Money

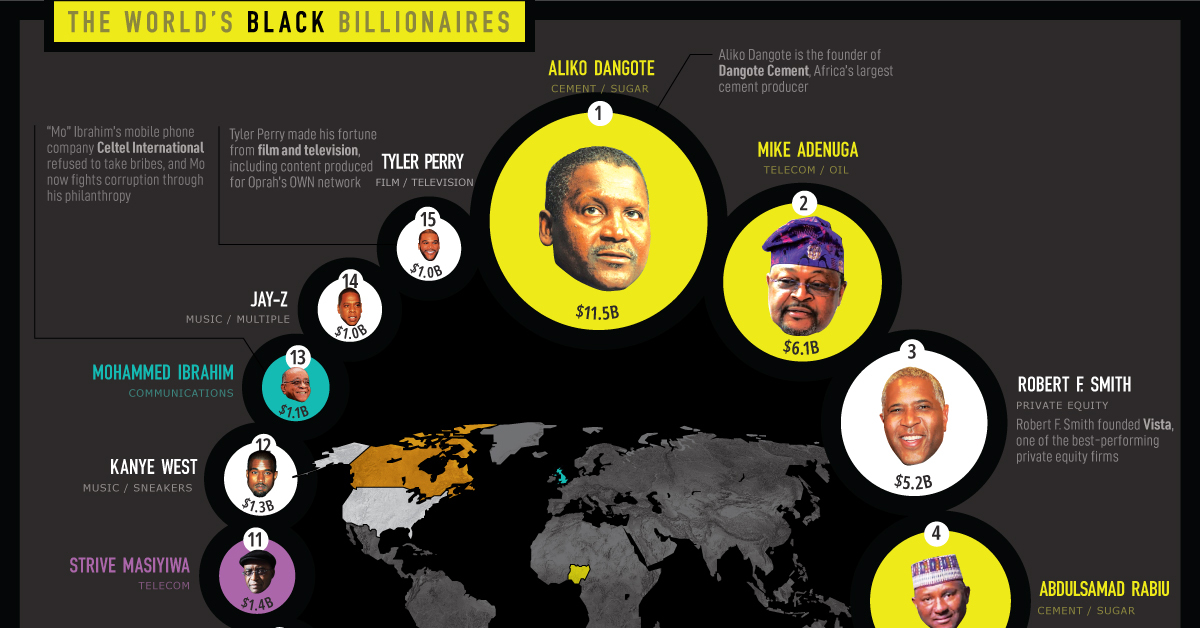

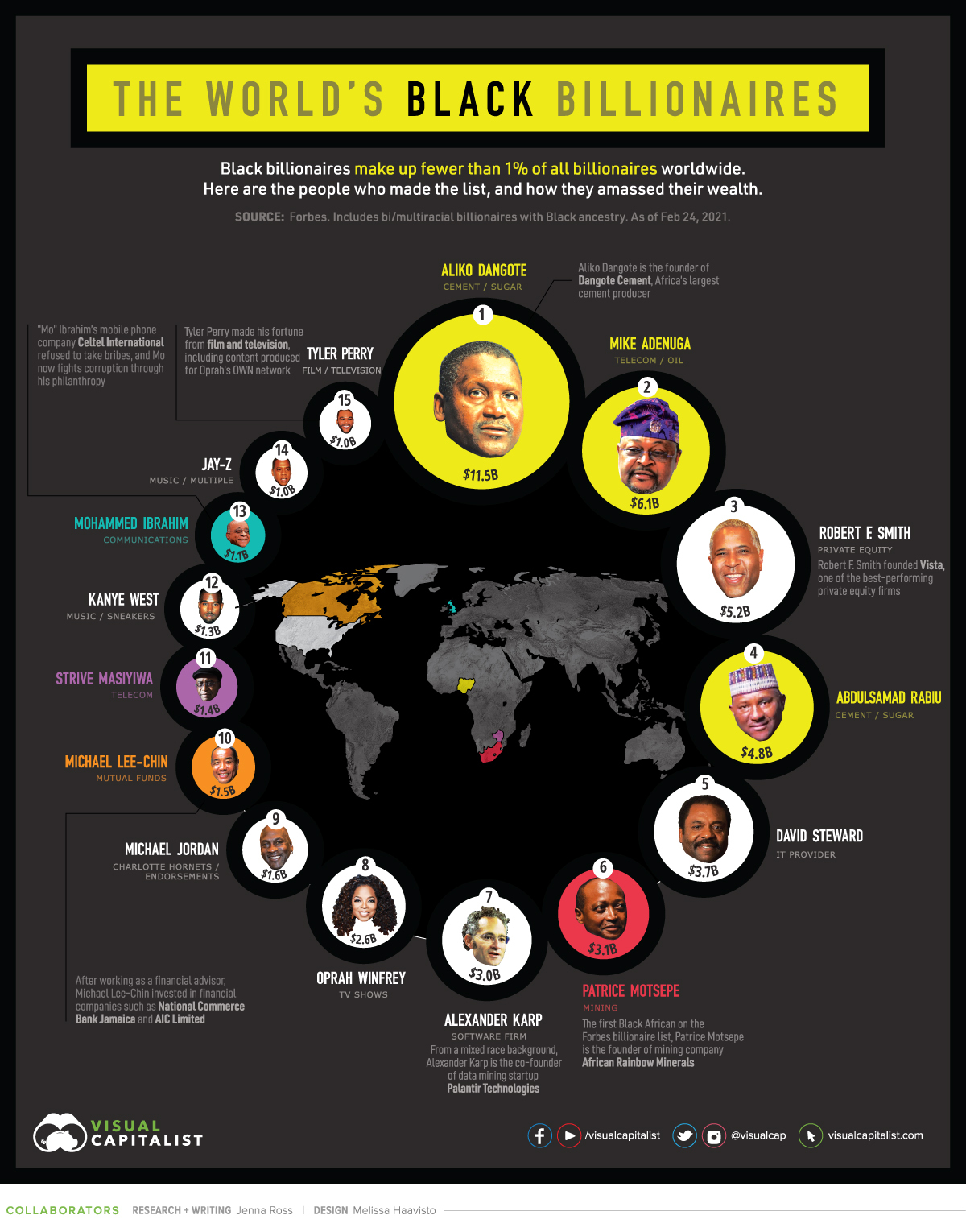

Ranked: The World’s Black Billionaires in 2021

The World’s Black Billionaires in 2021

Black billionaires make up fewer than 1% of all billionaires worldwide. Who are the select few who made it into the ranks of the world’s richest people?

In this graphic, we used the Forbes real-time billionaire list to highlight the most financially successful Black people, and the source(s) of their wealth.

Black Billionaires, Ranked

The data is as of February 24, 2021, and includes bi/multi racial individuals with Black ancestry. Altogether, there are 15 Black billionaires with a combined wealth of $48.9 billion.

Here is the how the full list breaks down:

| Rank | Name | Net Worth | Citizenship | Source |

|---|---|---|---|---|

| 1 | Aliko Dangote | $11.5B | Nigeria | Cement, sugar |

| 2 | Mike Adenuga | $6.1B | Nigeria | Telecom, oil |

| 3 | Robert F. Smith | $5.2B | United States | Private equity |

| 4 | Abdulsamad Rabiu | $4.8B | Nigeria | Cement, sugar |

| 5 | David Steward | $3.7B | United States | IT provider |

| 6 | Patrice Motsepe | $3.1B | South Africa | Mining |

| 7 | Alexander Karp | $3.0B | United States | Software firm |

| 8 | Oprah Winfrey | $2.6B | United States | TV shows |

| 9 | Michael Jordan | $1.6B | United States | Charlotte Hornets, endorsements |

| 10 | Michael Lee-Chin | $1.5B | Canada | Mutual funds |

| 11 | Strive Masiyiwa | $1.4B | Zimbabwe | Telecom |

| 12 | Kanye West | $1.3B | United States | Music, sneakers |

| 13 | Mohammed Ibrahim | $1.1B | United Kingdom | Communications |

| 14 | Shawn Carter (Jay-Z) | $1.0B | United States | Music, multiple |

| 15 | Tyler Perry | $1.0B | United States | Movies, television |

Aliko Dangote is the richest Black billionaire, and has held the title since 2013. He owns 85% of publicly-traded Dangote Cement, Africa’s largest cement producer. The company’s stock price went up more than 30% over the last year. In addition, Dangote also has investments in salt and sugar manufacturing companies.

The fifth richest Black person, David Steward, owns the technology solutions provider World Wide Technology. Steward had decided he wanted to be part of the technological revolution and founded the company in 1990, before the first internet browser had even been created. The company has since grown to be the largest Black-owned business in America with over $13.4 billion in annual revenue and more than 7,000 employees.

Best known for his music career, Shawn Carter, more commonly known as Jay-Z, is number 14 on the list. However, the rapper’s wealth goes far beyond his music. Jay-Z has built a diversified business empire, including investments in a fine art collection, an entertainment company, a clothing line, and alcohol brands. He recently sold half of his champagne brand to LVMH, the parent company of Dom Pérignon.

Unequal Representation

Unfortunately, little progress has been made with regards to the proportion of Black billionaires. Since 2011, Black billionaires have made up fewer than 1% of all billionaires worldwide.

In absolute numbers, the total number of billionaires rose by over 1,100 while the number of Black billionaires rose by just nine people.

The number of Black billionaires also falls very short of being representative of the general population. For example, only 8 or 1.2% of America’s 665 billionaires are Black. By contrast, Black people make up 12.2% of the U.S. population.

Breaking Through Barriers

There is still a large racial wealth gap between Black people and White people—even at the highest levels of financial achievement. However, despite these racial and systemic barriers, 14 of the 15 Black billionaires are self-made, meaning they built their wealth from the ground up. Who will be next to join the ranks?

“Innovation doesn’t happen without a person of color or a diversity of thought being at the table in order to challenge the status quo.”

—David Steward

Money

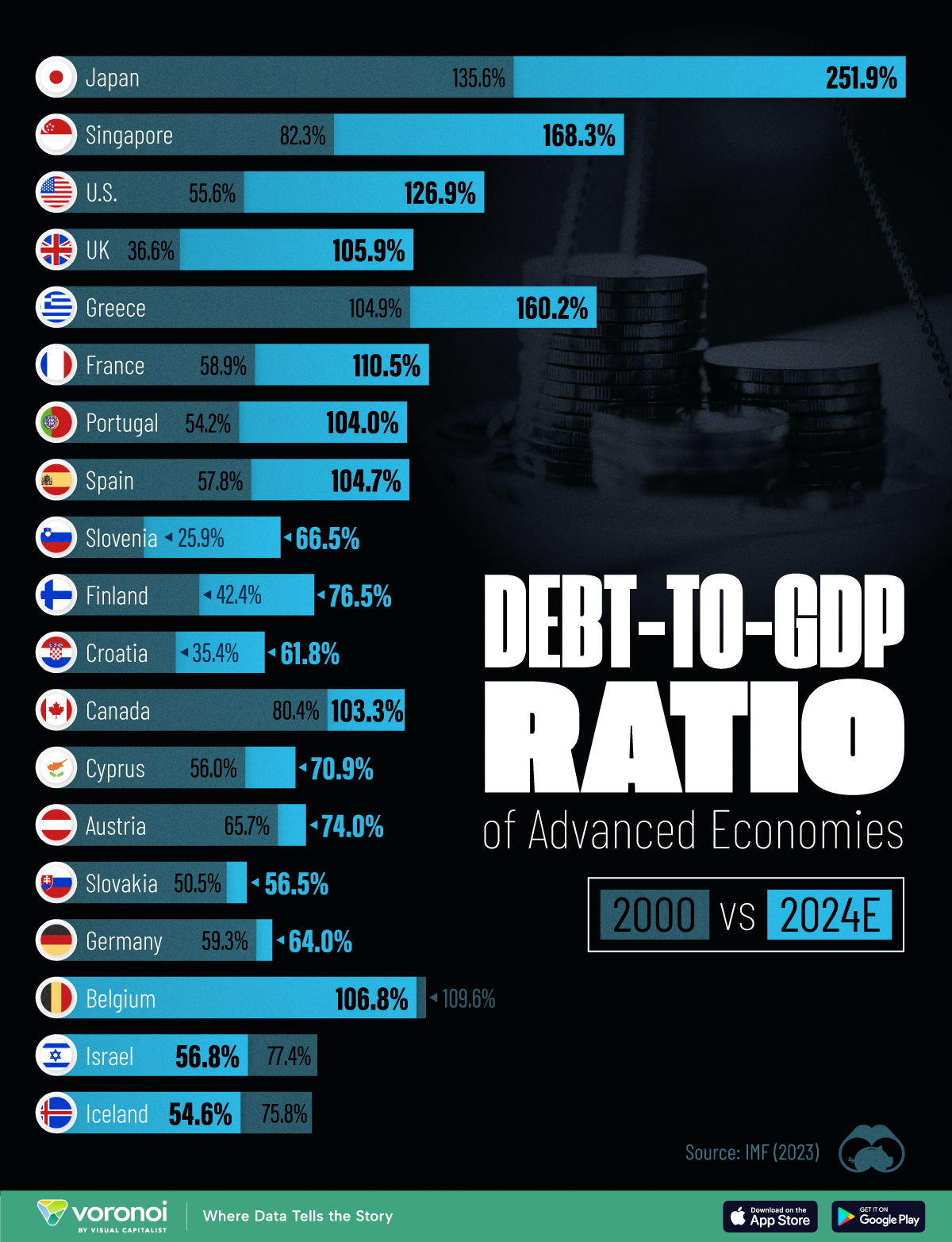

How Debt-to-GDP Ratios Have Changed Since 2000

See how much the debt-to-GDP ratios of advanced economies have grown (or shrank) since the year 2000.

How Debt-to-GDP Ratios Have Changed Since 2000

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

To gain perspective on this long-term trend, we’ve visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

| Country | 2000 (%) | 2024 (%) | Change (pp) |

|---|---|---|---|

| 🇯🇵 Japan | 135.6 | 251.9 | +116.3 |

| 🇸🇬 Singapore | 82.3 | 168.3 | +86.0 |

| 🇺🇸 United States | 55.6 | 126.9 | +71.3 |

| 🇬🇧 United Kingdom | 36.6 | 105.9 | +69.3 |

| 🇬🇷 Greece | 104.9 | 160.2 | +55.3 |

| 🇫🇷 France | 58.9 | 110.5 | +51.6 |

| 🇵🇹 Portugal | 54.2 | 104.0 | +49.8 |

| 🇪🇸 Spain | 57.8 | 104.7 | +46.9 |

| 🇸🇮 Slovenia | 25.9 | 66.5 | +40.6 |

| 🇫🇮 Finland | 42.4 | 76.5 | +34.1 |

| 🇭🇷 Croatia | 35.4 | 61.8 | +26.4 |

| 🇨🇦 Canada | 80.4 | 103.3 | +22.9 |

| 🇨🇾 Cyprus | 56.0 | 70.9 | +14.9 |

| 🇦🇹 Austria | 65.7 | 74.0 | +8.3 |

| 🇸🇰 Slovak Republic | 50.5 | 56.5 | +6.0 |

| 🇩🇪 Germany | 59.3 | 64.0 | +4.7 |

| 🇧🇪 Belgium | 109.6 | 106.8 | -2.8 |

| 🇮🇱 Israel | 77.4 | 56.8 | -20.6 |

| 🇮🇸 Iceland | 75.8 | 54.6 | -21.2 |

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

See More Debt Graphics from Visual Capitalist

Curious to see which countries have the most government debt in dollars? Check out this graphic that breaks down $97 trillion in debt as of 2023.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001