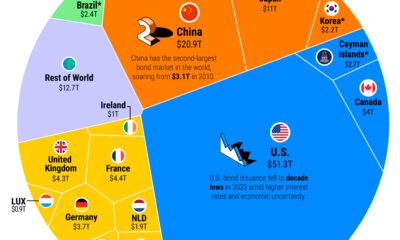

The global bond market stands at $133 trillion in value. Here are the major players in bond markets worldwide.

Foreign investors hold $7.3 trillion of the national U.S. debt. These holdings declined 6% in 2022 amid a strong U.S. dollar and rising rates.

Globally, central banks bought a record 1,136 tonnes of gold in 2022. How has central bank gold demand changed over the last three decades?

The effective federal funds rate has risen more than two percentage points in six months. How does this compare to other interest rate hikes?

Central bank digital currencies are coming, but progress varies greatly from country to country. View the infographic to learn more.

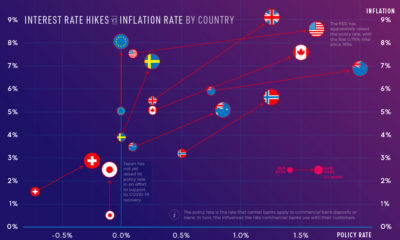

Inflation rates are reaching multi-decade highs in some countries. How aggressive have central banks been with interest rate hikes?