Energy

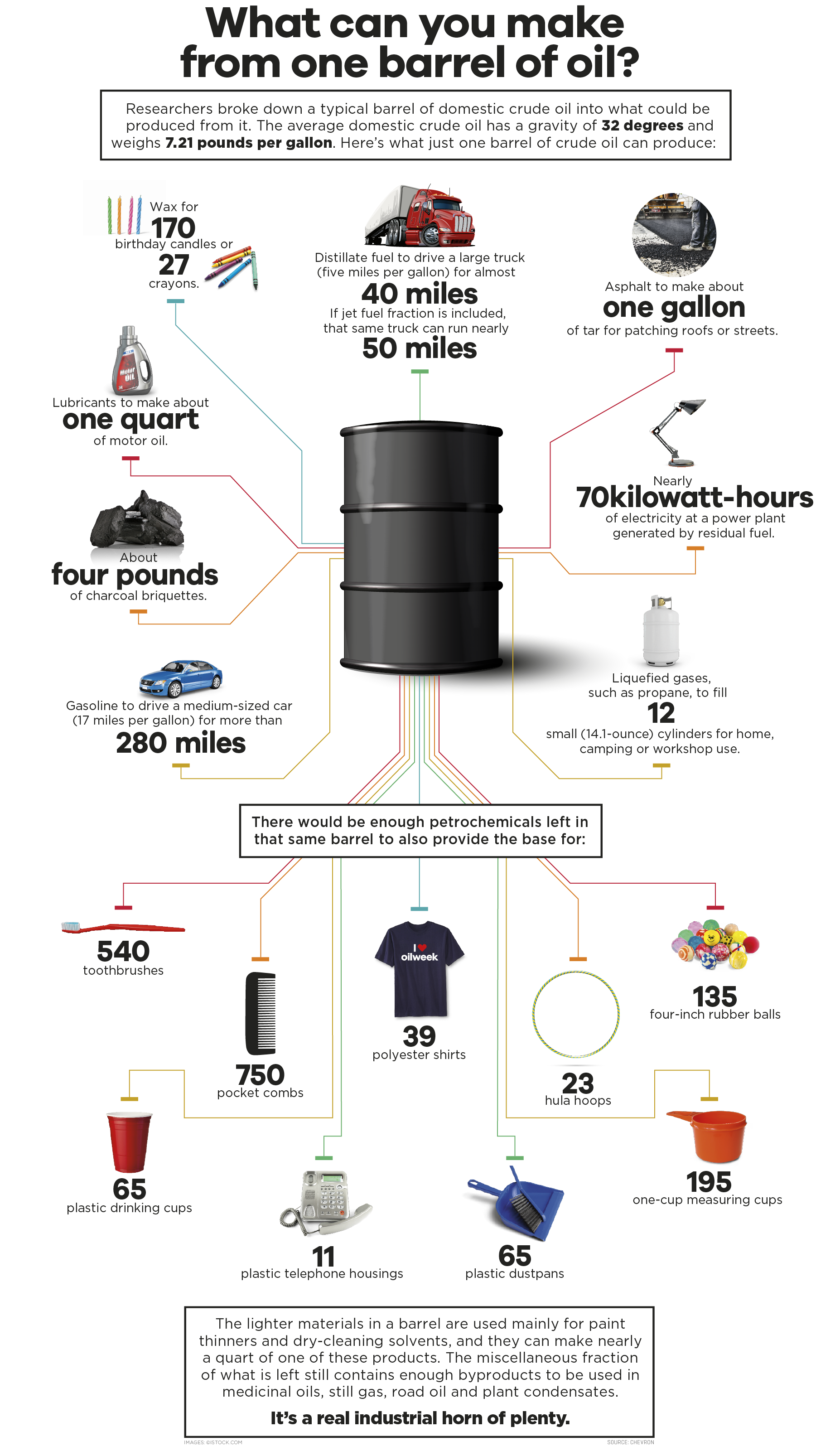

What Can Be Made from One Barrel of Oil?

What Can Be Made from One Barrel of Oil?

Oil gets a bad rap these days, but the stuff is actually quite incredible.

Many people think of crude oil as a thick, black liquid that is used to source our unquenchable thirst for gasoline. However, the reality is that each barrel of oil is refined to be used in a variety of applications that includes fuel, cosmetics, plastics, rubber, and candle wax.

What’s in one barrel of oil?

Today’s infographic comes from JWN Energy, an oil and gas news site. Using Chevron as a source, it shows 17 different things that can be made from each barrel of oil.

Here is everything that can be made from just one barrel of oil:

- Enough gasoline to drive a medium-sized car over 450km (280 miles).

- Enough distillate fuel to drive a large truck for almost 65km (40 miles). If jet fuel fraction is included, that same truck can run nearly 80km (50 miles).

- Nearly 70 kWh of electricity at a power plant generated by residual fuel.

- About 1.8 kg (4 lbs) of charcoal briquettes.

- Enough propane to fill 12 small (14.1 ounce) cylinders for home, camping or workshop use.

- Asphalt to make about 3.8 L (one gallon) of tar for patching roofs or streets.

- Lubricants to make about a 0.95 L (one quart) of motor oil.

- Wax for 170 birthday candles or 27 wax crayons.

But that’s not all. After producing all of the above products, there’s also enough petrochemicals leftover to be used as a base for one of the following:

- 39 polyester shirts

- 750 pocket combs

- 540 toothbrushes

- 65 plastic dustpans

- 23 hula hoops

- 65 plastic drinking cups

- 195 one-cup measuring cups

- 11 plastic telephone housings

- 135 four-inch rubber balls

Oil is not a one-trick pony, and the gooey black liquid actually has thousands of applications. The above serves as one example of how a barrel could be used, but here’s a list of many other oil applications. It includes everything from guitar strings to antihistamines.

Whatever your opinion is of fossil fuels, it’s still pretty astonishing what can be produced out of each barrel of oil.

Energy

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate MB-LI-0033

**Lithium carbonate MB-LI-0029

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

-

Lithium2 days ago

Lithium2 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy7 days ago

Energy7 days agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy4 weeks ago

Energy4 weeks agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy2 months ago

Energy2 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue