Mining

Canadian Venture Stocks Trade at Lowest Volume in a Decade [Chart]

![Canadian Venture Stocks Trade at Lowest Volume in a Decade [Chart]](https://www.visualcapitalist.com/wp-content/uploads/2016/01/venture-volume-decade-lows-chart.png)

Canadian Venture Stocks Trade at Lowest Volume in a Decade [Chart]

The last time volume was this low, iphones didn’t exist

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

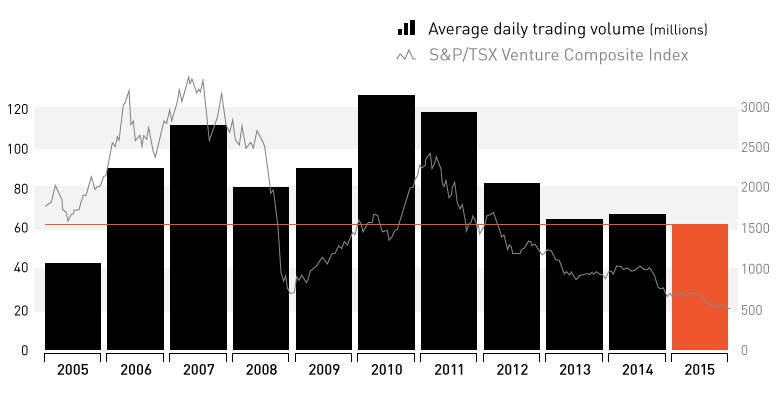

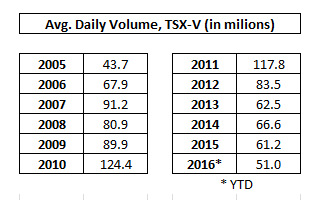

During last year’s plunge in commodity prices, the global benchmark exchange for junior resources recorded its lowest average daily trading volume in over a decade. In fact, the last time volume was this low on Canada’s TSX Venture index was in 2005, before iPhones even existed.

Data for this year is not so hot, either.

With an average of 51 million shares exchanging hands daily in the first 14 trading days of 2016, the volume is 16.6% lower than 2015.

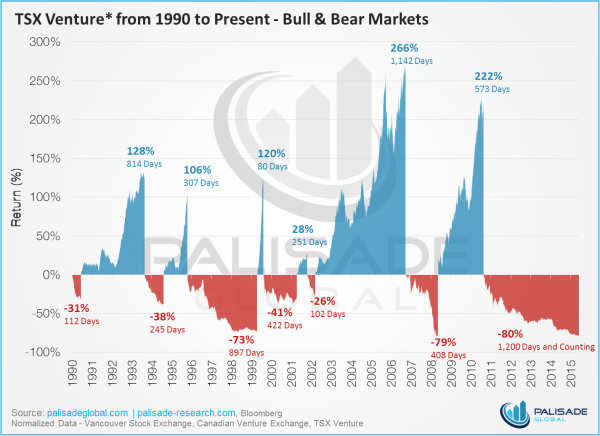

For most people, this is unsurprising, since the Venture index is now in a historic 1,200 day bear market.

Courtesy: Palisade Global

About Face

With no near-term upturn in commodities in sight, the sector finds itself between a rock and a hard place.

The TMX Group, the parent company of the exchange, has even recently published a white paper on ways to potentially revitalize the exchange. Goals of the group include significantly reducing the cost burden on issuers without compromising investor confidence, expanding the base of investors financing companies and enhancing liquidity, and diversifying the stock list to increase the attractiveness of the marketplace.

Critics will argue, however, that the problem of zombie companies cannot be simply solved by any combination of the measures that the TMX Group is willing to take. Reinstatement of the “uptick rule”, reforms on accredited investor regulations, and even bans on short-selling have been proposed by those that argue a greater course of action is needed.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075