Canada’s Gold Exploration Frontier: The Abitibi Greenstone Belt

The following content is sponsored by Maple Gold Mines.

The Abitibi: Canada’s Largest Gold District

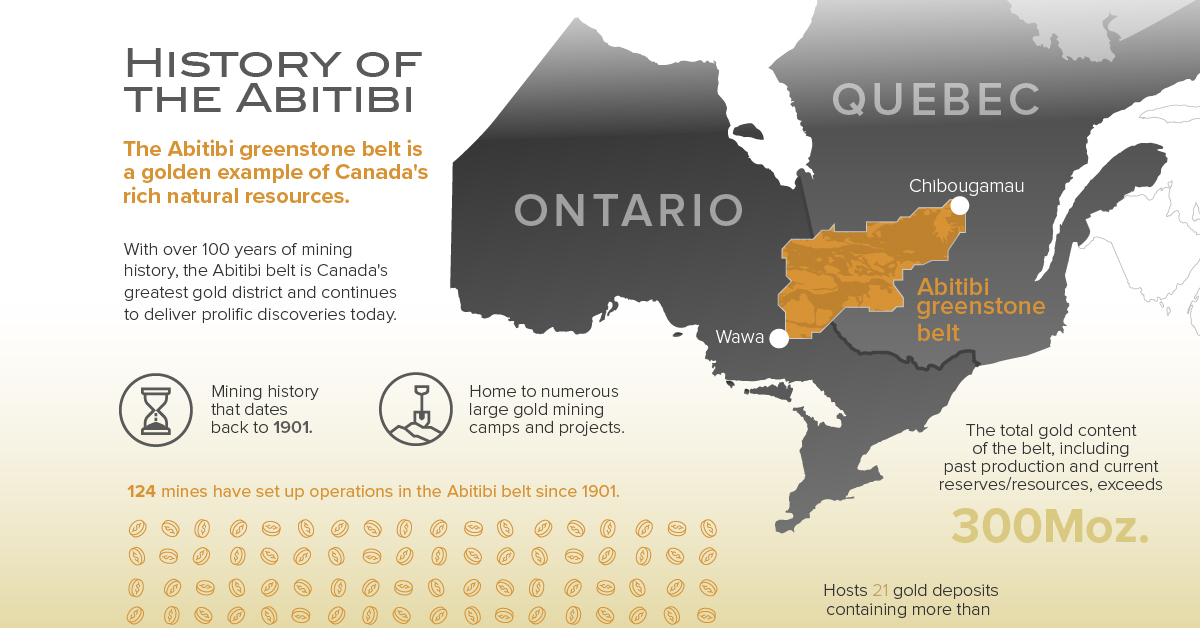

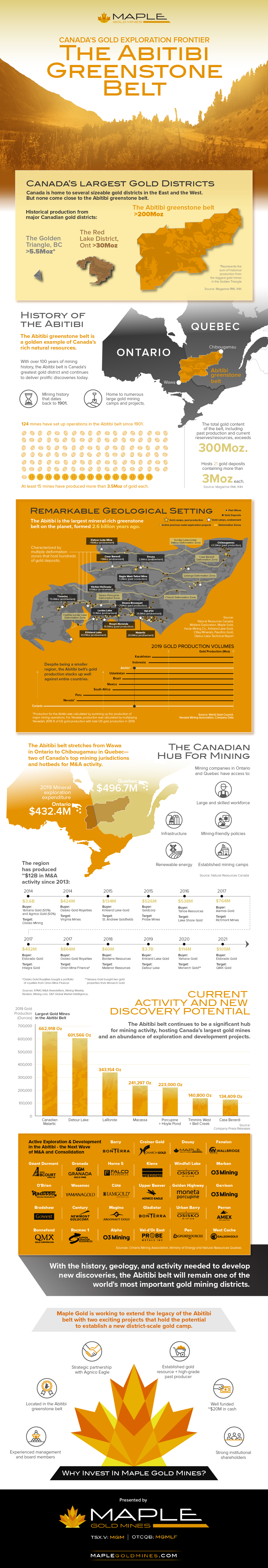

Canada is home to many great gold districts, but none come close to the Abitibi greenstone belt.

Having produced over 200 million ounces of gold since 1901, the Abitibi belt has etched its place as Canada’s largest gold district. Today, the region is bustling with exploration activity and hosts three of the country’s largest gold mines.

The above infographic from Maple Gold Mines showcases what makes the Abitibi a prolific gold district, from its history and geology to current activity and the potential for discovery.

The Abitibi Greenstone Belt: Remarkable Geology and History

Over 2.6 billion years ago, the Earth’s natural processes of creation and destruction resulted in the formation of metal-rich volcanic rocks and deformation zones that comprise the Abitibi greenstone belt.

The Abitibi belt hosts several economically viable deposits of gold, silver, zinc, iron, copper, and other base metals. The types of deposits found there include gold-rich quartz-carbonate veins, copper porphyries, and volcanogenic massive sulfide (VMS) deposits.

Since mining began in the early 1900s, more than 124 mines have been set up in the Abitibi, and at least 15 of these have yielded over 3.5 million ounces of gold. What’s more, the total gold content of the belt, including past production and current reserves and resources, exceeds 300 million ounces.

The majority of the Abitibi’s rich gold deposits lie along fault lines in major deformation zones such as the Cadillac-Larder Lake zone and the Destor-Porcupine zone. These deposits are the foundations of gold camps that boast historical production numbers in excess of 10 million ounces of gold.

Despite a mining history that spans over 100 years, the Abitibi belt remains an active mining region with plenty of potential for new discoveries.

Mining Activity and the Potential for Discovery

With one end in Wawa, Ontario, and the other in Chibougamau, Quebec, the Abitibi’s location spans two jurisdictions that offer various advantages for mining companies.

Ontario and Quebec are two of Canada’s top mining jurisdictions with 2019 exploration expenditures of $432.4 million and $496.7 million, respectively. Mining companies in the Abitibi benefit not only from its rich resource endowment but also from the infrastructure, skilled workforces, and mining-friendly policies in its jurisdictions.

In fact, the Abitibi has produced around $12 billion in mining M&A transactions since 2013.

| Year | Buyer/Investor | Target | Value (US$, millions) |

|---|---|---|---|

| 2014 | Yamana Gold, Agnico Eagle | Osisko Mining | $3,600 |

| 2014 | Osisko Gold Royalties | Virginia Mines | $424 |

| 2015 | Kirkland Lake Gold | St. Andrew Goldfields | $134 |

| 2015 | Goldcorp | Probe Mines | $526 |

| 2016 | Tahoe Resources | Lake Shore Gold | $538 |

| 2017 | Alamos Gold | Richmont Mines Ltd | $764 |

| 2017 | Eldorado Gold | Integra Gold | $432 |

| 2017 | Osisko Gold Royalties | Orion Mine Finance* | $864 |

| 2018 | Bonterra Resources | Metanor Resources | $60 |

| 2019 | Kirkland Lake Gold | Detour Lake | $3,700 |

| 2020 | Yamana Gold | Monarch Gold* | $114 |

| 2021 | Eldorado Gold | QMX Gold | $105 |

*Osisko Gold Royalties bought a portfolio of royalties from Orion Mine Finance and Yamana Gold bought two properties from Monarch Gold.

Back in 2014, Yamana Gold and Agnico Eagle each bought a 50% stake in Osisko Mining for a total of $3.6 billion to own Osisko’s flagship Canadian Malartic Mine, Canada’s largest gold mine. In a similarly-sized transaction in 2019, Kirkland Lake Gold acquired the Detour Lake mine—the second-largest gold mine in the country, for $3.7 billion. Both of these mines share a common home—the Abitibi greenstone belt.

The Legacy Continues

The Abitibi belt remains a hub for mining activity with Canada’s largest gold mines and 28 exploration projects on the hunt for precious metals and the next wave of M&A transactions.

With its rich history, remarkable geology, and plenty of gold left to discover, the Abitibi greenstone belt’s legacy as one of the world’s most important gold districts will continue.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.